India Trade Finance Market Size, Share, Trends and Forecast by Finance Type, Offering, Service Provider, End User, and Region, 2025-2033

Market Overview:

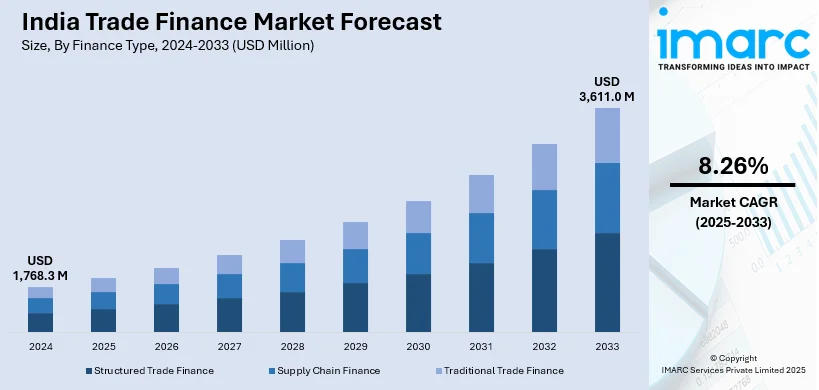

India trade finance market size reached USD 1,768.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,611.0 Million by 2033, exhibiting a growth rate (CAGR) of 8.26% during 2025-2033. The increasing advances in technology, such as blockchain and digital platforms, which have the potential to streamline trade finance processes, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,768.3 Million |

|

Market Forecast in 2033

|

USD 3,611.0 Million |

| Market Growth Rate 2025-2033 | 8.26% |

Trade finance refers to the financial instruments and products that facilitate international trade transactions. It plays a crucial role in mitigating the risks associated with cross-border commerce and ensures the smooth flow of goods and services between buyers and sellers in different countries. Common trade finance instruments include letters of credit, documentary collections, and trade credit insurance. Letters of credit provide a secure payment method by involving banks to guarantee payment upon fulfillment of specified conditions. Documentary collections involve the exchange of shipping documents through banks, providing a level of security for both parties. Trade credit insurance protects businesses from the risk of non-payment by buyers. Overall, trade finance is essential for fostering trust, reducing financial uncertainties, and promoting trade by providing the necessary financial infrastructure for international transactions.

To get more information on this market, Request Sample

India Trade Finance Market Trends:

The trade finance market in India is propelled by a myriad of factors that intricately connect economies. Firstly, the expanding international trade landscape serves as a fundamental driver, fostering the need for efficient financing mechanisms. As countries increasingly engage in transactions, financial institutions are compelled to innovate and streamline their trade finance services. Moreover, the ever-evolving technological landscape plays a pivotal role, acting as a catalyst for market growth. The integration of blockchain technology, for instance, has significantly enhanced transparency and security in trade finance processes, driving market dynamics. Additionally, the regulatory environment and geopolitical factors exert a substantial influence on trade finance trends. Changes in trade policies, tariffs, and geopolitical tensions can disrupt established trade patterns, prompting financial institutions to adapt their financing strategies accordingly. Furthermore, the demand for risk mitigation tools and solutions fuels the growth of the trade finance market. Businesses seek to minimize risks associated with currency fluctuations, payment delays, and political uncertainties, driving the adoption of trade finance instruments. In conclusion, the trade finance market in India is intricately woven into the fabric of commerce, with international trade dynamics, technological advancements, regulatory changes, and risk mitigation strategies serving as interconnected drivers propelling its evolution.

India Trade Finance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on finance type, offering, service provider, and end user.

Finance Type Insights:

- Structured Trade Finance

- Supply Chain Finance

- Traditional Trade Finance

The report has provided a detailed breakup and analysis of the market based on the finance type. This includes structured trade finance, supply chain finance, and traditional trade finance.

Offering Insights:

- Letters of Credit

- Bill of Lading

- Export Factoring

- Insurance

- Others

A detailed breakup and analysis of the market based on the offering have also been provided in the report. This includes letters of credit, bill of lading, export factoring, insurance, and others.

Service Provider Insights:

- Banks

- Trade Finance Houses

The report has provided a detailed breakup and analysis of the market based on the service provider. This includes banks and trade finance houses.

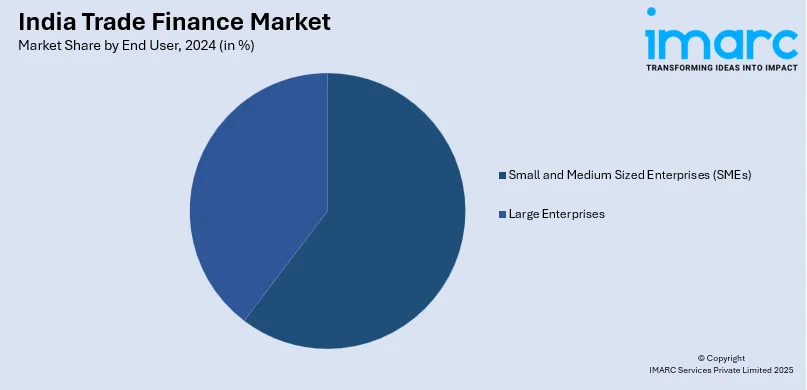

End User Insights:

- Small and Medium Sized Enterprises (SMEs)

- Large Enterprises

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes small and medium sized enterprises (SMEs) and large enterprises.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Trade Finance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Finance Types Covered | Structured Trade Finance, Supply Chain Finance, Traditional Trade Finance |

| Offerings Covered | Letters of Credit, Bill of Lading, Export Factoring, Insurance, Others |

| Service Providers Covered | Banks, Trade Finance Houses |

| End Users Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India trade finance market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India trade finance market?

- What is the breakup of the India trade finance market on the basis of finance type?

- What is the breakup of the India trade finance market on the basis of offering?

- What is the breakup of the India trade finance market on the basis of service provider?

- What is the breakup of the India trade finance market on the basis of end user?

- What are the various stages in the value chain of the India trade finance market?

- What are the key driving factors and challenges in the India trade finance?

- What is the structure of the India trade finance market and who are the key players?

- What is the degree of competition in the India trade finance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India trade finance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India trade finance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India trade finance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)