India Two-Wheeler Market Size, Share, Trends and Forecast by Type, Technology, Transmission, Engine Capacity, Fuel Type, End User, Distribution Channel, and Region, 2026-2034

India Two-Wheeler Market Summary:

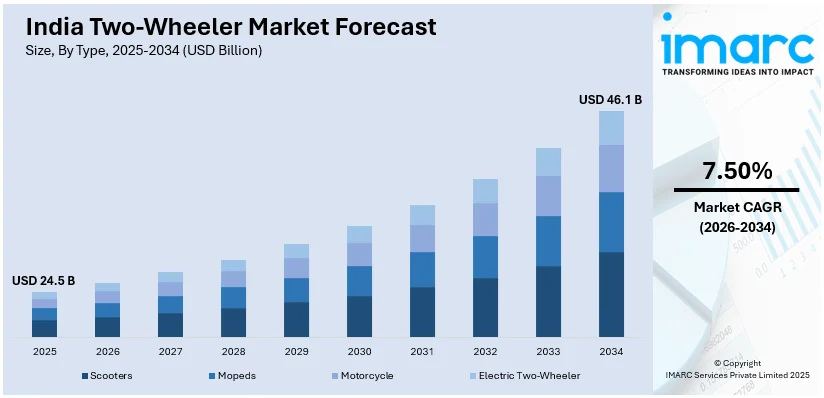

The India two-wheeler market size reached USD 24.5 Billion in 2025 and is projected to reach USD 46.1 Billion by 2034, growing at a compound annual growth rate of 7.50% from 2026-2034.

The market is driven by rapid urbanization, rising disposable incomes among the expanding middle-class population, and the growing need for cost-effective personal mobility solutions. Government initiatives supporting domestic manufacturing and the development of rural road infrastructure are further accelerating adoption. Additionally, the availability of affordable financing options and easy loan schemes has made vehicle ownership more accessible. Technological advancements incorporating smart connectivity features and fuel-efficient engines continue attracting consumers across demographics, contributing to the India two-wheeler market share.

Key Takeaways and Insights:

- By Type: Motorcycle dominates the market with a share of 56% in 2025, driven by versatility for long-distance and urban commuting, affordability, and preference among budget-conscious middle-class and lower-income consumers nationwide.

- By Technology: ICE leads the market with a share of 90% in 2025, owing to established refueling infrastructure, consumer familiarity with conventional powertrains, lower upfront costs, and extensive service networks across urban and rural areas.

- By Transmission: Manual represents the largest segment with a market share of 78% in 2025, driven by consumer preference for fuel efficiency, lower maintenance costs, enhanced riding control, and popularity among price-sensitive buyers seeking reliable, economical commuting solutions.

- By Engine Capacity: 100-125cc dominates the market with a share of 42% in 2025, owing to optimal balance between fuel economy and sufficient power, making it ideal for daily commuting across congested urban roads and longer rural distances.

- By Fuel Type: Petrol leads the market with a share of 47% in 2025, driven by widespread fuel station availability, established supply chains, competitive pricing, and consumer confidence in conventional fuel technology for daily transportation needs.

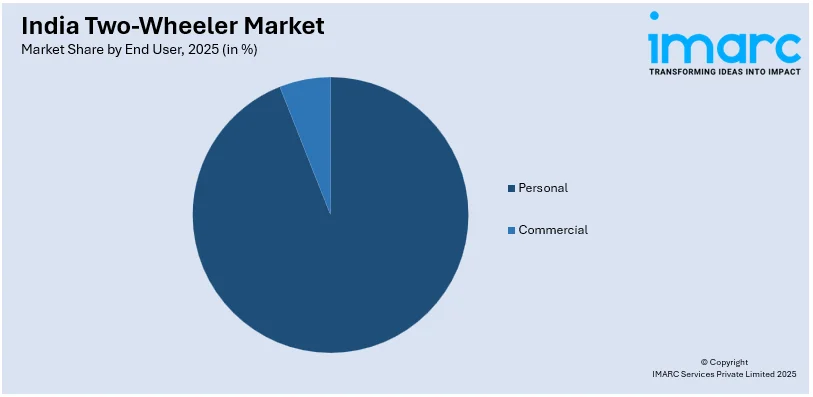

- By End User: Personal represents the largest segment with a market share of 94% in 2025, owing to growing need for individual mobility amid urban traffic congestion, limited public transport, and increasing vehicle ownership aspirations among young professionals.

- By Distribution Channel: Offline dominate the market with a share of 89% in 2025, driven by consumer preference for physical inspection, test rides, after-sales service assurance, and personalized dealer interactions despite rising digital adoption.

- By Region: West and Central India leads the market with a share of 34% in 2025, owing to major metropolitan populations, industrial growth, favorable economic conditions, and rising consumer purchasing power driving private vehicle adoption and market expansion.

- Key Players: The India two-wheeler market exhibits a highly competitive landscape, with established domestic manufacturers competing alongside international players across various price segments. Market participants focus on expanding product portfolios, strengthening dealer networks, introducing advanced technology features, and offering attractive financing schemes to capture consumer mindshare and enhance market positioning. Some of the key players operating the market include Bajaj Auto Limited, Hero MotoCorp Ltd, Honda Motorcycle and Scooter India Pvt. Ltd., India YAMAHA Motor Pvt. Ltd, Royal Enfield, Suzuki Motorcycle India, and TVS Motor Company.

To get more information on this market Request Sample

The India two-wheeler market is experiencing robust growth propelled by fundamental socioeconomic transformations reshaping consumer mobility patterns. Rapid urbanization continues driving millions from rural to urban areas seeking better employment opportunities, subsequently increasing demand for affordable personal transportation solutions that navigate congested city roads efficiently. The expanding middle-class population with enhanced purchasing power seeks convenient mobility options that balance cost-effectiveness with reliability. As per sources, in October 2025, India’s two‑wheeler retail sales exceeded 2.8 Million units, led by Hero MotoCorp, TVS, and Bajaj Auto, while electric scooter sales and premium motorcycles witnessed significant growth. Moreover, inadequate public transportation infrastructure in numerous cities compels consumers toward personal vehicle ownership for daily commuting requirements. Additionally, favorable government policies promoting domestic manufacturing through incentive schemes stimulate industry growth. The availability of flexible financing options through partnerships between manufacturers and financial institutions makes vehicle acquisition accessible across income segments. Technological innovations incorporating fuel-efficient engines, improved safety features, and smart connectivity appeal to tech-savvy consumers seeking modern transportation solutions that align with contemporary lifestyle aspirations.

India Two-Wheeler Market Trends:

Growing Adoption of Connected Vehicle Technologies

The India two-wheeler market is increasingly integrating smart connectivity, transforming conventional vehicles into intelligent mobility solutions. Manufacturers now equip models with GPS navigation, Bluetooth, and smartphone app integration, enhancing safety and rider experience. Digital instrument clusters offering real-time diagnostics, fuel monitoring, and maintenance alerts are becoming standard in premium segments. As per sources, MediaTek and JioThings introduced a “Made in India” smart digital cluster for two‑wheelers, providing real‑time diagnostics, voice recognition, and advanced connectivity features. Moreover, features like remote monitoring, anti-theft alerts, and geo-fencing address security concerns. The convergence of telecom and automotive technologies positions connected two-wheelers as vital components of smart city ecosystems, driving sustained consumer interest.

Premiumization Trend Among Urban Consumers

Urban consumers in India are driving a shift toward premium motorcycles and scooters, prioritizing performance, aesthetics, and brand prestige. Rising disposable incomes and aspirational purchasing behaviors support demand for higher-displacement vehicles with superior power and advanced features. Scooters and motorcycles now focus on comfort, modern design, and technology integration. In November 2025, Yamaha Motor launched two new electric scooters in India, the AEROX E and EC‑06, targeting premium buyers and supporting environmental goals through local production and strategic partnerships. Moreover, manufacturers are expanding premium portfolios, introducing international models adapted to local conditions. This trend reflects evolving lifestyles, where two-wheelers serve not only as transportation but also as symbols of personal identity and status.

Expansion of Flexible Ownership Models

Innovative ownership and financing models are transforming two-wheeler access in India, catering to diverse consumer segments. As per sources, in 2025, India’s two-wheeler market saw growth through flexible ownership models, including Hero MotoCorp’s Vida VX2 battery subscription, organized used vehicle platforms, fintech-enabled financing, and fleet leasing. Moreover, subscription services allow vehicle usage without full ownership, appealing to younger, experience-focused buyers. Organized used vehicle markets provide affordable mobility with quality assurances and warranties. Fintech partnerships offer embedded credit solutions for seamless digital financing at the point of sale. Leasing options for commercial fleets provide predictable costs supporting business growth. These flexible models expand market reach by accommodating varying financial capacities and lifestyle preferences.

Market Outlook 2026-2034:

The India two-wheeler market is set for significant revenue growth, driven by urbanization, rising incomes, and evolving mobility preferences. Premiumization trends, technological innovations, and improved rural infrastructure support expansion. Electric two-wheelers offer revenue potential, boosted by government incentives, charging network growth, and falling battery costs. Manufacturers focusing on product diversification, stronger distribution, and digital retail channels will capture emerging opportunities. Recovery in export demand and supportive domestic policies further enhance market momentum, positioning the sector for sustained growth throughout the forecast period. The market size was estimated at USD 24.5 Billion in 2025 and is expected to reach USD 46.1 Billion by 2034, reflecting a compound annual growth rate of 7.50% over the forecast period 2026-2034.

India Two-Wheeler Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Motorcycle | 56% |

| Technology | ICE | 90% |

| Transmission | Manual | 78% |

| Engine Capacity | 100-125cc | 42% |

| Fuel Type | Petrol | 47% |

| End User | Personal | 94% |

| Distribution Channel | Offline | 89% |

| Region | West and Central India | 34% |

Type Insights:

- Scooters

- Mopeds

- Motorcycle

- Electric Two-Wheeler

The motorcycle dominates with a market share of 56% of the total India two-wheeler market in 2025.

Motorcycle commands the dominant position within the India two-wheeler market, representing the preferred choice for diverse consumer segments across geographical regions. As per sources, in November 2025, Hero MotoCorp regained the top spot in India’s two-wheeler sales, selling 6,04,490 units, including 5,39,128 motorcycles, reflecting strong post-festive demand and a 31% YoY increase. Moreover, this leadership stems from the inherent versatility motorcycles offer, accommodating varied usage scenarios including daily urban commuting, long-distance intercity travel, and recreational riding purposes. The segment benefits from substantial product portfolio depth spanning entry-level commuter variants to premium performance-oriented models catering to differentiated consumer requirements and budget parameters.

The motorcycle segment's dominance is further reinforced by competitive pricing structures aligned with budget-conscious Indian consumer preferences. Lower total cost of ownership compared to alternative vehicle categories, combined with favorable fuel efficiency characteristics, positions motorcycles as economically rational mobility investments. Extensive dealer and service networks across metropolitan and rural areas ensure convenient access to sales and after-sales support. Additionally, strong resale value retention and established secondary markets enhance long-term ownership economics, sustaining motorcycle preference among value-oriented consumers.

Technology Insights:

- ICE

- Electric

ICE leads with a share of 90% of the total India two-wheeler market in 2025.

ICE maintains commanding market leadership, benefiting from decades of infrastructure development, consumer familiarity, and established supply chain ecosystems. The extensive nationwide network of fuel stations ensures convenient refueling accessibility regardless of geographical location, addressing practical operational requirements. Consumers demonstrate continued confidence in ICE technology based on proven reliability, predictable performance characteristics, and accumulated operational experience across diverse riding conditions.

ICE further benefits from lower upfront acquisition costs compared to alternative powertrains, aligning with price-sensitive market characteristics. Comprehensive service infrastructure including authorized dealerships, independent workshops, and spare parts availability ensures convenient maintenance accessibility. Additionally, established resale markets with predictable value trajectories provide ownership certainty. While electrification trends are emerging, the transition timeline remains gradual given infrastructure constraints, range limitations, and upfront cost premiums associated with alternative technologies.

Transmission Insights:

- Manual

- Automatic

Manual exhibits a clear dominance with a 78% share of the total India two-wheeler market in 2025.

Manual dominates consumer preference driven by tangible operational and economic advantages resonating with practical-minded Indian buyers. Enhanced fuel efficiency achievable through rider-controlled gear selection delivers measurable cost savings over vehicle lifespans, particularly significant given fuel price sensitivities. Additionally, lower maintenance requirements and reduced repair costs compared to automatic alternatives contribute favorable lifetime ownership economics appealing to value-conscious consumers.

It also benefits from rider preferences for enhanced vehicle control and engagement during diverse traffic conditions prevalent across Indian roads. The riding experience familiarity accumulated over generations reinforces transmission preference continuity. Furthermore, the broader product portfolio availability spanning entry-level to premium categories ensures manual transmission accessibility across price segments and usage requirements. While automatic transmissions are gaining traction in urban scooter segments, manual systems maintain dominance within motorcycle categories constituting primary market volume.

Engine Capacity Insights:

- <100cc

- 100-125cc

- 126-180cc

- 181-250cc

- 251-500cc

- 501-800cc

- 801-1600cc

- >1600cc

100-125cc dominates with a market share of 42% of the total India two-wheeler market in 2025.

The 100-125cc engine capacity segment leads market share by delivering optimal balance between operational efficiency and performance adequacy for typical Indian usage patterns. According to sources, in August 2025, Honda Motorcycle and Scooter India (HMSI) launched two new motorcycles in the 100 cc and 125 cc segments, aiming to expand its 28 percent market share. Furthermore, these displacement levels generate sufficient power output for comfortable daily commuting across varying road conditions while maintaining exceptional fuel economy—a critical consideration given consumer sensitivity to running costs. The segment addresses mainstream transportation requirements without over-engineering beyond practical necessities.

Vehicles within this displacement range offer attractive acquisition pricing aligned with middle-income consumer budgets while incorporating essential features expected from contemporary two-wheelers. Insurance and registration costs remain manageable, further supporting favorable ownership economics. The segment's versatility accommodates both urban commuting characterized by frequent stops and rural transportation requiring sustained cruising capability. Additionally, extensive model availability from major manufacturers ensures consumer choice across styling preferences and feature specifications within this popular displacement category.

Fuel Type Insights:

- Gasoline

- Petrol

- Diesel

- LPG/CNG

- Battery

Petrol leads with a share of 47% of the total India two-wheeler market in 2025.

Petrol maintains market leadership supported by established refueling infrastructure spanning urban and rural geographies nationwide. The ubiquitous availability of petrol stations ensures operational convenience without range anxiety concerns, a practical consideration influencing purchase decisions. According to sources, in 2025, India’s petrol consumption rose 7 % year-on-year to 3.65 Million Tonnes, driven by festive travel demand, while diesel sales remained largely flat at 7.6 Million Tonnes. Moreover, consumer familiarity with petrol engine characteristics, maintenance requirements, and operational behaviors accumulated over decades reinforces continued preference for this fuel category.

Petrol benefits from competitive fuel pricing and supply chain stability compared to alternative energy sources. Vehicle pricing within this fuel category spans accessible entry-level to premium segments, accommodating diverse budget parameters. Additionally, established service expertise across authorized and independent workshops ensures convenient maintenance accessibility. The segment's mature ecosystem encompassing fuel supply, vehicle availability, and service infrastructure creates a comprehensive ownership experience meeting consumer expectation for reliable, economical transportation solutions.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Personal

- Commercial

Personal exhibits a clear dominance with a 94% share of the total India two-wheeler market in 2025.

Personal constitutes the market majority, reflecting fundamental Indian consumer aspirations for individual mobility enabling lifestyle convenience and independence. The desire for private transportation transcends basic commuting functionality, representing achievement milestones and status markers within societal contexts. Rising urbanization intensifies personal vehicle demand as consumers seek alternatives to overcrowded and unreliable public transportation systems prevalent in numerous cities.

Personal benefits from evolving financing accessibility democratizing vehicle ownership across income strata. According to sources, in August 2025, Honda established Honda Finance India Private Ltd. in Gurugram, offering retail sales financing for motorcycles and automobiles, marking its ninth global financial services subsidiary. Further, easy loan availability with attractive terms enables aspirational purchases previously beyond immediate financial reach. Additionally, changing lifestyle patterns including flexible work arrangements, leisure activities, and social commitments intensify personal mobility requirements. The emotional connection consumers develop with personal vehicles, combined with practical ownership benefits including convenience, flexibility, and privacy, sustains dominant segment positioning within the market structure.

Distribution Channel Insights:

- Offline

- Online

Offline lead with a share of 89% of the total India two-wheeler market in 2025.

Offline continue to dominate the India two-wheeler market, driven by consumers’ preference for tangible engagement during high-value purchases. Physical dealership visits allow potential buyers to conduct thorough vehicle evaluations, including visual inspections, feature exploration, and test rides. This hands-on experience addresses information gaps that digital platforms cannot fully replicate, ensuring confident purchasing decisions. The immersive, personalized interaction provided by dealers strengthens buyer trust and satisfaction, particularly among middle-class and first-time vehicle owners who value professional guidance and accountability throughout the buying process. In October 2025, Suzuki Motorcycle India achieved its highest-ever monthly sales, dispatching 1,29,261 units with 8% year-on-year growth, driven by strong festive demand and a 71% surge in exports.

Dealerships also provide critical after-sales services, including maintenance scheduling, warranty support, and upgrade consultations, enhancing the overall ownership experience. Offline channels facilitate financing, insurance processing, and legal documentation, bundling these services into a convenient purchase journey. Despite rising digital adoption among younger demographics, the complexity and investment involved in two-wheeler purchases maintain strong reliance on offline networks. Recognizing this, manufacturers continue expanding and upgrading dealership infrastructures, incorporating interactive showrooms, customer engagement initiatives, and service enhancements to reinforce offline channel leadership and brand loyalty.

Regional Insights:

- North India

- West and Central India

- East India

- South India

West and Central India dominates with a market share of 34% of the total India two-wheeler market in 2025.

West and Central India commands market leadership driven by concentrated economic activity, dense urban populations, and favorable demographic profiles supporting vehicle demand. Major metropolitan centers within this region including financial and commercial hubs generate substantial mobility requirements from working populations navigating congested transportation landscapes. Strong industrial presence creates employment opportunities attracting population inflows subsequently intensifying personal vehicle demand.

The region benefits from relatively higher income levels and purchasing power compared to national averages, enabling premium vehicle adoption alongside volume segment growth. Established dealer networks ensure comprehensive market coverage facilitating convenient vehicle acquisition and service accessibility. Additionally, infrastructure development supporting improved road connectivity expands addressable markets within surrounding areas. Regional consumer preferences reflecting modern lifestyle aspirations align with manufacturer product strategies emphasizing contemporary designs and technology features, sustaining market leadership positioning.

Market Dynamics:

Growth Drivers:

Why is the India Two-Wheeler Market Growing?

Rising Urbanization and Inadequate Public Transportation Infrastructure

India's accelerating urbanization trajectory fundamentally reshapes transportation demand patterns, creating substantial growth opportunities for the two-wheeler market. Millions continue migrating from rural areas to urban centers seeking improved employment opportunities and lifestyle advancement, dramatically increasing city populations requiring daily mobility solutions. However, public transportation infrastructure development significantly lags population growth rates in numerous cities, creating chronic capacity shortfalls unable to accommodate commuter requirements. Overcrowded buses, unreliable schedules, and inadequate route coverage push consumers toward personal vehicle solutions offering convenience, flexibility, and time savings. According to sources, Honda Motorcycle & Scooter India (HMSI) announced plans to target a 30 % share of the Indian two-wheeler market by 2030, aiming to boost sales among female riders. Further, two- wheelers emerge as optimal urban mobility solutions given their maneuverability through congested traffic, minimal parking requirements, and operational cost efficiency.

Expanding Middle Class Population with Enhanced Purchasing Power

India's burgeoning middle class constitutes the primary demand driver for two-wheeler market expansion, as rising disposable incomes enable aspirational vehicle purchases previously beyond financial reach. Economic growth generates employment opportunities lifting household incomes across both urban and rural geographies. Enhanced purchasing power transforms two-wheelers from utilitarian necessities into accessible lifestyle products fulfilling personal mobility aspirations. The growing middle class demonstrates willingness to invest in quality vehicles offering reliability, comfort, and feature richness beyond basic transportation functionality. Additionally, dual-income households becoming increasingly common multiply discretionary spending capacity supporting vehicle acquisitions. Consumer confidence regarding future income stability encourages financing-supported purchases, accelerating ownership penetration.

Favorable Government Policies and Manufacturing Incentives

Government initiatives promoting domestic automotive manufacturing create conducive operating environments supporting industry expansion and consumer affordability. Production-linked incentive schemes encourage manufacturers to enhance local production capacities, driving employment generation and economic multiplier effects. In March 2025, Ola Electric became the first two-wheeler EV manufacturer in India to receive incentives under the PLI-Auto Scheme, securing Rs 73.74 Crore for FY 2023‑24. Policies supporting component localization reduce import dependencies while improving supply chain resilience and cost competitiveness. Additionally, infrastructure development investments improving road connectivity expand addressable markets by enhancing two-wheeler utility across previously underserved regions. Tax rationalization measures enhance consumer affordability while maintaining revenue sustainability. The regulatory framework evolution toward cleaner emission standards drives technology advancement investments, ultimately benefiting consumers through improved product quality.

Market Restraints:

What Challenges the India Two-Wheeler Market is Facing?

Volatile Fuel Prices Impacting Ownership Economics

Fluctuating fuel prices create uncertainty around two-wheeler operating costs, influencing purchase decisions among price-sensitive consumers. Rising petroleum costs increase commuting expenses, reduce personal vehicle attractiveness, and complicate household budgeting. Dependence on imported crude exposes domestic fuel prices to global market fluctuations, affecting consumer confidence. High fuel volatility may delay or cancel planned acquisitions and impacts financing decisions due to uncertain total ownership costs.

Infrastructure Limitations in Rural and Semi-Urban Areas

Poor road infrastructure in rural and semi-urban regions limits two-wheeler utility, accessibility, and market expansion. Unpaved roads, seasonal disruptions, and inadequate maintenance increase maintenance costs and compromise rider safety. Sparse fuel stations, limited dealer presence, and underdeveloped digital channels reduce acquisition convenience and awareness. Slow infrastructure development restricts market penetration in high demand but underserved areas, constraining overall growth potential.

Rising Vehicle Insurance and Registration Costs

Escalating insurance premiums and registration fees increase total two-wheeler ownership costs, potentially deterring budget-conscious consumers. Mandatory comprehensive coverage adds significant upfront expenditure, while regional fee variations introduce cost uncertainty. Entry-level segment buyers are disproportionately affected, and insurance claim complexities may reduce satisfaction. The cumulative regulatory costs can limit new vehicle adoption, restricting demand growth and affecting overall market expansion.

Competitive Landscape:

The India two-wheeler market exhibits intensely competitive dynamics characterized by established domestic manufacturers leveraging distribution scale competing alongside international players introducing global technologies. Market participants pursue differentiated strategies spanning product portfolio expansion, technology integration, pricing optimization, and distribution network strengthening to capture consumer mindshare. Competition intensifies across segments as manufacturers invest in research and development to introduce fuel-efficient engines, connected features, and contemporary designs meeting evolving consumer expectations. Strategic partnerships between manufacturers and financial institutions enable attractive financing schemes enhancing consumer accessibility. The competitive environment drives continuous product innovation, quality improvement, and service enhancement benefiting consumers through expanded choices and value propositions. Market positioning increasingly depends on brand perception, after-sales service quality, and technology leadership alongside traditional pricing competition.

Some of the key players include:

- Bajaj Auto Limited

- Hero MotoCorp Ltd

- Honda Motorcycle and Scooter India Pvt. Ltd.

- India YAMAHA Motor Pvt. Ltd

- Royal Enfield

- Suzuki Motorcycle India

- TVS Motor Company

Recent Developments:

- In July 2025, EV maker Kinetic Green announced plans to expand its electric two-wheeler business by launching three new e-scooters over the next 18 months. The company is partnering with Italy-based Torino Design to co-develop futuristic scooter models, strengthening its presence in India’s rapidly evolving electric mobility segment.

India Two-Wheeler Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Scooters, Mopeds, Motorcycle, Electric Two-Wheeler |

| Technologies Covered | ICE, Electric |

| Transmissions Covered | Manual, Automatic |

| Engine Capacities Covered | <100cc, 100-125cc, 126-180cc, 181-250cc, 251-500cc, 501-800cc, 801-1600cc, >1600cc |

| Fuel Types Covered | Gasoline, Petrol, Diesel, LPG/CNG, Battery |

| End Users Covered | Personal, Commercial |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | North India, West and Central India, East India, South India |

| Companies Covered | Bajaj Auto Limited, Hero MotoCorp Ltd, Honda Motorcycle and Scooter India Pvt. Ltd., India YAMAHA Motor Pvt. Ltd, Royal Enfield, Suzuki Motorcycle India, TVS Motor Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India two-wheeler market size reached USD 24.5 Billion in 2025.

The India two-wheeler market is expected to grow at a compound annual growth rate of 7.50% from 2026-2034, to reach USD 46.1 Billion by 2034.

Motorcycle held the largest market share, driven by its versatility, cost-effectiveness, and adaptability for varied commuting needs across urban and rural regions in India, making it the preferred choice for a wide range of consumers.

Key factors driving the India two-wheeler market include rapid urbanization creating personal mobility demand, expanding middle-class population with enhanced purchasing power, inadequate public transportation infrastructure, favorable government manufacturing policies, and affordable financing accessibility.

Major challenges include high upfront vehicle costs, limited charging infrastructure in remote areas, inconsistent government incentives, long battery replacement times, supply chain constraints, and low consumer awareness about electric mobility benefits.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)