India Synthetic Fibers Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Synthetic Fibers Market Overview:

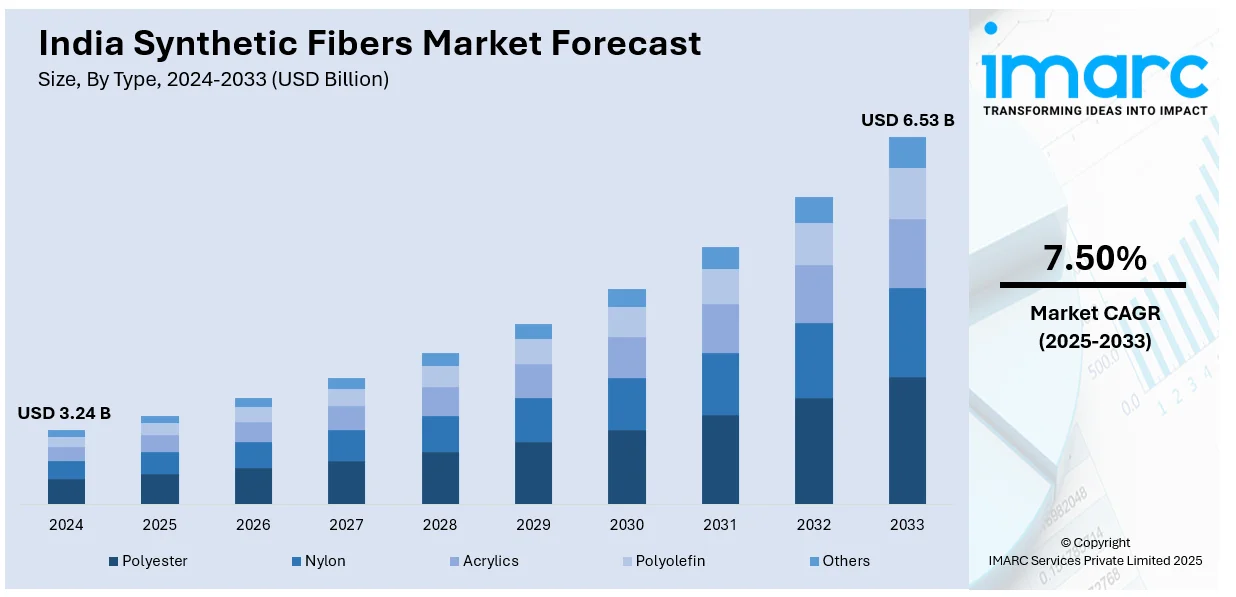

The India synthetic fibers market size reached USD 3.24 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.53 Billion by 2033, exhibiting a growth rate (CAGR) of 7.50% during 2025-2033. The India synthetic fibers market is expanding due to rising demand for technical textiles and synthetic apparel. Government policies, including import regulations and incentives, support domestic production. Odisha’s emerging role in fiber manufacturing and increasing adoption of performance-based textiles further drive market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.24 Billion |

| Market Forecast in 2033 | USD 6.53 Billion |

| Market Growth Rate (2025-2033) | 7.50% |

India Synthetic Fibers Market Trends:

Rising Demand for Technical Textiles

India's synthetic fiber market is witnessing strong growth due to the increasing demand for technical textiles across various industries. These textiles are used in automotive, healthcare, construction, and defense applications, where durability, strength, and functionality are essential. The government's push for infrastructure development and industrial expansion has further fueled this demand. Additionally, advancements in fiber technology, such as high-performance synthetic materials with enhanced properties like fire resistance, water repellency, and durability, are driving market growth. In January 2025, Odisha is poised to lead the global synthetic fiber textile industry, as predicted by Oerlikon Director Debabrata Ghosh. The state's strategic advantages, including port access, mineral resources, and cost-effective labor, position it as a key player in the fiber-based sector, boosting industrial growth and market expansion. This development strengthens India's production capacity and promotes large-scale manufacturing of specialized synthetic fibers for technical applications. Moreover, the rising adoption of smart textiles in the defense and medical sectors is contributing to market expansion. The Indian government's support through schemes like the Production-Linked Incentive (PLI) for textiles is encouraging investments in synthetic fiber production. The combination of domestic manufacturing advancements and industrial growth positions India as a major hub for technical textiles in the coming years.

To get more information on this market, Request Sample

Increasing Preference for Synthetic Apparel

The growing preference for synthetic apparel is shaping the Indian synthetic fiber market, driven by affordability, durability, and versatility. Consumers are increasingly choosing synthetic fabrics such as polyester and nylon due to their moisture-wicking properties, wrinkle resistance, and suitability for fast fashion. The expanding middle class and rising disposable incomes are also contributing to higher demand for stylish, cost-effective clothing options. Additionally, sportswear and activewear segments are witnessing significant growth, as synthetic fabrics provide comfort and flexibility for athletic activities. In October 2024, India expanded its import regulations on synthetic fibers, extending the Minimum Import Price (MIP) until December 31, 2024. New restrictions on various synthetic and artificial fibers aim to protect domestic manufacturers, impacting the market by curbing low-cost imports and boosting local production. This regulatory shift is expected to enhance domestic fiber production, making locally manufactured synthetic fabrics more accessible and cost-competitive. With India's textile industry focusing on self-reliance, domestic manufacturers are ramping up production to meet rising demand. Major brands and fashion retailers are increasingly sourcing synthetic fabrics from local suppliers, reducing dependency on imports. This trend is further strengthened by innovations in eco-friendly synthetic fibers, catering to sustainability-conscious consumers. As consumer preferences shift toward affordable and functional apparel, synthetic fibers are expected to dominate India's textile sector.

India Synthetic Fibers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Polyester

- Nylon

- Acrylics

- Polyolefin

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes polyester, nylon, acrylics, polyolefin, and others.

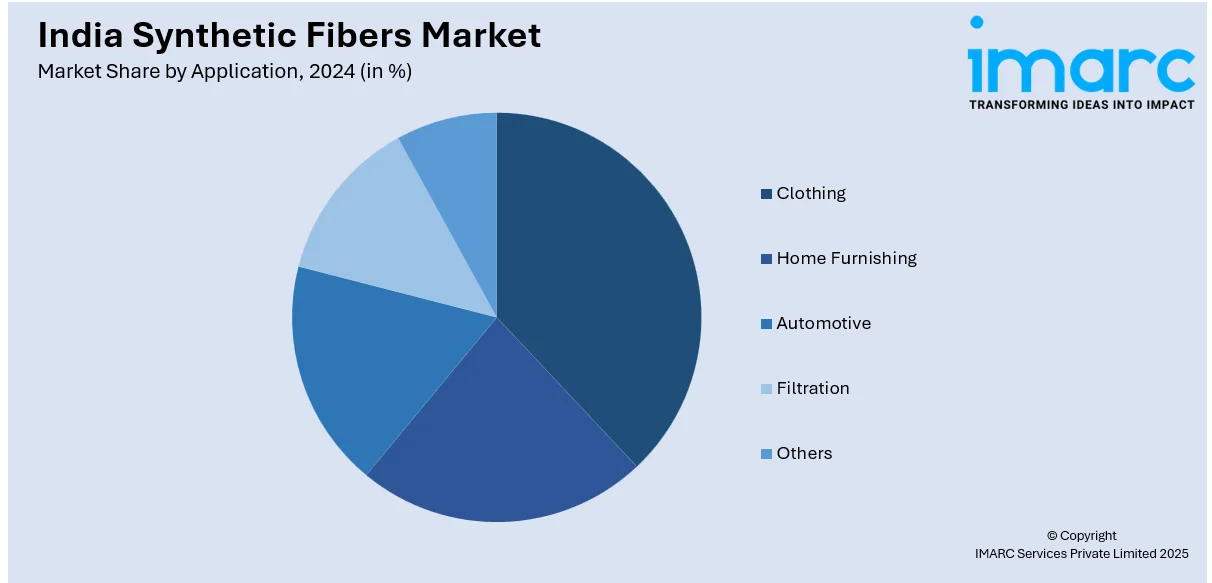

Application Insights:

- Clothing

- Home Furnishing

- Automotive

- Filtration

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes clothing, home furnishing, automotive, filtration, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Synthetic Fibers Market News:

- February 2025: RSWM Limited won the 1st Runner-Up award for "Innovative Water Management and Conservation" at the CITI Textile Sustainability Awards. Their investment in sustainable practices, such as water recycling and energy-efficient technologies, strengthens RSWM's leadership in synthetic fiber production and sets new industry benchmarks.

- September 2024: Paramount Dye Tec Limited launched its IPO to raise up to INR 28.43 Crore, focusing on recycling waste synthetic fibers to produce high-quality yarns. This move aligns with growing demand for sustainable textiles, positioning the company to expand its market share in the synthetic fibers sector.

India Synthetic Fibers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Polyester, Nylon, Acrylics, Polyolefin, Others |

| Applications Covered | Clothing, Home Furnishing, Automotive, Filtration, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India synthetic fibers market performed so far and how will it perform in the coming years?

- What is the breakup of the India synthetic fibers market on the basis of type?

- What is the breakup of the India synthetic fibers market on the basis of application?

- What are the various stages in the value chain of the India synthetic fibers market?

- What are the key driving factors and challenges in the India synthetic fibers market?

- What is the structure of the India synthetic fibers market and who are the key players?

- What is the degree of competition in the India synthetic fibers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India synthetic fibers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India synthetic fibers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India synthetic fibers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)