India Telecom Cable Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Telecom Cable Market Overview:

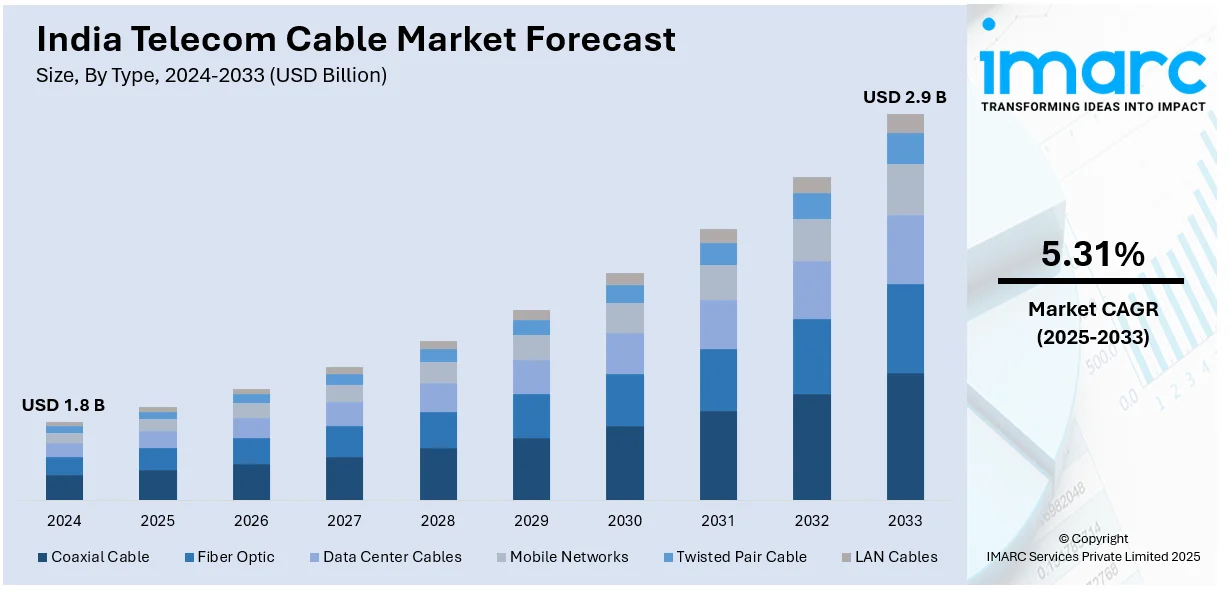

The India telecom cable market size reached USD 1.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.31% during 2025-2033. The rising internet penetration, rapid urbanization, and increasing demand for high-speed connectivity is aiding the market demand. Government initiatives like BharatNet and Digital India, along with fifth generation (5G) infrastructure rollout and expanding FTTH networks, are fueling cable deployment, while growing data consumption accelerates the need for robust telecom infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.9 Billion |

| Market Growth Rate 2025-2033 | 5.31% |

India Telecom Cable Market Trends:

Surge in Fiber-to-the-Home (FTTH) Deployments

India's telecom cable market is expanding rapidly with the growth of Fiber-to-the-Home (FTTH) networks. Rising demand for high-speed internet, driven by remote work, online education, and digital entertainment, is prompting heavy investments in fiber-optic infrastructure. Government initiatives like BharatNet and Digital India are accelerating last-mile fiber connectivity, especially in rural areas. Over 1.17 million FTTH connections have been commissioned, along with 104,574 Wi-Fi hotspots, enhancing connectivity. As FTTH adoption increases, the need for high-bandwidth, low-latency fiber cables is surging. Competition among service providers to offer ultra-fast broadband is driving infrastructure upgrades and fiber rollout. The transition from copper to fiber networks is reshaping the market, boosting demand for advanced telecom cabling solutions across urban and semi-urban regions.

To get more information on this market, Request Sample

Rising Demand from 5G Infrastructure Rollout

The rollout of 5G technology is reshaping India's telecom cable market, driving demand for high-capacity, low-loss fiber optic cables. Nationwide 5G deployment requires dense fiber connectivity to support high data throughput and ultra-low latency. The installation of small cells, edge data centers, and distributed antenna systems is accelerating telecom cabling expansion. Also, 5G use in smart cities, autonomous cars, and industrial automation is encouraging network upgrade by infrastructure providers. India's data center capacity is likely to almost double from 950 MW to 1,800 MW by 2026 driven by artificial intelligence (AI), 5G, and digital expansion. This transition is pushing cable manufacturers to develop advanced solutions, such as micro cables and bend-insensitive fibers, to meet evolving performance and space-saving demands in an increasingly data-driven economy.

Growth in Underground and Aerial Cabling Projects

The Indian telecom cable market is seeing strong growth in underground and aerial cabling projects, driven by urban modernization and network reliability demands. Smart city initiatives and urban infrastructure projects are increasing the need for concealed, weather-resistant, and tamper-proof cable installations. Underground cabling enhances resilience, lowers maintenance costs, and improves aesthetics, with the government’s Integrated Power Development Scheme (IPDS) allocating ₹20 billion for 18,008 km of underground cabling across states. In rural and semi-urban regions, aerial cabling remains a preferred choice due to cost-effectiveness and ease of deployment. To achieve maximum network coverage and effectiveness, state governments and private companies are embracing hybrid deployment models. In order to meet evolving telecom infrastructure needs, this diversification is increasing demand for specialized cable solutions including armored fiber cables and self-supporting aerial cables.

India Telecom Cable Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Coaxial Cable

- Fiber Optic

- Data Center Cables

- Mobile Networks

- Twisted Pair Cable

- LAN Cables

The report has provided a detailed breakup and analysis of the market based on the type. This includes coaxial cable, fiber optic, data center cables, mobile networks, twisted pair cable, and LAN cables.

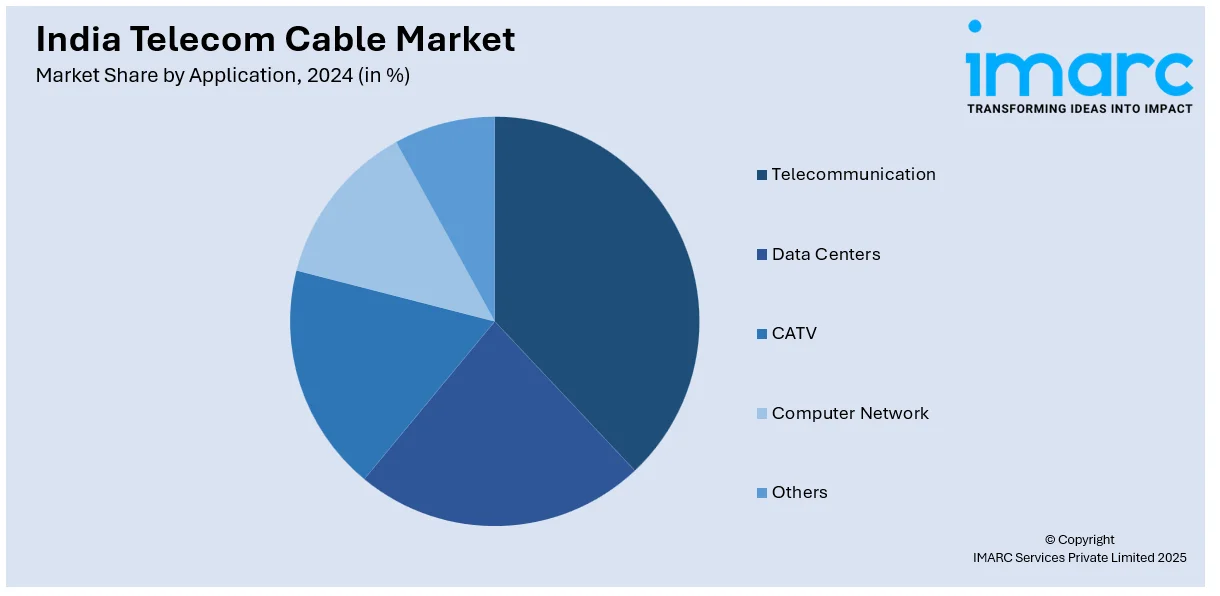

Application Insights:

- Telecommunication

- Data Centers

- CATV

- Computer Network

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes telecommunication, data centers, CATV, computer network, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Telecom Cable Market News

- In February 2025, Bharti Airtel is poised to launch satellite communication services in India, pending spectrum allocation approval. With 635 satellites already in orbit and services active globally, Bharti has base stations ready in Gujarat and Tamil Nadu. Vice Chairman Rajan Bharti Mittal emphasized the need for spectrum auctions for fair competition. He noted satellite services are ideal for remote areas, while India’s robust 4G and 5G networks suffice for urban regions.

- In December 2024, The ITU and ICPC established a 40-member International Advisory Body to enhance submarine cable resilience, including India's telecom secretary. The group will meet twice a year to address cable vulnerabilities and share best practices. With over 200 annual faults affecting global connectivity, the initiative aims to safeguard critical internet infrastructure. The advisory body’s first meeting is scheduled for December 12, focusing on strengthening global communication networks.

India Telecom Cable Market Report Coverage

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Coaxial Cable, Fiber Optic, Data Center Cables, Mobile Networks, Twisted Pair Cable, LAN Cables |

| Applications Covered | Telecommunication, Data Centers, CATV, Computer Network, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India telecom cable market performed so far and how will it perform in the coming years?

- What is the breakup of the India telecom cable market on the basis of type?

- What is the breakup of the India telecom cable market on the basis of application?

- What is the breakup of the India telecom cable market on the basis of region?

- What are the various stages in the value chain of the India telecom cable market?

- What are the key driving factors and challenges in the India telecom cable market?

- What is the structure of the India telecom cable market and who are the key players?

- What is the degree of competition in the India telecom cable market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India telecom cable market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India telecom cable market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India telecom cable industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)