India Uninterrupted Power Supply System Market Size, Share, Trends and Forecast by Type, Rating, End User and Region, 2025-2033

India Uninterrupted Power Supply System Market Size and Share:

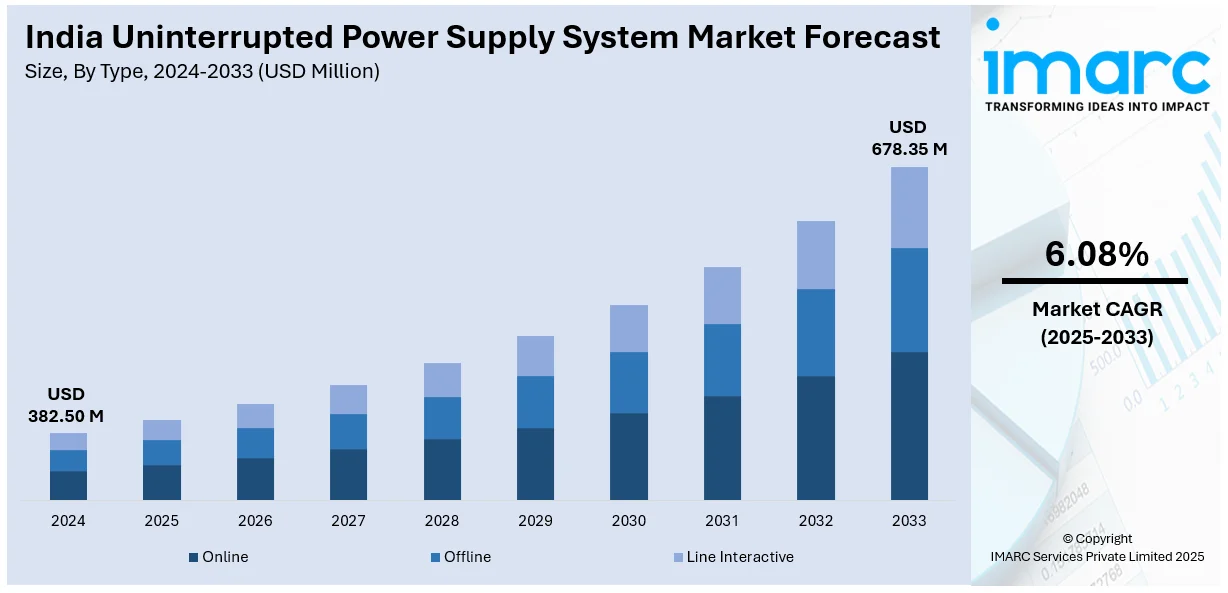

The India uninterrupted power supply system market size reached USD 382.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 678.35 Million by 2033, exhibiting a growth rate (CAGR) of 6.08% during 2025-2033. The India uninterrupted power supply system market share is propelled by rising power outages, industrial expansion, digitalization, and an escalating demand for reliable power in industries such as IT, healthcare, and manufacturing. Government policies favoring infrastructure development and urbanization, as well as heightened awareness of power protection, are further enhancing the India uninterrupted power supply system market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 382.50 Million |

| Market Forecast in 2033 | USD 678.35 Million |

| Market Growth Rate (2025-2033) | 6.08% |

India Uninterrupted Power Supply System Market Trends:

Growing Demand for UPS Systems in the IT and Data Center Sector

One of the leading trends fueling the India uninterrupted power supply (UPS) system market is the growing dependence on IT infrastructure and data centers. With companies and government organizations quickly digitizing their processes, demand for efficient power backup systems has witnessed an upsurge. Data centers, being the backbone of cloud computing, e-commerce sites, and digital services, need constant power to keep servers and networking devices running continuously without any downtime. Power failures have the potential to result in data loss, downtime, and financial losses, making UPS systems a necessity in this industry. Moreover, increased remote working, online learning, and the expansion of the e-commerce sector have added to the increased need for stable and continuous power supply systems. Green UPS technology provides improved efficiency ranging from 94 to 97 percent compared to the standard 80 to 88 percent. The increasing number of data centers in cities such as Bengaluru, Hyderabad, and Gurugram is playing a major role in the growth of the UPS market in India.

To get more information on this market, Request Sample

Shift Toward Green and Energy-Efficient UPS Systems

One of the prominent trends in the India UPS market is growing interest in green and energy-efficient systems. The government's stress on sustainability, as well as the worldwide momentum for minimizing carbon footprints, has led to industries increasingly moving towards eco-friendly UPS solutions with low energy consumption and emissions. The need for energy-efficient UPS systems is particularly high in the healthcare, IT, and manufacturing industries, where operational efficiency is a key aspect. Producers are currently adding sophisticated technologies like lithium-ion batteries, which are more effective, longer lasting, and cleaner compared to lead-acid batteries. As per the industry reports, eco-friendly UPS designs can cut energy use by as much as 75% in comparison to traditional systems. Lithium-ion batteries too, provide a lifespan of 11–15 years, exceeding that of conventional lead-acid batteries. Moreover, UPS system innovation like smart monitoring and load management functionality optimizes the use of energy, and that results in lower operating costs. As companies seek to comply with regulations and cut energy usage, the trend toward green UPS systems will continue to grow in India.

India Uninterrupted Power Supply System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, rating, end user and region.

Type Insights:

- Online

- Offline

- Line Interactive

The report has provided a detailed breakup and analysis of the market based on the type. This includes online, offline, and line interactive.

Rating Insights:

- <5KVA

- 5-<50KVA

- 50-200 KVA

- >200 KVA

The report has provided a detailed breakup and analysis of the market based on the rating. This includes <5KVA, 5-<50KVA, 50-200 KVA, and >200KVA.

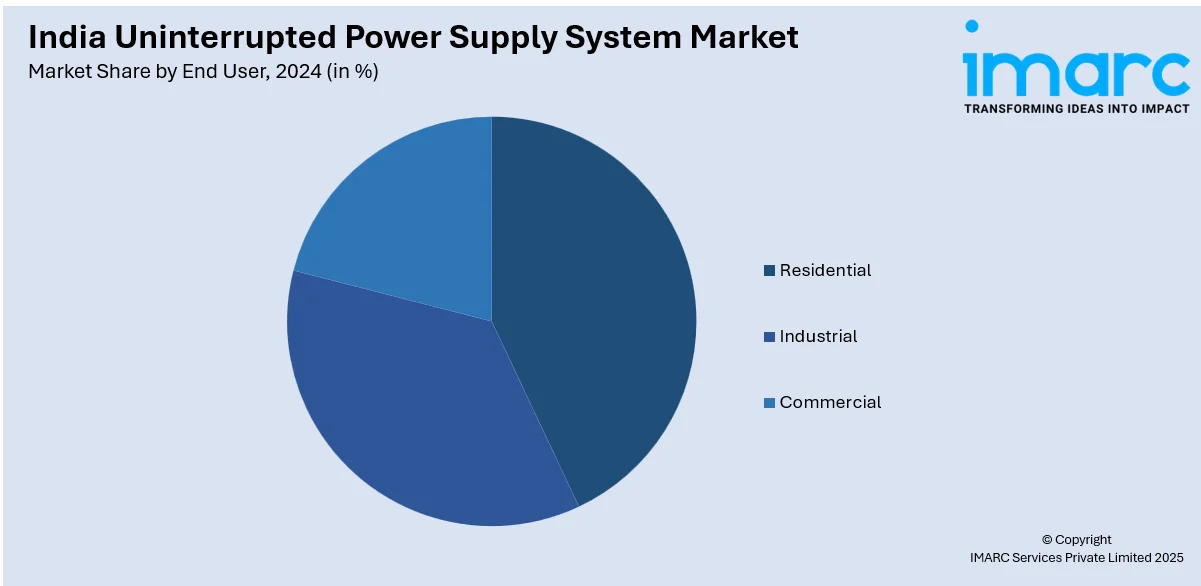

End User Insights:

- Residential

- Industrial

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, industrial, and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Uninterrupted Power Supply System Market News:

- In July 2023, ABB India's Electrification division introduced MegaFlex DPA (Decentralized Parallel Architecture) UPS solutions for the Indian market. The inaugural sustainable UPS of its kind, included in the ABB EcoSolutions™ portfolio, adheres to the ABB circularity framework. It is crafted for a high-density computing setting with maximum efficiency and minimal footprint.

- In March 2025, Schneider Electric introduced the Galaxy VXL UPS, tailored for AI hyperscale data centers and essential infrastructure. The UPS boasts a sleek design, modular expandability, and exceptional efficiency, reaching up to 99 percent efficiency in eConversion mode and 97.5% in double conversion mode.

India Uninterrupted Power Supply System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Online, Offline, Line Interactive |

| Ratings Covered | <5KVA, 5-<50KVA, 50-200 KVA, >200 KVA |

| End Users Covered | Residential, Industrial, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India uninterrupted power supply system market performed so far and how will it perform in the coming years?

- What is the breakup of the India uninterrupted power supply system market on the basis of type?

- What is the breakup of the India uninterrupted power supply system market on the basis of rating?

- What is the breakup of the India uninterrupted power supply system market on the basis of end user?

- What is the breakup of the India uninterrupted power supply system market on the basis of region?

- What are the various stages in the value chain of the India uninterrupted power supply system market?

- What are the key driving factors and challenges in the India uninterrupted power supply system market?

- What is the structure of the India uninterrupted power supply system market and who are the key players?

- What is the degree of competition in the India uninterrupted power supply system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India uninterrupted power supply system market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India uninterrupted power supply system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India uninterrupted power supply system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)