India Turbochargers Market Size, Share, Trends and Forecast by Fuel Type, Technology, Sales Channel, and Region, 2025-2033

India Turbochargers Market Overview:

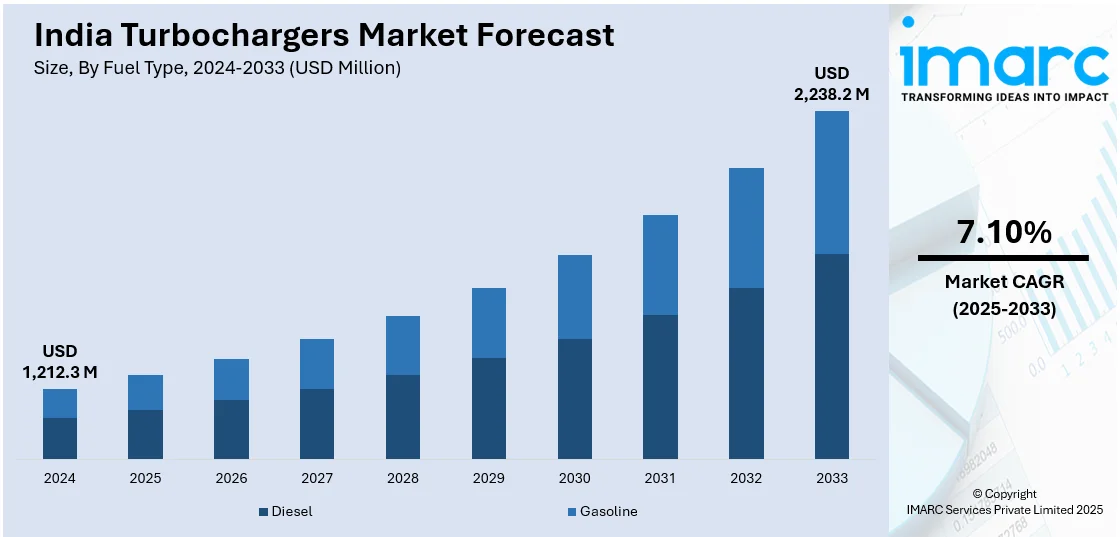

The India turbochargers market size reached USD 1,212.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,238.2 Million by 2033, exhibiting a growth rate (CAGR) of 7.10% during 2025-2033. The market is expanding due to stricter emission norms, rising production of fuel-efficient vehicles, demand for improved engine performance, growth in commercial and passenger vehicle segments, and increasing penetration of turbocharged diesel engines. Government policies supporting automotive innovation and localization of turbocharger manufacturing also contribute to market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,212.3 Million |

| Market Forecast in 2033 | USD 2,238.2 Million |

| Market Growth Rate 2025-2033 | 7.10% |

India Turbochargers Market Trends:

Rising Demand for Turbochargers in Passenger Vehicles

There is a notable increase in the adoption of turbochargers in India’s passenger vehicle segment. For instance, as per industry reports, the passenger car segment’s market share in automotive turbochargers is anticipated to cross 70% by 2037. Moreover, in 2024, India’s passenger car sales reached 43 lakh units, up 4.2% from 2023. December alone saw a 10% year-on-year rise in dispatches to 3,14,934 units. The October–December quarter also marked the highest-ever passenger vehicle sales at 10.6 lakh units, a 4.5% increase. Manufacturers are integrating turbochargers in smaller engine configurations to comply with BS-VI norms while maintaining performance levels. This trend is particularly strong in urban regions where consumers prioritize fuel efficiency and lower emissions without compromising driving dynamics. Hatchbacks and compact SUVs, which dominate urban mobility solutions, are being equipped with low-displacement turbocharged petrol engines. Automotive OEMs are leveraging this technology to offer enhanced acceleration and power output while meeting regulatory compliance. Additionally, consumer awareness about the performance benefits of turbocharged vehicles is increasing, contributing to wider adoption across mid-range and premium vehicle categories.

To get more information on this market, Request Sample

Growth in Turbochargers for Commercial Vehicles and Off-Highway Applications

The commercial vehicle segment is witnessing increased integration of turbochargers due to the demand for fuel efficiency and regulatory compliance. Heavy-duty trucks, construction equipment, and agricultural machinery now require higher power density and lower emissions, both achievable through turbocharging. As infrastructure development accelerates under government programs like Bharatmala and PM Gati Shakti, the usage of turbocharged engines in off-highway applications is rising. Engine manufacturers are incorporating high-boost turbochargers with advanced cooling and pressure control to meet the performance requirements of high-load operations. This trend is creating opportunities for specialized turbocharger solutions, particularly in Tier 2 and Tier 3 cities where industrial and logistics demand is growing. For instance, in January 2025, Cummins Turbo Technologies showcased its latest two-stage turbocharging innovation, aimed at enhancing performance and emissions compliance in medium- and heavy-duty engines. The two-stage system, combining small and large turbochargers in series, improves power delivery across engine speeds—offering low-speed torque and high-speed efficiency. Cummins applies this technology in sequential, compound, and parallel configurations, suitable for diesel, natural gas, and hydrogen combustion engines.

India Turbochargers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on fuel type, technology, and sales channel.

Fuel Type Insights:

- Diesel

- Gasoline

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes diesel and gasoline.

Technology Insights:

- VGT/VNT

- Wastegate

- Electric Turbocharger

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes VGT/VNT, wastegate, and electric turbocharger.

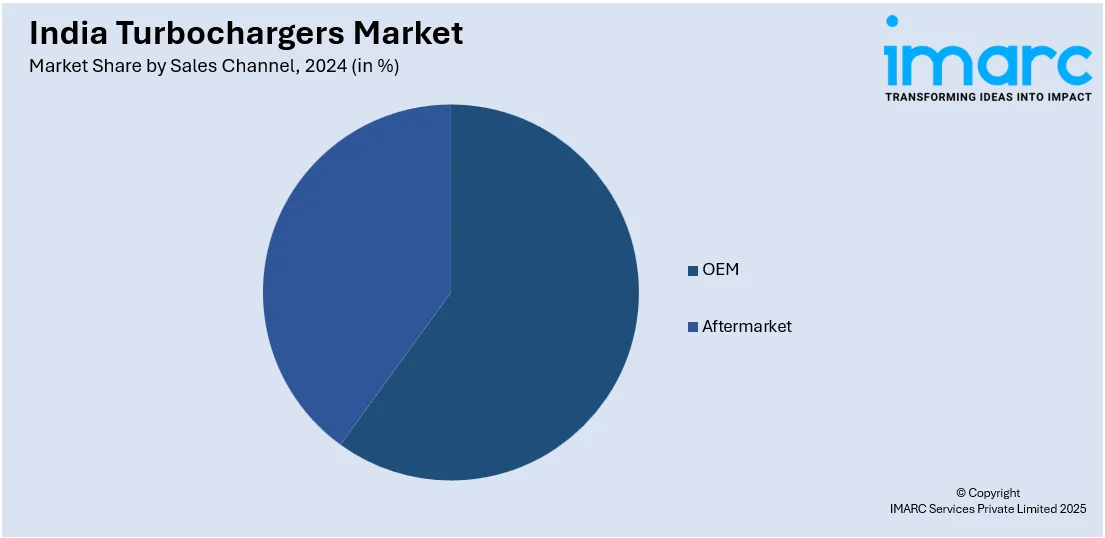

Sales Channel Insights:

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes OEM and aftermarket.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Turbochargers Market News:

- In November 2024, Cummins Inc. introduced upgraded turbocharger compressor technology to boost performance, efficiency, and emissions compliance for diesel and alternative fuel engines. As part of its Destination Zero initiative, the updates target heavy-duty applications by enhancing surface finishes, minimizing wheel-to-housing clearances using abradable coatings, and optimizing air handling. These features improve brake-specific fuel consumption, reliability, and compatibility with hydrogen ICE and fuel cell systems. Cummins applied advanced CFD simulations to integrate these improvements into its Gen7 and Gen8 turbochargers.

- In February 2024, Tata Motors unveiled the Nexon iCNG at the Bharat Mobility Global Expo, introducing India’s first SUV equipped with a turbocharged CNG powertrain featuring a 1.2-litre petrol engine.

India Turbochargers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Diesel, Gasoline |

| Technologies Covered | VGT/VNT, Wastegate, Electric Turbocharger |

| Sales Channels Covered | OEM, Aftermarket |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India turbochargers market performed so far and how will it perform in the coming years?

- What is the breakup of the India turbochargers market on the basis of fuel type?

- What is the breakup of the India turbochargers market on the basis of technology?

- What is the breakup of the India turbochargers market on the basis of sales channel?

- What are the various stages in the value chain of the India turbochargers market?

- What are the key driving factors and challenges in the India turbochargers market?

- What is the structure of the India turbochargers market and who are the key players?

- What is the degree of competition in the India turbochargers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India turbochargers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India turbochargers market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India turbochargers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)