India Toughened Glass Market Size, Share, Trends and Forecast by Type, Thickness, Application, End Use, and Region, 2025-2033

India Toughened Glass Market Size and Share:

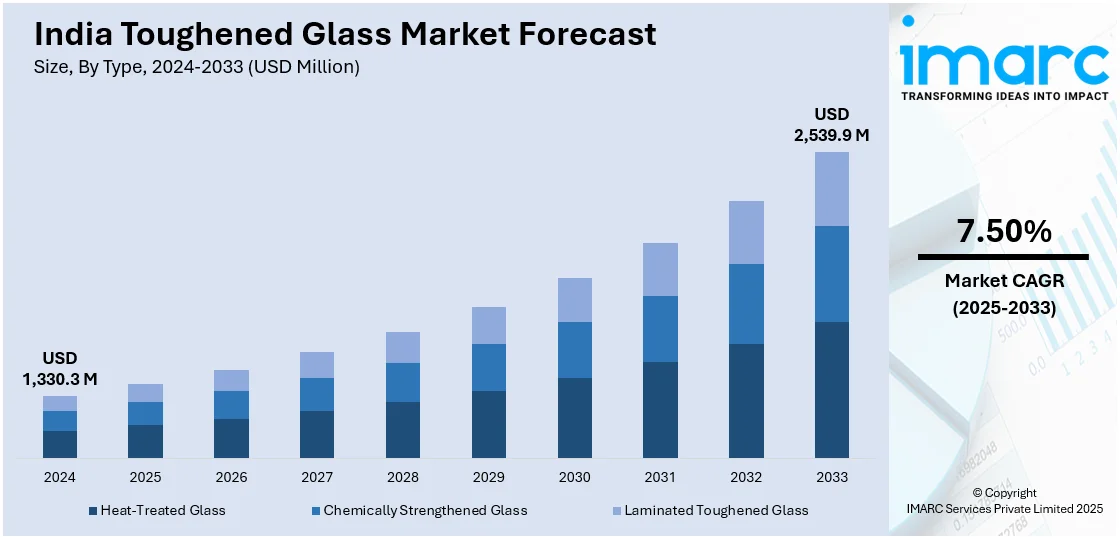

The India toughened glass market size reached USD 1,330.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,539.9 Million by 2033, exhibiting a growth rate (CAGR) of 7.50% during 2025-2033. The market is growing due to rising smartphone usage, cheaper internet, and demand for remote communication. Along with this, businesses are adopting toughened glass to cut costs and improve efficiency, especially in customer support and remote work setups.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,330.3 Million |

| Market Forecast in 2033 | USD 2,539.9 Million |

| Market Growth Rate (2025-2033) | 7.50% |

India Toughened Glass Market Trends:

Automotive Sector Driving Premium Demand

India’s automotive sector is witnessing a noticeable rise in the use of toughened glass, primarily due to the increasing focus on vehicle safety, energy efficiency, and luxury aesthetics. With the rapid growth in the premium and electric vehicle segments, manufacturers are shifting toward lightweight and performance-enhancing materials. Toughened glass plays a vital role in this transition due to its strength, shatter resistance, and ability to support advanced features like UV protection, sound insulation, and solar control. Consumers are also showing a preference for vehicles with better temperature regulation and lower noise levels, making toughened glass essential in design upgrades. In June 2024, Asahi India Glass announced the expansion of its automotive glass operations to increase its passenger vehicle market share to 75%. The company enhanced its production capacity of tempered glass to address the growing demand from automotive OEMs. This expansion is backed by rising interest in thinner, UV-cut toughened glass solutions that meet premium segment requirements. The development not only strengthens Asahi’s position but also indicates the broader industry’s shift toward high-performance glass technologies. With domestic production scaling up and innovation in lightweight safety glass accelerating, the automotive sector remains a core driver of India’s toughened glass market growth.

To get more information on this market, Request Sample

Appliance Integration Expanding Product Scope

In the Indian home appliance segment, toughened glass is emerging as a preferred material, driven by evolving consumer preferences toward stylish, durable, and safe product designs. As home interiors become more design-focused, materials that offer both visual appeal and performance are gaining traction. Toughened glass shelves and panels provide higher load-bearing capacity, impact resistance, and thermal stability, making them ideal for modern appliances like refrigerators, microwave ovens, and cooktops. Its ability to retain transparency and strength under repeated use enhances overall product value and consumer trust. In June 2024, Haier launched its Phoenix series glass door refrigerators in India, introducing durable toughened glass shelves. This move reflects a clear design trend in the consumer appliance sector, where manufacturers are leveraging the material’s properties to improve product aesthetics and functionality. The integration of toughened glass into everyday electronics marks a significant shift in the Indian market, expanding its usage beyond construction and automotive applications. As durability and design continue to influence buying behavior, more appliance brands are adopting toughened glass to meet the demand for premium-quality products. This ongoing trend is expected to widen the material’s application base in the Indian toughened glass market.

India Toughened Glass Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, thickness, application, and end use.

Type Insights:

- Heat-Treated Glass

- Chemically Strengthened Glass

- Laminated Toughened Glass

The report has provided a detailed breakup and analysis of the market based on the type. This includes heat-treated glass, chemically strengthened glass, and laminated toughened glass.

Thickness Insights:

- 3mm-6mm

- 6mm-12mm

- 12mm-25mm

- Above 25mm

A detailed breakup and analysis of the market based on the thickness have also been provided in the report. This includes 3mm-6mm, 6mm-12mm, 12mm-25mm, and above 25mm.

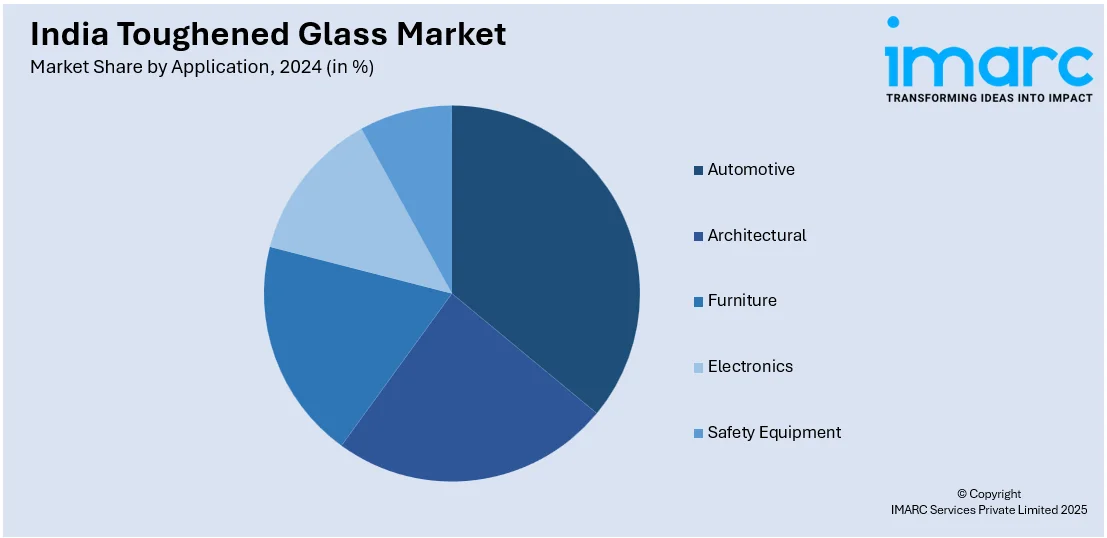

Application Insights:

- Automotive

- Architectural

- Furniture

- Electronics

- Safety Equipment

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, architectural, furniture, electronics, safety equipment.

End Use Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Toughened Glass Market News:

- November 2024: Agarwal Toughened Glass India Ltd launched an INR 62.64 Crore IPO, offering toughened, laminated, frosted, and double-glazed glass. It supported market expansion in the construction and automotive sectors, boosting investor interest in India’s specialty glass manufacturing segment.

- June 2024: Gold Plus commissioned its Karnataka facility, boosting total float glass capacity to 1,040,250 TPA and entering solar glass production. This expansion supported downstream toughened glass manufacturing and strengthened supply for construction and renewable sectors across India.

India Toughened Glass Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Heat-Treated Glass, Chemically Strengthened Glass, Laminated Toughened Glass |

| Thicknesses Covered | 3mm-6mm, 6mm-12mm, 12mm-25mm, Above 25mm |

| Applications Covered | Automotive, Architectural, Furniture, Electronics, Safety Equipment |

| End Uses Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India toughened glass market performed so far and how will it perform in the coming years?

- What is the breakup of the India toughened glass market on the basis of type?

- What is the breakup of the India toughened glass market on the basis of thickness?

- What is the breakup of the India toughened glass market on the basis of application?

- What is the breakup of the India toughened glass market on the basis of mode of end use?

- What are the various stages in the value chain of the India toughened glass market?

- What are the key driving factors and challenges in the India toughened glass market?

- What is the structure of the India toughened glass market and who are the key players?

- What is the degree of competition in the India toughened glass market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India toughened glass market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India toughened glass market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India toughened glass industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)