India Tablet Market Size, Share, Trends and Forecast by Product, Operating System, Screen Size, End User, Distribution Channel, and Region, 2026-2034

India Tablet Market Size and Share:

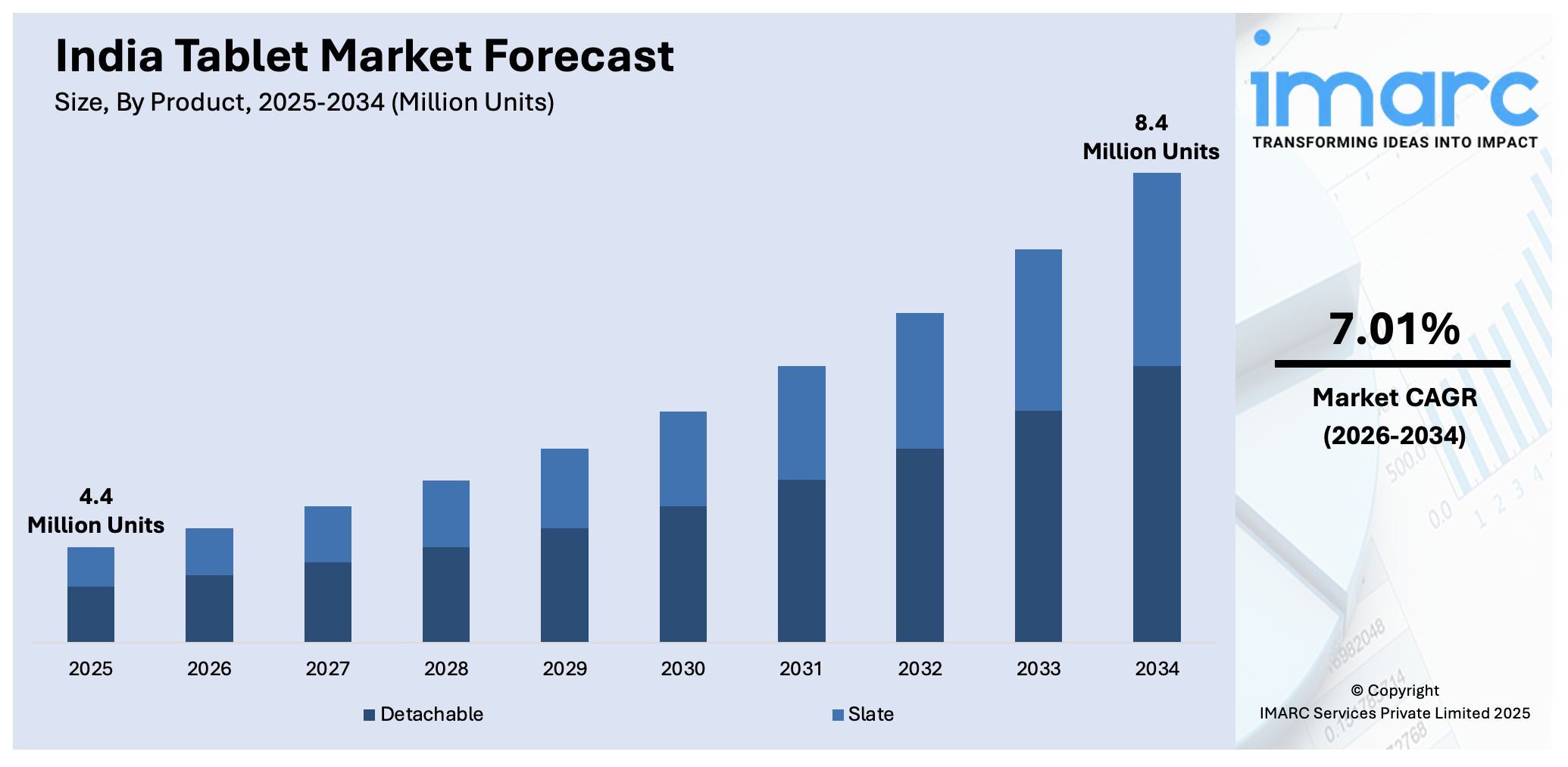

The India tablet market size reached 4.4 Million Units in 2025. The market is expected to reach 8.4 Million Units by 2034, exhibiting a growth rate (CAGR) of 7.01% during 2026-2034. The market growth is attributed to the growing demand in the education industry to facilitate interactive learning experiences with educational apps, videos, and online courses. Also, the wide availability of tablets through online and offline distribution channels and increasing digitalization are supporting market expansion, product, operating system, screen size, end user, and distribution channel.

Market Insights:

- Based on region, the market is divided into South India, North India, West & Central India, and East India.

- On the basis of product, the market is categorized as detachable and slate.

- Based on the operating system, the market is segmented into android, iOS, and Windows.

- On the basis of screen size, the market is categorized as 8” and 8” and above.

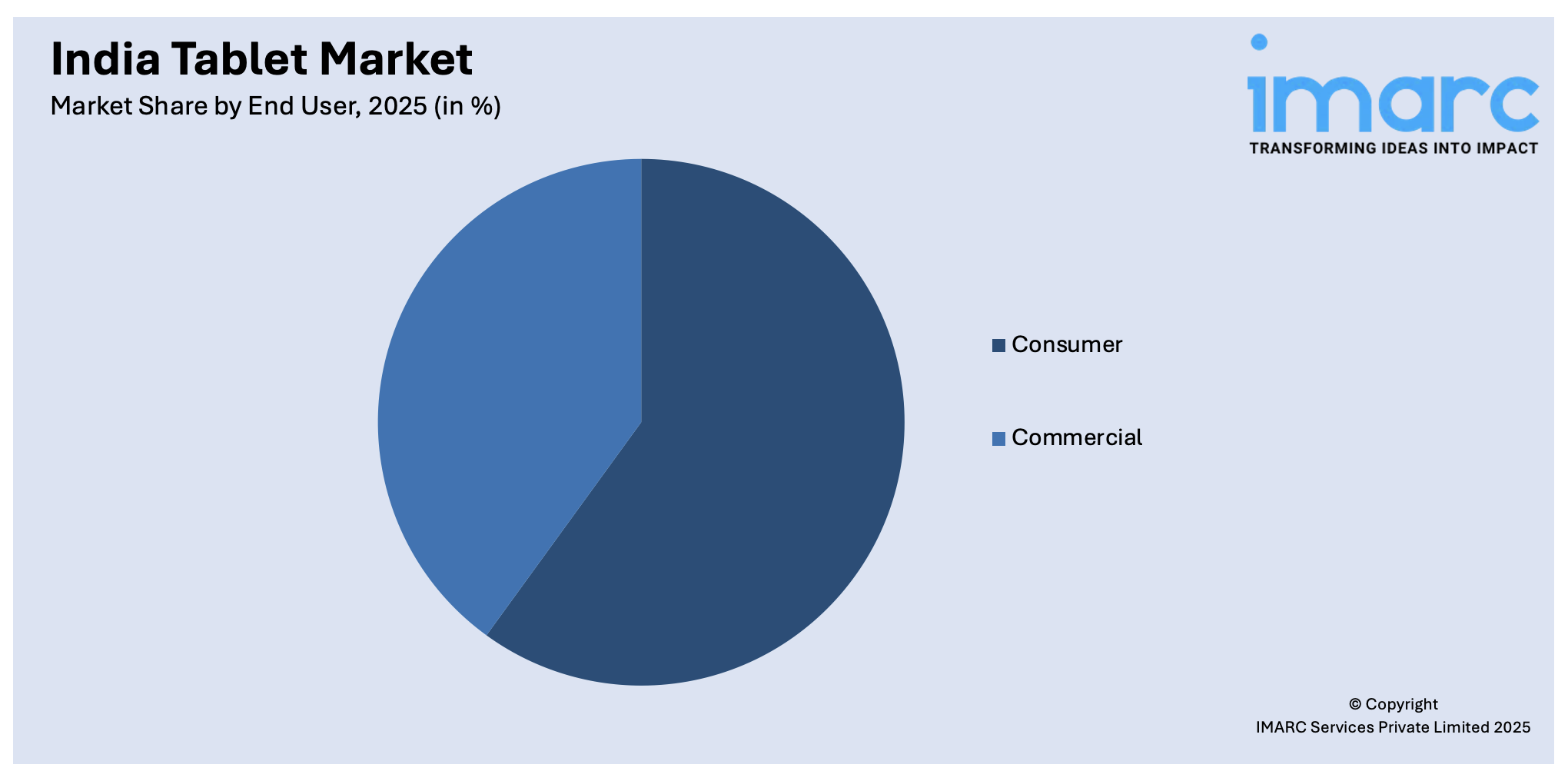

- Based on end user, the market is segmented into consumer and commercial.

- On the basis of distribution channel, the market is categorized as online and offline.

Market Size and Forecast:

- 2025 Market Size: 4.4 Million Units

- 2034 Projected Market Size: 8.4 Million Units

- CAGR (2026-2034): 7.01%

India Tablet Market Analysis:

- Major Market Drivers: The increasing utilization of tablets in the education industry to facilitate interactive learning experiences with educational apps, videos, and online courses, along with rapid digitalization in India, represents one of the major factors influencing the market positively. In line with this, the rising adoption of tablets, as they are easy to carry in bags and even hands, making them ideal for traveling, is strengthening the India tablet market demand.

- Key Market Trends: The growing demand in the healthcare sector to efficiently manage patient records and data management is offering a positive market outlook. Besides this, the wide availability of tablets through online and offline distribution channels, coupled with the thriving e-commerce industry in the country, is supporting the tablet market growth in India.

- Competitive Landscape: The India tablet market analysis report has also provided a comprehensive analysis of the competitive landscape in the market. Also, detailed profiles of all major companies have been provided.

- Geographical Trends: South India, including states like Karnataka, Tamil Nadu, Andhra Pradesh, and Telangana, has a strong focus on education and IT. The presence of numerous educational institutions and tech companies drives the demand for tablets. Moreover, in West and Central India, the demand is driven by economic growth, educational use, and consumer electronics. Tablets are popular in both urban and industrial settings.

- Challenges and Opportunities: High competition from smartphones and poor internet and connectivity issues, particularly in rural areas, are hampering the market's growth. However, India’s expanding middle class is driving demand for technology products, including tablets. As disposable incomes rise, there’s a growing market for higher-end tablets and innovative features.

To get more information on this market Request Sample

India Tablet Market Trends:

Rising Internet Penetration

The rising internet penetration is one of the significant drivers in the Indian tablet market growth. For instance, according to Statista, in 2023, India had more than 1.2 billion internet users nationwide. India's internet penetration rate increased to more than 52% in 2024, up from around 14% in 2014. This figure is expected to rise to more than 1.6 billion users by 2050. With better internet access, there’s a growing demand for streaming services, e-books, online gaming, and other digital content. Tablets, offering a larger screen and better multimedia capabilities compared to smartphones, are well-suited for such activities. These factors are further positively influencing the India tablet market forecast.

Remote Work Trends

The shift towards remote work and hybrid work models has increased the need for portable and efficient devices. For instance, according to an article published by Forbes, as of 2024, nearly 12.7% of full-time employees in India work from home, with approximately 28% using a hybrid model. Moreover, by 2025, between 60 and 90 million Indians will work remotely. Tablets offer a versatile solution for professionals needing a lightweight, touch-screen device for work. These factors are further contributing to the India tablet market share.

Technological Advancements

Improvements in tablet technology, including better processors, higher-resolution displays, and longer battery life, have made tablets more appealing and functional for a range of uses. For instance, in August 2024, Poco launched its first tablet, Poco Pad 5G, in India. The Poco Pad 5G features a 12.1-inch LCD display with a 16:10 aspect ratio and a refresh rate of up to 120 Hz. The display can reach 6,00 nits of peak brightness. It features Dolby Vision and is covered with Corning Gorilla Glass 3. These factors are augmenting the India tablet market growth.

Rising Gaming Adoption and the Growing Demand for 5G Tablets

India is witnessing a substantial increase in tablet usage for gaming, driven by the rising popularity of online multiplayer games, esports, and cloud-based gaming platforms. Tablets offer a larger screen and superior graphics processing compared to smartphones, making them an appealing choice for mobile gamers seeking an immersive experience. This shift is particularly evident among Gen Z and millennial consumers in urban areas, who demand high-refresh-rate displays, better RAM configurations, and responsive processors in gaming-centric devices. Alongside this, the demand for 5G-enabled tablets is surging due to the increasing penetration of 5G services across Tier I and Tier II cities. This, in turn, is augmenting the tablet market share in India. Consumers are looking for future-ready devices that offer enhanced streaming, seamless cloud gaming, and real-time connectivity. Leading manufacturers are responding by launching 5G tablets with mid- to high-tier specifications at competitive price points, further fueling market expansion. The integration of advanced features like high-resolution audio and thermal management also reflects this shift.

Growth in Domestic Tablet Manufacturing and the Popularity of Budget Segments

Under the government’s “Make in India” initiative, tablet production in India has seen a considerable boost, especially as global brands and homegrown manufacturers set up local assembly units. The introduction of Production-Linked Incentive (PLI) schemes has made the domestic ecosystem more conducive for electronics manufacturing, resulting in reduced import dependency and lower costs. This has encouraged brands to tailor devices for Indian consumers while maintaining price competitiveness, which is further expanding the tablet market size in India. Concurrently, there is growing demand for budget and mid-range tablets, particularly from students, educators, and small enterprises. With increasing digital literacy and a rise in remote education and work, affordable tablets in the INR 10,000 to INR 20,000 range are witnessing strong traction. Moreover, manufacturers are prioritizing essential features like long battery life, 4G/5G support, and decent processing speeds without overloading devices with high-end specifications. The synergy between local production capabilities and cost-sensitive consumer segments is enabling rapid scaling of low- to mid-tier tablet adoption across urban and rural markets.

India Tablet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India tablet market report, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, operating system, screen size, end user, and distribution channel.

Breakup by Product:

- Detachable

- Slate

The report has provided a detailed breakup and analysis of the market based on the product. This includes detachable and slate.

According to the India tablet market outlook, detachable tablets, also known as 2-in-1 tablets, feature a design where the keyboard can be physically separated from the screen. This design allows the device to function both as a traditional tablet and as a laptop when the keyboard is attached. While slate tablets are traditional tablets with a single, seamless design that does not include a detachable keyboard. They are primarily used in tablet mode and are typically thinner and lighter compared to detachable tablets.

Breakup by Operating System:

- Android

- iOS

- Windows

A detailed breakup and analysis of the market based on the operating system has also been provided in the report. This includes android, iOS, and Windows.

According to the India tablet market overview, android tablets cover a broad range of price points, making them accessible to a larger segment of the market. This affordability attracts budget-conscious consumers and educational institutions. Moreover, iOS tablets, particularly the iPad, are known for their premium build quality, high-resolution displays, and overall user experience, which appeals to users looking for a high-end device. Besides this, windows tablets are often chosen for their productivity features and the ability to run full desktop applications, making them suitable for business and professional use.

Breakup by Screen Size:

- 8”

- 8” and Above

A detailed breakup and analysis of the market based on the screen size has also been provided in the India tablet market report. This includes 8” and 8” and above.

Tablets with an 8-inch screen size are generally considered compact and portable. They strike a balance between screen real estate and ease of handling. Their small form factor makes them well-suited for use during travel, whether for reading, entertainment, or light work. While tablets with screens 8 inches and above provide more screen real estate, enhancing productivity, multitasking, and media consumption. Larger tablets often support productivity features and accessories, such as detachable keyboards and styluses, making them suitable for professional and business use.

Breakup by End User:

Access the comprehensive market breakdown Request Sample

- Consumer

- Commercial

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes consumer and commercial.

Consumers value tablets for their portability, making them ideal for use during travel, commuting, or leisure. Compact tablets (like 8-inch models) offer a balance between screen size and ease of handling. Moreover, commercial tablets are used for tasks, such as field data collection, sales presentations, and business meetings. Larger tablets with keyboard attachments or stylus support are often preferred for productivity.

Breakup by Distribution Channel:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes online and offline.

Large e-commerce platforms like Amazon, Flipkart, Best Buy, and Walmart offer a wide range of tablets from various brands. Online platforms provide convenience and extensive product information. While offline stores like Best Buy, Croma, and Reliance Digital provide an opportunity to see and test tablets before purchase.

Breakup by Region:

- South India

- North India

- West & Central India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include South India, North India, West & Central India, and East India.

According to the India tablet market statistics, South India, particularly cities like Bangalore, Hyderabad, and Chennai, shows a strong demand for tablets. This is driven by the region's tech-savvy population and the presence of numerous IT companies. Moreover, North India exhibits a varied demand for tablets. Major cities like Delhi, Noida, and Chandigarh have a higher concentration of tablet users, driven by educational institutions and a growing interest in technology.

Competitive Landscape:

The India tablet market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- July 2025: OnePlus announced the launch of its AI-powered OnePlus Pad 3 in India, with the first sale scheduled for September 2025 and pricing to be revealed soon. Equipped with the Snapdragon 8 Elite chipset, the tablet is available in two configurations: 12 GB RAM with 256 GB storage and 16 GB RAM with 512 GB storage. It operates on OxygenOS 15, based on Android 15, and promises three years of operating system updates along with six years of security support. The device boasts a 13.2-inch 3.4K LCD screen with a 144 Hz adaptive refresh rate, an eight-speaker setup with Dolby Atmos support, and a 12,140 mAh battery that supports 80W SuperVOOC fast charging.The device also integrates advanced AI tools.

- July 2025: Lenovo India launched the Yoga Tab Plus, its first AI‑powered tablet in the Indian market, with a limited‑time introductory price of INR 44,999 (regular retail INR 49,999), bundled with the Lenovo Tab Pen Pro stylus and a 2-in-1 detachable keyboard for enhanced productivity. It is equipped with a 12.7-inch 3K LTPS PureSight Pro display, delivering sharp visuals and vibrant color accuracy. Lenovo’s proprietary AI Now assistant, backed by large language models, enables local AI functions like real‑time summaries, voice‑to‑text transcription, smart prompts, and content organization.

- April 2025: Samsung India unveiled the Galaxy Tab S10 FE and Galaxy Tab S10 FE+ tablets in India. These models feature large Super PLS LCD displays, IP68 water resistance, Exynos 1580 chipset, and support S Pen along with built‑in Galaxy AI capabilities Promotional offers include bundled accessories, bank cashback, upgrade bonuses, and no‑cost EMI schemes. This launch is enhancing offerings in the tablet industry in India.

- March 2025: Lenovo officially launched its AI‑enhanced Idea Tab Pro in India, with the 8 GB RAM + 128 GB storage model priced at INR 27,999 and the 12 GB RAM + 256 GB variant at INR 30,999, available via the Lenovo India e-store and Amazon India. The 12.7-inch tablet features a 3K display with a 144 Hz refresh rate, a MediaTek Dimensity 8300 chipset, JBL‑tuned quad speakers supporting Dolby Atmos, and a bundled Tab Pen Plus stylus. It supports AI‑driven features, along with a real‑time “Translate Without Switching Apps” function and offers two major Android OS upgrades plus four years of security updates.

- August 2024: Samsung India introduced the Galaxy Tab Iris, which includes iris-recognition technology and is ready for Aadhar identification via an integrated and highly secure biometric device. The Galaxy Tab Iris will offer cashless and paperless services in a variety of applications, including banking and eGovernment services like passports, taxes, healthcare, and education.

- August 2024: Poco launched its first tablet, Poco Pad 5G, in India. The Poco Pad 5G features a 12.1-inch LCD display with a 16:10 aspect ratio and a refresh rate of up to 120 Hz. The display can reach 6,00 nits of peak brightness. It features Dolby Vision and is covered with Corning Gorilla Glass 3.

- July 2024: Lenovo launched the Lenovo Tab Plus with eight speakers in India. The Lenovo Tab Plus is powered by the Helio G99 CPU and comes with 256GB of storage that can be increased via the microSD card slot.

India Tablet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Units |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Detachable, Slate |

| Operating Systems Covered | Android, iOS, Windows |

| Screen Sizes Covered | 8”, 8” and Above |

| End Users Covered | Consumer, Commercial |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India tablet market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India tablet market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India tablet industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India tablet market size reached 4.4 Million Units in 2025.

The India tablet market is expected to reach 8.4 Million Units by 2034, exhibiting a CAGR of 7.01% during 2026-2034.

The market growth is fueled by increasing digital adoption, rising demand for affordable and portable computing devices, expanding internet penetration, growth in the education and corporate sectors, and advancements in tablet technology.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)