India Tower Crane Market Size, Share, Trends and Forecast by Type, Lifting Capacity, End Use Industry, and Region, 2025-2033

India Tower Crane Market Overview:

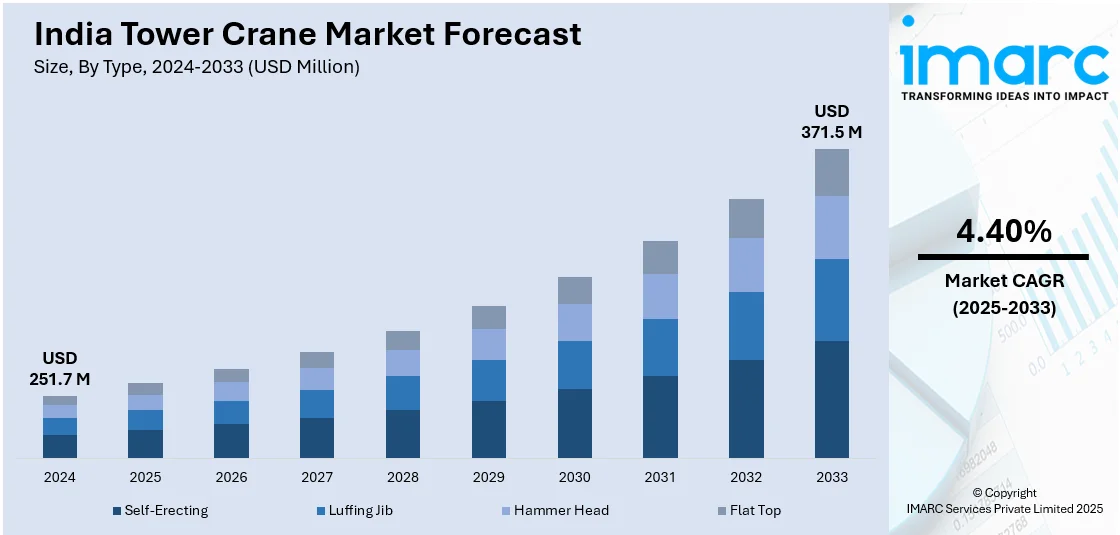

The India tower crane market size reached USD 251.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 371.5 Million by 2033, exhibiting a growth rate (CAGR) of 4.40% during 2025-2033. The market is expanding due to increasing urban infrastructure projects, rising demand for high-rise construction, government-backed smart city initiatives, growth in metro rail and commercial real estate developments, foreign direct investments, and adoption of advanced construction equipment enhancing productivity, safety, and precision on large construction sites.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 251.7 Million |

| Market Forecast in 2033 | USD 371.5 Million |

| Market Growth Rate (2025-2033) | 4.40% |

India Tower Crane Market Trends:

Growing Adoption of Rental Tower Cranes by Construction Firms

The tower crane rental model is becoming increasingly prominent in India as construction firms seek cost-effective solutions for temporary infrastructure projects. High capital investment and maintenance costs associated with owning cranes have pushed contractors toward rental services, especially for short-term or project-specific needs. Rental providers are now offering technologically advanced tower cranes with flexible leasing terms, on-site service support, and real-time monitoring capabilities. This trend is enabling smaller contractors and regional developers to access high-capacity cranes without substantial upfront investment. The rental ecosystem is expanding in tier-1 and tier-2 cities, driven by rapid residential and commercial development. Furthermore, foreign players entering the Indian rental space are contributing to a more organized and efficient crane rental market. For instance, in February 2024, Potain announced that Tata Projects is using five Potain tower cranes to build the upcoming Noida International Airport near New Delhi, which will become India’s largest airport. Tata purchased two MCT 565 A topless tower cranes and rented three MCT 385 A cranes from Rental Partners. Manitowoc Lift Solutions customized the MCT 565 A cranes to extend the jib length from 80 to 85 meters, improving job site coverage. The cranes are handling major lifting tasks on the terminal building, expected to be completed by the end of 2024.

To get more information on this market, Request Sample

Surge in Demand for Flat-Top and Luffing Jib Tower Cranes

Demand for flat-top and luffing jib tower cranes is rising across India due to space constraints and height requirements in urban construction. These crane types are favored in densely populated cities where multiple cranes operate simultaneously and minimal over-swing is critical. For instance, as per industry reports, Delhi-NCR contributes nearly 35% of India’s tower crane business, driven by rising real estate and infrastructure projects. Manufacturers such as Potain, ACE, Zoomlion-ElectroMech, Liebherr, Comansa, Spartan, and Anupam are capitalizing on the demand for high-capacity cranes, particularly for precast and high-rise construction. Flat-top cranes reduce erection time and simplify transportation while luffing jib cranes offer flexible operations in confined zones. Infrastructure developers are prioritizing these cranes for high-rise residential, commercial complexes, and metro station developments. Manufacturers are responding by expanding their product range with localized modifications to meet Indian climatic and operational conditions. The increasing complexity of urban projects is reinforcing the relevance of such specialized cranes, encouraging further innovation and diversification in crane design and deployment strategies.

India Tower Crane Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, lifting capacity, and end use industry.

Type Insights:

- Self-Erecting

- Luffing Jib

- Hammer Head

- Flat Top

The report has provided a detailed breakup and analysis of the market based on the type. This includes self-erecting, luffing jib, hammer head, and flat top.

Lifting Capacity Insights:

- Less than 5 Ton

- 6 to 10 Ton

- More than 10 Ton

A detailed breakup and analysis of the market based on the lifting capacity have also been provided in the report. This includes less than 5 ton, 6 to 10 ton, and more than 10 ton.

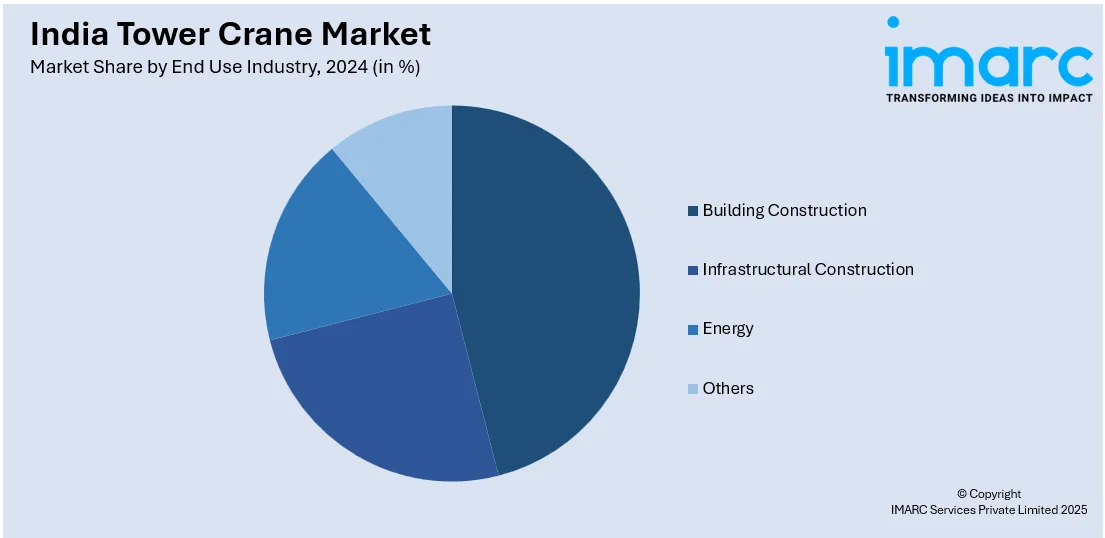

End Use Industry Insights:

- Building Construction

- Infrastructural Construction

- Energy

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes building construction, infrastructural construction, energy, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Tower Crane Market News:

- In January 2025, Mammoet deployed three of the world’s largest heavy-lift ring cranes—PTC210-DS (5,000t), PTC35-DS (1,600t), and PT50 (2,000t)—across refinery projects in Gujarat and Rajasthan, marking a milestone in India’s energy infrastructure development. This is the first time Mammoet has operated all three high-capacity cranes in India simultaneously. Known for their compact design and containerized components, the cranes enable efficient parallel operations, reduce construction timelines, and minimize civil work. The company also plans to bring its next-generation SK190 (4,300t) and SK6000 (6,000t) cranes to India, boosting modular construction and efficiency in future mega projects.

- In January 2025, Mtandt Group took over the exclusive distribution and rental of Comansa tower cranes in India, Nepal, and Bhutan. This was followed by a new agreement signed between Mtandt’s joint venture entity Vertikal and Spain-based Comansa.

India Tower Crane Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Self-Erecting, Luffing Jib, Hammer Head, Flat Top |

| Lifting Capacities Covered | Less Than 5 Ton, 6 to 10 Ton, More Than 10 Ton |

| End Use Industries Covered | Building Construction, Infrastructural Construction, Energy, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India tower crane market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India tower crane market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India tower crane industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India tower crane market was valued at USD 251.7 Million in 2024.

The India tower crane market is projected to exhibit a CAGR of 4.40% during 2025-2033, reaching a value of USD 371.5 Million by 2033.

The India tower crane market is driven by rapid urban infrastructure growth, high-rise construction, and large-scale civil engineering projects. Increasing investments in real estate and public works, alongside technological advancements for improved safety and efficiency, support market expansion. Growing demand in railway, bridge, and industrial sectors further fuels adoption across India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)