India Vegan Ice Cream Market Size, Share, Trends and Forecast by Source, Flavour, Sales Type, Distribution Channel and Region, 2025-2033

India Vegan Ice Cream Market Overview:

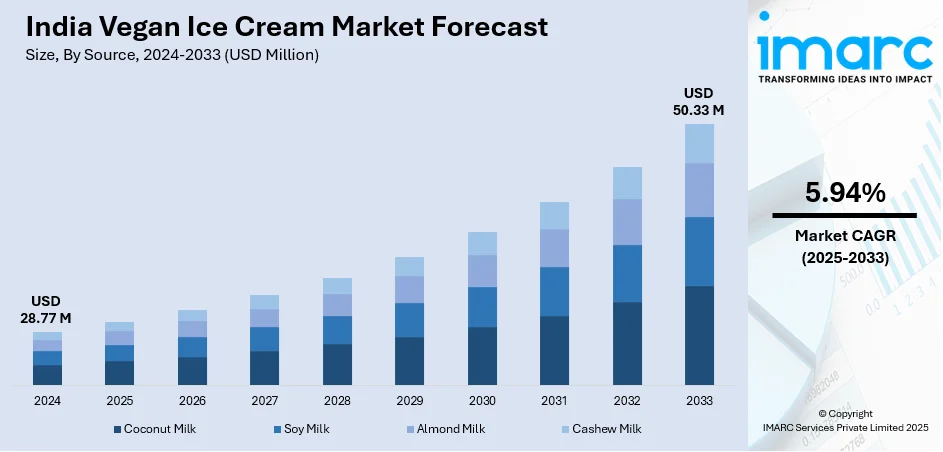

The India vegan ice cream market size reached USD 28.77 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 50.33 Million by 2033, exhibiting a growth rate (CAGR) of 5.94% during 2025-2033. The market is experiencing strong growth due to heightening health awareness, growing lactose intolerance, and expanding vegan population. Unique flavors and plant-based content are broadening product ranges, with high demand in retail and online sales channels.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 28.77 Million |

| Market Forecast in 2033 | USD 50.33 Million |

| Market Growth Rate (2025-2033) | 5.94% |

India Vegan Ice Cream Market Trends:

Innovative Plant-Based Ingredients

Indian vegan ice cream industry is welcoming modern plant-based foods, shifting focus from the age-old bases such as almond milk and coconut milk to oat, cashew, and millet. These options present a rich and creamy texture along with appealing to consumers who need healthier and allergy-friendly options. For instance, in February 2023, Keventers introduced its initial vegan ice cream assortment in India with Vegan Strawberry and Vegan Dark Chocolate flavors that support dairy-free and gluten-free consumers. Moreover, the use of natural sweeteners like dates, jaggery, and stevia is becoming highly popular too, offering sugar-free refined pleasure. Brands are also playing around with nutrient-dense ingredients such as chia seeds, quinoa, and spirulina to enrich the nutritional content of their products. This is fuelled by boosting demand for clean-label products as consumers become increasingly vocal about demanding transparency and natural ingredients. The emphasis on locally sourced fruits and vegetables supports the "vocal for local" initiative, which fosters sustainability and aids regional farmers. This trend mirrors the larger move toward conscious eating, whereby consumers seek out rich, dairy-free ice creams that not only happen to be guilt-free but are also filled with goodness.

To get more information on this market, Request Sample

Exotic and Functional Flavors

The Indian vegan ice cream industry is witnessing growth of exotic and functional flavors that fascinate adventurous eaters and healthy consumers alike. Classic flavors vanilla and chocolate are being joined by new-age fare such as turmeric latte, masala chai, saffron-pistachio, and rose-almond. Drawing inspiration from local and international cuisines, these flavors come with superfood ingredients such as matcha, activated charcoal, and acai berries, finding a balance of indulgence with health. Seasonal and local produce such as alphonso mango, tender coconut, and jamun are being offered in fruit-based varieties also. Moreover, a trend has started for functional ice creams which have been added with probiotics, prebiotics, and adaptogens that can target the well-being-centric group of people. This taste breakthrough not only elevates the sensory experience but also caters to the growing consumer preference for foods that are both delicious and healthy, making vegan ice creams a tasty yet conscious indulgence for daily pleasure.

Sustainability and Eco-Friendly Practices

Sustainability is emerging as a key trend in India's vegan ice cream industry as brands and consumers alike favor environmentally friendly options. Brands are embracing sustainable practices along the supply chain, ranging from sourcing ethically made, plant-based materials to utilizing biodegradable or recyclable packaging. There is also growing momentum around minimizing food waste by adding "ugly" fruits and excess produce to ice cream flavors, fostering a circular economy. The focus on cruelty-free and vegan certifications ensures that consumers are purchasing something ethical. Brands are also switching to low-carbon production and collaborating with local farmers to minimize the company's carbon footprint. Consumers are seeking products that share their values of environmental responsibility and ethical purchasing, and the embrace of ecofriendly practices in the vegan ice cream market not only adds to brand credibility but also appeals to an expanding demographic of aware consumers who are dedicated to making sustainable purchasing decisions.

India Vegan Ice Cream Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on source, flavor, sales type, and distribution channel.

Source Insights:

- Coconut Milk

- Soy Milk

- Almond Milk

- Cashew Milk

The report has provided a detailed breakup and analysis of the market based on the source. This includes coconut, soy, almond and cashew milk.

Flavor Insights:

- Chocolate

- Caramel

- Coconut

- Vanilla

- Coffee

- Fruit

A detailed breakup and analysis of the market based on the flavor have also been provided in the report. This includes chocolate, caramel, coconut, vanilla, coffee and fruit.

Sales Type Insights:

- Impulse

- Take Home

- Artisanal

The report has provided a detailed breakup and analysis of the market based on the sales type. This includes impulse, take home and artisanal.

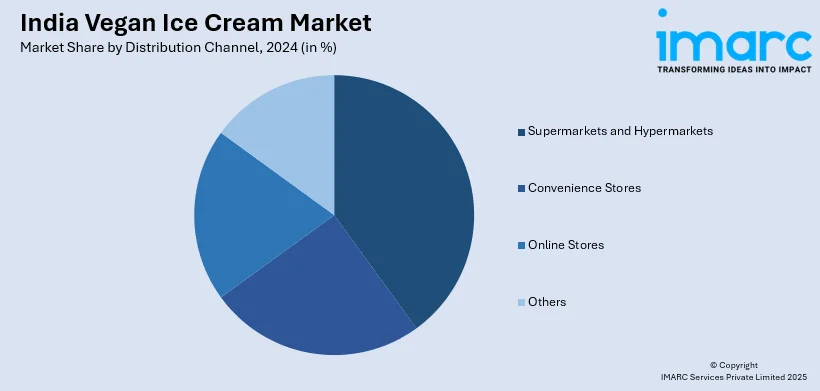

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, online stores and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Vegan Ice Cream Market News:

- In January 2025, Vesta launched India's first coconut milk-based vegan ice cream. This new product does away with dairy, providing a sustainable and healthy option. Although vegan ice creams are available in Mumbai and Tamil Nadu, Vesta's is the first to use coconut milk in India.

- In April 2024, Magnum has introduced Magnum Chill, a new vegan ice cream featuring vanilla biscuit-flavored ice cream with a blueberry sorbet core, crunchy cookie pieces, and rich vegan chocolate couverture. Part of the Magnum Pleasure Express range, this launch reinforces the brand’s commitment to plant-based indulgence and multi-sensorial experiences for consumers.

India Vegan Ice Cream Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Coconut Milk, Soy Milk, Almond Milk, Cashew Milk |

| Flavors Covered | Chocolate, Caramel, Coconut, Vanilla, Coffee, Fruit |

| Sales Types Covered | Impulse, Take Home, Artisanal |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India vegan ice cream market performed so far and how will it perform in the coming years?

- What is the breakup of the India vegan ice cream market on the basis of source?

- What is the breakup of the India vegan ice cream market on the basis of flavor?

- What is the breakup of the India vegan ice cream market on the basis of sales type?

- What is the breakup of the India vegan ice cream market on the basis of region?

- What is the breakup of the India vegan ice cream market on the basis of distribution channel?

- What are the various stages in the value chain of the India vegan ice cream market?

- What are the key driving factors and challenges in the India vegan ice cream?

- What is the structure of the India vegan ice cream market and who are the key players?

- What is the degree of competition in the India vegan ice cream market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India vegan ice cream market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India vegan ice cream market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India vegan ice cream industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)