India Sweeteners Market Size, Share, Trends and Forecast by Type, Form, Application, and Region, 2025-2033

India Sweeteners Market Overview:

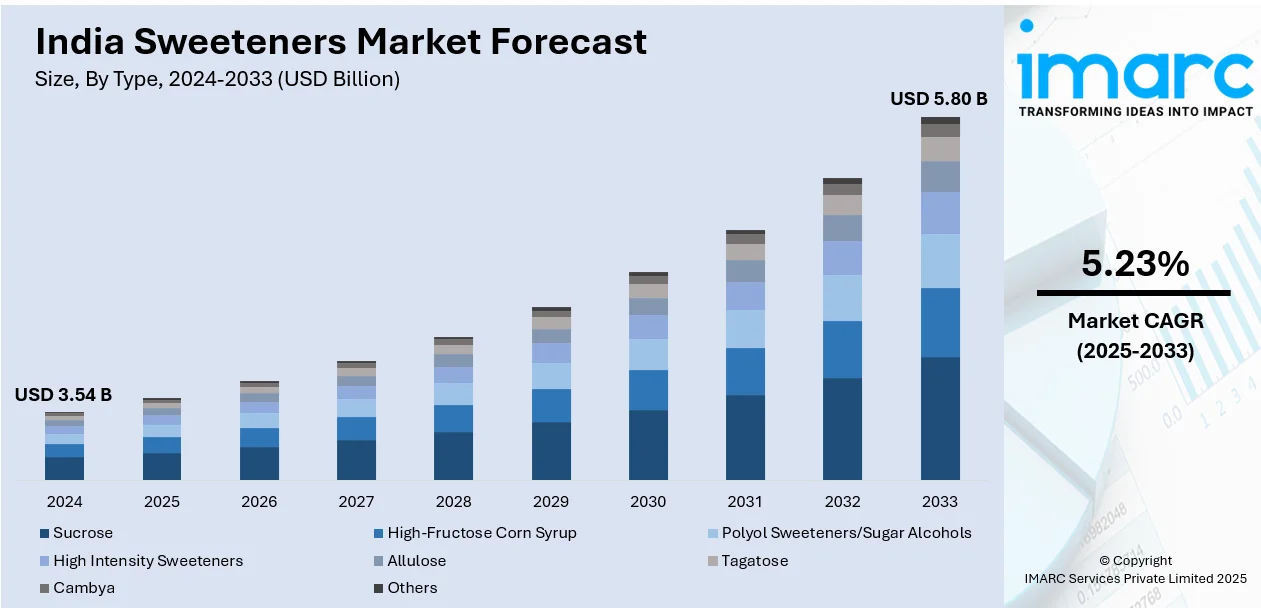

The India sweeteners market size reached USD 3.54 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.80 Billion by 2033, exhibiting a growth rate (CAGR) of 5.23% during 2025-2033. The market comprises natural and artificial sweeteners such as sugar, stevia, sucralose, and aspartame, serving food, beverage, and pharma industries. Regulatory clearances, demand from consumers for low-calorie options, and growing applications fuel market growth in varied categories.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.54 Billion |

| Market Forecast in 2033 | USD 5.80 Billion |

| Market Growth Rate (2025-2033) | 5.23% |

India Sweeteners Market Trends:

Rise of Natural and Plant-Based Sweeteners

Indian sweetener industry is experiencing a paradigm shift towards plant-based and natural alternatives as the consumer becomes health-conscious. Due to heightening concern over artificial preservatives and man-made sweeteners, demand is increasing for sweeteners that come from natural origins like stevia, monk fruit, and allulose. For example, in April 2024, Ingredion introduced PURECIRCLE™ Clean Taste Solubility Solution, game-changing stevia innovation with greater than 100 times solubility of Reb M, offering cleaner sugar-like taste without additives for clean-label applications. Moreover, these alternatives have the advantage of being low in calories while providing sweetness, hence suitable for diabetics and weight-watchers. Regulatory pressure for clean-label products has further spurred the use of natural sweeteners among food and beverages manufacturers. Additionally, technology advancements in the food segment have enhanced plant-based sweeteners' taste profile, eliminating bitter aftertastes typical of sweeteners. Moreover, bakery manufacturers, drink firms, and dairy companies are innovating very quickly to put natural sweeteners in their brands. This is a trend consistent with the growing demand for organic and less processed food among consumers, further boosting the growth of India's natural sweetener market.

To get more information on this market, Request Sample

Growth of Sugar Alternatives in the Health and Wellness Sector

The market for sugar substitutes in India is growing, led by the increasing prevalence of lifestyle conditions like diabetes and obesity. Customers are looking proactively for healthy alternatives that taste as sweet without the ill health caused by sugar. Polyol sweeteners like erythritol and xylitol are finding popularity as they have a low glycemic index and positive oral health implications. High-intensity sweeteners, such as tagatose and brazzein are also becoming strong contenders for reducing sugar in foods and beverages. Furthermore, the pharmaceutical industry is using alternative sweeteners in syrups and medication to target health-aware consumers. This phenomenon is also stimulated by boosting health awareness of sugar problems through government initiatives and fitness bloggers endorsing low-sugar living. Consequently, leading brands are repositioning their products to contain these sugar substitutes in a bid to balance taste, health, and affordability.

Expansion of Sugar Reduction Strategies in Packaged Foods and Beverages

As consumers highly demand lower-sugar products, Indian food and beverages manufacturers are embracing novel sugar-reduction technologies. Brands are using a blend of substitute sweeteners such as stevia, sucralose, and allulose to create products with the same flavor as their original counterparts but with less sugar. In drinks, manufacturers of soft drinks and juices are reformulating the recipe to lower added sugar, usually through a mix of high-intensity and polyol sweeteners. In the dairy industry, frozen foods, flavored yogurts, and milk-based beverages are also seeing a spurt in low-sugar forms. The Indian government has also introduced policies favoring sugar reduction, such as the potential of taxing high-sugar items. According to the reports, in February 2025, the FSSAI will formulate standalone regulations for artificial sweeteners, such as aspartame, differing from global guidelines. It is intended to provide safety based on the country's own dietary habits and scientific risk analysis. Moreover, with ongoing changing consumer preferences, businesses are going for research and development to establish innovative, low-calorie, and sugar-free products appealing both to health-minded consumers as well as to general consumers aiming at lowering the level of sugar they consume.

India Sweeteners Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, form, and application.

Type Insights:

- Sucrose

- High-Fructose Corn Syrup

- Polyol Sweeteners/Sugar Alcohols

- Sorbitol

- Xylitol

- Mannitol

- Maltitol

- Isomalt

- Erythritol

- Lyxitol

- Others

- High Intensity Sweeteners

- Aspartame

- Sucralose

- Saccharin

- Cyclamates

- Acesulfame Potassium (Ace- K)

- Stevia

- Monk Fruit (Luo Han Guo)

- Brazzein

- Others

- Allulose

- Tagatose

- Cambya

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes sucrose, high-fructose corn syrup, polyol sweeteners/sugar alcohols, (sorbitol, xylitol, mannitol, maltitol, isomalt, erythritol, lyxitol, others), high-intensity sweeteners, (aspartame, sucralose, saccharin, cyclamates, acesulfame potassium, ace-k, stevia, monk fruit, luo han guo, brazzein, others), allulose, tagatose, cambya, others.

Form Insights:

- Solid

- Liquid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes solid and liquid.

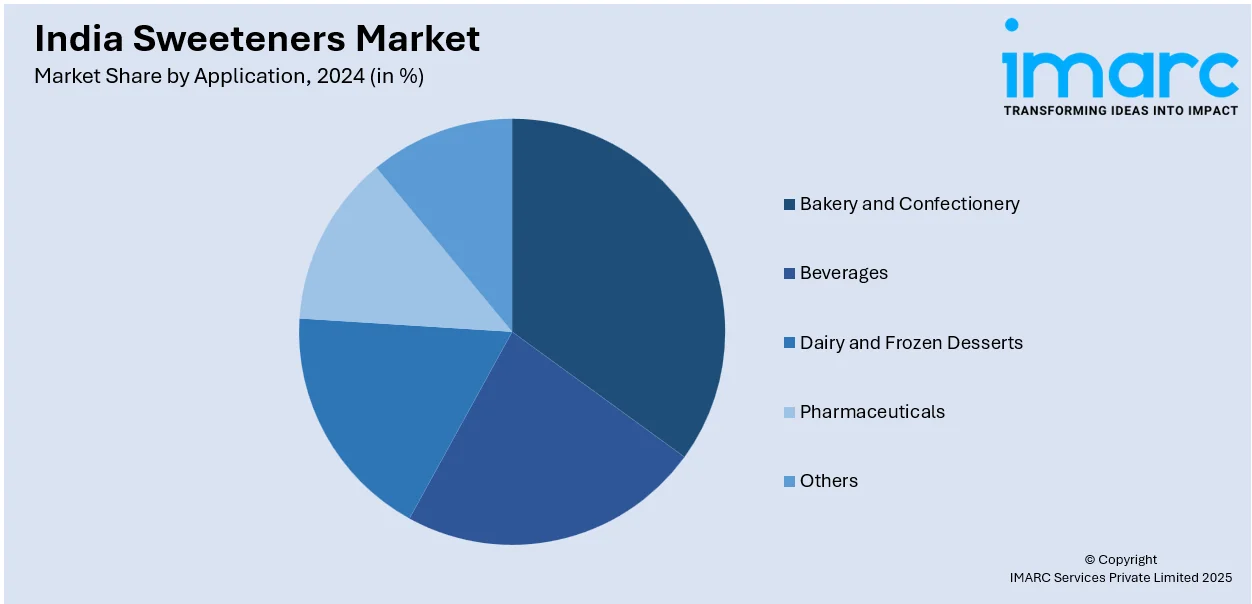

Application Insights:

- Bakery and Confectionery

- Beverages

- Dairy and Frozen Desserts

- Pharmaceuticals

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes bakery and confectionery, beverages, dairy and frozen desserts, pharmaceuticals, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Sweeteners Market News:

- In February 2025, Gudworld, a company founded on a 40-year tradition of jaggery-making, is revolutionizing the Indian sweetener industry with new-fangled jaggery cubes and powders. Pioneering to turn jaggery into a handy sugar substitute, the firm has won acclaim for its Ayurveda-supported path, meeting the rising need for natural and healthy sweeteners.

- In October 2024, 1-2-Taste becomes the first Indian company to get FSSAI certification for the sale of Allulose, a natural low-calorie sweetener. This is a significant move in India's sugar substitutes industry, meeting increased consumer demand for healthier ingredients in food and beverage products.

India Sweeteners Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Forms Covered | Solid, Liquid |

| Applications Covered | Bakery And Confectionery, Beverages, Dairy And Frozen Desserts, Pharmaceuticals, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India sweeteners market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India sweeteners market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India sweeteners industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sweeteners market in India was valued at USD 3.54 Billion in 2024.

The India sweeteners market is projected to exhibit a CAGR of 5.23% during 2025-2033, reaching a value of USD 5.80 Billion by 2033.

The sweeteners market in India is driven by growing health consciousness, rising incidences of diabetes and obesity, and a strong shift toward low-calorie, sugar-free, and natural alternatives like stevia and jaggery. Expanding applications in food and beverages, ongoing product innovations, and supportive regulatory frameworks further fuel market growth and adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)