India Telecom Tower Market Size, Share, Trends, and Forecast by Type of Tower, Fuel Type, Installation, Ownership, and Region, 2025-2033

India Telecom tower Market Overview:

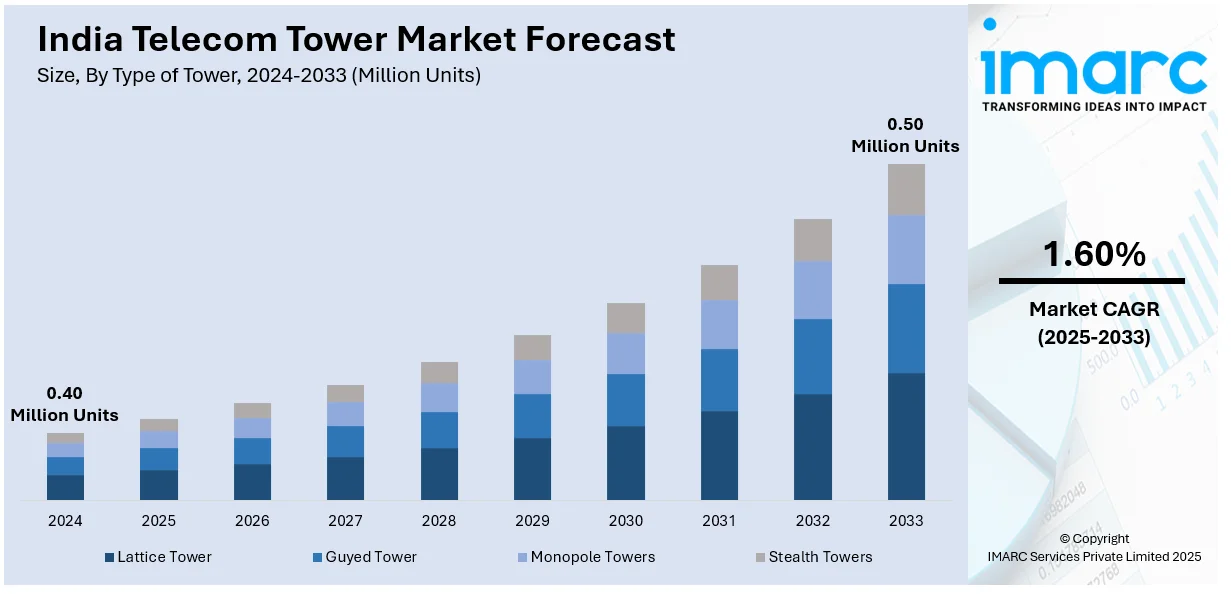

The India telecom tower market size reached 0.40 Million Units in 2024. Looking forward, IMARC Group expects the market to reach 0.50 Million Units by 2033, exhibiting a growth rate (CAGR) of 1.60% during 2025-2033. The market is witnessing significant growth, driven by the expansion of 5G infrastructure and tower deployment, along with an enhanced focus on green telecom towers and sustainable energy solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 0.40 Million Units |

| Market Forecast in 2033 | 0.50 Million Units |

| Market Growth Rate 2025-2033 | 1.60% |

India Telecom tower Market Trends:

Expansion of 5G Infrastructure and Tower Deployment

The Indian telecom tower market is expanding vividly with the rapid rollout of 5G networks. While an increasing number of carriers put towers in place to help their respective 5G systems- with greater bandwidth and lower latencies in increasingly better reach-focus on the government that fuels digitalization on the one hand and increased data consumption on the other as other pressing responsibilities. For instance, in November 2024, with 90% coverage of 5G in India, digital transformation is poised to accelerate, whereas affordable service offerings are driving accessibility and a growing base of subscriptions, thereby consolidating the leadership position of the country in next-gen connectivity. With the rollout of 5G services by key players like Reliance Jio, Bharti Airtel, and Vodafone Idea, the demand for small cell towers, fiberized backhaul, and high-density network coverage is surging. 5G technology requires, in contrast with 4G, a greater number of towers located in a much denser fashion; small cells are primarily in urban areas, while macro towers are sparsely distributed in semi-urban and rural localities. Besides this, initiatives from the government, such as the PM Gati Shakti National Master Plan, are fast-tracking tower approvals for faster infrastructure expansions. The widespread adoption of edge computing, IoT devices, and AI-powered automation keeps increasing the demand for next-gen telecom towers. While 5G spreads all over the nation, telecom operators and tower companies build up their high-capacity tower architecture for low latency to provide seamless connectivity and future-ready networks

To get more information on this market, Request Sample

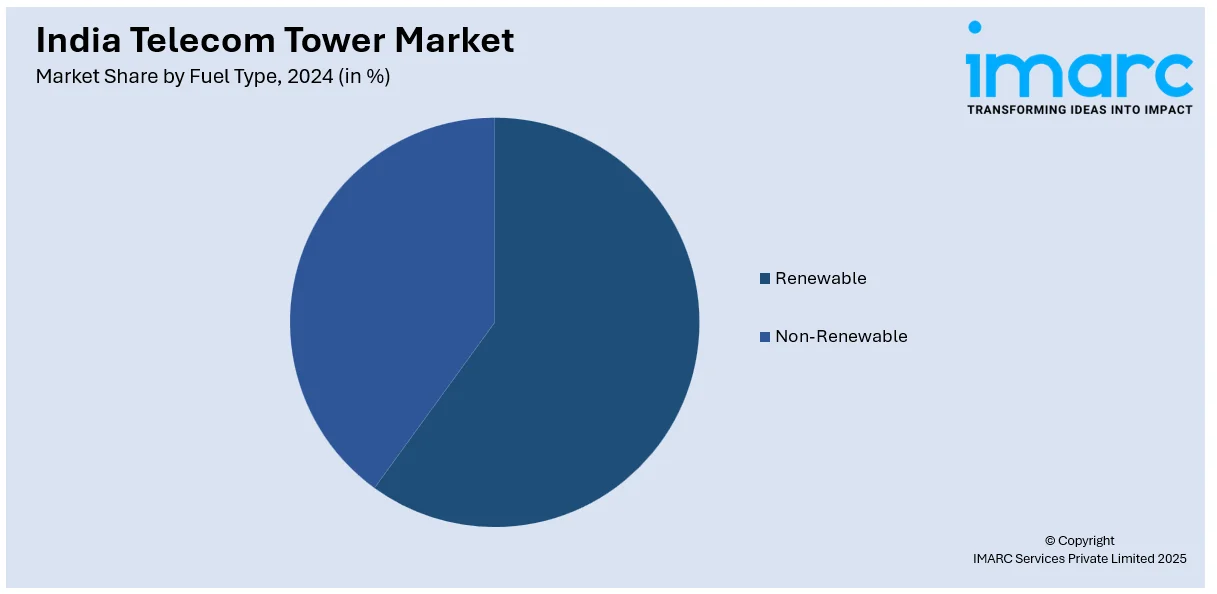

Rising Focus on Green Telecom Towers and Sustainable Energy Solutions

Sustainability is becoming a key priority in India's telecom tower market, with operators and infrastructure providers increasingly adopting green energy solutions to reduce operational costs and carbon emissions. The sector is shifting from diesel-powered towers to solar, wind, and hybrid energy-based systems, aligning with India's net-zero commitments and environmental regulations. For instance, in April 2024, TRAI proposed sharing active and passive telecom infrastructure to cut costs by 16-35% and reduce the sector’s carbon footprint, enhancing efficiency through shared networks, towers, and fiber assets. Companies such as Indus Towers, Bharti Infratel, and American Tower Corporation are actively deploying solar panels, lithium-ion battery storage, and AI-based energy management systems to optimize power consumption. Additionally, smart grid integration, energy-efficient cooling systems, and AI-driven predictive maintenance are improving operational efficiency, reducing downtime, and lowering costs. Government initiatives, such as the Renewable Energy for Telecom (RET) program, are also facilitating the transition to clean energy-powered telecom infrastructure. As sustainability gains prominence in the telecom sector, green telecom towers are expected to play a crucial role in reducing operational expenses, enhancing network reliability, and supporting India's climate change mitigation efforts.

India Telecom tower Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type of tower, fuel type, installation, and ownership.

Type of Tower Insights:

- Lattice Tower

- Guyed Tower

- Monopole Towers

- Stealth Towers

The report has provided a detailed breakup and analysis of the market based on the type of tower. This includes lattice tower, guyed tower, monopole towers, and stealth towers.

Fuel Type Insights:

- Renewable

- Non-Renewable

A detailed breakup and analysis of the market based on the fuel type have also been provided in the report. This includes renewable and non-renewable.

Installation Insights:

- Rooftop

- Ground-based

A detailed breakup and analysis of the market based on the installation have also been provided in the report. This includes rooftop and ground-based.

Ownership Insights:

- Operator-Owned

- Joint Venture

- Private-Owned

- MNO Captive

A detailed breakup and analysis of the market based on the ownership have also been provided in the report. This includes operator-owned, joint venture, private-owned, and MNO captive.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Telecom tower Market News:

- In March 2025, Bharti Airtel announced a partnership with Elon Musk’s SpaceX to launch Starlink satellite internet in India, pending regulatory approvals. COAI Director General Lt. Gen. Dr. SP Kochhar emphasized that while India welcomes new players, compliance with national policies and objectives remains essential for market entry and operational alignment.

- In March 2025, the government accelerated BSNL’s 5G rollout, upgrading 4G with 65,000 new towers toward a 100,000-tower goal. Simultaneously, 5G deployment gained momentum, with plans to involve foreign vendors in a $2 billion auction for network equipment, enhancing India’s telecom infrastructure and next-generation connectivity.

India Telecom tower Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Units |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Towers Covered | Lattice Tower, Guyed Tower, Monopole Towers, Stealth Towers |

| Fuel Types Covered | Renewable, Non-Renewable |

| Installations Covered | Rooftop, Ground-based |

| Ownerships Covered | Operator-Owned, Joint Venture, Private-Owned, MNO Captive |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India telecom tower market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India telecom tower market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India telecom tower industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India telecom tower market size reached 0.40 Million Units in 2024.

The India telecom tower market is expected to reach 0.50 Million Units by 2033, exhibiting a CAGR of 1.60% during 2025-2033.

Market growth is driven by the ongoing expansion of mobile network coverage, increasing data consumption, rising adoption of 4G and 5G technologies, and growing investments in rural connectivity and digital infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)