India Trout Market Size, Share, Trends and Forecast by Trout Type, Trout Size, Distribution, Form, and Region, 2025-2033

Market Overview:

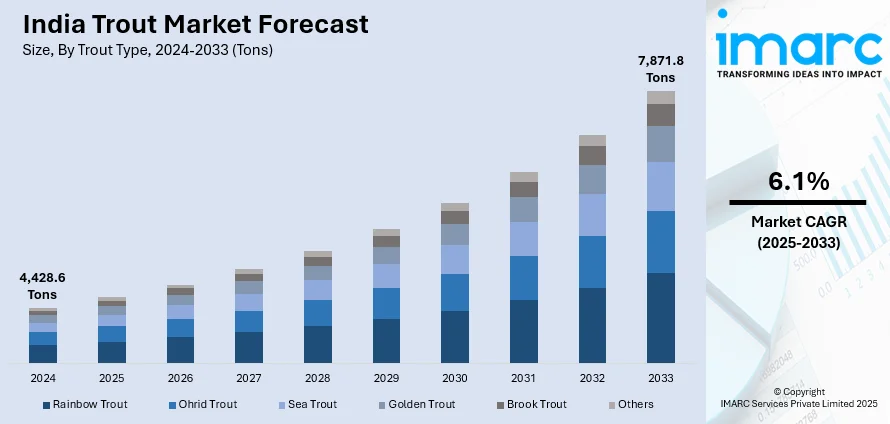

The India trout market size reached 4,428.6 Tons in 2024. Looking forward, IMARC Group expects the market to reach 7,871.8 Tons by 2033, exhibiting a growth rate (CAGR) of 6.1% during 2025-2033. The increasing consumer awareness of its high protein content, omega-3 fatty acids, rising consumption among individuals, and government initiatives promoting aquaculture activities to enhance the local economy represent some of the key factors driving the Indian trout market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

4,428.6 Tons |

|

Market Forecast in 2033

|

7,871.8 Tons |

| Market Growth Rate 2025-2033 | 6.1% |

Trout is a common name for a variety of species in the family Salmonidae, notably featuring in freshwater habitats. It is endowed with flavorful, firm flesh, and is highly appreciated in the gastronomic world, often prized by chefs for its culinary versatility and by consumers for its rich nutrient profile. They are cold-water fish, typically found in rivers, streams, and lakes, though some species inhabit saltwater. The spectrum of trout species includes the rainbow, brown, and brook trout, each with unique characteristics and preferred environments. Predominantly carnivorous, their diet ranges from insects to smaller fish, hence the development and requirement for specialized trout food to mimic this nutritional supply in aquaculture settings. Additionally, the cultivation of trout necessitates a diet formulated to optimize growth and health, enhancing both the quantity and quality of yield, which is where the need for specialized trout food arises.

To get more information of this market, Request Sample

India Trout Market Trends:

The expansion of trout farming activities across the country, primarily in hilly regions where the cold-water conditions are ideal for trout cultivation, majorly drives the India trout market growth. Due to increasing awareness of its high protein content, omega-3 fatty acids, and other vital nutrients, the demand for trout, both domestically and internationally, is significantly supporting the market. This rise in demand is favoring the expansion of trout farming, subsequently fuelling the need for quality trout food products. Besides, India trout market forecast highlights the diversification of trout food product offerings - varying in ingredient composition, nutritional value, and cost - caters to the different needs of trout farmers, bolstering the market’s growth. In addition, government initiatives promoting aquaculture activities to enhance local economy and self-sufficiency are also serving as significant India trout market trends. Apart from this, eco-friendly, bio-based trout food products with reduced environmental impact are gaining traction. Therefore, the growing shift towards sustainable aquaculture practices is positively influencing the market. In confluence with this, manufacturers are increasingly producing trout food with ingredients that are beneficial for the fish and minimize environmental harm. The adoption of these eco-friendly alternatives, often featuring reduced reliance on wild-caught fish, is a trend poised to shape the future of the India trout market share. Furthermore, innovation in formulation and packaging, catering to a wide array of trout species and life stages, is another notable trend. The incorporation of scientific research into product development, aiming to maximize growth efficiency and fish health, is creating a positive India trout market outlook. Some of the other factors driving the India trout market demand include rapid urbanization and inflating disposable income levels.

India Trout Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India trout market report, along with forecasts at the country levels for 2025-2033. Our report has categorized the market based on trout type, trout size, distribution, and form.

Trout Type Insights:

- Rainbow Trout

- Ohrid Trout

- Sea Trout

- Golden Trout

- Brook Trout

- Others

The report has provided a detailed breakup and analysis of the market based on the trout type. This includes rainbow trout, ohrid trout, sea trout, golden trout, brook trout, and others.

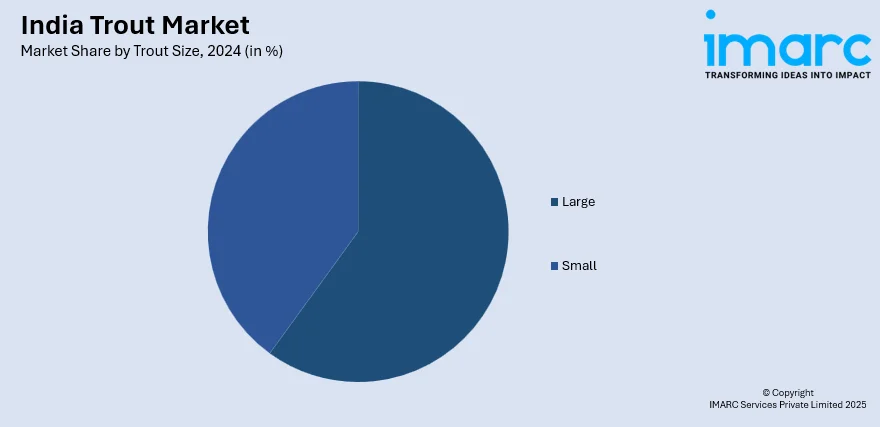

Trout Size Insights:

- Large

- Small

A detailed breakup and analysis of the market based on the trout size has also been provided in the report. This includes large and small.

Distribution Insights:

- Foodservice

- Retail

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Outlets

- Online Channels

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution. This includes foodservice and retail (supermarkets and hypermarkets, convenience stores, specialty outlets, online channels, and others).

Form Insights:

- Fresh

- Frozen

- Canned

- Others

A detailed breakup and analysis of the market based on the form has also been provided in the report. This includes fresh, frozen, canned, and others.

Regional Insights:

- South India

- North India

- West & Central India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include South India, North India, West & Central India, and East India.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the India trout market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In November 2024, Japanese technology is set to revolutionize trout farming in Himachal Pradesh by implementing a "recirculating aquaculture system" at the Indo-Norway Trout Fish Farm in Patlikuhal, Kullu. This system recycles and filters water from the fish farming tanks, significantly reducing water usage and conserving space. With the adoption of this innovative technology, fish production is expected to increase fourfold, enhancing the efficiency and sustainability of trout farming in the region.

- In March 2024, Biokraft Foods, an Indian cultivated meat startup, partnered with ICAR-Directorate of Coldwater Fisheries Research (DCFR) to develop cultivated snow and rainbow trout products. ICAR-DCFR will create fish cell lines, while Biokraft will use 3D bioprinting and customized bioinks for final product development. As India’s leading coldwater aquaculture research institute, ICAR-DCFR aims to promote sustainable practices and conservation, enhancing the commercial value of trout in the Indian market.

- In March 2021, FreshToHome, the largest online fresh fish and meat brand, has partnered with Zarin, a Kashmiri startup, to market the Himalayan Rainbow Trout, a fish similar to Atlantic salmon. Zarin was founded by three students from Kashmir and Bengaluru, addressing challenges faced by local fish farmers. FreshToHome will help these fishermen expand their reach, allowing them to sell their products across India, ensuring fair prices and high-quality products.

India Trout Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Tons |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Trout Types Covered | Rainbow Trout, Ohrid Trout, Sea Trout, Golden Trout, Brook Trout, Others |

| Trout Sizes Covered | Large, Small |

| Distributions Covered |

|

| Forms Covered | Fresh, Frozen, Canned, Others |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India trout market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India trout market?

- What is the breakup of the India trout market on the basis of trout type?

- What is the breakup of the India trout market on the basis of trout size?

- What is the breakup of the India trout market on the basis of distribution?

- What is the breakup of the India trout market on the basis of form?

- What are the various stages in the value chain of the India trout market?

- What are the key driving factors and challenges in the India trout market?

- What is the structure of the India trout market and who are the key players?

- What is the degree of competition in the India trout market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India trout market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India trout market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India trout industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)