India Syringe Pumps Market Size, Share, Trends and Forecast by Type, Product Type, Application, End User, and Region, 2025-2033

India Syringe Pumps Market Overview:

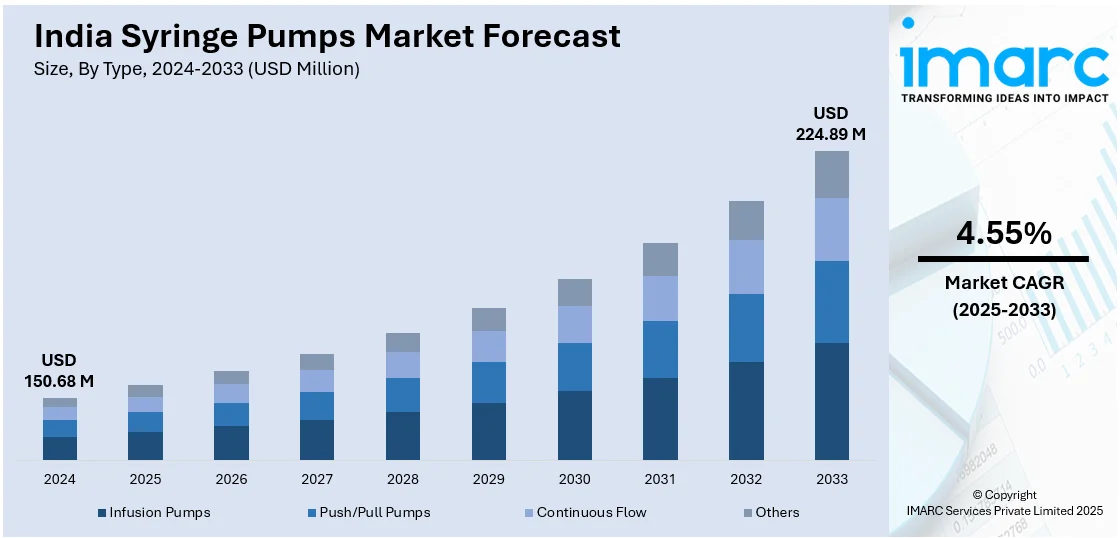

The India syringe pumps market size reached USD 150.68 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 224.89 Million by 2033, exhibiting a growth rate (CAGR) of 4.55% during 2025-2033. Government support for the manufacturing of medical devices, healthcare infrastructure expansion, substantial demand for accurate drug delivery in ICUs and neonatal units, prevalence of chronic diseases that need constant infusion therapy, and technological improvement in infusion systems are some major drivers for the India syringe pumps market that guarantee better patient care and medical efficiency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 150.68 Million |

| Market Forecast in 2033 | USD 224.89 Million |

| Market Growth Rate 2025-2033 | 4.55% |

India Syringe Pumps Market Trends:

Advancements in Healthcare Infrastructure

India's fast-changing healthcare infrastructure is substantially fueling the syringe pumps market. With growing government spending on public health, demand for sophisticated medical devices, such as syringe pumps, has been propelled. The National Health Policy 2017 aimed to increase public health expenditure up to 2.5% of GDP by 2025, which resulted in an upsurge in government spending on health from INR 2,31,104 crore during 2017-18 to INR 4,34,163 crore during 2021-22. This significant investment has enabled the construction and upgradation of hospitals, Primary Health Centers (PHCs), and Community Health Centers (CHCs), where syringe pumps are crucial for accurate drug delivery. In addition, syringe pumps are critical in intensive care units (ICUs), neonatal care, and emergency departments, making them a must-have in both public and private healthcare centers. The post-pandemic emphasis on enhancing the delivery of healthcare has further accelerated the use of syringe pumps to ensure more efficient and safer drug management in the country.

To get more information on this market, Request Sample

Increasing Prevalence of Chronic Diseases Requiring Continuous Drug Delivery

The Indian syringe pumps market is experiencing robust growth as a result of the rising incidence of chronic diseases that need to be administered with precise and continuous medication. Diseases like cardiovascular, cancer, and diabetes need accurate infusion of drugs, and therefore, syringe pumps are an integral part of contemporary healthcare provision. As the prevalence of cancer grows, the need for controlled delivery of chemotherapy agents, immunotherapies, and pain relief solutions has risen, further solidifying the position of syringe pumps in Indian hospitals and cancer treatment centers. In India, the number of cancer cases is anticipated to rise from 1.46 million in the year 2022 to 1.57 million in 2025. Furthermore, India's aging population is propelling the use of syringe pumps for the management of age-related conditions, such as coronary heart disease, deep vein thrombosis, and neurodegenerative disorders. The demand for flawless drug infusion in geriatric care and intensive care units (ICUs) has compelled hospitals, specialty clinics, and home healthcare organizations to invest in sophisticated syringe pump technology.

India Syringe Pumps Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, product type, application, and end user.

Type Insights:

- Infusion Pumps

- Push/Pull Pumps

- Continuous Flow

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes infusion pumps, push/pull pumps, continuous flow, and others.

Product Type Insights:

- Stationary

- Portable

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes stationary and portable.

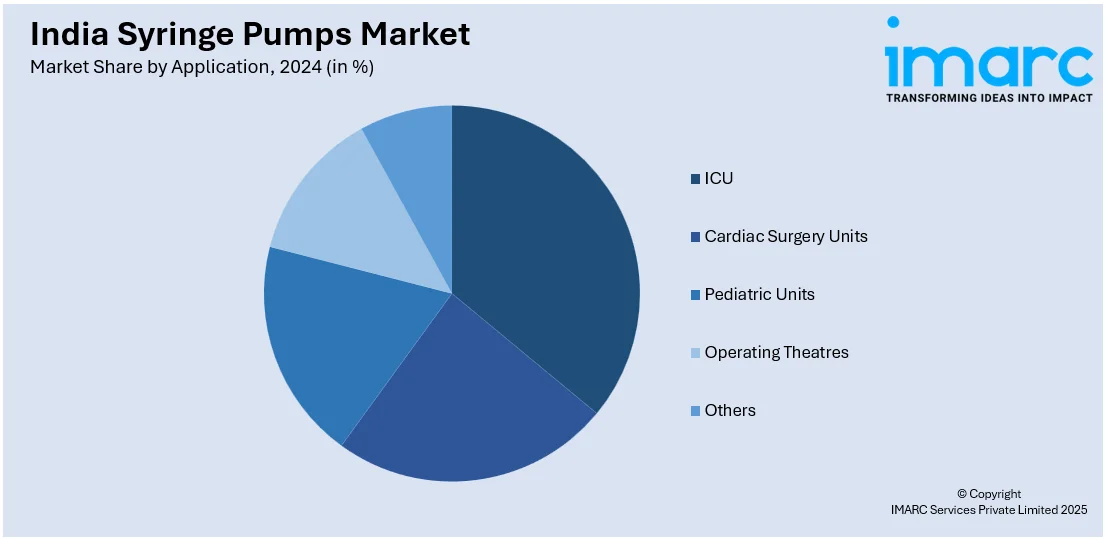

Application Insights:

- ICU

- Cardiac Surgery Units

- Pediatric Units

- Operating Theatres

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes ICU, cardiac surgery units, pediatric units, operating theatres, and others.

End User Insights:

- Hospitals and Clinics

- Ambulatory Surgical Settings

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, ambulatory surgical settings, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Syringe Pumps Market News:

- April 2024: Hindustan Syringes and Medical Devices (HMD) introduced Dispojekt syringes with safety needles to mitigate needle stick injuries among medical staff. The product is consistent with India's 'Make in India' initiative to boost domestic manufacturing and export possibilities in the field of medical devices. Thus, such development leads to the expansion of India's syringe market by satisfying local as well as global requirements.

- November 2023: Terumo India launched an insulin syringe for patients who need daily insulin injections to control diabetes. The product launch increases the supply of specialized syringes, thus bolstering the Indian syringes market. By providing patients with additional choices for insulin injection, Terumo India's move aids the development of the medical devices industry in India.

India Syringe Pumps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Infusion Pumps, Push/Pull Pumps, Continuous Flow, Others |

| Product Types Covered | Stationary, Portable |

| Applications Covered | ICU, Cardiac Surgery Units, Pediatric Units, Operating Theatres, Others |

| End Users Covered | Hospitals and Clinics, Ambulatory Surgical Settings, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India syringe pumps market performed so far and how will it perform in the coming years?

- What is the breakup of the India syringe pumps market on the basis of type?

- What is the breakup of the India syringe pumps market on the basis of product type?

- What is the breakup of the India syringe pumps market on the basis of application?

- What is the breakup of the India syringe pumps market on the basis of end user?

- What are the various stages in the value chain of the India syringe pumps market?

- What are the key driving factors and challenges in the India syringe pumps market?

- What is the structure of the India syringe pumps market and who are the key players?

- What is the degree of competition in the India syringe pumps market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India syringe pumps market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India syringe pumps market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India syringe pumps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)