India Ventilation System Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, and Region, 2025-2033

India Ventilation System Market Overview:

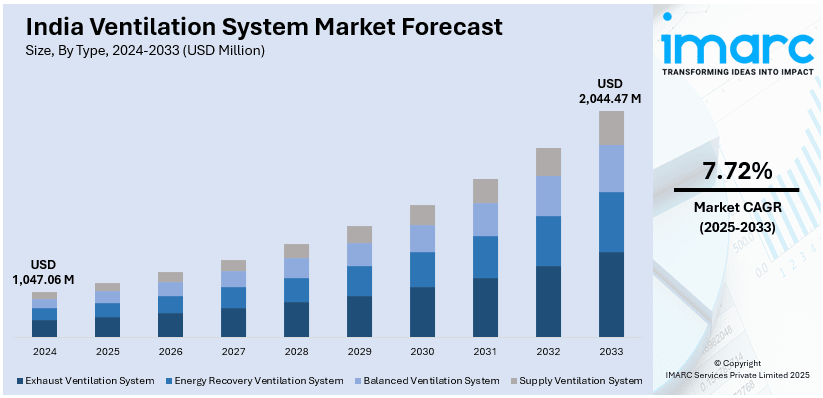

The India ventilation system market size reached USD 1,047.06 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,044.47 Million by 2033, exhibiting a growth rate (CAGR) of 7.72% during 2025-2033. The market is driven by rapid urbanization, rising awareness about indoor air quality, government regulations on energy efficiency, and increasing commercial and industrial construction. Technological advancements, growing demand for smart HVAC systems, and rising health concerns due to pollution further boost the India ventilation system market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,047.06 Million |

| Market Forecast in 2033 | USD 2,044.47 Million |

| Market Growth Rate (2025-2033) | 7.72% |

India Ventilation System Market Trends:

Rapid Urbanization and Infrastructure Growth

India's fast-paced urbanization has led to a surge in residential, commercial, and industrial construction, increasing the demand for efficient ventilation systems. As high-rise buildings and smart cities expand, maintaining proper airflow and air quality becomes essential. The rise of co-working spaces, shopping malls, and hospitals further fuels the need for advanced HVAC systems. Additionally, government-backed infrastructure projects and real estate growth in tier-2 and tier-3 cities contribute to increased adoption of ventilation systems. This growing emphasis on energy-efficient and health-focused infrastructure is pushing developers to integrate advanced ventilation technologies in both new and retrofitted projects. For instance, in June 2024, ABB India announced its partnership with Witt India to enhance safety and efficiency in tunnel ventilation for critical infrastructure projects. By integrating ABB's high-performance smoke extraction motors with Witt’s Banana® Jet Fans this collaboration aims to ensure safer travel through India’s road tunnels setting new standards in tunnel ventilation technology. With expanding urban populations and evolving building designs, the necessity for efficient air circulation and ventilation solutions continues to fuel the India ventilation system market share.

To get more information of this market, Request Sample

Increasing Awareness about Indoor Air Quality (IAQ)

Rising air pollution levels, especially in metropolitan cities, have heightened public awareness reagrding indoor air quality (IAQ) and its impact on health. Poor ventilation can lead to respiratory diseases, allergies, and the spread of airborne infections, increasing demand for air purification and ventilation solutions. The COVID-19 pandemic reinforced the importance of proper air circulation in homes, offices, and healthcare facilities. Consumers and businesses are now prioritizing high-efficiency ventilation systems to maintain clean indoor air, reducing pollutants, allergens, and pathogens. Amid this backdrop, digital tools and AI-driven platforms are emerging to support cleaner air initiatives. For instance, in November 2024, Google announced Air View+, an AI-powered ecosystem designed to provide hyperlocal air quality data to Indian citizens and government officials to address this situation. Despite India's fast urbanization and technological advancements, air pollution remains a significant challenge. This growing awareness is pushing both residential and commercial sectors to invest in modern ventilation technologies, creating a positive India ventilation system market outlook.

Technological Advancements and Smart Ventilation Systems

The integration of IoT, AI, and automation in ventilation systems has revolutionized the market. Smart ventilation solutions with sensors, automated airflow controls, and real-time air quality monitoring are becoming increasingly popular in modern homes and commercial spaces. For instance, in October 2023, Delta Electronics India, a prominent provider of IoT-driven smart energy-saving solutions, announced its partnership with ISHRAE to host an esteemed seminar, in Mumbai serving as a platform for the official unveiling of Delta’s latest innovations in Indoor Air Quality (IAQ) solutions. These IAQ solutions, comprising BLDC Motored Energy Recovery Ventilators, Ventilation Fans, and Fresh Air Supply Fans, all utilizing our proprietary DC brushless motor technology, have been acknowledged as Green Pro products by the Indian Green Building Congress – CII for their significant efforts in lowering power usage and CO2 emissions while improving indoor air quality. Advanced ventilation technologies help optimize air circulation, improve energy efficiency, and provide remote monitoring capabilities. Additionally, innovations such as heat recovery ventilation (HRV) and demand-controlled ventilation (DCV) are gaining traction, enabling buildings to maintain optimal air quality while minimizing energy consumption. As consumers seek smarter, cost-effective, and sustainable solutions, the demand for advanced ventilation systems continues to rise.

India Ventilation System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, distribution channel, and end user.

Type Insights:

- Exhaust Ventilation System

- Energy Recovery Ventilation System

- Balanced Ventilation System

- Supply Ventilation System

The report has provided a detailed breakup and analysis of the market based on the type. This includes exhaust ventilation system, energy recovery ventilation system, balanced ventilation system, and supply ventilation system.

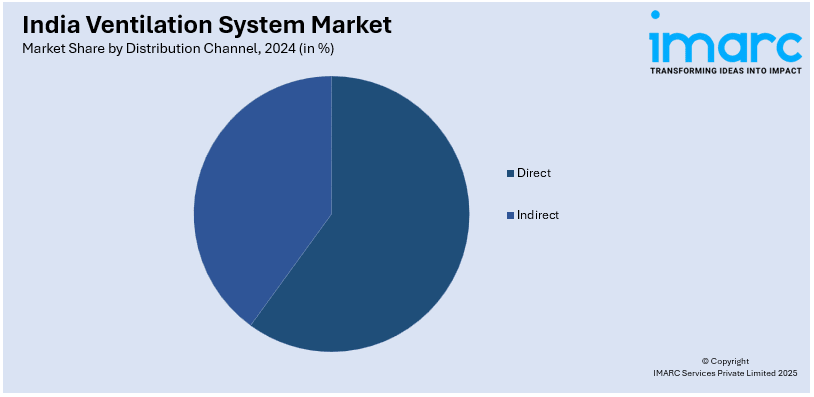

Distribution Channel Insights:

- Direct

- Indirect

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes direct and indirect.

End User Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ventilation System Market News:

- In February 2024, Getinge announced its plans to launch its state-of-the-art Servo-c mechanical ventilator in India. The Servo-c offers lung-protective therapy solutions tailored to meet the respiratory needs of both adult and pediatric patients.

- In June 2023, Systemair, a prominent worldwide supplier of air distribution and ventilation systems, enhanced its presence in India by opening its advanced third manufacturing facility.

India Ventilation System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Exhaust Ventilation System, Energy Recovery Ventilation System, Balanced Ventilation System, Supply Ventilation System |

| Distribution Channels Covered | Direct, Indirect |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India ventilation system market performed so far and how will it perform in the coming years?

- What is the breakup of the India ventilation system market on the basis of type?

- What is the breakup of the India ventilation system market on the basis of distribution channel?

- What is the breakup of the India ventilation system market on the basis of end user?

- What is the breakup of the India ventilation system market on the basis of region?

- What are the various stages in the value chain of the India ventilation system market?

- What are the key driving factors and challenges in the India ventilation system market?

- What is the structure of the India ventilation system market and who are the key players?

- What is the degree of competition in the India ventilation system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ventilation system market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ventilation system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ventilation system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)