India Trade Credit Insurance Market Size, Share, Trends and Forecast by Component, Coverage, Enterprise Size, Application, Vertical, and Region, 2025-2033

India Trade Credit Insurance Market Overview:

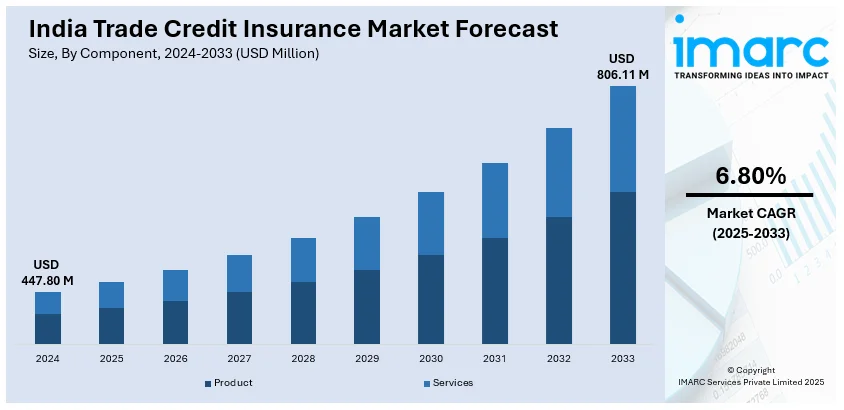

The India trade credit insurance market size reached USD 447.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 806.11 Million by 2033, exhibiting a growth rate (CAGR) of 6.80% during 2025-2033. The market is driven by rising cross-border trade, increasing awareness among exporters about payment risk mitigation, and growing support from government export promotion schemes. Additionally, heightened insolvency risks and the need for secure cash flow management among SMEs are fueling demand for comprehensive credit insurance solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 447.80 Million |

| Market Forecast in 2033 | USD 806.11 Million |

| Market Growth Rate (2025-2033) | 6.80% |

India Trade Credit Insurance Market Trends:

Rising Demand from MSMEs for Risk Mitigation

A significant trend shaping the India Trade Credit Insurance market is the growing adoption among Micro, Small, and Medium Enterprises (MSMEs). As MSMEs increasingly engage in both domestic and international trade, they face heightened payment default risks due to buyer insolvency or political disruptions. Credit insurance offers these businesses a safety net against such uncertainties, helping ensure business continuity and stable cash flows. Moreover, with limited access to traditional financial risk management tools, MSMEs find credit insurance to be a cost-effective solution. Government initiatives encouraging MSME exports have further driven awareness and uptake of trade credit insurance, making it a vital component of their risk management strategies in a competitive trading environment.

To get more information on this market, Request Sample

Integration of Technology and Digital Platforms

Technological advancements are revolutionizing the India Trade Credit Insurance market by streamlining policy issuance, claims processing, and risk assessments. Insurers are adopting artificial intelligence (AI)-driven underwriting tools, digital platforms, and data analytics to enhance customer experience and accelerate turnaround times. AI and automation have significantly reduced manual claim processing timelines from over 30 days to as few as one to 15 days, while cutting processing costs by up to 30% and minimizing errors. These tools also assist in real-time buyer credit monitoring, fraud detection, and efficient damage estimation. Digital platforms are enabling better policy customization, improving risk profiling and pricing accuracy. Furthermore, insurtech collaborations are expanding access to small businesses by simplifying complex insurance processes. This digital transformation is boosting operational efficiency and making credit insurance more responsive, accessible, and transparent for modern trade ecosystems.

Regulatory Support and Product Innovation

Regulatory changes and increased support from institutions like the Insurance Regulatory and Development Authority of India (IRDAI) are driving innovation and growth in trade credit insurance, aligning closely with the financial challenges faced by India’s 22 million MSMEs. These enterprises often rely on personal funds or informal loans due to limited access to institutional finance, as traditional debt requires collateral that many early-stage businesses cannot provide. Recent reforms in trade credit insurance now offer greater flexibility in product design and expanded coverage options, enabling insurers to develop solutions tailored to MSMEs. Bundled offerings combining credit insurance with trade finance are helping these businesses secure working capital without collateral, serving as an alternative form of risk capital. These structural changes are redefining MSME financing and promoting broader insurance adoption across sectors.

India Trade Credit Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on component, coverage, enterprise size, application, and vertical.

Component Insights:

- Product

- Services

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes product, and services.

Coverage Insights:

- Whole Turnover Coverage

- Single Buyer Coverage

The report has provided a detailed breakup and analysis of the market based on the coverage. This includes whole turnover coverage, and single buyer coverage.

Enterprise Size Insights:

- Large Enterprises

- Medium Enterprises

- Small Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes large enterprises, medium enterprises, and small enterprises.

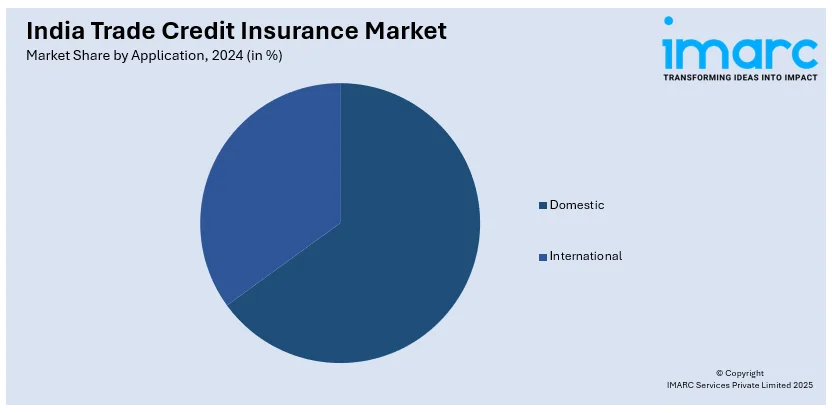

Application Insights:

- Domestic

- International

The report has provided a detailed breakup and analysis of the market based on the application. This includes domestic, and international.

Vertical Insights:

- Food and Beverages

- IT and Telecom

- Metals and Mining

- Healthcare

- Energy and Utilities

- Automotive

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes food and beverages, IT and telecom, metals and mining, healthcare, energy and utilities, automotive, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Trade Credit Insurance Market News:

- In January 2025, Liberty General Insurance India, a joint venture of Liberty Mutual, is set to enter the specialty insurance market with a planned launch of its surety line in the coming months. The company confirmed the development exclusively to Insurance Asia News, highlighting growing interest in surety products across India. This strategic move marks Liberty India’s expansion into niche segments, aligning with rising demand for trade credit and specialty insurance solutions.

- In April 2024, Allianz Trade introduced its next-generation Trade Credit Insurance product in the UK and Ireland, enhancing its core offering to protect businesses against non-payment risks of trade receivables. This updated B2B insurance solution activates when a customer fails to pay as per contractual terms, helping companies safeguard cash flow and manage trade risks more effectively. The launch reflects Allianz Trade’s commitment to evolving risk management solutions for businesses.

India Trade Credit Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Product, Services |

| Coverages Covered | Whole Turnover Coverage, Single Buyer Coverage |

| Enterprise Sizes Covered | Large Enterprises, Medium Enterprises, Small Enterprises |

| Applications Covered | Domestic, International |

| Verticals Covered | Food and Beverages, IT and Telecom, Metals and Mining, Healthcare, Energy and Utilities, Automotive, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India trade credit insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India trade credit insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India trade credit insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The trade credit insurance market in India was valued at USD 447.80 Million in 2024.

The India trade credit insurance market is projected to exhibit a CAGR of 6.80% during 2025-2033, reaching a value of USD 806.11 Million by 2033.

The growth of the India trade credit insurance market is driven by increasing demand for risk mitigation solutions amid growing trade activities. Businesses seek protection from defaults on receivables, especially in volatile economic conditions. Rising export activities, along with a growing number of small and medium enterprises (SMEs), further boost the demand for trade credit insurance. Additionally, favorable government initiatives and regulatory support are accelerating market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)