India Telemedicine Market Size, Share, Trends and Forecast by Component, Type, Deployment Mode, Modality, Application, End User, and Region, 2026-2034

India Telemedicine Market Summary:

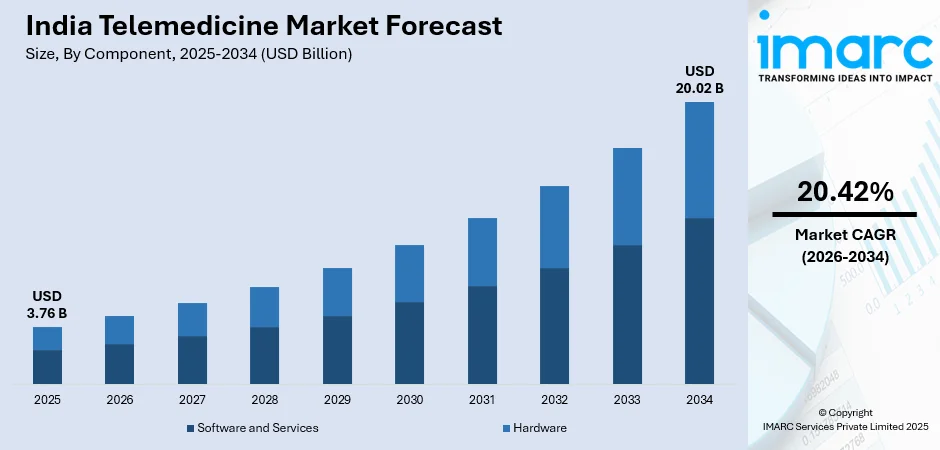

The India telemedicine market size was valued at USD 3.76 Billion in 2025 and is projected to reach USD 20.02 Billion by 2034, growing at a compound annual growth rate of 20.42% from 2026-2034.

The market is driven by increasing smartphone and internet penetration across urban and rural areas, supportive government initiatives promoting digital healthcare infrastructure, rising demand for accessible and affordable medical services, growing adoption of remote patient monitoring technologies, and expanding healthcare IT capabilities facilitating seamless virtual consultations. Additionally, heightened consumer acceptance of virtual care delivery models and healthcare provider investments in telemedicine platforms are collectively contributing to the expanding India telemedicine market share.

Key Takeaways and Insights:

- By Component: Software and services dominate the market with a share of 61% in 2025, driven by rising telemedicine platform adoption, electronic health record integration, and video consultation software enabling seamless virtual healthcare delivery.

- By Type: Tele-hospitals lead the market with a share of 45% in 2025, owing to increasing virtual hospital network establishment, multi-specialty consultation integration, and healthcare institutions extending reach beyond physical boundaries.

- By Deployment Mode: Cloud-based represents the largest segment with a market share of 49% in 2025, driven by reduced infrastructure costs, enhanced scalability, improved data accessibility, and seamless integration with existing hospital management systems.

- By Modality: Real time dominates the market with a share of 60% in 2025, owing to patient preference for immediate physician interaction, enhanced diagnostic accuracy through live video assessments, and synchronous communication comfort.

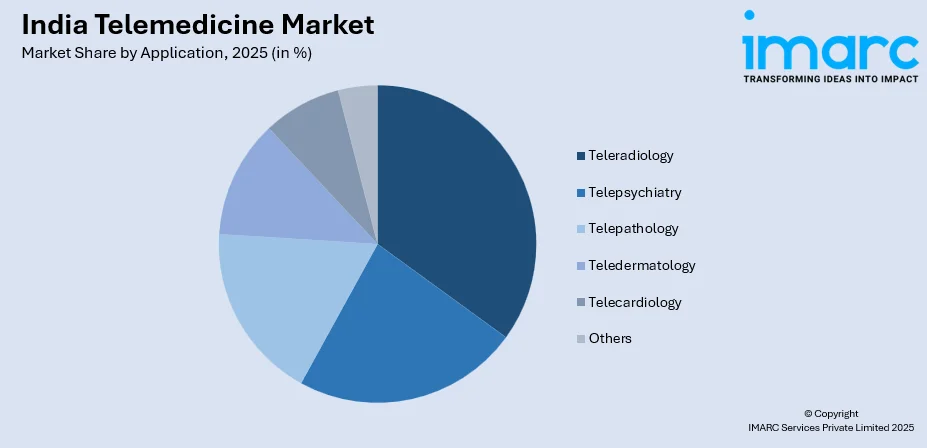

- By Application: Teleradiology represents the largest segment with a market share of 34% in 2025, driven by critical need for remote diagnostic imaging interpretation, shortage of specialized radiologists in rural areas, and increasing medical imaging procedure volumes.

- By End User: Providers dominate the market with a share of 48% in 2025, owing to hospital investments in telemedicine infrastructure, physician adoption of virtual consultation platforms, and healthcare system modernization initiatives.

- By Region: North India leads the market with a share of 37% in 2025, driven by concentrated healthcare infrastructure in Delhi-NCR, higher digital literacy rates, robust internet connectivity, and significant population density.

- Key Players: The India telemedicine market exhibits a moderately competitive landscape, with established healthcare conglomerates competing alongside emerging digital health startups across various service categories. Market participants are differentiating through technology innovation, specialty-focused platforms, and strategic partnerships with insurance providers.

To get more information on this market Request Sample

The India telemedicine market is experiencing robust expansion driven by transformative factors reshaping healthcare delivery nationwide. Government initiatives promoting digital health infrastructure have established foundational frameworks enabling widespread telemedicine adoption across public and private healthcare networks. According to reports, in 2025, India’s national telemedicine service eSanjeevani facilitated over 43 Crore consultations across all states and UTs, underscoring its role in expanding remote care access for underserved populations and strengthening primary care delivery. Moreover, the proliferation of smartphones and affordable internet connectivity has democratized access to virtual healthcare services, particularly benefiting underserved rural and semi-urban populations. Growing consumer acceptance of remote consultations reflects changing healthcare-seeking behaviours and increased trust in digital medical interactions. Healthcare providers are investing substantially in telemedicine capabilities to extend their service reach, optimize operational efficiency, and meet evolving patient expectations for convenient care access. Rising prevalence of chronic diseases necessitates continuous remote monitoring and management solutions, further accelerating telemedicine platform adoption. Additionally, supportive regulatory frameworks and increasing insurance coverage for virtual consultations are strengthening the healthcare ecosystem.

India Telemedicine Market Trends:

Integration of Artificial Intelligence in Virtual Healthcare Delivery

The integration of artificial intelligence (AI) technologies is transforming telemedicine services across India by enhancing diagnostic capabilities and streamlining clinical workflows. AI-powered symptom checkers and preliminary assessment tools are enabling patients to receive initial evaluations before connecting with physicians, optimizing consultation efficiency. As per reports, the Health Ministry stated that eSanjeevani’s AI-based Clinical Decision Support System supported over 282 Million consultations with standardized data capture and AI-generated diagnostic recommendations. Moreover, machine learning (ML) algorithms are being deployed to analyze patient data patterns, supporting healthcare providers in making informed clinical decisions during virtual consultations.

Expansion of Specialty-Focused Telemedicine Platforms

The telemedicine landscape in India is witnessing significant growth in specialty-focused virtual healthcare platforms addressing specific medical disciplines. Dedicated telepsychiatry and mental health platforms are gaining prominence as awareness regarding psychological wellbeing increases among Indian populations. According to reports, in September 2024, the Delhi Government launched tele‑medicine services across 13 medical specialties, broadening access to specialist care such as cardiology, dermatology, and psychiatry through virtual consultations. Furthermore, specialized teledermatology services are enabling patients to receive expert skin condition evaluations through high-resolution image sharing and video consultations.

Rural Healthcare Transformation Through Mobile Health Solutions

Mobile health applications are revolutionizing healthcare accessibility in rural India by bridging geographical barriers between patients and healthcare providers. In August 2025, India’s Health Ministry announced expansion of telemedicine to 50,000 rural clinics with video links to certified physicians, enabling real‑time mobile health consultations across underserved districts. Moreover, vernacular language support in telemedicine applications is enabling wider adoption among non-English speaking populations across diverse Indian states. Integration of telemedicine services with primary health centers is extending specialist consultation access to remote villages lacking adequate healthcare infrastructure. Community health workers are being equipped with mobile telemedicine tools to facilitate patient consultations with urban specialists.

Market Outlook 2026-2034:

The India telemedicine market revenue demonstrates strong growth potential throughout the forecast period, supported by favorable regulatory frameworks and expanding digital healthcare infrastructure. Healthcare institutions are allocating substantial resources toward telemedicine platform development and clinical system integration. Insurance providers are increasingly incorporating virtual consultation coverage within health plans, driving revenue growth. Government healthcare programs are leveraging telemedicine capabilities to enhance primary care delivery efficiency. Technological advancements in connectivity and device capabilities continue expanding the addressable market, positioning the sector for sustained revenue expansion. The market generated a revenue of USD 3.76 Billion in 2025 and is projected to reach a revenue of USD 20.02 Billion by 2034, growing at a compound annual growth rate of 20.42% from 2026-2034.

India Telemedicine Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component | Software and Services | 61% |

| Type | Tele-Hospitals | 45% |

| Deployment Mode | Cloud-based | 49% |

| Modality | Real Time | 60% |

| Application | Teleradiology | 34% |

| End User | Providers | 48% |

| Region | North India | 37% |

Component Insights:

- Software and Services

- Hardware

Software and services dominate with a market share of 61% of the total India telemedicine market in 2025.

The software and services leads the market, driven by comprehensive platform requirements across healthcare delivery networks. Telemedicine software solutions encompass video consultation platforms, electronic health record integration systems, appointment scheduling modules, and prescription management tools essential for virtual healthcare operations. In September 2025, an Indian hospital network partnered with a local tech firm to integrate advanced telehealth software, enabling video consultations, electronic prescriptions, and remote monitoring across multiple facilities. Furthermore, healthcare providers are prioritizing software investments to establish robust digital infrastructure capable of supporting growing patient consultation volumes.

These continue expanding as healthcare institutions integrate advanced functionalities including AI-powered diagnostics, automated appointment management, and secure patient communication tools within telemedicine platforms. Platform customization capabilities enable healthcare providers to address specific clinical specialty requirements and organizational workflow preferences effectively. Continuous software updates ensure compliance with evolving regulatory standards and data security requirements governing digital healthcare delivery. Comprehensive service packages including implementation support, staff training, and technical maintenance further strengthen adoption across hospitals, clinics, and primary healthcare centers nationwide.

Type Insights:

- Tele-Hospitals

- mHealth

- Tele-Homes

Tele-hospitals lead with a share of 45% of the total India telemedicine market in 2025.

Tele-hospitals dominate the India telemedicine market, reflecting healthcare institution investments in virtual care delivery capabilities. Large hospital networks are establishing comprehensive telemedicine programs offering multi-specialty consultations through integrated virtual platforms. As per sources, in 2024, HealthNet Global launched a Tele-ICU programme at Apollo Spectra Hospital, Pusa Road, enabling remote monitoring and expert critical-care intervention, improving healthcare access, especially in rural regions. Moreover, these tele-hospital models enable healthcare institutions to extend service reach beyond geographical limitations while optimizing physician resource utilization.

The tele-hospital segment encompasses various service offerings including outpatient consultations, second opinion services, follow-up appointments, and chronic disease management programs delivered through digital channels. Healthcare institutions are developing dedicated telemedicine departments with trained staff managing virtual patient interactions efficiently. Quality assurance protocols established by leading hospitals ensure virtual consultations maintain clinical standards comparable to in-person visits. Collaborative care models facilitate seamless coordination between specialists across different medical disciplines.

Deployment Mode Insights:

- On-premises

- Cloud-based

- Web-based

Cloud-based exhibits a clear dominance with a 49% share of the total India telemedicine market in 2025.

Cloud-based leads the India telemedicine market due to compelling advantages in cost efficiency, scalability, and operational flexibility for healthcare organizations. Healthcare organizations adopting cloud infrastructure eliminate substantial capital expenditure requirements associated with on-premises server installations and ongoing maintenance. According to sources, Apollo Hospitals expanded its Apollo 24|7 platform on Google Cloud, integrating AI-powered telemedicine, clinical decision support, and scalable cloud infrastructure to enhance healthcare access across India. Furthermore, scalable cloud resources enable telemedicine platforms to accommodate fluctuating patient consultation volumes without infrastructure constraints limiting service capacity.

These facilitate rapid platform implementation, accelerating time-to-market for healthcare organizations launching telemedicine services across multiple locations. Remote accessibility inherent in cloud-based systems enables healthcare providers to conduct consultations from various locations, enhancing service continuity and physician flexibility. Cloud service providers offer robust security measures and compliance certifications addressing healthcare data protection requirements mandated by regulatory authorities. Disaster recovery capabilities embedded within cloud infrastructure ensure business continuity protection for critical telemedicine operations during unforeseen disruptions affecting healthcare service delivery.

Modality Insights:

- Store and Forward

- Real Time

- Others

Real time leads with a market share of 60% of the total India telemedicine market in 2025.

Real time dominate the market, reflecting patient and provider preference for synchronous virtual healthcare interactions enabling immediate communication. Live video consultations enable immediate physician-patient communication facilitating comprehensive clinical assessments comparable to physical examinations conducted in traditional healthcare settings. According to reports, 60.4 % of telemedicine consultations in India were conducted via real-time audio or video interactions, highlighting strong patient and provider preference for synchronous virtual healthcare. Furthermore, real-time modality supports dynamic diagnostic processes where physicians can direct patients through physical assessments, observe symptoms, and gather clinical information interactively.

Healthcare providers favor real time for acute care consultations requiring immediate clinical decision-making and timely treatment initiation for patients. Specialist consultations benefit significantly from real-time interaction enabling detailed case discussions and comprehensive patient evaluations across medical disciplines. Emergency telemedicine applications rely predominantly on real-time capabilities to support urgent clinical scenarios requiring immediate physician guidance and intervention. Technological advancements in video streaming quality and connectivity infrastructure continue enhancing real-time consultation experiences across diverse healthcare settings serving urban and rural populations.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

Teleradiology leads with a share of 34% of the total India telemedicine market in 2025.

Teleradiology represents the largest application segment within the India telemedicine market, addressing critical needs in diagnostic imaging interpretation services nationwide. The substantial shortage of qualified radiologists across Indian healthcare facilities creates significant demand for remote imaging analysis services from specialized experts. As per sources, in September 2024, Uttar Pradesh began offering teleradiology X‑ray diagnostic services at 361 CHCs, expanding remote image reporting and specialist interpretation across rural facilities. Moreover, teleradiology platforms enable healthcare institutions to access specialized radiologist expertise regardless of geographical location, ensuring timely and accurate diagnostic reports.

Teleradiology incorporate AI capabilities supporting radiologists in image analysis, anomaly detection, and preliminary report generation improving efficiency. Picture archiving and communication systems integrated with teleradiology platforms facilitate seamless image transmission and storage meeting clinical requirements and regulatory standards. Subspecialty teleradiology services addressing specific imaging modalities including mammography, cardiac imaging, and neuroimaging are experiencing increased adoption across healthcare institutions. Quality assurance protocols within teleradiology workflows ensure diagnostic accuracy standards comparable to on-site radiology services maintaining clinical excellence throughout operations.

End User Insights:

- Providers

- Payers

- Patients

- Others

Providers exhibit a clear dominance with a 48% share of the total India telemedicine market in 2025.

Providers dominate the market, representing the primary adopters and operators of telemedicine services across the Indian healthcare landscape. Hospitals and multi-specialty healthcare networks are implementing comprehensive telemedicine programs as strategic initiatives extending service capabilities beyond traditional boundaries. According to reports, in June 2025, Southern Railway launched a telemedicine link across its hospital network, enabling remote specialist and super‑specialist consultations via real‑time video for patients in remote railway units nationwide. Moreover, primary care providers are adopting telemedicine platforms to manage routine consultations efficiently while reserving physical appointments for cases requiring in-person examination.

Clinic chains and diagnostic centers are leveraging telemedicine capabilities to differentiate service offerings and expand patient reach beyond immediate geographic areas effectively. Healthcare provider investments in telemedicine infrastructure reflect strategic priorities around service modernization and competitive positioning within evolving healthcare markets. Staff training programs within healthcare organizations ensure clinical teams possess necessary competencies for effective virtual patient interactions maintaining quality standards. Provider satisfaction with telemedicine platforms continues improving as technology maturity enhances consultation workflow efficiency and clinical utility across diverse healthcare settings.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India dominates with a market share of 37% of the total India telemedicine market in 2025.

North India leads the market, driven by concentrated healthcare infrastructure and favorable digital adoption conditions across the region. The Delhi-NCR metropolitan area serves as a significant healthcare hub with leading hospital networks actively expanding telemedicine service capabilities and reach. States including Uttar Pradesh, Punjab, Haryana, and Rajasthan demonstrate growing telemedicine adoption supported by improving internet connectivity infrastructure. Large population concentrations across North Indian states create substantial addressable markets for telemedicine service providers establishing comprehensive regional presence and service networks.

Government healthcare programs in North Indian states are incorporating telemedicine components to enhance primary care delivery across district health networks effectively. Medical education institutions in the region are training healthcare professionals in telemedicine practices, building workforce capabilities supporting sustained sector growth. Private healthcare investments in North India include significant telemedicine infrastructure development addressing urban and rural healthcare accessibility requirements across communities. Regional health challenges including chronic disease prevalence and specialist access limitations are driving telemedicine service demand across diverse North Indian populations seeking accessible healthcare solutions.

Market Dynamics:

Growth Drivers:

Why is the India Telemedicine Market Growing?

Government Initiatives Promoting Digital Health Infrastructure

The Indian government has implemented comprehensive policy frameworks and infrastructure programs accelerating telemedicine adoption across public and private healthcare sectors. National digital health initiatives have established foundational technology standards and interoperability guidelines enabling seamless information exchange between healthcare platforms. According to reports, in August 2024, over 127,499 Health & Wellness Centres were operating as telemedicine spokes with 16,211 hubs and 477 online OPDs integrated into eSanjeevani, expanding government telehealth reach. Further, public healthcare networks are integrating telemedicine capabilities within primary health centers, extending specialist consultation access to underserved populations across rural districts. Regulatory frameworks governing telemedicine practice provide clarity for healthcare providers, encouraging broader adoption of virtual consultation services.

Expanding Internet and Smartphone Penetration

The proliferation of affordable smartphones and expanding internet connectivity infrastructure is fundamentally transforming healthcare accessibility across Indian populations. Mobile device ownership rates continue increasing across urban and rural demographics, creating substantial addressable markets for telemedicine service providers. As per sources, internet users in rural India surpassed 504 Million as overall internet users crossed 800 Million mark, highlighting rapid digital inclusion essential for telemedicine adoption. Moreover, declining data costs enable patients to engage in video consultations without significant connectivity expense barriers limiting service utilization. Internet service provider investments in network infrastructure are extending reliable connectivity coverage to previously underserved regions.

Rising Chronic Disease Prevalence Requiring Continuous Care Management

The increasing burden of chronic diseases including diabetes, cardiovascular conditions, and respiratory disorders creates sustained demand for remote patient monitoring and management services. Chronic disease patients benefit significantly from telemedicine capabilities enabling regular physician consultations without frequent physical facility visits. In October 2024, India’s DigiSetu telemedicine initiative supported over 11,000 disease patients in rural areas, improving diabetes and hypertension management through remote consultations and trained health workers. Moreover, remote monitoring devices integrated with telemedicine platforms facilitate continuous health data collection supporting proactive clinical intervention strategies. Healthcare providers are developing specialized chronic disease management programs delivered through telemedicine channels addressing growing patient population requirements.

Market Restraints:

What Challenges the India Telemedicine Market is Facing?

Digital Literacy and Technology Adoption Barriers

Limited digital literacy among elderly patients and rural communities creates barriers to telemedicine adoption. Many users lack familiarity with smartphone applications and video calling interfaces. Language barriers persist where platforms offer limited vernacular support. Technology anxiety leads to preference for traditional consultations, requiring healthcare providers to invest in patient education.

Infrastructure and Connectivity Limitations

Internet connectivity reliability remains inconsistent across India, particularly in the rural and remote regions. Bandwidth limitations affect video consultation quality, potentially compromising clinical assessment accuracy. Electricity supply inconsistencies create additional infrastructure challenges. Healthcare facilities in underserved regions often lack adequate technology infrastructure, limiting addressable market expansion and service delivery consistency.

Regulatory and Reimbursement Complexities

Evolving regulatory frameworks create compliance uncertainties for healthcare providers navigating dynamic policy environments. Insurance reimbursement policies for telemedicine consultations remain inconsistent across payers, affecting revenue predictability. Cross-state practice regulations introduce complexity for providers serving multiple jurisdictions. Data privacy requirements impose ongoing compliance obligations, potentially slowing market development and operational expansion.

Competitive Landscape:

The India telemedicine market features a dynamic competitive environment characterized by diverse participant categories pursuing distinct market positioning strategies. Established healthcare conglomerates leverage brand recognition, clinical expertise, and existing patient relationships to expand telemedicine service offerings. Technology-focused startups bring innovation capabilities and user experience expertise developing sophisticated digital health platforms. The market demonstrates ongoing consolidation activity as larger players acquire specialized platforms to enhance service portfolios and technology capabilities. Strategic partnerships between healthcare providers, technology companies, and insurance organizations are creating integrated service ecosystems addressing comprehensive patient healthcare requirements.

Recent Developments:

- In August 2025, the Ram Manohar Lohia Institute of Medical Sciences (RMLIMS), Lucknow, announced the launch of a pilot telemedicine facility. The initiative enables patients to consult physicians remotely, share diagnostic reports, and receive prescriptions online, thereby improving healthcare accessibility and reducing outpatient department congestion.

India Telemedicine Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software and Services, and Hardware |

| Types Covered | Tele-Hospitals, mHealth, Tele-Homes |

| Deployment Modes Covered | On-premises, Cloud-based, Web-based |

| Modalities Covered | Store and Forward, Real Time, Others |

| Applications Covered | Teleradiology, Telepsychiatry, Telepathology, Teledermatology, Telecardiology, Others |

| End Users Covered | Providers, Payers, Patients, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India telemedicine market size was valued at USD 3.76 Billion in 2025.

The India telemedicine market is expected to grow at a compound annual growth rate of 20.42% from 2026-2034 to reach USD 20.02 Billion by 2034.

Software and services held the largest market share, driven by increasing healthcare provider investments in comprehensive telemedicine platform solutions enabling video consultations, electronic health record integration, and virtual care delivery workflows.

Key factors driving the India telemedicine market include expanding government digital health initiatives, increasing smartphone and internet penetration, rising chronic disease prevalence requiring remote monitoring, growing consumer acceptance of virtual healthcare consultations, and healthcare provider investments in digital infrastructure.

Major challenges include digital literacy limitations among certain population segments, inconsistent internet connectivity in rural regions, evolving regulatory compliance requirements, variable insurance reimbursement policies for virtual consultations, data security concerns, and technology adoption barriers among elderly patients.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)