India Synthetic Caffeine Market Size, Share, Trends and Forecast by Type, and Application, 2026-2034

India Synthetic Caffeine Market Summary:

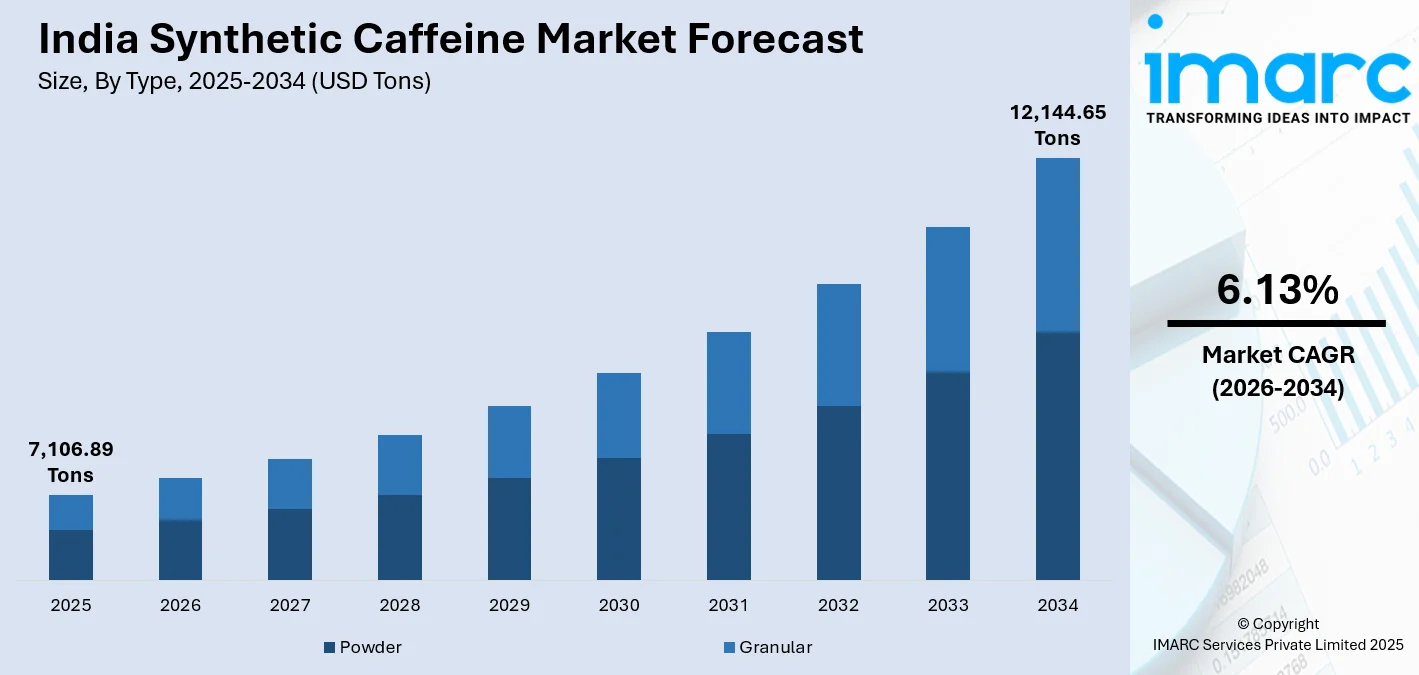

The India synthetic caffeine market size reached 7,106.89 Tons in 2025 and is projected to reach 12,144.65 Tons by 2034, growing at a compound annual growth rate of 6.13% from 2026-2034.

The India synthetic caffeine market is witnessing substantial growth driven by the expanding food and beverage industry, rising pharmaceutical manufacturing, and increasing consumer demand for functional products. Growing health consciousness among the population, coupled with rising participation in fitness activities, is accelerating demand for caffeinated energy products. The cost-effectiveness and consistent quality of synthetic caffeine over natural alternatives are strengthening its adoption across beverage manufacturers, pharmaceutical companies, and personal care product formulators, contributing to the India synthetic caffeine market share.

Key Takeaways and Insights:

- By Type: Powder dominates the market with a share of 62% in 2025, owing to its high purity levels, ease of incorporation into formulations, and extensive usage across pharmaceutical, nutraceutical, and beverage applications.

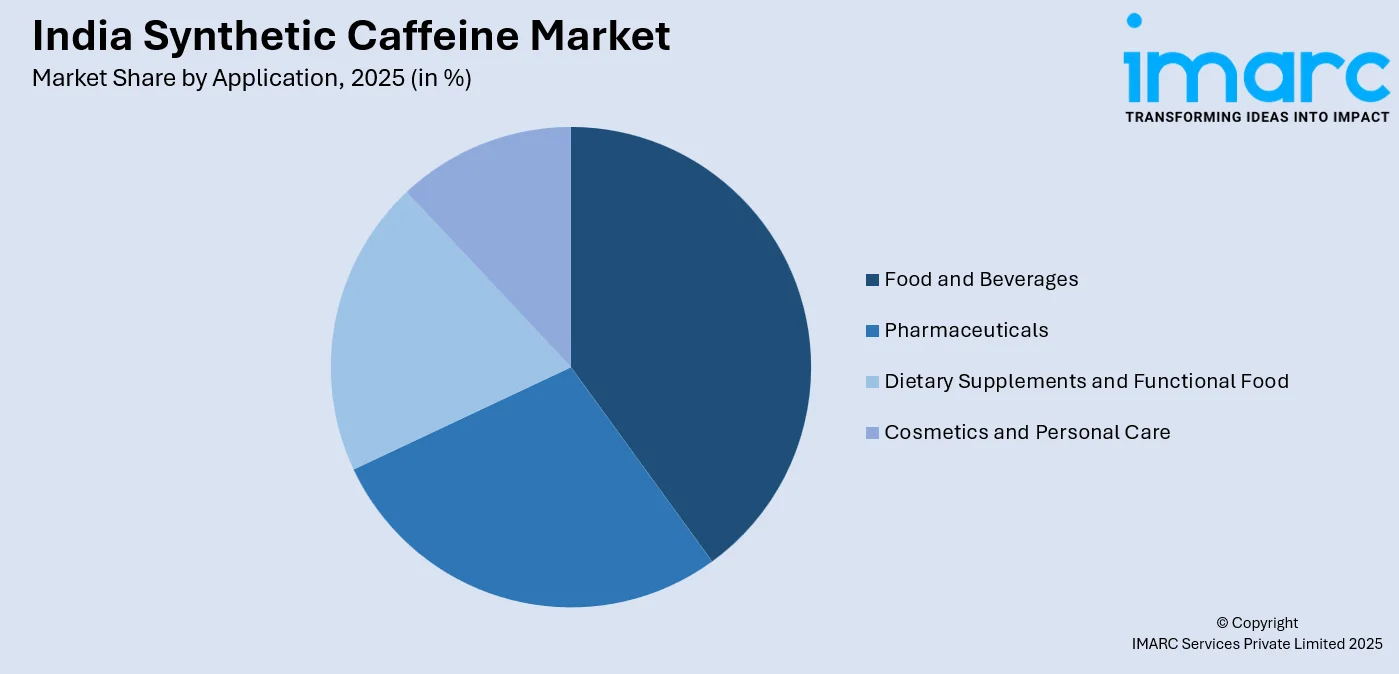

- By Application: Food and beverages lead the market with a share of 29% in 2025, driven by rising consumption of energy drinks, carbonated beverages, and functional food products among the young and health-conscious population.

- Key Players: The India synthetic caffeine market is highly consolidated, with domestic manufacturers holding a strong presence. Leading companies are focusing on expanding production capacity, obtaining quality certifications, and increasing penetration into export markets to enhance their competitive positioning and support sustained growth. Some of the companies covered in the report include Aarti Industries Limited, Bajaj Healthcare Limited, Bakul Aromatics and Chemicals Pvt Ltd, and Central Drug House Private Limited.

To get more information on this market Request Sample

The India synthetic caffeine market is experiencing growth driven by expanding applications across various industries and strengthened domestic production capabilities. The pharmaceutical sector remains a major consumer, incorporating synthetic caffeine as an active ingredient in products such as analgesics, migraine treatments, and respiratory medications. Increasing use in dietary supplements, energy drinks, and personal care products is further broadening demand, while rising e-commerce adoption is transforming distribution channels and enabling direct consumer access. Domestic manufacturers are focusing on enhancing production capacities and adhering to strict quality standards to ensure product safety and efficacy across applications. These developments reflect the industry’s commitment to meeting growing demand, supporting wider availability, and reinforcing India’s position as a reliable supplier in both domestic and international markets.

India Synthetic Caffeine Market Trends:

Rising Adoption in Cosmetics and Personal Care Formulations

The cosmetics and personal care industry is increasingly incorporating synthetic caffeine into product formulations due to its antioxidant properties and stimulating effects on skin microcirculation. India's beauty and personal care market was valued at USD 28 billion in 2024, with a growing share of new skincare product launches featuring synthetic caffeine for reducing puffiness and dark circles. Eye creams, anti-aging serums, and hair care products are primary applications benefiting from caffeine's ability to improve blood flow, protect against UV damage, and promote hair growth.

Expansion of E-Commerce Distribution Channels

Digital retail platforms are significantly improving consumer access to synthetic caffeine products across India. The rapid expansion of online beauty and nutrition retail is enabling wider availability of caffeine-infused dietary supplements, energy products, and personal care items. E-commerce channels are particularly effective in reaching consumers in tier-two and tier-three cities, reducing dependence on metropolitan retail networks. The India e-commerce market size was valued at USD 129.72 Billion in 2025 and is projected to reach USD 651.10 Billion by 2034, growing at a compound annual growth rate of 19.63% from 2026-2034. This shift toward digital distribution is broadening the consumer base, enhancing product visibility, and supporting the sustained growth of the synthetic caffeine market nationwide.

Integration in Functional Beverages and Sports Nutrition

The functional beverages segment is emerging as a significant growth driver for synthetic caffeine consumption. The India energy drinks market size was valued at USD 1.41 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.77 Billion by 2033, exhibiting a CAGR of 7.40% from 2025-2033. Rising participation in fitness activities and sports among the young population is accelerating demand for caffeinated pre-workout supplements, energy shots, and performance-enhancing beverages that provide rapid energy release and improved mental alertness.

Market Outlook 2026-2034:

The India synthetic caffeine market is set for sustained growth, supported by favorable demographic dynamics, expanding industrial activity, and rising consumer awareness of health and wellness. A large working-age population continues to drive demand for caffeinated products across beverages, dietary supplements, and pharmaceutical applications. At the same time, domestic manufacturing capabilities are improving through capacity enhancements and technological advancements, reducing reliance on imports and strengthening supply chain stability. These factors collectively create a supportive environment for long-term market expansion and increased competitiveness in both domestic and export-oriented segments. The market size was estimated at 7,106.89 Tons in 2025 and is expected to reach 12,144.65 Tons by 2034, reflecting a compound annual growth rate of 6.13% over the 2026-2034.

India Synthetic Caffeine Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Powder |

62% |

|

Application |

Food and Beverages |

29% |

Type Insights:

- Powder

- Granular

Powder dominates with a market share of 62% of the total India synthetic caffeine market in 2025.

Powdered synthetic caffeine maintains market leadership due to its high purity levels, superior solubility characteristics, and versatility across diverse industrial applications. The pharmaceutical industry extensively utilizes powdered caffeine in formulating analgesics, migraine medications, and respiratory treatments, where precise dosage control is essential. Additionally, the dietary supplements sector favors powder form for incorporation into pre-workout formulations and energy boosters, as it enables rapid absorption and consistent performance enhancement for fitness enthusiasts.

The food and beverage industry is a major end user of powdered synthetic caffeine, incorporating it into energy drinks, carbonated beverages, and a wide range of functional food products. Synthetic caffeine is preferred for its cost efficiency compared to naturally sourced alternatives, making it attractive for large-scale commercial use. Its powdered form offers advantages such as longer shelf life, consistent potency, and easy blending into formulations, supporting efficient manufacturing processes in beverage production and confectionery applications.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverages

- Pharmaceuticals

- Dietary Supplements and Functional Food

- Cosmetics and Personal Care

Food and beverages lead with a share of 29% of the total India synthetic caffeine market in 2025.

The food and beverages application segment holds the leading share of the market, supported by rising consumption of energy drinks, carbonated beverages, and caffeinated functional products. Growing urbanization, changing lifestyles, and demand for quick energy solutions are fueling category expansion. Both established and emerging brands are broadening their offerings, while locally produced, affordable options are gaining traction among price-sensitive consumers, particularly in tier-two and tier-three cities. This combination of product diversification and wider geographic reach continues to reinforce the segment’s dominant position.

Rising urbanization and evolving consumer lifestyles are driving stronger demand for ready-to-drink caffeinated products that offer quick energy and improved mental alertness. A large and active young population forms a key consumer segment for energy-boosting beverages. In response, manufacturers are introducing innovative formulations such as sugar-free options and unique flavor blends, while strengthening distribution through modern retail formats and e-commerce platforms. These strategies are helping brands tap into growing demand across both urban and semi-urban markets.

Market Dynamics:

Growth Drivers:

Why is the India Synthetic Caffeine Market Growing?

Rapid Expansion of Food and Beverage Industry

The growing food and beverage industry is a key driver of synthetic caffeine consumption in India. A large working-age population forms a significant consumer base for energy-boosting products, supporting sustained demand. Factors such as rising urbanization, increasing disposable incomes, and the adoption of Western consumption habits are further accelerating the uptake of energy drinks, carbonated beverages, and functional food products. Synthetic caffeine is favored as a cost-effective stimulant ingredient, offering manufacturers advantages in large-scale production while meeting consumer demand for convenient, performance-enhancing, and functional food and beverage options.

Growing Pharmaceutical Industry Demand

India's pharmaceutical industry expansion is driving substantial demand for synthetic caffeine as an active pharmaceutical ingredient. The india API market size reached USD 8,652.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 16,559.3 Million by 2034, exhibiting a growth rate (CAGR) of 7.48% during 2026-2034. India manufactures over 500 different APIs and holds 57% share of WHO prequalified APIs globally. The Production Linked Incentive scheme has significantly supported the expansion of domestic manufacturing capabilities. Synthetic caffeine continues to see widespread use in the pharmaceutical sector, serving as an active ingredient in analgesics, migraine treatments, respiratory medications, and performance-enhancing formulations. This diverse range of applications ensures steady demand from the pharmaceutical industry, reinforcing its role as a critical driver of growth for the synthetic caffeine market and highlighting the importance of strengthening local production capacity to meet ongoing industry needs.

Rising Health Consciousness and Sports Participation

Growing health awareness and increasing participation in fitness activities are accelerating demand for synthetic caffeine in dietary supplements and sports nutrition products. The India nutritional supplements market size reached USD 20.64 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 57.53 Billion by 2033, exhibiting a growth rate (CAGR) of 11.14% during 2025-2033. Rising gym culture, expanding fitness center networks, and growing consumer preference for performance-enhancing supplements are creating substantial opportunities for caffeine-infused pre-workout formulations, energy shots, and functional beverages.

Market Restraints:

What Challenges the India Synthetic Caffeine Market is Facing?

Stringent Regulatory Standards and Compliance Requirements

The Food Safety and Standards Authority of India has imposed stringent regulations on the permissible limits and packaging standards on foods and drinks that contain caffeine. The regulation imposed on energy drinks has made it impossible to change the formulation due to the maximum caffeine concentration limit imposed, only 300 mg per liter.

Consumer Preference for Natural Alternatives

Consumer awareness about the presence of synthetic ingredients in diet tablets is leading to shifts in preference towards natural caffeine sources obtained from coffee beans, tea leaves, and guarana. This is especially true for health-conscious buyers, which puts pressure on the market for makers of synthetic caffeine. This is more true for high-end brands.

Raw Material Price Volatility and Import Dependency

Synthetic caffeine production relies on key raw materials including urea and chloroacetic acid, whose prices are subject to global market fluctuations. Import dependency for certain intermediates exposes manufacturers to supply chain disruptions and currency exchange rate variations. Price volatility in fermentation inputs during early 2025 compressed operating margins across the API manufacturing sector.

Competitive Landscape:

The Indian market for synthetic caffeine is highly concentrated, especially since local companies have a strong presence here. The manufacturing process takes place in approved plants that meet strict standards regarding GMP, food safety, and global compliance. International competition, especially from large global companies, affects the pricing structure within the pharmaceutical market. To stay competitive, companies are emphasizing increased production capacity, improved compliance, and approvals for regulated markets, respectively. These efforts not only strengthen domestic market positioning but also enable participation in export opportunities, supporting the growth of synthetic caffeine applications across pharmaceuticals, nutraceuticals, beverages, and other industries while ensuring consistent supply and product reliability.

Some of the major market players include:

- Aarti Industries Limited

- Bajaj Healthcare Limited

- Bakul Aromatics and Chemicals Pvt Ltd

- Central Drug House Private Limited

Recent Developments:

- October 2025: Herbalife India, a leading health and wellness company, introduced Liftoff®, an effervescent beverage infused with caffeine designed to boost energy and enhance alertness. Offered in a watermelon flavor and free from added sugar, the drink is crafted for consumers looking to maintain an active, balanced, and health-conscious lifestyle.

- January 2025: Predator Energy, a Monster Beverage brand, signed a three-year sponsorship deal worth approximately USD 1.2 million with the Indian Street Premier League, becoming its official energy drink partner and demonstrating continued investment in the Indian market by global energy drink manufacturers.

India Synthetic Caffeine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Powder, Granular |

| Applications Covered | Food and Beverages, Pharmaceuticals, Dietary Supplements and Functional Food, Cosmetics and Personal Care |

| Companies Covered | Aarti Industries Limited, Bajaj Healthcare Limited, Bakul Aromatics and Chemicals Pvt Ltd, Central Drug House Private Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India synthetic caffeine market reached a volume of 7,106.89 Tons in 2025.

The India synthetic caffeine market is expected to grow at a compound annual growth rate of 6.13% from 2026-2034 to reach 12,144.65 Tons by 2034.

Powder dominated with a 62% market share in 2025, driven by its high purity levels, superior solubility, and extensive applications across pharmaceutical, food and beverage, and dietary supplement industries.

Key factors driving the India synthetic caffeine market include rapid expansion of the food and beverage industry, growing pharmaceutical manufacturing sector, rising health consciousness, increasing sports participation, and expanding e-commerce distribution channels.

Major challenges include stringent regulatory standards from FSSAI with strict caffeine content limits, growing consumer preference for natural alternatives, raw material price volatility, import dependency for key intermediates, and competition from Chinese manufacturers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)