India Switchgear Market Size, Share, Trends and Forecast by Voltage Type, Insulation, Installation, End Use, and Region, 2026-2034

India Switchgear Market Summary:

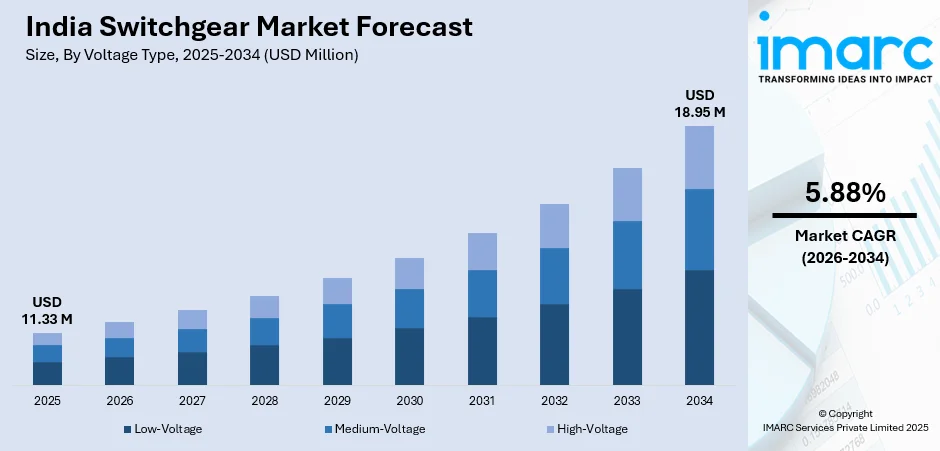

The India switchgear market size was valued at USD 11.33 Million in 2025 and is projected to reach USD 18.95 Million by 2034, growing at a compound annual growth rate of 5.88% from 2026-2034.

The growth of the switchgear market in India is robust, impelled by rapid urbanization and industrialization, and supported by the modernization of power infrastructure facilitated by the Government of India. A spur in electricity demand, together with substantial investments in smart grid technologies and integration of renewable energy, is driving market growth. The focus on safe and efficient power distribution in residential, commercial, and industrial sectors remains one of the prime drivers of advanced switchgear solutions' demand across the country.

Key Takeaways and Insights:

- By Voltage Type: Low-voltage dominates the market with a share of 46% in 2025, driven by widespread adoption in residential and commercial applications requiring safe and reliable power distribution.

- By Insulation: Air Insulated Switchgear (AIS) leads the market with a share of 51% in 2025, owing to its cost-effectiveness, ease of maintenance, and suitability for diverse environmental conditions.

- By Installation: Indoor dominates the market with a share of 60% in 2025, attributed to the growing construction of commercial complexes, industrial facilities, and urban infrastructure projects.

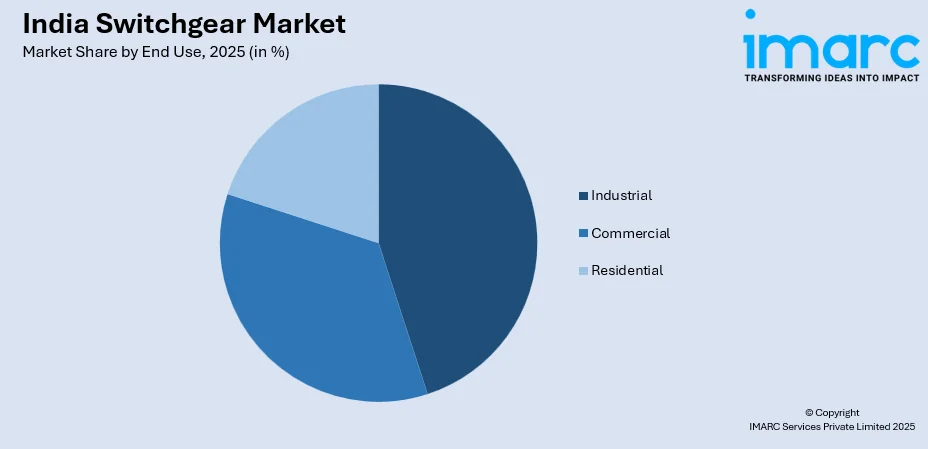

- By End Use: Industrial leads the market with a share of 45% in 2025, reflecting the rapid expansion of manufacturing facilities and heavy industries requiring robust power management systems.

- By Region: North India dominates the market with a share of 32% in 2025, driven by extensive industrialization, urbanization, and substantial government investments in power infrastructure development.

- Key Players: The India switchgear market exhibits a moderately competitive landscape, with a mix of multinational corporations and domestic manufacturers competing across various voltage segments and product categories. Major players focus on technological innovation, strategic partnerships, and expanding manufacturing capabilities to strengthen their market presence.

To get more information on this market Request Sample

India's switchgear market is undergoing significant transformation driven by the nation's emphasis on power infrastructure modernization and urban-rural electrification initiatives. According to reports, ABB India inaugurated a new state-of-the-art factory in Nashik that doubled its Gas Insulated Switchgear (GIS) production capacity and launched eco-efficient SF₆-free switchgear models designed for smart grid applications, reinforcing domestic manufacturing and smart grid deployment priorities. The increasing adoption of smart and automated switchgear systems represents a core aspect influencing the industry. The integration of Internet of Things connectivity and real-time monitoring capabilities enables predictive maintenance and enhanced operational efficiency. Government initiatives such as the Smart Cities Mission and the Revamped Distribution Sector Scheme are accelerating infrastructure development and creating substantial demand for advanced electrical equipment. The growing renewable energy sector, with ambitious targets for non-fossil fuel capacity, necessitates sophisticated switchgear solutions for seamless grid integration and load management.

India Switchgear Market Trends:

Smart and Digital Switchgear Adoption

The India switchgear market is witnessing a significant shift towards smart and digital solutions aimed at maximizing power distribution effectiveness and reliability. For example, in September 2025, Sharika Enterprises secured a contract with JSW Renew Energy Three to supply advanced 33 kV smart SF₆ load break switches for a wind farm project, highlighting strong adoption of intelligent switchgear in renewable infrastructure. Modern switchgear components incorporate built-in sensors, communication modules, and IoT connectivity that enable real-time monitoring, predictive maintenance, and remote management capabilities.

Renewable Energy Integration Requirements

The rapid expansion of renewable energy generation in India is creating substantial demand for advanced switchgear solutions capable of managing power fluctuations, grid synchronization, and load balancing. For instance, RMC Switchgears announced plans to set up a new 1 GWp solar module and mounting structure manufacturing facility in Rajasthan in 2025, reflecting how switchgear and related renewable infrastructure companies are aligning with India’s clean energy growth. As the nation progresses toward its ambitious non-fossil fuel capacity targets, switchgear systems equipped with sophisticated control mechanisms become essential for stable and reliable integration of solar, wind, and other renewable sources into the existing power grid infrastructure.

Compact and Modular Switchgear Solutions

Urban infrastructure development is driving increasing demand for modular and compact switchgear solutions that deliver high performance while occupying minimal space. In November 2025, Toshiba T&D India delivered India’s first 220 kV mobile GIS to Power Grid, highlighting compact solutions enhancing grid resilience in space-constrained projects. Cities experiencing rapid growth require space-saving electrical products for commercial buildings, data centers, and transportation infrastructure. Gas-insulated switchgear is gaining traction due to its compact footprint, minimal maintenance requirements, and enhanced protection against environmental elements, making it ideal for space-constrained urban installations.

Market Outlook 2026-2034:

The India switchgear market outlook remains positive, supported by sustained investments in power infrastructure, grid modernization initiatives, and the expanding renewable energy sector. Government programs focused on rural electrification, smart city development, and industrial corridor expansion are expected to generate substantial demand for switchgear solutions across all voltage categories. The integration of advanced technologies including automation, digitalization, and environmentally friendly insulation alternatives will shape market evolution throughout the forecast period. The market generated a revenue of USD 11.33 Million in 2025 and is projected to reach a revenue of USD 18.95 Million by 2034, growing at a compound annual growth rate of 5.88% from 2026-2034.

India Switchgear Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Voltage Type |

Low-Voltage |

46% |

|

Insulation |

Air Insulated Switchgear (AIS) |

51% |

|

Installation |

Indoor |

60% |

|

End Use |

Industrial |

45% |

|

Region |

North India |

32% |

Voltage Type Insights:

- Low-Voltage

- Medium-Voltage

- High-Voltage

The low-voltage dominates with a market share of 46% of the total India switchgear market in 2025.

Low-voltage switchgear serves as a critical component of India's electrical infrastructure, ensuring the secure and efficient functioning of systems operating at voltages lower than one thousand volts. This segment encompasses circuit breakers, disconnectors, switches, and protection relays that guarantee safety across residential, commercial, industrial, and infrastructure sectors. According to reports, Siemens Ltd strengthened its presence in India’s rapidly expanding electrification market by acquiring C&S Electric’s low-voltage switchgear and power distribution business, enhancing local manufacturing and design capabilities.

The rising need for consistent and dependable power supply, coupled with increasing investments in real estate, smart cities, and urban infrastructure, continues to accelerate low-voltage switchgear adoption. Government-led initiatives promoting rural electrification and the expansion of electricity access across underserved areas further contribute to market growth. Rapid industrialization and the transition toward automation and smart energy management systems create additional demand for modern low-voltage switchgear solutions that enhance operational safety and energy efficiency.

Insulation Insights:

- Gas Insulated Switchgear (GIS)

- Air Insulated Switchgear (AIS)

- Others

Air Insulated Switchgear (AIS) leads with a share of 51% of the total India switchgear market in 2025.

Air-insulated switchgear has maintained its leading position in the market because of its reliability, economic viability, and simplicity of maintenance compared to other insulation materials. The extensive use of AIS switchgear range has been observed in the transmission and distribution system, industrial area, as well as in the commercial sector, where the area constraint does not restrict its adoption.

The increasing trend towards sustainability is also accelerating the innovation front in the AIS technology sector as more efficient and environmentally sustainable solutions are being developed by suppliers. The market is also aided by the fact that the solutions have low capital expenditures and easy-to-follow maintenance processes, making it an attractive option for cost-conscious and simplified operational solutions. The increasing infrastructure development and replacement of old electric equipment are also maintaining the demand for air insulated switchgear solutions.

Installation Insights:

- Indoor

- Outdoor

The indoor dominates with a market share of 60% of the total India switchgear market in 2025.

Indoor switchgear installations dominate the market due to the rapid expansion of commercial complexes, manufacturing facilities, data centers, and urban infrastructure projects requiring protected electrical equipment. In July 2025, Schneider Electric acquired the remaining 35% stake in its Indian joint venture, gaining full ownership to accelerate investment and manufacturing expansion for data centres and critical infrastructure. The controlled environment of indoor installations ensures enhanced equipment longevity, reduced maintenance requirements, and improved safety standards. Buildings across residential, commercial, and industrial sectors increasingly incorporate indoor switchgear rooms as integral components of their electrical infrastructure.

The growth of smart city initiatives and the construction of modern commercial buildings, shopping centers, and technology parks drive substantial demand for indoor switchgear solutions. These installations benefit from protection against environmental factors including weather conditions, dust, and humidity that can impact equipment performance. The integration of advanced monitoring and automation systems is more readily achieved in indoor installations, supporting the broader trend toward intelligent building management systems.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Residential

- Industrial

The industrial leads with a share of 45% of the total India switchgear market in 2025.

The industrial sector maintains market leadership driven by extensive manufacturing expansion, heavy industry growth, and the establishment of industrial corridors across the country. Manufacturing facilities, process industries, and production plants require robust and reliable switchgear solutions to ensure uninterrupted operations and protect critical equipment from electrical faults. The emphasis on operational efficiency and safety standards in industrial environments necessitates advanced power distribution systems.

Government initiatives promoting manufacturing under various industrial policies and the development of dedicated industrial zones continue to drive demand for industrial switchgear. The modernization of existing facilities and the adoption of automation technologies require upgraded electrical infrastructure capable of supporting advanced production systems. Energy-intensive industries particularly benefit from sophisticated switchgear solutions that optimize power consumption and enhance operational reliability.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 32% share of the total India switchgear market in 2025.

North India accounts for a significant share of the India switchgear market, supported by rapid urbanization, strong industrial concentration, and expanding manufacturing hubs across states such as Uttar Pradesh, Haryana, Rajasthan, and Punjab. Large-scale investments in power transmission, substation modernization, and distribution network upgrades are strengthening demand for reliable low- and medium-voltage switchgear solutions.

Rising investments in smart city development, metro rail expansion, and commercial real estate are further accelerating switchgear adoption in the region. Additionally, increasing renewable energy capacity and grid integration projects require advanced switchgear for load management, grid stability, and safety, driving sustained demand from utilities, infrastructure developers, and industrial end users.

Market Dynamics:

Growth Drivers:

Why is the India Switchgear Market Growing?

Rapid Urbanization and Infrastructure Development

India’s rapid urbanization is driving switchgear market growth, boosting demand for reliable power distribution across residential, commercial, and industrial sectors. In 2025, CG Power announced a ₹748 crore investment in a new greenfield switchgear facility in western India to double production capacity for infrastructure and urban projects. Government initiatives like the Smart Cities Mission and urban development programs are fueling construction of commercial real estate, including offices, malls, and tech parks, increasing the need for advanced low-voltage and intelligent switchgear systems to manage complex electrical loads safely and efficiently.

Renewable Energy Sector Expansion

India’s rapid renewable energy expansion is driving switchgear market growth, requiring advanced solutions for integration challenges. Specialized systems with real-time monitoring ensure stable grid integration, manage power fluctuations, and support load balancing. The India renewable energy market size reached USD 23.9 Billion in 2024. Looking forward the market is expected to reach USD 52.1 Billion by 2033, exhibiting a growth rate (CAGR) of 8.1% during 2025-2033. Increasing adoption of energy storage solutions further boosts demand for switchgear capable of efficiently connecting and managing these devices within India’s evolving power network.

Power Grid Modernization Initiatives

Government initiatives to modernize India’s power grid are driving switchgear market growth. In 2025, ₹3,600 crore was approved under the revamped distribution sector scheme to upgrade distribution networks in Gurugram and Faridabad, including gas‑insulated substations and advanced feeder systems. Smart grid technologies, such as automated distribution systems and advanced metering, increase demand for digitally enabled switchgear. Investments in transmission and distribution infrastructure, combined with a focus on grid stability, resilience, and cybersecurity, are accelerating adoption of innovative switchgear solutions that improve monitoring, control, and automation across India’s evolving power networks.

Market Restraints:

What Challenges the India Switchgear Market is Facing?

High Initial Investment Requirements

The substantial capital investment required for advanced switchgear systems presents a significant barrier for market expansion, particularly among small and medium enterprises and in price-sensitive applications. The cost differential between conventional and smart switchgear solutions influences purchasing decisions, especially in regions with limited budgets for electrical infrastructure upgrades, slowing adoption rates and delaying modernization plans across developing and cost-constrained power distribution networks.

Technical Skill Gap and Maintenance Challenges

The shortage of qualified technicians capable of installing, operating, and maintaining sophisticated switchgear systems constrains market growth. Advanced switchgear technologies require specialized expertise for proper implementation and ongoing maintenance. Training and skill development remain ongoing challenges, particularly in remote and rural areas where technical support infrastructure is limited, resulting in longer project timelines, higher operational risks, increased downtime, and greater reliance on external service providers for utilities globally.

Environmental Concerns with Conventional Insulation

Environmental regulations concerning conventional insulation gases used in certain switchgear types create compliance challenges for manufacturers and end-users. The transition toward environmentally friendly alternatives requires technological adaptation and investment. Regulatory pressures and sustainability requirements influence product development and market dynamics, necessitating ongoing innovation in insulation technologies, increasing costs, extending certification timelines, reshaping procurement strategies, and accelerating adoption of low-emission, recyclable insulation solutions worldwide across diverse applications.

Competitive Landscape:

the presence of established multinational corporations alongside prominent domestic manufacturers. Key players compete through technological innovation, product quality, pricing strategies, and service capabilities. The market demonstrates ongoing consolidation as larger entities pursue strategic acquisitions to expand product portfolios and manufacturing capacities. Competition intensifies across all voltage segments, with players focusing on differentiated offerings addressing specific application requirements. Domestic manufacturers leverage local market knowledge and cost advantages while international players capitalize on technological expertise and global best practices. Strategic partnerships between technology providers and local distributors enhance market reach and customer support capabilities. The emphasis on sustainability and digital transformation drives competitive positioning as manufacturers invest in environmentally friendly solutions and smart switchgear technologies.

Recent Developments:

- In February 2025, Lauritz Knudsen Electrical & Automation (formerly L&T Switchgear) announced a major product launch at ELECRAMA 2025, unveiling a comprehensive portfolio of switchgear and automation solutions for industrial, infrastructure, and residential applications. The company also revealed plans to expand AI-driven smart energy solutions, strengthening local manufacturing and R&D capabilities in India.

India Switchgear Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Voltage Types Covered | Low-Voltage, Medium-Voltage, High-Voltage |

| Insulations Covered | Gas Insulated Switchgear (GIS), Air Insulated Switchgear (AIS), Others |

| Installations Covered | Indoor, Outdoor |

| End Uses Covered | Commercial, Residential, Industrial |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India switchgear market size was valued at USD 11.33 Million in 2025.

The India switchgear market is expected to grow at a compound annual growth rate of 5.88% from 2026-2034 to reach USD 18.94 Million by 2034.

Low-voltage switchgear dominates the market with a 46% share, driven by widespread adoption in residential, commercial, and light industrial applications requiring safe and cost-effective power distribution solutions.

Key factors driving the India switchgear market include rapid urbanization and infrastructure development, expanding renewable energy integration requirements, power grid modernization initiatives, and increasing electricity demand across industrial, commercial, and residential sectors.

Major challenges include high initial investment requirements for advanced systems, shortage of skilled technicians for installation and maintenance, environmental compliance pressures related to conventional insulation materials, and infrastructure constraints in remote and rural areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)