India Vegan Food Market Size, Share, Trends and Forecast by Product, Source, Distribution Channel, and Region, 2026-2034

India Vegan Food Market Summary:

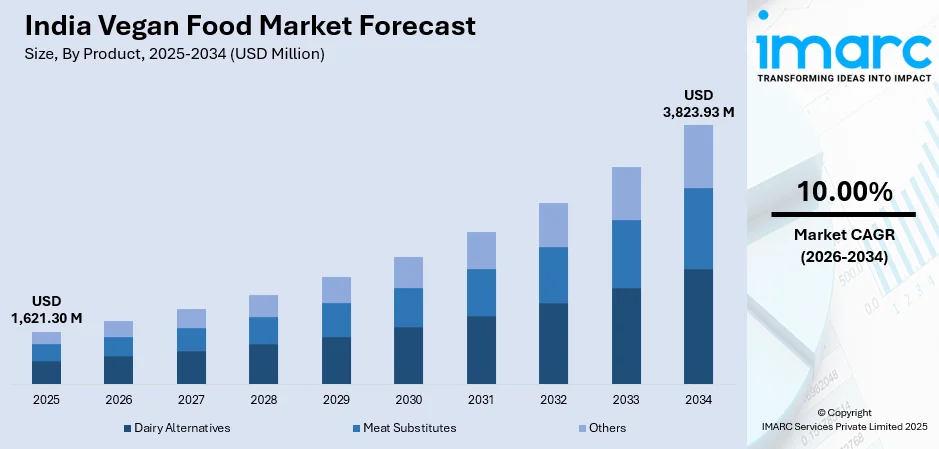

The India vegan food market size was valued at USD 1,621.30 Million in 2025 and is projected to reach USD 3,823.93 Million by 2034, growing at a compound annual growth rate of 10.00% from 2026-2034.

The increasing cases of lactose intolerance among people, the growing health awareness among consumers, along with the awareness about the environmental impact associated with animal farming, are all factors responsible for the phenomenal growth seen in the vegan food market within India. The increasing demands within the food and beverage segment are further accelerating the growth of the vegan food market. The vegan food market share within India is further supported by initiatives by the government regarding sustainable agriculture practices, easy accessibility within structured retail channels for vegan food products, as well as alignment with food patterns among vegetarians.

Key Takeaways and Insights:

- By Product: Dairy alternatives dominate the market with a share of 46% in 2025, owing to the rising prevalence of lactose intolerance among Indian consumers, increasing demand for plant-based milk alternatives in cafes and households, and growing consumer preference for cholesterol-free and healthier dietary options.

- By Source: Soy leads the market with a share of 34% in 2025, driven by its affordability, high protein content, widespread availability across India, and its established presence in traditional Indian cuisine through products like tofu, soy milk, and textured vegetable protein.

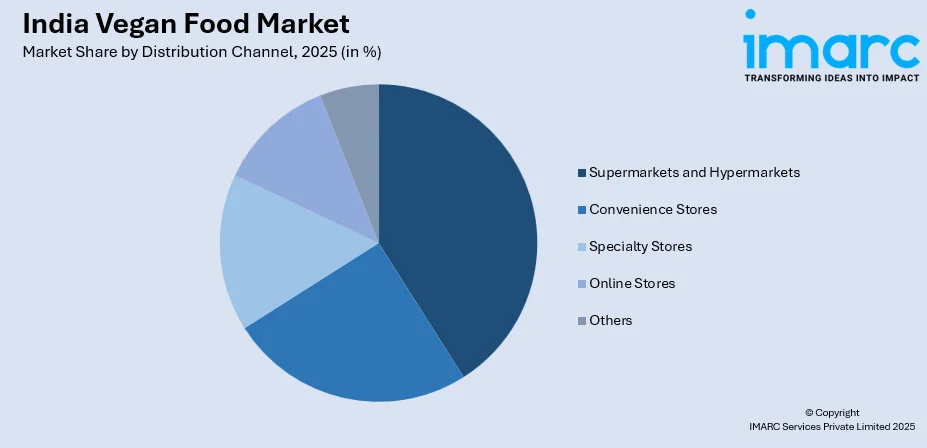

- By Distribution Channel: Supermarkets and hypermarkets represent the biggest segment with a market share of 41% in 2025, reflecting the expansion of organized retail chains, dedicated vegan product shelves, promotional activities, and enhanced product accessibility for urban consumers seeking plant-based alternatives.

- By Region: North India is the largest region with 30% share in 2025, driven by rich vegetarian culinary traditions in states like Punjab and Delhi NCR, higher disposable incomes, rapid urbanization, and strong food service sector development supporting vegan product adoption.

- Key Players: Key players drive the India vegan food market by expanding product portfolios, investing in research and development for improved taste and texture, strengthening distribution networks, and collaborating with food service establishments to increase accessibility and consumer awareness.

To get more information on this market Request Sample

A combination of health, environmental, and ethical factors that are influencing the dietary behavior of consumers is fueling the vegan food market in India. The need for plant-based foods that are perceived to be healthier options is being triggered by increasing awareness of lifestyle diseases such as diabetes and cardiovascular diseases. Since Indian millennials are actively participating in taking up healthier dining options, the increasing number of millennials is more concerned about sustainable consumerism practices. Adoption of vegan diets is also being promoted by awareness of the environment being harmed by water pollution and greenhouse gas emissions caused by animal-based food production. Although vegan diets are being promoted by endorsements in the form of influencers and celebrities on television, increasing vegan restaurants, cafes, and cloud kitchens in the major cities of India are also making products more accessible. Advancements in food processing technology, such as those in the use of extrusion machinery and fermentation, are also making vegan foods more attractive to mainstream consumers who change over from meat-based diets.

India Vegan Food Market Trends:

Rising Demand for Plant-Based Dairy Alternatives

The India vegan food market is witnessing significant growth in plant-based dairy alternatives as consumers increasingly seek lactose-free and cholesterol-free options. Products including oat milk, almond milk, soy milk, and coconut-based yogurts are gaining popularity across urban centers, driven by café culture adoption and health-conscious consumer behavior. Major retailers including Reliance Fresh and BigBasket have dedicated vegan shelves offering diverse plant-based dairy products. In August 2024, 1.5 Degree launched a complete range of plant-based frozen desserts and beverages including oat milk and soy milk at the India International Hospitality Expo in Greater Noida, expanding consumer choices.

Innovation in Plant-Based Meat Substitutes

Plant-based meat alternatives have been innovating very rapidly as companies start working on mimicking traditional meat by taste, texture, and look. Materials like pea protein, soy, and jackfruit, combined with natural ingredients, aid in making burgers, nuggets, and kebabs for health-concerned consumers. With more room temperatures-stable food, convenience and availability improve, thereby rectifying previous adoption constraints based on storage issues. State-of-the-art technology for extrusion allows for texture that very much resembles muscle tissue, which helps in achieving a similar pattern observed in animal muscles, and naturalistic methods for making flavors that fascinate flexitarians converting dietary lifestyles without moving away from comfort food.

Expansion of Vegan Options in Food Service Sector

The food service sector in India is rapidly incorporating vegan menu options as restaurants, cafes, and quick-service chains respond to evolving consumer preferences. Major hospitality brands and popular café chains are collaborating with vegan movements to introduce limited-time and permanent plant-based offerings. This trend reflects growing consumer demand for dining experiences aligned with ethical and health-conscious values. In January 2025, SOCIAL café partnered with Veganuary to launch a special vegan menu featuring plant-based meatballs, protein stir fry, and vegan momos.

Market Outlook 2026-2034:

The India vegan food market outlook remains positive, supported by favorable demographic shifts, increasing health awareness, and expanding retail infrastructure. The growing prevalence of lifestyle diseases and rising consumer interest in sustainable consumption patterns are expected to sustain demand for plant-based products across dairy alternatives, meat substitutes, and vegan confectionery segments. The market generated a revenue of USD 1,621.30 Million in 2025 and is projected to reach a revenue of USD 3,823.93 Million by 2034, growing at a compound annual growth rate of 10.00% from 2026-2034. Technological innovations improving product taste and texture, coupled with government initiatives promoting sustainable agriculture and foreign investments in plant-based startups, will further accelerate market expansion. The proliferation of e-commerce platforms and direct-to-consumer vegan brands enhances product accessibility while mainstream adoption by FMCG majors validates the category's growth potential.

India Vegan Food Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Dairy Alternatives |

46% |

|

Source |

Soy |

34% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

41% |

|

Region |

North India |

30% |

Product Insights:

- Dairy Alternatives

- Cheese

- Dessert

- Snacks

- Others

- Meat Substitutes

- Tofu

- TVP

- Seiten

- Quorn

- Others

- Others

Dairy alternatives dominate with a market share of 46% of the total India vegan food market in 2025.

The dairy alternatives segment commands the largest share of the India vegan food market, driven by the high prevalence of lactose intolerance in the Indian population. Consumers increasingly seek plant-based milk, yogurt, cheese, and dessert alternatives that offer comparable taste and nutritional benefits without digestive discomfort. The segment benefits from growing café culture adoption where plant-based milk options including oat and almond milk are incorporated into beverages.

Product innovation in fortified plant-based dairy enhances segment appeal as manufacturers incorporate essential nutrients including calcium, vitamin D, and vitamin B12 to address nutritional gaps. Indian taste preferences are accommodated through locally inspired flavors including turmeric, masala chai, and saffron-infused alternatives. The availability of diverse products across supermarkets, specialty stores, and e-commerce platforms improves accessibility for urban and semi-urban consumers transitioning from conventional dairy. Brand collaborations with food service establishments further normalize plant-based dairy consumption, positioning the segment for sustained growth aligned with health-conscious consumer behavior and environmental sustainability awareness.

Source Insights:

- Almond

- Soy

- Oats

- Wheat

- Others

Soy leads with a share of 34% of the total India vegan food market in 2025.

Soy maintains dominance as the preferred source in the India vegan food market owing to its affordability, high protein content, and versatility across product applications. Soy-based products including tofu, textured vegetable protein, soy milk, and soy-based meat alternatives resonate with Indian consumers seeking economical plant-based protein sources. India's robust soybean production capacity ensures consistent raw material supply, supporting domestic manufacturing of diverse soy-derived vegan products. The established presence of soy in traditional Indian vegetarian cuisine facilitates consumer acceptance and adoption. In November 2024, Delhi-based Vezlay Foods introduced Tofu Fries and Crispy Veg Chicken at the India International Trade Fair, showcasing soy-based innovations providing complete protein sources for vegetarians and vegans.

The nutritional profile of soy aligns with health-conscious consumer preferences, offering approximately twelve grams of protein per hundred grams serving alongside essential amino acids. Textured vegetable protein derived from soy commands significant share in the meat substitutes category, utilized extensively in institutional catering including schools, hospitals, and defense establishments. Technological advancements in extrusion processing enhance soy-based product texture and mouthfeel, improving consumer acceptance. Government support for soybean and cotton farmers including the Maharashtra state allocation of INR 2,399 Crore in September 2024 strengthens the agricultural foundation supporting soy-based vegan food production and market expansion.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets exhibit a clear dominance with 41% share of the total India vegan food market in 2025.

Supermarkets and hypermarkets serve as primary retail enablers for vegan food products in India, offering high visibility, diverse product assortments, and direct consumer education opportunities. Major retail chains including Reliance Fresh, BigBasket, and Spencer's have established dedicated vegan sections featuring chilled, frozen, and ambient product categories. The organized retail format facilitates product discovery through weekend promotions, recipe cards, and influencer-driven in-store events that attract health-conscious shoppers. In January 2024, grocery chain The Organic World expanded its vegan range with new launches including ice cream, bread, tofu, and personal care products, responding to increasing consumer demand for plant-based options across retail formats.

The physical retail environment remains vital for trust-building, particularly among first-time vegan product purchasers who prefer examining products before purchase. Smart shelf technology and QR-code-linked ingredient traceability enhance transparency for clean-label conscious consumers. Extended operating hours and convenient shopping experiences across urban and suburban locations improve accessibility for working professionals and families exploring vegan dietary transitions. The channel's established infrastructure, promotional capabilities, and competitive pricing strategies position supermarkets and hypermarkets as critical drivers of mainstream vegan food adoption in India.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India represents the leading segment with 30% share of the total India vegan food market in 2025.

North India dominates the India vegan food market, benefiting from rich vegetarian culinary traditions prevalent in states including Punjab, Rajasthan, and Uttar Pradesh. Traditional cuisines in these regions feature extensive plant-based dishes naturally aligned with vegan dietary principles, facilitating consumer acceptance of dedicated vegan products. Metropolitan cities including Delhi, Chandigarh, and Gurugram demonstrate strong demand for plant-based alternatives driven by higher disposable incomes, rising health consciousness, and growing food service sector development. The concentration of multinational corporations, technology companies, and educational institutions in the National Capital Region attracts young professionals and students who demonstrate heightened awareness of sustainable consumption patterns and willingness to experiment with innovative food choices.

Rapid urbanization and significant urban population concentration in North India create favorable conditions for vegan product penetration through organized retail and food service channels. Fitness culture adoption, social media influence, and ethical consumerism strongly shape purchasing behavior among urban millennials seeking sustainable dietary alternatives. The region benefits from robust distribution infrastructure and established presence of national and regional vegan brands. Collaborations between restaurants and global vegan movements further accelerate market development. The proliferation of vegan-friendly cafes, cloud kitchens, and quick-service restaurants across Delhi NCR provides consumers convenient access to plant-based dining experiences, normalizing vegan food consumption among diverse demographic segments and positioning North India as a trendsetter influencing adoption patterns across other regions.

Market Dynamics:

Growth Drivers:

Why is the India Vegan Food Market Growing?

Rising Health Consciousness and Lifestyle Disease Prevalence

The India vegan food market is experiencing substantial growth driven by increasing health awareness and the growing prevalence of lifestyle diseases among the Indian population. Rising incidence of diabetes, cardiovascular conditions, obesity, and hypertension prompts consumers to seek healthier dietary alternatives perceived as beneficial for disease prevention and management. Plant-based diets are recognized for their efficacy in lowering cholesterol levels, reducing saturated fat intake, and providing essential nutrients including fiber, vitamins, and antioxidants. The growing fitness culture, particularly among millennial and urban populations, amplifies demand for protein-rich, cholesterol-free vegan products aligning with wellness-oriented lifestyles. The proliferation of fitness influencers, nutritionists, and health-focused social media content normalizes vegan dietary choices, accelerating mainstream adoption across diverse demographic segments seeking improved health outcomes.

Environmental Sustainability and Ethical Consumption Awareness

Environmental sustainability concerns represent significant growth drivers for the India vegan food market as consumers increasingly recognize the ecological impact of conventional animal agriculture. Awareness regarding deforestation, greenhouse gas emissions, water consumption, and land utilization associated with livestock production encourages adoption of plant-based dietary alternatives. Younger consumers demonstrate heightened sensitivity toward climate change mitigation, influencing purchasing decisions favoring sustainably produced food products. Ethical considerations regarding animal welfare further propel vegan food adoption as exposure to global animal rights movements shapes consumer empathy toward cruelty-free consumption patterns. Government initiatives including the Green India Mission and National Mission on Sustainable Agriculture promote sustainable agricultural practices supporting plant-based food production. The alignment of vegan consumption with broader sustainability goals attracts environmentally conscious consumers seeking dietary choices that minimize ecological footprint while maintaining nutritional adequacy and taste preferences.

Expanding Retail Infrastructure and Product Accessibility

The expansion of organized retail channels and e-commerce platforms significantly drives India vegan food market growth by enhancing product accessibility and visibility across urban and semi-urban regions. Supermarket chains, hypermarkets, and specialty health food stores increasingly dedicate shelf space to vegan product categories, facilitating consumer discovery and trial. Online retail platforms including Amazon, Flipkart, BigBasket, and dedicated vegan aggregators like Vegan Dukan expand reach to consumers in smaller cities where physical retail presence remains limited. Direct-to-consumer brands leverage digital marketing and subscription models to build customer relationships and ensure repeat purchases. The food service industry expansion including vegan-friendly restaurants, cafes, and cloud kitchens normalizes plant-based dining experiences. Major FMCG companies entering the vegan segment validate category potential while their extensive distribution networks accelerate nationwide product availability. Enhanced cold chain infrastructure supports frozen and refrigerated vegan product distribution, ensuring quality maintenance across supply chains.

Market Restraints:

What Challenges the India Vegan Food Market is Facing?

Premium Pricing and Affordability Concerns

The India vegan food market faces challenges related to premium pricing of plant-based products compared to conventional alternatives, limiting adoption among price-sensitive consumer segments. Higher production costs associated with specialized ingredients, processing technologies, and smaller production scales contribute to elevated retail prices. Import duties on international vegan brands further increase costs for consumers seeking globally recognized products. Limited economies of scale in domestic manufacturing constrain price competitiveness, particularly for innovative products including plant-based meats and specialty dairy alternatives. Achieving price parity with conventional animal-derived products remains critical for mainstream market penetration.

Limited Consumer Awareness in Non-Metropolitan Areas

Consumer awareness regarding vegan food products and their benefits remains limited outside metropolitan cities, constraining market expansion into tier-two, tier-three, and rural regions. Traditional dietary habits, cultural associations with dairy consumption, and misconceptions about plant-based nutrition create adoption barriers among less urbanized populations. Limited retail distribution infrastructure and fewer food service establishments offering vegan options reduce product accessibility in smaller towns. Educational efforts addressing nutritional adequacy, preparation methods, and availability of vegan alternatives require substantial investment to penetrate beyond urban consumer segments.

Taste and Texture Perception Challenges

Taste and texture limitations of certain vegan products compared to conventional alternatives impact consumer acceptance and repeat purchasing behavior. Plant-based meat and dairy substitutes sometimes fail to replicate the sensory characteristics of animal-derived products, deterring consumers seeking identical experiences. Some plant-based ingredients introduce unfamiliar tastes or aftertastes affecting product appeal. Indian consumers' strong connection to traditional flavors and textures necessitates continuous product innovation ensuring vegan alternatives meet local taste preferences while maintaining nutritional integrity and competitive pricing.

Competitive Landscape:

The vegan food market in India has a fragmented competitive environment with a presence of key FMCG giants, startups from the vegan food segment, as well as foreign companies expanding their operations within the India vegan food market. Key players are concentrating on product Development as a measure to improve the taste, texture, and nutritional value of products while searching for ways on how to achieve more affordable prices. Development of the distribution network within the India vegan food market through organized retailing, online sites, as well as direct sales, is increasing penetration among varied consumer groups. Collaboration with international suppliers of ingredients, culinary schools, as well as non-profit vegan movements is expanding the India vegan food market.

India Vegan Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered |

|

| Sources Covered | Almond, Soy, Oats, Wheat, Others |

| Distribution Channels Covered | Supermarkets And Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India vegan food market size was valued at USD 1,621.30 Million in 2025.

The India vegan food market is expected to grow at a compound annual growth rate of 10.00% from 2026-2034 to reach USD 3,823.93 Million by 2034.

Dairy alternatives dominated the market with a share of 46%, driven by rising lactose intolerance prevalence, growing café culture adoption of plant-based milk, and increasing consumer preference for cholesterol-free dairy substitutes.

Key factors driving the India vegan food market include rising health consciousness, growing prevalence of lifestyle diseases, environmental sustainability awareness, ethical consumption considerations, and expanding retail infrastructure enhancing product accessibility.

Major challenges include premium pricing limiting affordability for price-sensitive consumers, limited awareness in non-metropolitan areas, taste and texture perception gaps compared to conventional products, and the need for broader distribution networks reaching smaller towns.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)