India Used Car Market Size, Share, Trends and Forecast by Vehicle Type, Vendor Type, Fuel Type, Sales Channel, and Region, 2026-2034

India Used Car Market Summary:

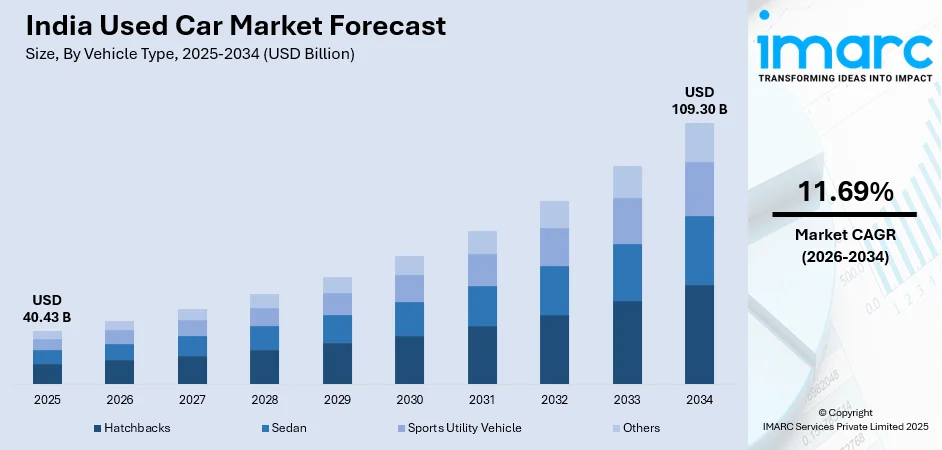

The India used car market size was valued at USD 40.43 Billion in 2025 and is projected to reach USD 109.30 Billion by 2034, growing at a compound annual growth rate of 11.69% from 2026-2034.

The India used car market is currently experiencing robust expansion on account of rising new vehicle prices, growing middle-class aspirations for personal mobility, and increasing consumer preference for affordable transportation solutions. Digital platforms and organized dealerships are transforming the traditional buying experience by offering transparent pricing, certified pre-owned vehicles, and comprehensive warranty programs that build consumer confidence in pre-owned vehicle transactions.

Key Takeaways and Insights:

- By Vehicle Type: Hatchbacks dominate the market with a share of 38% in 2025, owing to their compact size, affordability, superior fuel efficiency, and suitability for congested urban roads. Rising middle-class incomes and preferences for practical, budget-friendly vehicles continue fueling this segment's growth.

- By Vendor Type: Organized leads the market with a share of 63% in 2025. This dominance reflects growing consumer trust in certified pre-owned programs, transparent pricing mechanisms, warranty-backed purchases, and standardized quality inspections offered by established dealerships and digital platforms.

- By Fuel Type: Gasoline exhibits a clear dominance in the market with 55% share in 2025, driven by widespread refueling infrastructure availability, lower upfront vehicle costs compared to diesel alternatives, and strong consumer familiarity with petrol engines across all vehicle segments.

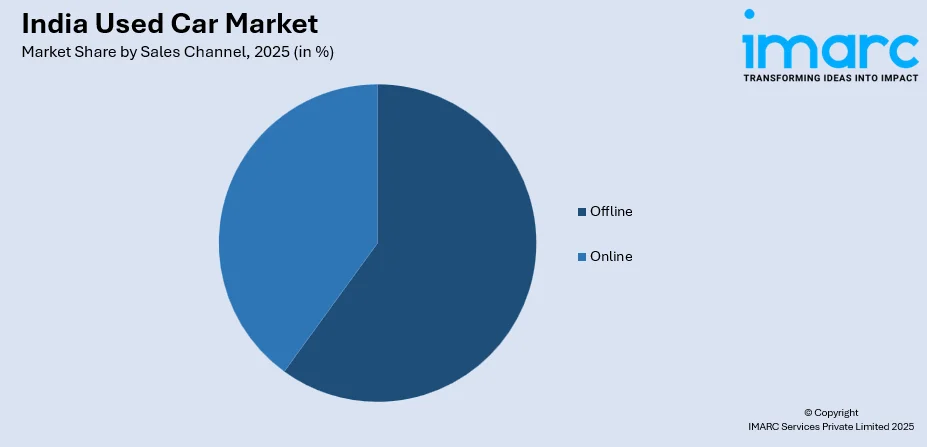

- By Sales Channel: Offline represents the biggest segment with a market share of 74% in 2025, reflecting consumer preferences for physical vehicle inspections, test drives, and direct dealer interactions that enable thorough condition assessment before purchasing pre-owned vehicles.

- By Region: North India is the largest region with 30% share in 2025, driven by high population density in Delhi-NCR, rising disposable incomes, extensive dealer networks, and strong demand for personal mobility solutions across major urban centers.

- Key Players: Key players drive the India used car market by expanding certified pre-owned programs, enhancing digital platforms with AI-driven pricing tools, investing in multi-point inspection facilities, and strengthening financing partnerships to improve consumer accessibility and market penetration. Some of the key players operating in the market include Big Boy Toyz Ltd, BMW India Private Limited (Bayerische Motoren Werke AG), Cars24, CarTrade.com, Honda Cars India Limited (Honda Motor Co. Ltd.), Mahindra First Choice Wheels (Mahindra & Mahindra Limited), Maruti Suzuki India Limited (Suzuki Motor Corporation), OLX (OLX Group), Quikr India Private Limited, Spinny (Valuedrive Technologies Private Limited), and Toyota Kirloskar Motor Private Limited (Toyota Motor Corporation).

To get more information on this market Request Sample

The India used car market is witnessing accelerated growth as consumers increasingly seek affordable mobility solutions amid rising new vehicle prices and stricter emission compliance costs. The implementation of Bharat Stage VI emission norms has significantly increased manufacturing expenses for automakers, pushing new car prices substantially higher and making pre-owned vehicles an attractive alternative for price-conscious buyers. Digital transformation is reshaping the industry landscape, with online platforms integrating AI-powered pricing engines, comprehensive vehicle history reports, and instant loan approval services to enhance transaction transparency. The expanding middle-class population, particularly in tier-2 and tier-3 cities, coupled with improving rural incomes and road infrastructure development, presents substantial growth opportunities. Furthermore, certified pre-owned programs backed by multi-point inspections and warranty coverage are building consumer confidence, encouraging first-time buyers to consider pre-owned vehicles as viable ownership alternatives.

India Used Car Market Trends:

Digital Platform Transformation and Online Sales Growth

The India used car market is experiencing significant digital transformation as online platforms revolutionize traditional buying and selling processes. Advanced technologies including AI-driven pricing analytics, virtual vehicle tours, and comprehensive inspection reports are enhancing consumer confidence. These platforms offer seamless experiences with transparent pricing, doorstep delivery, and instant financing options. Major industry players are investing substantially in technology infrastructure to develop real-time car valuation and maintenance tracking capabilities, demonstrating the sector's commitment to digital innovation. This transformation is particularly pronounced among younger buyers seeking convenient, contactless transaction experiences that eliminate traditional dealership friction points.

Rising Demand for Certified Pre-Owned Vehicles

Consumer preferences are increasingly shifting toward certified pre-owned vehicles as buyers prioritize quality assurance and warranty coverage. Organized dealers and OEM-certified programs offering multi-point inspections, extended warranties, and transparent vehicle histories are gaining substantial market traction. This trend reflects growing consumer awareness and demand for reliable pre-owned alternatives. In January 2025, Toyota Kirloskar Motor launched Toyota Mobility Solutions and Services India offering certified vehicles with a comprehensive 203-point inspection program, planning nationwide expansion by 2030. The certified segment is capturing quality-conscious buyers willing to pay premium prices for assured vehicle conditions.

Expansion into Tier-2 and Tier-3 Cities

The India used car market growth is increasingly driven by expansion into smaller cities and semi-urban areas where personal mobility demand is rising rapidly. Organized players are establishing dealership networks in previously underserved regions, leveraging digital platforms to overcome geographical barriers. Rising incomes, improved road infrastructure, and limited public transportation options create compelling opportunities in these markets. Leading companies are actively expanding their pre-owned car store networks across India, focusing on both urban and semi-urban areas to develop broader client bases. This strategic expansion addresses the significant demand-supply gap in non-metro regions where quality used vehicle availability remains limited compared to metropolitan centers.

Market Outlook 2026-2034:

The India used car market is poised for substantial expansion as evolving consumer preferences, digital transformation, and increasing vehicle affordability concerns drive sustained demand. Rising new car prices, stricter emission regulations, and expanding middle-class aspirations for personal mobility continue positioning pre-owned vehicles as attractive alternatives. The market generated a revenue of USD 40.43 Billion in 2025 and is projected to reach a revenue of USD 109.30 Billion by 2034, growing at a compound annual growth rate of 11.69% from 2026-2034. The organized sector is expected to capture increasing market share as digital platforms, certified pre-owned programs, and improved financing accessibility reshape consumer buying patterns. Government initiatives including vehicle scrappage policies and infrastructure development will further accelerate market formalization and growth trajectory.

India Used Car Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Vehicle Type |

Hatchbacks |

38% |

|

Vendor Type |

Organized |

63% |

|

Fuel Type |

Gasoline |

55% |

|

Sales Channel |

Offline |

74% |

|

Region |

North India |

30% |

Vehicle Type Insights:

- Hatchbacks

- Sedan

- Sports Utility Vehicle

- Others

Hatchbacks dominate with a market share of 38% of the total India used car market in 2025.

The hatchback segment maintains its leadership position in the India used car market due to its inherent advantages of compact size, superior fuel efficiency, and affordable price points that resonate strongly with first-time buyers and urban commuters. These vehicles offer practical mobility solutions for navigating congested city streets while providing lower ownership costs including maintenance, insurance, and fuel expenses. The segment particularly appeals to middle-class families and young professionals seeking reliable transportation without significant financial burden. According to Spinny's 2024 annual report, the Renault Kwid and Hyundai Grand i10 retained their positions as the top two preferred used car models, with hatchbacks remaining the most popular vehicle category among buyers.

The sustained demand for pre-owned hatchbacks is further supported by strong resale value retention and widespread availability across all price segments. Popular models including Maruti Suzuki Swift, Alto, and WagonR dominate the secondary market due to their proven reliability, extensive service network availability, and low spare parts costs. The segment's affordability makes it particularly attractive in price-sensitive tier-2 and tier-3 markets where cost-effectiveness remains the primary purchase consideration. Urban buyers continue preferring hatchbacks for daily commuting due to easy maneuverability in heavy traffic conditions and convenient parking in space-constrained areas, ensuring continued segment dominance throughout the forecast period.

Vendor Type Insights:

- Organized

- Unorganized

Organized leads with a share of 63% of the total India used car market in 2025.

The organized segment has established market leadership through its comprehensive approach to building consumer trust via certified pre-owned programs, transparent pricing mechanisms, and warranty-backed purchases. Authorized dealerships and established digital platforms offer multi-point vehicle inspections, verified ownership histories, and standardized refurbishment processes that address traditional concerns about used car quality and reliability. These value-added services attract quality-conscious buyers willing to pay premium prices for assured vehicle conditions. In March 2025, Spinny secured USD 131 Million funding to expand its lending services and integrate automotive media brands, demonstrating strong investor confidence in organized sector growth potential.

The organized sector continues gaining market share by addressing key consumer pain points including financing accessibility, after-sales support, and transaction security. Major players are expanding their footprints through franchise networks and digital platforms that enable nationwide reach while maintaining service quality standards. Partnerships with banks and non-banking financial companies facilitate easier loan approvals and competitive interest rates for pre-owned vehicle purchases. The segment benefits from increasing consumer awareness about certified vehicle benefits and growing preference for hassle-free buying experiences that include documentation assistance, registration transfer support, and comprehensive warranty coverage programs.

Fuel Type Insights:

- Gasoline

- Diesel

- Others

The gasoline segment exhibits a clear dominance with a 55% share of the total India used car market in 2025.

Gasoline-powered vehicles maintain market leadership in the India used car segment due to widespread refueling infrastructure availability, lower upfront acquisition costs compared to diesel alternatives, and strong consumer familiarity with petrol engine maintenance requirements. The segment dominates entry-level and mid-range vehicle categories where price sensitivity drives purchase decisions, with petrol variants offering optimal balance between performance and operational expenses. Urban buyers particularly prefer gasoline vehicles for their quieter operation, smoother performance in stop-and-go traffic conditions, and lower maintenance complexity.

The gasoline segment's dominance is further reinforced by the abundant availability of pre-owned petrol vehicles across all price segments and body styles. Hatchbacks and compact sedans, which form the bulk of used car transactions, are predominantly petrol-powered, ensuring consistent supply in the secondary market. Lower service costs, wider mechanic availability, and simpler engine technology make petrol vehicles attractive for first-time buyers and cost-conscious consumers. The segment continues benefiting from shorter ownership cycles as consumers frequently upgrade their petrol vehicles, maintaining a healthy supply of quality pre-owned units across organized and unorganized channels.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Offline represents the leading segment with a 74% share of the total India used car market in 2025.

The offline sales channel maintains market dominance as Indian consumers continue preferring physical dealership interactions for high-value vehicle purchases. In-person inspections, test drives, and direct negotiations with dealers provide the hands-on experience buyers require before committing to pre-owned vehicle purchases. Physical dealerships offer immediate vehicle availability, same-day transaction completion, and face-to-face documentation assistance that digital platforms cannot fully replicate. The offline channel particularly resonates with older demographics and first-time buyers who value personal relationships and local dealer reputation.

Traditional dealerships and local sellers maintain competitive advantages through established customer relationships, flexible negotiation capabilities, and immediate service availability. The offline channel benefits from extensive dealer networks in smaller cities where digital adoption remains limited and consumers rely on word-of-mouth recommendations for vehicle purchases. Physical showrooms enable comprehensive vehicle evaluation including mechanical inspections, bodywork assessment, and interior condition verification that remote digital platforms cannot substitute. However, organized offline dealers are increasingly integrating digital tools for inventory management, pricing optimization, and customer engagement to enhance operational efficiency while preserving the traditional buying experience.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India holds the largest share with 30% of the total India used car market in 2025.

North India dominates the used car market driven by high population density, rising disposable incomes, and extensive dealer networks across Delhi-NCR, Haryana, Punjab, and Uttar Pradesh. The region benefits from mature credit ecosystems, strong digital platform adoption, and policy incentives including scrappage certificate benefits that accelerate vehicle replacement cycles. Urban centers demonstrate particularly strong demand for certified pre-owned vehicles as quality-conscious buyers increasingly prefer organized dealership purchases. The concentration of corporate offices and business hubs creates substantial demand from working professionals seeking reliable personal transportation solutions for daily commuting needs.

The region's market leadership is supported by concentration of organized players, established financing options, and growing first-time buyer segments in expanding tier-2 cities. Delhi-NCR serves as a primary hub for premium used car transactions while surrounding states demonstrate strong demand for affordable hatchbacks and compact sedans. Infrastructure development, improving road connectivity, and increasing urbanization continue driving personal mobility demand across North India's diverse consumer segments throughout the forecast period. The region's well-developed service networks and spare parts availability further enhance consumer confidence in pre-owned vehicle ownership experiences.

Market Dynamics:

Growth Drivers:

Why is the India Used Car Market Growing?

Rising New Vehicle Prices and Affordability Gap

The India used car market is experiencing significant growth as rising new vehicle prices create substantial affordability gaps that push consumers toward pre-owned alternatives. Implementation of Bharat Stage VI emission norms has required automakers to invest in advanced exhaust after-treatment systems and engine technologies, resulting in higher manufacturing costs that translate into elevated retail prices for new vehicles. Higher taxes, stricter regulatory compliance, and increasing raw material costs further compound affordability challenges for middle-income buyers. This pricing pressure makes pre-owned vehicles increasingly attractive as consumers seek quality mobility solutions without substantial financial burden. The widening price differential between new and used vehicles enables buyers to access higher-specification models or newer vehicle segments within their budget constraints, driving sustained demand for certified pre-owned options.

Digital Platform Expansion and Enhanced Transparency

Digital transformation is fundamentally reshaping the India used car market by introducing unprecedented transparency and convenience into traditionally opaque transactions. Online platforms now offer comprehensive vehicle inspection reports, AI-powered pricing analytics, verified ownership histories, and instant financing approvals that address long-standing consumer trust concerns. These technological advancements enable buyers to make informed decisions based on accurate vehicle condition assessments rather than relying solely on seller representations. The integration of digital tools including virtual vehicle tours, detailed condition reports, and comparative pricing databases empowers consumers with information previously unavailable in traditional dealer interactions. Doorstep delivery services, easy return policies, and warranty-backed purchases further enhance the digital buying experience.

Expanding Middle-Class Population and Personal Mobility Demand

The expanding middle-class population across India is driving sustained demand for affordable personal mobility solutions that used cars effectively provide. Rising disposable incomes, changing lifestyle aspirations, and increasing urbanization are motivating first-time buyers to seek vehicle ownership without the significant capital outlay required for new car purchases. The growing preference for individual transportation over public transit, particularly following heightened hygiene awareness, has accelerated personal vehicle demand across demographic segments. Urban migration and expanding professional opportunities in tier-2 and tier-3 cities create new customer pools seeking cost-effective mobility solutions. Young professionals, small business owners, and middle-income families find used cars offering optimal value propositions that balance affordability with aspiration.

Market Restraints:

What Challenges the India Used Car Market is Facing?

Higher Financing Costs for Pre-Owned Vehicles

The India used car market faces financing constraints as interest rates for pre-owned vehicle loans remain substantially higher than new car financing options. Used car loan interest rates are typically several percentage points above those offered for new vehicles, creating significant cost differentials that impact total ownership expenses. This financing gap particularly affects first-time buyers and price-sensitive consumers who rely on loan accessibility to enable vehicle purchases, potentially deterring transactions and limiting market penetration among budget-conscious demographics.

Limited Transparency in Unorganized Market Segments

The prevalence of unorganized dealers in the India used car market creates persistent transparency challenges including odometer tampering, undisclosed accident histories, and unclear ownership documentation. Consumers face difficulties verifying vehicle conditions, maintenance records, and legal compliance when transacting through informal channels. The absence of standardized inspection protocols and quality certifications in unorganized segments perpetuates trust deficits that discourage potential buyers from entering the used car market.

Supply-Demand Imbalances in Popular Price Segments

The India used car market experiences supply-demand imbalances particularly in affordable price segments where first-time buyer demand significantly exceeds available vehicle supply. This mismatch creates pricing pressures with consistent annual resale price increases across segments, potentially limiting affordability advantages that attract buyers to the used car market. The concentration of quality vehicle supply in metropolitan areas further exacerbates availability challenges in smaller cities, forcing buyers to compromise on preferences or postpone purchases.

Competitive Landscape:

The India used car market is characterized by intense competition between organized platforms and traditional unorganized dealers vying for consumer attention. Major players are differentiating through certified pre-owned programs, AI-powered pricing tools, comprehensive warranty offerings, and integrated financing solutions that enhance customer experience. Digital platforms are investing heavily in technology infrastructure and customer acquisition while expanding geographic footprints into tier-2 and tier-3 cities. OEM-backed certified programs leverage brand trust and standardized processes to capture quality-conscious buyers. Strategic partnerships between used car platforms and financial institutions are improving financing accessibility and streamlining purchase processes. Market consolidation trends are evident as organized players pursue scale advantages in logistics, customer service, and technology capabilities that smaller competitors cannot match.

Some of the key players include:

- Big Boy Toyz Ltd

- BMW India Private Limited (Bayerische Motoren Werke AG)

- Cars24

- CarTrade.com

- Honda Cars India Limited (Honda Motor Co. Ltd.)

- Mahindra First Choice Wheels (Mahindra & Mahindra Limited)

- Maruti Suzuki India Limited (Suzuki Motor Corporation)

- OLX (OLX Group)

- Quikr India Private Limited

- Spinny (Valuedrive Technologies Private Limited)

- Toyota Kirloskar Motor Private Limited (Toyota Motor Corporation)

Recent Developments:

- In April 2025, CARS24 acquired Team-BHP, India's largest online automotive community, to combine peer knowledge and enthusiast insights with its digital marketplace. The acquisition aims to strengthen CARS24's position in the pre-owned vehicle sector by leveraging the community's trusted automotive content and buyer guidance resources.

India Used Car Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Hatchbacks, Sedan, Sports Utility Vehicle, Others |

| Vendor Types Covered | Organized, Unorganized |

| Fuel Types Covered | Gasoline, Diesel, Others |

| Sales Channels Covered | Online, Offline |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | Big Boy Toyz Ltd, BMW India Private Limited (Bayerische Motoren Werke AG), Cars24, CarTrade.com, Honda Cars India Limited (Honda Motor Co. Ltd.), Mahindra First Choice Wheels (Mahindra & Mahindra Limited), Maruti Suzuki India Limited (Suzuki Motor Corporation), OLX (OLX Group), Quikr India Private Limited, Spinny (Valuedrive Technologies Private Limited) and Toyota Kirloskar Motor Private Limited (Toyota Motor Corporation) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India used car market size was valued at USD 40.43 Billion in 2025.

The India used car market is expected to grow at a compound annual growth rate of 11.69% from 2026-2034 to reach USD 109.30 Billion by 2034.

Hatchbacks dominated the market with a share of 38%, driven by their compact size, affordability, superior fuel efficiency, and suitability for congested urban roads that appeal strongly to first-time buyers.

Key factors that are presently driving the India used car market include rising new vehicle prices, expanding middle-class population, digital platform transformation, certified pre-owned program growth, and improving financing accessibility.

Major challenges include higher financing costs for pre-owned vehicles, limited transparency in unorganized market segments, supply-demand imbalances in popular price segments, inadequate quality standardization, and inconsistent regulatory frameworks for ownership transfers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)