India Taxi Services Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

India Taxi Services Market Overview:

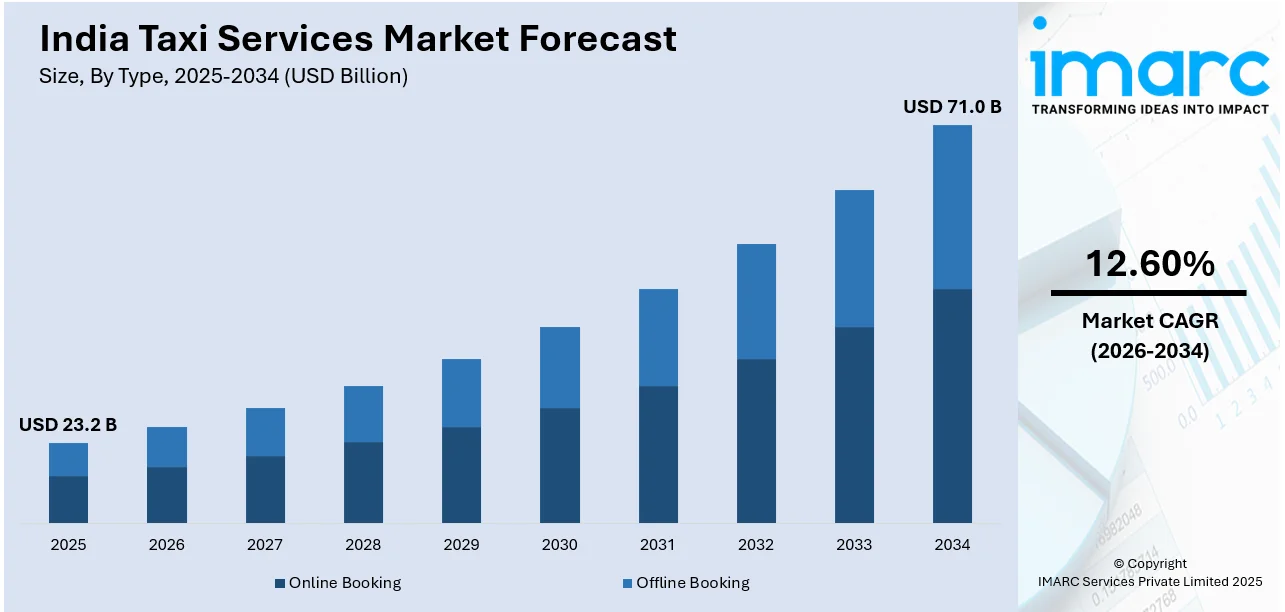

The India taxi services market size reached USD 23.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 71.0 Billion by 2034, exhibiting a growth rate (CAGR) of 12.60% during 2026-2034. The market is driven by rapid urbanization, increasing disposable income, rising smartphone penetration, and growing demand for app-based ride-hailing services. Improved road infrastructure, government initiatives, and the need for convenient, affordable transportation are further contributing to the expansion of India taxi services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 23.2 Billion |

| Market Forecast in 2034 | USD 71.0 Billion |

| Market Growth Rate 2026-2034 | 12.60% |

India Taxi Services Market Trends:

Rapid Urbanization and Population Growth

India's increasing urban population is a key driver of the taxi services market. With more people migrating to cities for jobs and education, the demand for reliable and convenient transportation has surged. Public transport infrastructure struggles to meet growing commuter needs, making taxis a preferred alternative. Most people in metropolitan areas prefer rideshare services over private ownership since rising traffic congestion makes owning cars less attractive. The shift towards shared mobility solutions, including carpooling and ride-sharing, further drives the India taxi services market growth. As urbanization continues, the reliance on taxis as a primary mode of transport is expected to rise significantly. For instance, in December 2024, Zoomcar introduced a chauffeur-driven cab rental service in Bengaluru, India, expanding its offerings beyond the self-drive concept. The company aims to provide rentals ranging from two hours to one month, aiming to attract a broader market for vehicles with drivers.

To get more information on this market Request Sample

Smartphone and Internet Penetration

The widespread adoption of smartphones and affordable internet access has revolutionized India's taxi market. Users can obtain immediate trips through the app-based taxi services Ola, Uber, and Rapido. Through digital payments and GPS tracking, taxis provide enhanced safety and convenience to users making them pick transportation taxis above conventional options. The rapid growth of online taxi services can be attributed to the increasing number of tech-savvy consumers, particularly millennials and Gen Z. As digital infrastructure continues to improve, the expansion of app-based taxi aggregators into smaller cities and rural areas creates a positive India taxi services market outlook. Building on this momentum, companies are introducing new service formats to attract a wider user base. For instance, in November 2024, the ride-hailing business Rapido announced the launch of shared taxi services, beginning with Bengaluru's Kempegowda International Airport (KIA). Similar shared services were previously introduced by the corporation for its car rickshaw rides. Speaking at the EV & Future of Mobility panel at the Bengaluru Tech Summit 2024, Sanka stated that the company hopes to build on this success by extending its "shared" offering to airport taxis. The new service is expected to launch by early next 2025.

India Taxi Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Online Booking

- Offline Booking

The report has provided a detailed breakup and analysis of the market based on the type. This includes online booking and offline booking.

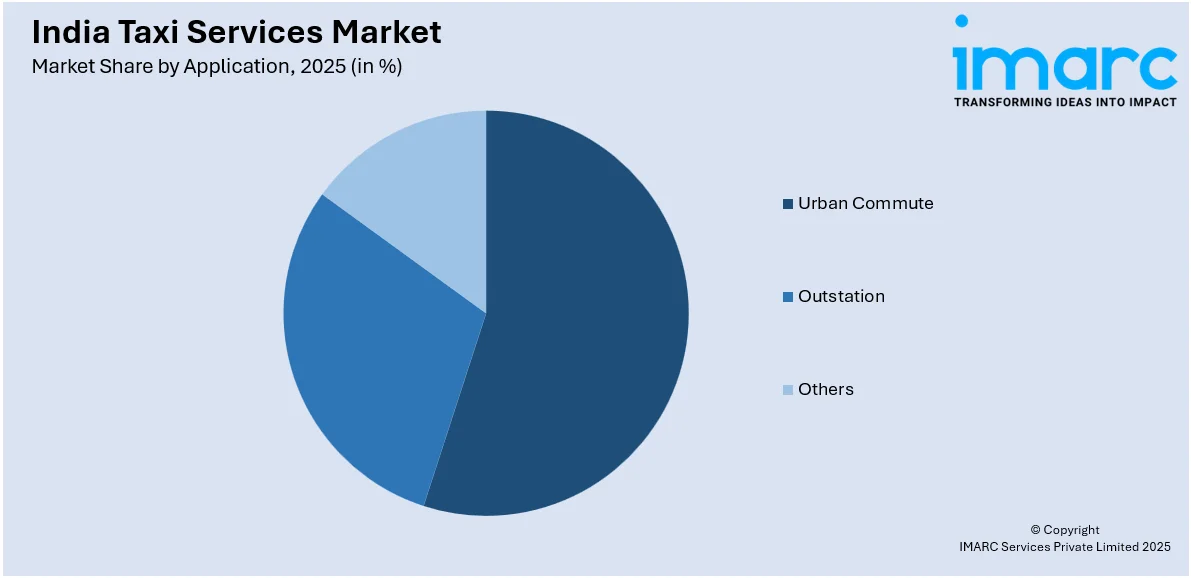

Application Insights:

Access the comprehensive market breakdown Request Sample

- Urban Commute

- Outstation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes urban commute, outstation, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Taxi Services Market News:

- In December 2024, the Noida International Airport (NIA) announced its partnership with Mahindra Logistics Mobility to offer a top-tier, all-electric taxi service for travelers arriving at and departing from the airport. The 24/7 service will offer premium pick-up and drop-off options situated at the arrival and departure curbs, reducing walking distance.

- In November 2024, Delhi Metro Rail Corporation (DMRC) announced the launch of a bike taxi service via its Momentum app from 12 metro stations. The service features SHERYDS for women and RYDR for all commuters, offering convenient last-mile connectivity. Initially operating with a fleet of 200 bikes, the service will expand to over 100 stations soon.

India Taxi Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Online Booking, Offline Booking |

| Applications Covered | Urban Commute, Outstation, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India taxi services market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India taxi services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India taxi services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India taxi services market was valued at USD 23.2 Billion in 2025.

The India Taxi Services market is projected to exhibit a CAGR of 12.60% during 2026-2034, reaching a value of USD 71.0 Billion by 2034.

The market is driven by rapid urbanization, increasing disposable income, rising smartphone penetration, and the growing demand for app-based ride-hailing services. Furthermore, improved road infrastructure, government initiatives, and the need for convenient, affordable transportation are also fueling the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)