India Used Car Loan Market Size, Share, Trends and Forecast by Vehicle Type, Financier, Percentage of Amount Sanctioned, Tenure, and Region, 2026-2034

India Used Car Loan Market Overview:

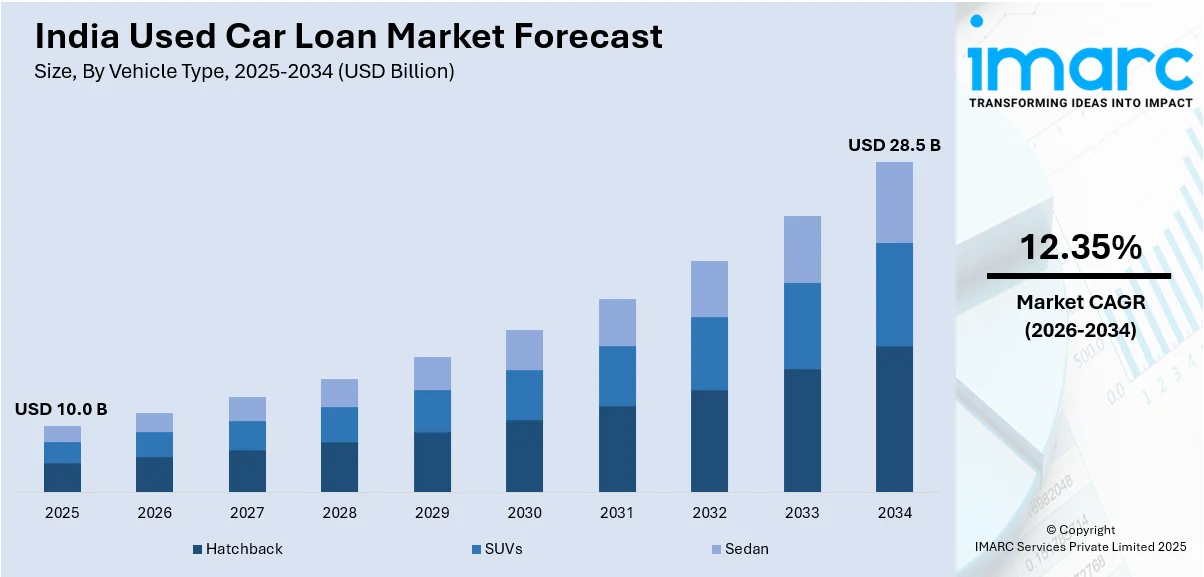

The India used car loan market size reached USD 10.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 28.5 Billion by 2034, exhibiting a growth rate (CAGR) of 12.35% during 2026-2034. The used car loan market in India is being driven by technological advancements, greater financing options, and rise of peer-to-peer lending platforms. These factors simplify the loan application process, offer diverse loan products, and improve accessibility, making financing more available to a wider user base.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 10.0 Billion |

| Market Forecast in 2034 | USD 28.5 Billion |

| Market Growth Rate (2026-2034) | 12.35% |

India Used Car Loan Market Trends:

Technological Advancements in Loan Process

The used car loan market in India is progressively shaped by technological innovations that simplify the application and approval procedures. Digital platforms, mobile applications, and online websites are transforming how buyers handle used car financing. Lenders employ sophisticated algorithms and machine learning (ML) techniques to evaluate creditworthiness rapidly and effectively, decreasing paperwork and shortening loan approval duration. The ease of applying for loans online, along with the clarity of digital communication, guarantees that clients have access to up-to-date information, compare offers, and make educated choices. The simplicity of using these platforms, combined with faster fund distribution, is attracting more clients to the used car loan sector. In 2024, Rupyy, the digital lending platform of CarDekho, announced plans to expand into the used commercial vehicle financing market in FY25. The company aimed to address the lack of digitization in this sector by offering a streamlined loan process for light commercial vehicles like pickup trucks. Rupyy planned to implement digital solutions similar to those in the used car market to enhance client experience and speed up loan processing.

To get more information on this market Request Sample

Increased Availability of Financing Options

Traditionally controlled by banks, the industry now features a diverse array of monetary organizations, such as non-banking financial companies (NBFCs), fintech startups, and peer-to-peer lending services. These institutions provide customized loan options, featuring low interest rates, adjustable repayment plans, and diverse down payment criteria, thereby appealing to a wider range of clients. As competition grows stronger, lenders are more frequently implementing creative approaches to draw in buyers, like providing pre-approved loans, fast disbursements, and reduced paperwork. The ease of access and adaptability of these financial products are facilitating securing financing for used cars for individuals from various demographics. In 2023, Mahindra Finance launched the 'Used Car Digi Loans' initiative in collaboration with Car&Bike (Mahindra First Choice Wheels) and Rupyy (CarDekho). This digital platform allowed clients to access customized loan offers for used cars, enabling quicker loan approvals and seamless processing. The system aimed to enhance customer satisfaction with faster loan disbursals and real-time application tracking.

Rise in Peer-to-Peer (P2P) Lending Platforms

The emergence of peer-to-peer (P2P) lending platforms is transforming the used car loan market in India. These platforms link borrowers directly with private lenders, avoiding conventional financial institutions and providing attractive loan conditions. P2P lending platforms generally provide adaptable interest rates, customized loan terms, and faster approval procedures than conventional banks or NBFCs, making them an appealing choice for used car purchasers. As these platforms become more popular, they are broadening the overall range of financing choices accessible to individuals, particularly for those who may find it difficult to secure loans from traditional sources. By providing increased access to funding and presenting an alternative to conventional lending methods, P2P platforms are playing a crucial role in the expansion of the used car loan sector in India. In 2024, Nxcar launched an integrated platform for peer-to-peer used car transactions in India, offering loans, vehicle inspection, valuation, insurance, and RC transfer services. The platform simplified the process of buying second-hand cars, providing access to loans even for individual sellers. Nxcar had partnered with over 20 banks and NBFCs for nationwide coverage.

India Used Car Loan Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on vehicle type, financier, percentage of amount sanctioned, and tenure.

Vehicle Type Insights:

- Hatchback

- SUVs

- Sedan

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes hatchback, SUVs, and sedan.

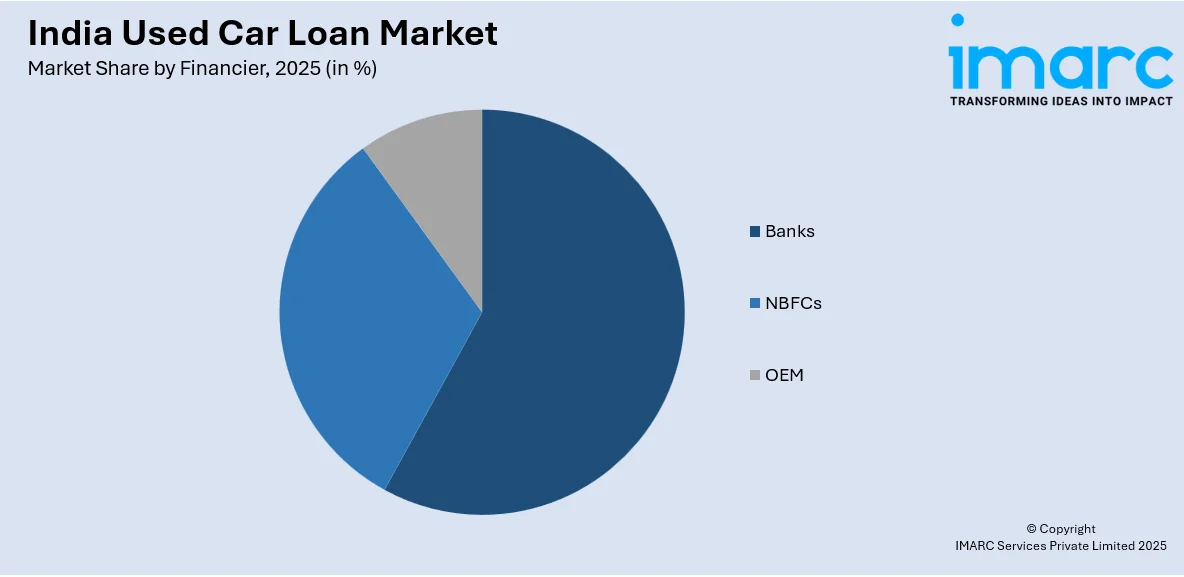

Financier Insights:

Access the Comprehensive Market Breakdown Request Sample

- Banks

- NBFCs

- OEM

A detailed breakup and analysis of the market based on the financier have also been provided in the report. This includes banks, NBFCs, and OEM.

Percentage of Amount Sanctioned Insights:

- Up to 25%

- 25-50%

- 51-75%

- Above 75%

The report has provided a detailed breakup and analysis of the market based on the percentage of amount sanctioned. This includes up to 25%, 25-50%, 51-75%, and above 75%.

Tenure Insights:

- Less than 3 Years

- 3-5 Years

- More than 5 Years

A detailed breakup and analysis of the market based on the tenure have also been provided in the report. This includes less than 3 years, 3-5 years, and more than 5 years.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Used Car Loan Market News:

- In September 2024, OLX India partnered with IDFC FIRST Bank to launch an end-to-end used-vehicle financing solution, simplifying the purchase of pre-owned cars and bikes. This collaboration offered quick and easy financing directly on the OLX platform, enhancing user convenience. The partnership aimed to streamline the entire transaction process and capture a growing share of India's pre-owned vehicle market.

- In August 2024, Bajaj Finserv launched an innovative car loan app that offered instant approvals and seamless loan management for both new and used cars. The app simplified the car loan process with a user-friendly interface, personalized loan offers, and robust security features. It aimed to provide a faster, more efficient way for users to apply for and manage loans for used car purchases online.

India Used Car Loan Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Hatchback, SUVs, Sedan |

| Financiers Covered | Banks, NBFCs, OEM |

| Percentage of Amount Sanctioneds Covered | Up to 25%, 25-50%, 51-75%, Above 75% |

| Tenures Covered | Less than 3 Years, 3-5 Years, More than 5 Years |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India used car loan market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India used car loan market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India used car loan industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The used car loan market in India was valued at USD 10.0 Billion in 2025.

The India used car loan market is projected to exhibit a CAGR of 12.35% during 2026-2034, reaching a value of USD 28.5 Billion by 2034.

Key factors driving the India used car loan market include rising demand for affordable personal mobility, increasing acceptance of certified pre-owned vehicles, and the availability of flexible financing options. Digital loan processing, growing middle-class aspirations, and improved credit access are further fueling the market’s expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)