India Textile Chemicals Market Size, Share, Trends and Forecast by Fiber Type, Product Type, Application, and Region, 2025-2033

India Textile Chemicals Market Size and Share:

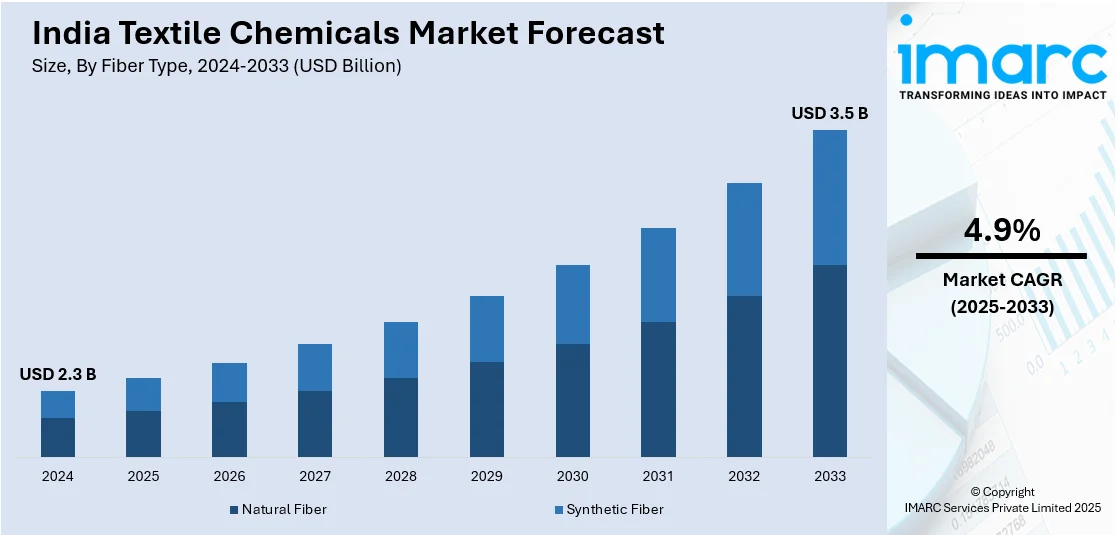

The India textile chemicals market size reached USD 2.3 Billion in 2024. The market is expected to reach USD 3.5 Billion by 2033, exhibiting a growth rate (CAGR) of 4.9% during 2025-2033. The market growth is attributed to textiles being utilized increasingly in technical applications, advancements in high-performance fabrics that are seeing rising demand, technological advancements in manufacturing, also government initiatives promoting domestic production.

Market Insights:

- On the basis of fiber type, the market has been divided into natural fiber and synthetic fiber.

- On the basis of product type, the market has been divided into coating and sizing chemicals, finishing agents, colorants and auxiliaries, surfactants, desizing agents, and others.

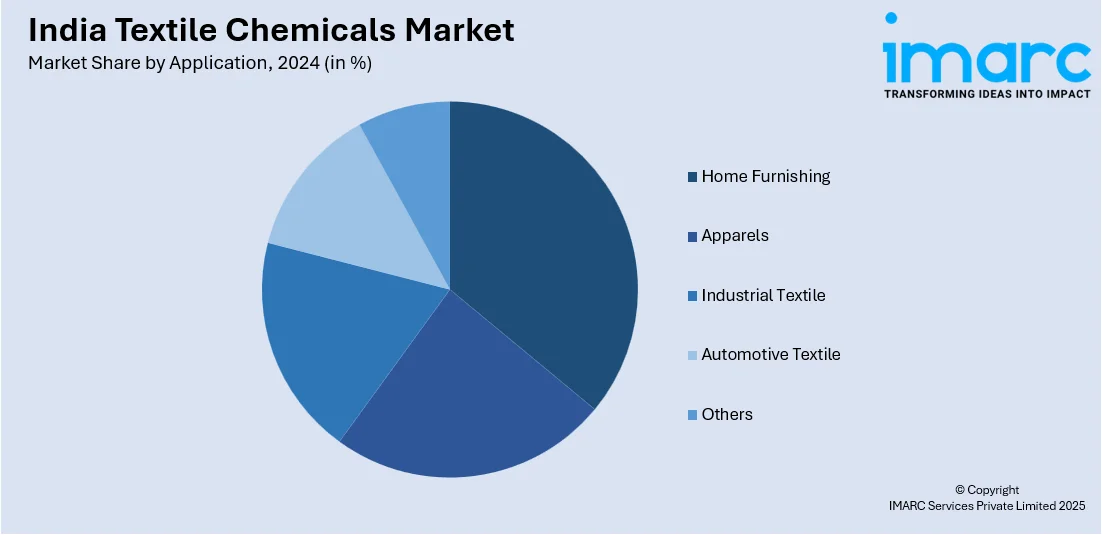

- On the basis of application, the market has been divided into home furnishing, apparels, industrial textile, automotive textile, and others.

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

Market Size and Forecast:

- 2024 Market Size: USD 2.3 Billion

- 2033 Projected Market Size: USD 3.5 Billion

- CAGR (2025-2033): 4.9%

Textile chemicals are a diverse group of substances applied during the processing of textiles to enhance their properties, performance, and appearance. These chemicals play a crucial role in various stages of textile manufacturing, from fiber production to fabric finishing. Common textile chemicals include dyes, pigments, and auxiliaries such as softeners, sizing agents, and flame retardants. Dyes impart color to fabrics, while pigments provide opacity and brightness. Softeners enhance fabric feel while sizing agents improve yarn strength and control shrinkage. Flame retardants are essential for making textiles fire-resistant. Additionally, chemicals are used in processes like bleaching and scouring to prepare fibers for dyeing. While these chemicals contribute significantly to the textile industry's efficiency and product quality, there is increasing attention on developing eco-friendly alternatives to minimize environmental impact and promote sustainable practices in textile manufacturing.

To get more information on this market, Request Sample

India Textile Chemicals Market Trends:

Rising demand for advanced and high-performance fabrics

The escalating regional population and rising disposable incomes have propelled the demand for textiles, fostering India textile chemicals market share expansion. This shift towards eco-friendly practices not only addresses environmental concerns but also aligns with the evolving consumer expectations, driving market growth. Moreover, technological advancements in textile manufacturing, such as the development of smart textiles and nanotechnology applications, have fueled the demand for specialized chemicals. The integration of these technologies enhances the functionality and performance of textiles, catering to diverse applications in the healthcare, sports, and automotive sectors. The growing emphasis on sustainability and environmental responsibility is transforming how textile chemicals are developed and utilized across the Indian manufacturing landscape. As the market shifts towards online retail, there is increasing demand for dyes, finishes, and specialty chemicals that cater to specific consumer needs. The Indian startup ecosystem has witnessed exponential growth, with a significant share of retail sales expected to shift online by 2025, according to the Ministry of Commerce and Industry, significantly impacting the India textile chemicals market growth. This shift necessitates the availability of a wide range of textile chemicals that are suitable for diverse online clothing brands. This evolving landscape provides a major growth opportunity for the market. The rapid growth of e-commerce in India is significantly influencing the textile sector, especially concerning the distribution of textile chemicals and creating new demand patterns for specialized formulations.

Circular Economy Practices and Sustainable Manufacturing Revolution

The industry is being reshaped by the widespread adoption of circular economy principles that prioritize recycling, upcycling, and waste reduction throughout the textile chemical value chain, which is creating a positive India textile chemicals market outlook. This transformative approach encompasses the development of chemical formulations specifically designed for textile-to-textile recycling processes, enabling the efficient breakdown of used garments into reusable fibers without compromising quality. Advanced enzyme-based technologies are facilitating the separation of different fiber types from blended fabrics, making previously non-recyclable textiles suitable for circular processing. Companies are increasingly investing in closed-loop manufacturing systems where textile chemicals are recovered and reused multiple times, dramatically reducing waste generation and raw material consumption. The integration of digital technologies like blockchain and IoT sensors is enabling real-time tracking of chemical usage and waste streams, ensuring optimal resource utilization in the Indian textile chemicals market. Waterless dyeing technologies and zero-liquid discharge systems are becoming standard practices, supported by innovative chemical formulations that require minimal water usage. This circular approach extends to packaging solutions, with biodegradable and refillable chemical containers gaining prominence. The industry is also witnessing collaborations between chemical suppliers and textile recycling facilities to develop specialized chemicals for breaking down complex synthetic fibers, supporting the government's waste management initiatives and contributing to the broader goal of achieving a sustainable textile ecosystem.

Bio-based Innovation and Health-Focused Textile Treatments

The textile chemicals industry in India is experiencing a paradigm shift toward bio-based and natural-derived chemicals, driven by advances in biotechnology and enzyme engineering that are revolutionizing traditional chemical processes. Plant-based alternatives derived from renewable feedstocks like sugarcane, corn, and agricultural waste are replacing petroleum-based chemicals in dyeing, finishing, and coating applications. Enzyme-driven solutions, including cellulases, pectinases, and laccases, are enabling precise fiber modification while reducing environmental impact and energy consumption. The emergence of health-focused treatments represents a significant growth driver, with antimicrobial, antibacterial, and hypoallergenic finishes becoming standard requirements across medical textiles, activewear, and intimate apparel segments. Climate-responsive chemical formulations are addressing evolving consumer needs for UV protection, moisture management, and temperature regulation in fabrics, particularly relevant for India's diverse climatic conditions. Strategic collaborations between chemical suppliers and fashion designers are fostering innovation in trend-driven finishes, custom colorations, and specialized textures that meet specific aesthetic and functional requirements. Government initiatives like "Make in India" are catalyzing local innovation in textile chemicals through increased R&D investments, technology transfer partnerships, and incentive schemes for sustainable chemical manufacturing. The textile chemicals industry size in India is expanding as ethical sourcing practices gain prominence, with transparency in supply chains becoming a competitive advantage, while the fusion of traditional dyeing techniques with modern chemical innovations is creating unique market opportunities that honor cultural heritage while meeting contemporary performance standards.

Growth, Opportunities, and Challenges in the India Textile Chemicals Market:

- Growth Drivers of the India Textile Chemicals market: The primary growth drivers include the robust expansion of the textile and apparel industry supported by government initiatives like the PLI scheme and PM MITRA parks development. Rising demand for technical textiles in automotive, healthcare, and construction sectors is creating new application opportunities for specialized chemical formulations. The growing emphasis on sustainability and eco-friendly production methods is driving innovation in bio-based and environmentally responsible textile chemicals.

- Opportunities in the India Textile Chemicals market: Significant opportunities exist in developing specialized chemicals for emerging applications such as smart textiles, wearable electronics, and medical textiles that require advanced functional properties. The expansion of export-oriented textile manufacturing presents substantial growth potential for high-performance chemical solutions. Strategic partnerships with international brands and technology providers can accelerate innovation and market penetration in premium segments.

- Challenges in the India Textile Chemicals market: The market faces challenges from stringent environmental regulations requiring substantial investments in cleaner production technologies and waste treatment systems. Fluctuating raw material prices, particularly petroleum-based feedstocks, create cost pressures and margin compression for manufacturers. Intense competition from low-cost imports and the need for continuous technological upgradation pose operational challenges for domestic players, as per the India textile chemicals market analysis.

India Textile Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on fiber type, product type, and application.

Fiber Type Insights:

- Natural Fiber

- Synthetic Fiber

The report has provided a detailed breakup and analysis of the market based on the fiber type. This includes natural fiber and synthetic fiber.

Product Type Insights:

- Coating and Sizing Chemicals

- Finishing Agents

- Colorants and Auxiliaries

- Surfactants

- Desizing Agents

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes coating and sizing chemicals, finishing agents, colorants and auxiliaries, surfactants, desizing agents, and others.

Application Insights:

- Home Furnishing

- Apparels

- Industrial Textile

- Automotive Textile

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes home furnishing, apparels, industrial textile, automotive textile, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- August 2025: India reopened the Textile PLI Scheme portal for new applications until August 31, 2025, covering MMF apparel, fabrics, and technical textiles with an approved outlay of INR 106.83 Billion to drive large-scale investments and boost domestic manufacturing.

India Textile Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fiber Types Covered | Natural Fiber, Synthetic Fiber |

| Product Types Covered | Coating and Sizing Chemicals, Finishing Agents, Colorants and Auxiliaries, Surfactants, Desizing Agents, Others |

| Applications Covered | Home Furnishing, Apparels, Industrial Textile, Automotive Textile, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India textile chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India textile chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India textile chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India textile chemicals market was valued at USD 2.3 Billion in 2024.

The India textile chemicals market is projected to exhibit a CAGR of 4.9% during 2025-2033, reaching a value of USD 3.5 Billion by 2033.

India's textile chemicals market is driven by increasing demand for diverse textile applications, growing focus on fabric quality, and rising preference for sustainable processing. Innovations in fabric treatment, eco-friendly solutions, and evolving fashion trends support market expansion. Government support and modernization in textile manufacturing further enhance industry growth and transformation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)