India Transmission Line Market Size, Share, Trends and Forecast by Type, Product, Material Type, Technology, Voltage Level, Application, and Region, 2025-2033

India Transmission Line Market Size and Share:

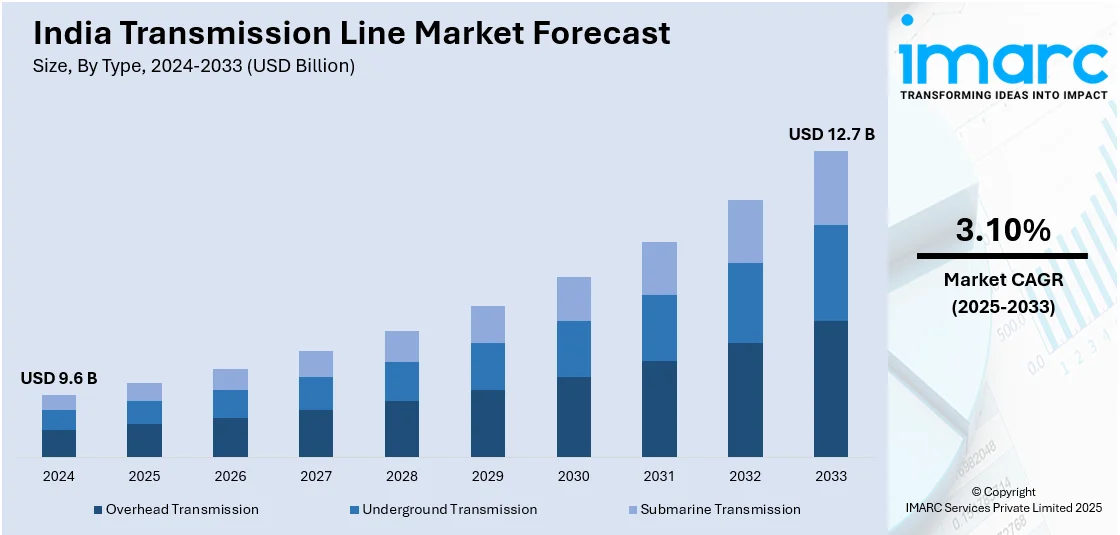

The India transmission line market size reached USD 9.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3.10% during 2025-2033. The growing focus on developing cyclone-resilient infrastructure to ensure transmission continuity, increasing number of renewable energy zones that require high-capacity transmission corridors, and rising need for energy infrastructure to facilitate industrial development are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.6 Billion |

| Market Forecast in 2033 | USD 12.7 Billion |

| Market Growth Rate (2025-2033) | 3.10% |

India Transmission Line Market Trends:

Climate Resilience and Disaster-Proofing of Transmission Infrastructure

Severe weather occurrences, including floods, cyclones, and heatwaves, are heightening the susceptibility of transmission infrastructure. Planners are emphasizing climate-resilient designs to ensure transmission continuity is maintained. For instance, in 2024, Empowertrans commissioned India's first cyclone-resistant 220kV transmission line in Odisha. The project replaced a cyclone-damaged 26 km line connecting the Pandiabili and Samagara substations, designed to withstand extreme cyclones. This initiative provided a new standard for transmission infrastructure in cyclone-prone regions. Besides this, towers and substations are being redesigned to endure strong wind forces, water intrusion, and temperature strain. The choice of transmission routes is progressively relying on environmental risk mapping. Redundancy planning and interconnected networks are decreasing reliance on individual corridors. The use of weather prediction tools and remote diagnostics is enhancing readiness and reducing service interruptions. These resilience strategies are incorporated into regulatory frameworks and procurement criteria, guaranteeing that new transmission installations are constructed to withstand climate-induced pressures with little disruption.

To get more information on this market, Request Sample

Expansion of Renewable Energy Parks and Energy Zones

Dedicated renewable energy zones are being developed in states abundant in solar and wind resources to consolidate generation and simplify transmission planning. These zones require high-capacity transmission corridors that can evacuate power efficiently to demand centers. Centralized planning for energy parks is enabling economies of scale in both generation and transmission infrastructure. Regulatory bodies are prioritizing these projects through competitive bidding and expedited clearances to meet national clean energy targets. For example, in 2025, Power Grid Corporation of India (PGCIL) secured two transmission projects from PFC Consulting to evacuate 15.5 GW of renewable energy in Karnataka and Rajasthan. The projects involve establishing new substations and upgrading existing ones to support the renewable energy zones. Furthermore, investments are focused on strengthening inter-regional connectivity and reinforcing weak links in the existing grid. By supporting energy flow from renewable-heavy states to demand centers, these efforts are reducing transmission bottlenecks and enabling smoother integration of variable power sources. This approach is key to maintaining system reliability while accelerating India’s renewable energy expansion.

Infrastructure Development and Clean Energy Projects

The rising need for energy infrastructure to facilitate industrial development and the shift towards clean energy is bolstering the market growth. As India speeds up its renewable energy goals, there is a higher need to upgrade the power transmission network and move energy from generation sites to utilization regions effectively. Significant infrastructure initiatives, including enhancing substations and broadening transmission networks, are essential for addressing the nation’s energy demands. Moreover, the growing focus on clean energy programs, such as green hydrogen and ammonia creation, is leading to substantial funding in transmission infrastructure to facilitate these eco-friendly initiatives. This trend is also being supported by private firms and government entities focusing on the advancement of sophisticated transmission lines to guarantee a dependable and expandable energy supply nationwide. In 2025, Adani Energy Solutions secured a $324 million transmission contract to power a green hydrogen and ammonia facility in Gujarat. The project includes upgrading substations and building a 75km transmission line. It supports the goal of India of making 5 million tons of green hydrogen annually by 2030.

India Transmission Line Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, product, material type, technology, voltage level, and application.

Type Insights:

- Overhead Transmission

- Underground Transmission

- Submarine Transmission

The report has provided a detailed breakup and analysis of the market based on the type. This includes overhead transmission, underground transmission, and submarine transmission.

Product Insights:

- Conductors

- Insulators

- Towers

- Transformers

- Cables

- Switchgear

- Circuit Breakers

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes conductors, insulators, towers, transformers, cables, switchgear, and circuit breakers.

Material Type Insights:

- Aluminum

- Copper

- Composite Materials

The report has provided a detailed breakup and analysis of the market based on the material type. This includes aluminum, copper, and composite materials.

Technology Insights:

- HVDC

- HVAC

- Flexible AC Transmission Systems (FACTS)

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes HDVC, HVAC and flexible AC transmission systems (FACTS).

Voltage Level Insights:

- Low Voltage (LV) Transmission Equipment

- Medium Voltage (MV) Transmission Equipment

- High Voltage (HV) Transmission Equipment

- Extra High Voltage (EHV) Transmission Equipment

The report has provided a detailed breakup and analysis of the market based on the voltage level. This includes low voltage (LV) transmission equipment, medium voltage (MV) transmission equipment, high voltage (HV) transmission equipment, and extra high voltage (EHV) transmission equipment.

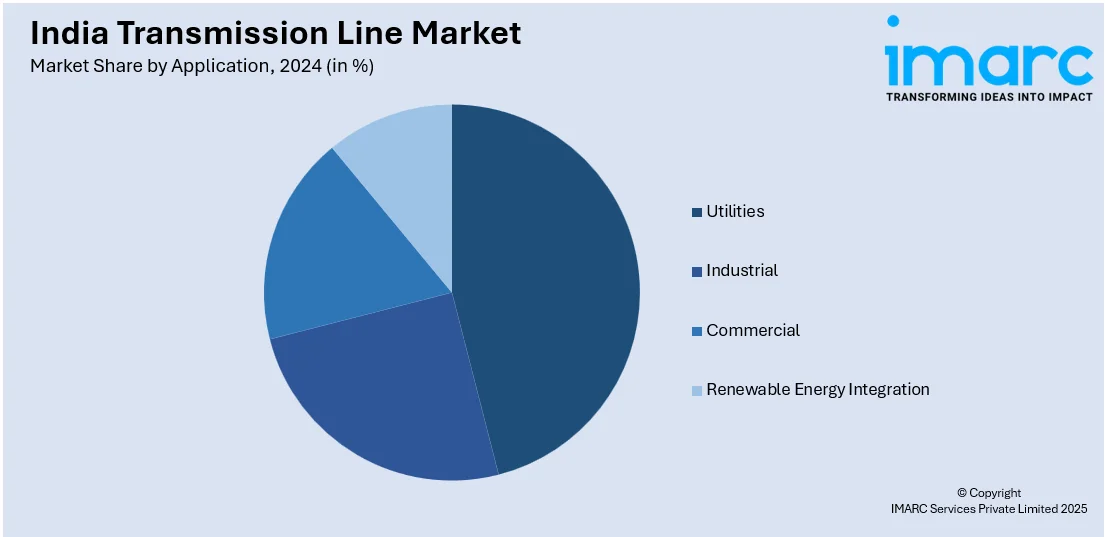

Application Insights:

- Utilities

- Industrial

- Commercial

- Renewable Energy Integration

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes utilities, industrial, commercial, and renewable energy integration.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Transmission Line Market News:

- In March 2025, Power Grid Corporation of India secured three transmission projects under the Build, Own, Operate, and Transfer (BOOT) mode. These projects include power evacuation systems and capacity augmentation at substations in Rajasthan, Gujarat, and Andhra Pradesh. The contracts aim to enhance the inter-state transmission system.

- In February 2025, Sterlite Power commissioned the 400kV Nangalbibra-Bongaigaon transmission line, enhancing power infrastructure in North-East India. This project, spanning 300 circuit kilometers, enables the transfer of over 1000 MW of electricity and strengthens supply reliability in Assam and Meghalaya.

India transmission line Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Overhead Transmission, Underground Transmission, Submarine Transmission |

| Products Covered | Conductors, Insulators, Towers, Transformers, Cables, Switchgear, Circuit Breakers |

| Material Types Covered | Aluminum, Copper, Composite Materials |

| Technologies Covered | HDVC, HVAC, Flexible AC Transmission Systems (FACTS) |

| Voltage Levels Covered | Low Voltage (LV) Transmission Equipment, Medium Voltage (MV) Transmission Equipment, High Voltage (HV) Transmission Equipment, Extra High Voltage (EHV) Transmission Equipment |

| Applications Covered | Utilities, Industrial, Commercial, Renewable Energy Integration |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India transmission line market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India transmission line market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India transmission line industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The transmission line market in India was valued at USD 9.6 Billion in 2024.

The India transmission line market is projected to exhibit a (CAGR) of 3.10% during 2025-2033, reaching a value of USD 12.7 Billion by 2033.

The market is expanding owing to rising power requirement, renewable integration, and network expansion. Ministry-led initiatives, such as the Green Energy Corridor and rural electrification schemes, facilitate the growth of large-scale transmission networks. Urbanization and industrialization also require grid modernization and high-voltage line installations to provide continuous and efficient supply of electricity across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)