India Toothpaste Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, and Region, 2025-2033

India Toothpaste Market:

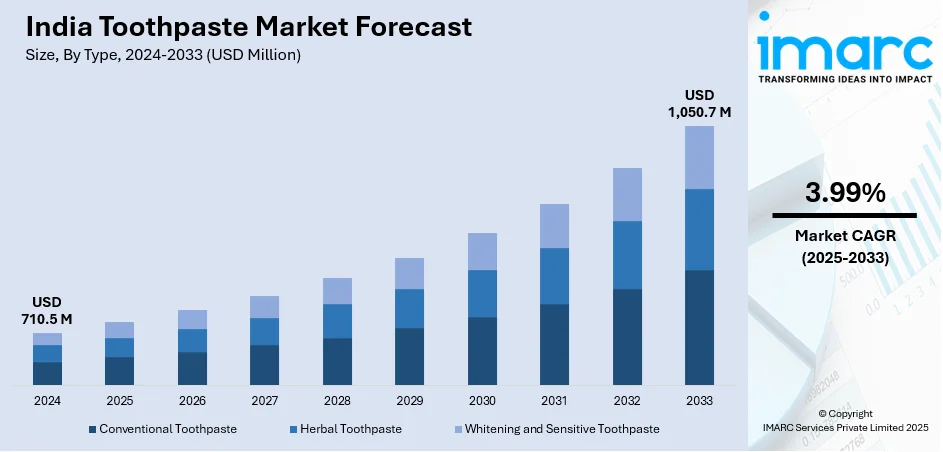

India toothpaste market size reached USD 710.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,050.7 Million by 2033, exhibiting a growth rate (CAGR) of 3.99% during 2025-2033. The rising consumer dental hygiene concerns and the growing adoption of aggressive marketing tactics are primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 710.5 Million |

| Market Forecast in 2033 | USD 1,050.7 Million |

| Market Growth Rate (2025-2033) | 3.99% |

India Toothpaste Market Analysis:

- Major Market Drivers: The nation's heightened focus on oral hygiene and a growing awareness of dental care is driving the India toothpaste market growth. Moreover, the market in this country has evolved to cater to diverse consumer preferences, leading to a variety of formulations, including whitening, sensitivity, anti-cavity, herbal, and medicated types, thereby acting as another significant growth-inducing factor.

- Key Market Trends: The rising consumer awareness, innovative product formulations, and a growing emphasis on preventive dental care are also positively influencing the market growth across the country. In addition, as oral health becomes an integral part of overall well-being, the toothpaste market in India is expected to continue its expansion.

- Competitive Landscape: The India toothpaste market report has also provided a comprehensive analysis of the competitive landscape in the market. Also, detailed profiles of all major companies have been provided.

- Geographical Trends: In North India, there's a higher demand for a variety of toothpaste brands and types, including premium and specialized products. In rural areas, the demand might be more focused on basic, economical options. Moreover, in West and Central India, there is a notable demand for toothpastes with added ingredients, like neem or clove, reflecting traditional preferences.

- Challenges and Opportunities: High competition among key players and supply chain disruptions are hampering the market's growth. However, the increasing awareness about oral hygiene and preventive dental care is driving the demand for toothpastes with specific benefits, such as anti-cavity, whitening, and gum care. This trend opens up opportunities for brands to innovate and introduce specialized products.

To get more information on this market, Request Sample

India Toothpaste Market Trends:

Rising Prevalence of Dental Disorders

The rising prevalence of dental disorders in India is significantly contributing to the growth of the toothpaste market. For instance, according to the results of a survey done across India in 2020, over 17% of respondents suffered from cavities and decay. Similarly, according to an article published by the Indian Dental Association, gum disease affects approximately 95% of the population. As more people become aware of the importance of oral hygiene and seek solutions to prevent and treat dental issues, the demand for toothpastes, particularly those with specialized formulations, has increased. These factors are further positively influencing the India toothpaste market forecast.

Expanding E-Commerce Sector

The growth of the e-commerce sector is one of the key factors fueling the India toothpaste market growth. For instance, according to IMARC, the India e-commerce market size reached US$ 92.7 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 259.0 Billion by 2032, exhibiting a growth rate (CAGR) of 29.3% during 2024-2032. E-commerce platforms make it easier for consumers to access a wide range of toothpaste brands and variants. This convenience often leads to increased sales as people can shop from the comfort of their homes. These factors are further contributing to the India toothpaste market share.

Product Innovations

Continuous innovation in toothpaste formulations, such as the introduction of natural and herbal ingredients, new flavors, and multifunctional products (e.g., toothpaste that also helps with breath freshening and gum care), is attracting a diverse consumer base. For instance, in May 2024, Dabur Herb'l Charcoal, the premium toothpaste brand from Dabur, collaborated with Disney's Star Wars franchise to launch a limited-edition Star Wars pack for Dabur Herb'l's renowned Activated Charcoal Toothpaste. These factors are augmenting the India toothpaste market demand.

India Toothpaste Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, distribution channel, and end user.

Breakup by Type:

- Conventional Toothpaste

- Herbal Toothpaste

- Whitening and Sensitive Toothpaste

The report has provided a detailed breakup and analysis of the market based on the type. This includes conventional toothpaste, herbal toothpaste, and whitening and sensitive toothpaste.

According to the India toothpaste market analysis report, general awareness about oral hygiene and dental health drives the demand for conventional toothpaste. People often choose this option for its proven effectiveness and familiar formulation. Moreover, the rising preference for natural and organic products drive the demand for herbal toothpaste. Consumers are increasingly concerned about synthetic chemicals and seek products with natural ingredients. Besides this, dentists often recommend sensitive toothpaste to patients experiencing issues with tooth sensitivity, influencing its demand.

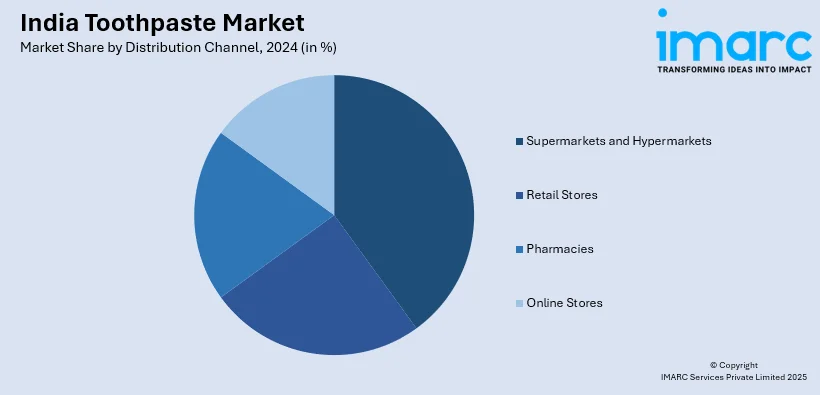

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Retail Stores

- Pharmacies

- Online Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, retail stores, pharmacies, and online stores.

According to the India toothpaste market outlook, supermarkets and hypermarkets stores often experience high demand for toothpastes due to their wide customer base and the convenience they offer for purchasing everyday essentials. Consumers typically buy toothpaste alongside other grocery items. Moreover, in general retail stores, toothpaste remains a commonly purchased item. Demand is steady, but these stores may not offer as wide a selection as larger supermarkets or hypermarkets. Besides this, pharmacies typically cater to customers looking for specific health-related products, so there may be higher demand for toothpastes targeting particular dental health issues, such as sensitivity or gum care. Furthermore, online stores have seen a significant increase in toothpaste demand, driven by the convenience of home delivery and the ability to easily compare prices and brands.

Breakup by End User:

- Adults

- Kids

The report has provided a detailed breakup and analysis of the market based on the end user. This includes adults and kids.

Adults often seek toothpaste with specific benefits such as enamel protection, sensitivity relief, or whitening. Demand for toothpaste with fluoride, anti-cavity, and anti-gingivitis properties is high. Moreover, toothpaste for children often emphasizes safety and taste. Products are designed to be non-toxic, swallowable, and available in flavors that appeal to kids. Furthermore, many parents prefer toothpaste with lower fluoride levels or those specifically formulated for children to ensure safety.

Breakup by Region:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

According to the India toothpaste market statistics, in North India, there is a growing middle class with increasing awareness of dental hygiene. This urbanization drives demand for modern dental care products, including toothpaste. Moreover, in western and central India cities like Mumbai, Pune, and Ahmedabad have a burgeoning middle class with rising disposable incomes, leading to increased expenditure on personal care products. Furthermore, higher literacy rates in states like Kerala and Tamil Nadu contribute to greater awareness and adoption of advanced dental care products.

Competitive Landscape:

The India toothpaste market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Toothpaste Market News:

- July 2024: Patanjali Dant Kanti, a dental care brand, introduced its new Dant Kanti Fresh Active Gel toothpaste with a television commercial starring prominent Bollywood stars Tiger Shroff and Tamannaah Bhatia.

- May 2024: Dabur Herb'l Charcoal, the premium toothpaste brand from Dabur, collaborated with Disney's Star Wars franchise to launch a limited-edition Star Wars pack for Dabur Herb'l's renowned Activated Charcoal Toothpaste.

- April 2024: Colgate-Palmolive (India) Limited, the oral care company, launched Colgate Active Salt.

India Toothpaste Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Conventional Toothpaste, Herbal Toothpaste, Whitening and Sensitive Toothpaste |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Retail Stores, Pharmacies, Online Stores |

| End Users Covered | Adults, Kids |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India toothpaste market performed so far and how will it perform in the coming years?

- What is the breakup of the India toothpaste market on the basis of type?

- What is the breakup of the India toothpaste market on the basis of distribution channel?

- What is the breakup of the India toothpaste market on the basis of end user?

- What are the various stages in the value chain of the India toothpaste market?

- What are the key driving factors and challenges in the India toothpaste?

- What is the structure of the India toothpaste market and who are the key players?

- What is the degree of competition in the India toothpaste market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India toothpaste market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India toothpaste market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India toothpaste industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)