India Tin Market Size, Share, Trends and Forecast by Product Type, Application, End Use Industry, and Region, 2026-2034

Market Overview:

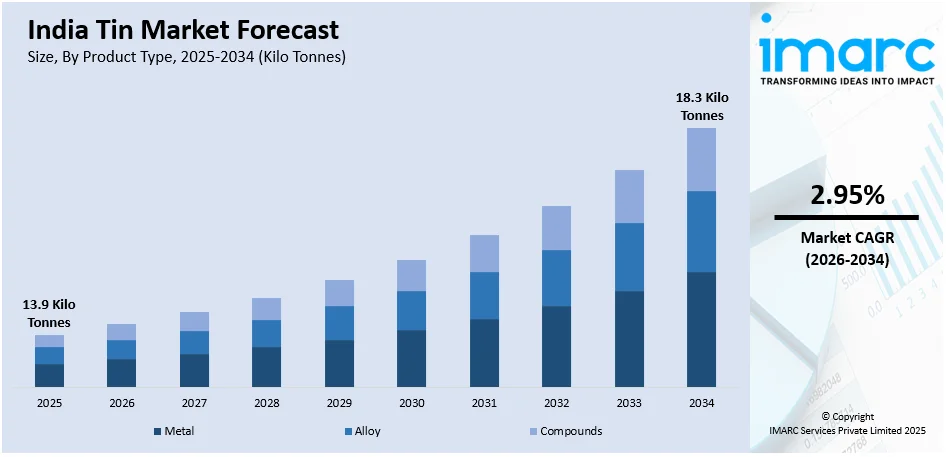

The India tin market size reached 13.9 Kilo Tonnes in 2025. Looking forward, IMARC Group expects the market to reach 18.3 Kilo Tonnes by 2034, exhibiting a growth rate (CAGR) of 2.95% during 2026-2034. The widespread production of tin in the manufacturing of consumer electronics, packaging, and automotive industries, the rising government's focus on promoting domestic manufacturing, and the growing e-commerce, and organized retail platforms, represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

13.9 Kilo Tonnes |

|

Market Forecast in 2034

|

18.3 Kilo Tonnes |

| Market Growth Rate 2026-2034 | 2.95% |

Tin is a chemical element represented by the symbol Sn and the atomic number 50. This soft, silvery-white metal belongs to group 14 of the periodic table and exhibits a low melting point relative to many metals. It is ductile and highly resistant to corrosion from water, making it suitable for a variety of practical applications. Tin is commonly used in alloys, the most notable of which is bronze, composed of copper and tin. Additionally, it functions as an essential role in the production of tinplate, which is used extensively in the food packaging industry for tin cans. The association of tin with the packaging industry, particularly in the production of tinplate, is pivotal. Tin's corrosion-resistant nature makes it an ideal choice for safeguarding food products and beverages, preserving their quality and ensuring consumer safety. Tin's application in the production of tin cans has revolutionized food preservation and distribution, highlighting its indispensable role in modern food packaging. Moreover, tin is utilized in the electronics industry for solder due to its ability to create solid, conductive, and corrosion-resistant joints. The metal's unique properties, such as malleability, ductility, and resistance to corrosion, underscore its importance across various industries.

To get more information on this market Request Sample

India Tin Market Trends:

The India tin market has exhibited consistent growth patterns due to the growing product utilization across various industries. This can be supported by the widespread production of tin in the manufacturing of consumer electronics, packaging, and automotive industries. India's rapid urbanization and growth in disposable incomes are leading to increased consumption of products that utilize tin, further boosting the market. On the other hand, the government's focus on promoting domestic manufacturing, combined with strategic partnerships and investments in mining and refining facilities, ensures a stable supply chain. Additionally, technological advancements in recycling and processing methods are adding to the market's sustainability, aligning with global environmental concerns. In confluence with this, environmental concerns and the need for responsible mining also put pressure on the industry. The future of the Indian tin market appears promising, with continuing technological innovation, investment in infrastructure, and favorable government policies likely to contribute to sustained growth and development. Apart from this, the rise in e-commerce, organized retail, and increasing consumer awareness about sustainable packaging is contributing to the market. Tin, with its excellent properties, including recyclability, preservation, and resistance to corrosion, is gaining popularity as a preferred material for packaging solutions. This trend presents a significant opportunity for tin manufacturers and suppliers to cater to the packaging sector's increasing demands.

India Tin Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India tin market report, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, application, and end use industry.

Product Type Insights:

- Metal

- Alloy

- Compounds

The report has provided a detailed breakup and analysis of the market based on the product type. This includes metal, alloy, and compounds.

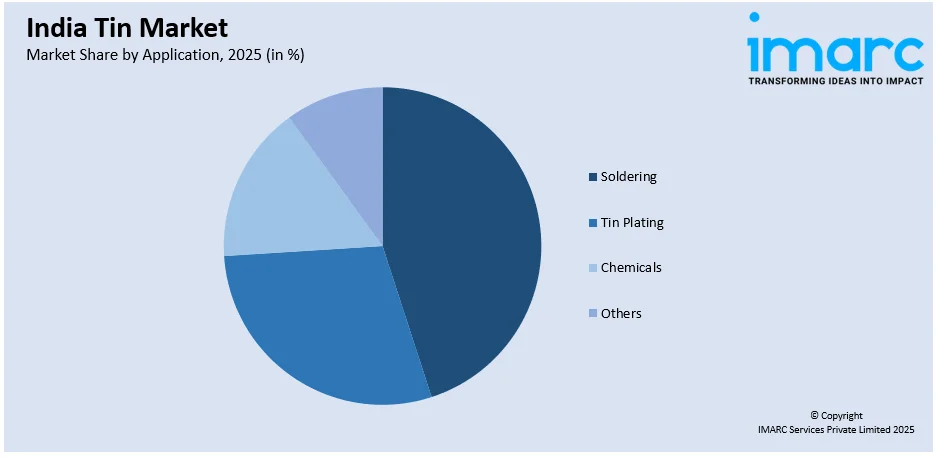

Application Insights:

Access the comprehensive market breakdown Request Sample

- Soldering

- Tin Plating

- Chemicals

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes soldering, tin plating, chemicals, and others.

End Use Industry Insights:

- Automotive

- Electronics

- Packaging (Food and Beverages)

- Glass

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, electronics, packaging (food and beverages), glass, and others.

Regional Insights:

- South India

- North India

- West & Central India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include South India, North India, West & Central India, and East India.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Tin Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Kilo Tonnes |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Metal, Alloy, Compounds |

| Applications Covered | Soldering, Tin Plating, Chemicals, Others |

| End Use Industries Covered | Automotive, Electronics, Packaging (Food and Beverages), Glass, Others |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India tin market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India tin market?

- What is the breakup of the India tin market on the basis of product type?

- What is the breakup of the India tin market on the basis of application?

- What is the breakup of the India tin market on the basis of end use industry?

- What are the various stages in the value chain of the India tin market?

- What are the key driving factors and challenges in the India tin market?

- What is the structure of the India tin market and who are the key players?

- What is the degree of competition in the India tin market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India tin market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India tin market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India tin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)