India Sustainable Finance Market Size, Share, Trends and Forecast by Investment Type, Transaction Type, Industry Vertical, and Region, 2026-2034

India Sustainable Finance Market Overview:

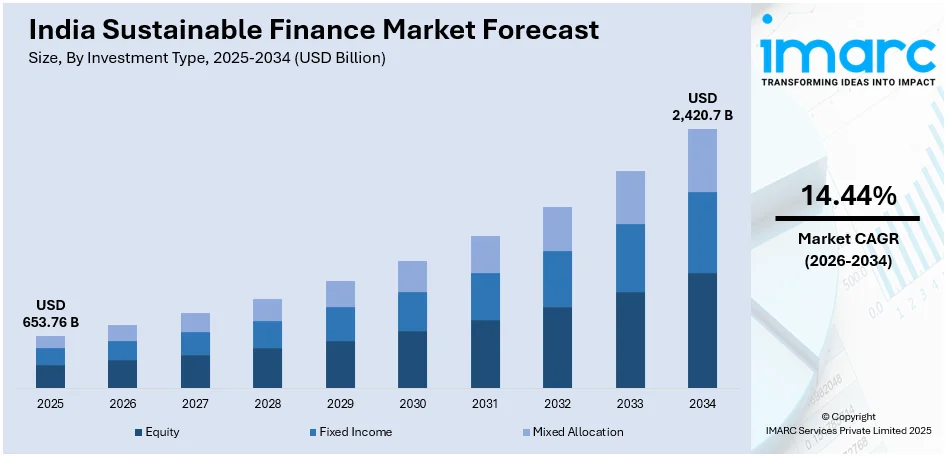

The India sustainable finance market size reached USD 653.76 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2,420.7 Billion by 2034, exhibiting a growth rate (CAGR) of 14.44% during 2026-2034. Government policies and environmental, social, and governmental (ESG) regulations are positively influencing the India sustainable finance market share. Besides this, rising green bonds and loans, increased investor demand and international funding are expanding capital inflows, accelerating India’s shift towards a low-carbon economy.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 653.76 Billion |

| Market Forecast in 2034 | USD 2,420.7 Billion |

| Market Growth Rate 2026-2034 | 14.44% |

India Sustainable Finance Market Trends:

Rising Infrastructure Investments

The government is prioritizing sustainable infrastructure projects including renewable energy, smart cities, and electric vehicle (EV) charging networks. These projects require substantial funding, catalyzing the demand for green bonds and sustainability-linked loans. Financial institutions are expanding green finance offerings to support eco-friendly infrastructure projects across various sectors. Public-private partnerships (PPPs) are facilitating large-scale sustainable infrastructure development with long-term financing solutions. International investors and development banks are providing capital for sustainable infrastructure projects in India. Renewable energy infrastructure such as solar and wind farms, is attracting significant sustainable investments. Green buildings and energy-efficient urban infrastructure are becoming key focus areas for sustainable finance initiatives. Sustainable transportation projects like metro expansions and electric buses, are enhancing green finance adoption. The shift toward climate-resilient infrastructure is encouraging banks to develop innovative sustainable financing mechanisms. Recognizing the need for long-term funding, in 2024, SBI raised ₹10,000 crore through an infrastructure bond issue at a 7.70% coupon rate for 15 years. The funds would support large-scale infrastructure projects, strengthening India’s sustainable finance market and enhance investor confidence. The issue witnessed strong demand, with bids exceeding ₹21,045 crore, highlighting faith in India’s infrastructure growth and economic resilience. Policy support and corporate sustainability goals are further aligning with green finance to strengthen the India sustainable finance market growth.

To get more information on this market Request Sample

Growth of Green Bonds and Loans

The increasing number of green bonds and loans is significantly influencing the India sustainable finance market outlook. Corporates and financial institutions are increasingly issuing green bonds to finance renewable energy and sustainability projects. Green loans are supporting eco-friendly initiatives including water conservation, energy efficiency, and low-carbon infrastructure development. Government policies and regulatory frameworks are encouraging the issuance of green bonds to fund sustainable initiatives. The Securities and Exchange Board of India (SEBI) and Reserve Bank of India (RBI) are promoting green finance instruments. Investor demand for sustainable investments is increasing, supporting capital inflows into green bonds and sustainability-linked loans. International financial institutions are strengthening India’s green bond market by investing in certified sustainable projects. In June 2024, British International Investment (BII) and Symbiotics Investments jointly launched a $75 million Green Bond Fund to support India’s clean energy transition. The fund would finance clean transportation, renewable energy, green buildings, and energy efficiency, focusing on micro, small and medium enterprises (MSME) lenders. This initiative aimed to expand green lending and climate-focused investments, strengthening India’s sustainable finance market. Renewable energy developers are raising funds through green bonds for wind, solar, and hydroelectric power projects. Infrastructure companies are utilizing green loans to finance climate-resilient projects and carbon reduction initiatives. Additionally, sustainable finance instruments are reducing financial risks while improving long-term social and environmental benefits. The expansion of sustainable bonds and loans is accelerating India’s shift toward a low-carbon economy.

India Sustainable Finance Market Segmentation

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on investment type, transaction type, and industry vertical.

Investment Type Insights:

- Equity

- Fixed Income

- Mixed Allocation

The report has provided a detailed breakup and analysis of the market based on the investment type. This includes equity, fixed income, and mixed allocation.

Transaction Type Insights:

- Green Bond

- Social Bond

- Mixed-Sustainability Bond

A detailed breakup and analysis of the market based on the transaction type have also been provided in the report. This includes green bond, social bond, and mixed-sustainability bond.

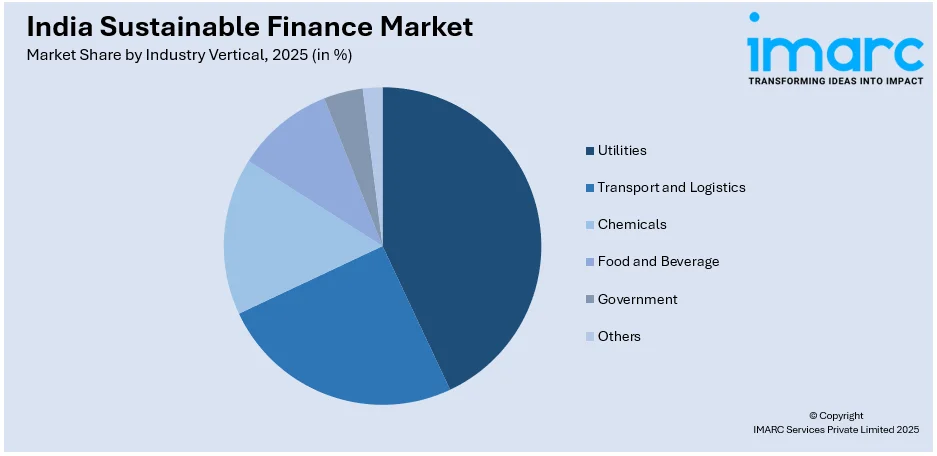

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Utilities

- Transport and Logistics

- Chemicals

- Food and Beverage

- Government

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes utilities, transport and logistics, chemicals, food and beverage, government, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Sustainable Finance Market News

- In March 2025, Standard Chartered issued a €1 billion social bond to support sustainable development in emerging markets, with 57% of funds allocated to India. The bond will finance SMEs, healthcare, and education, promoting inclusive economic growth. This initiative strengthens India's sustainable finance market by improving credit access and social infrastructure investments.

- In December 2024, Shriram Finance launched Shriram Green Finance to support sustainable solutions, funding electric vehicles (EVs), renewable energy products, battery charging stations, and energy-efficient machinery. The company aimed for an AUM of ₹5,000 crore in 3-4 years, initially focusing on Karnataka, Kerala, Delhi NCR, and Maharashtra, strengthening India's sustainable finance market and green investments.

India Sustainable Finance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Investment Types Covered | Equity, Fixed Income, Mixed Allocation |

| Transaction Types Covered | Green Bond, Social Bond, Mixed-Sustainability Bond |

| Industry Verticals Covered | Utilities, Transport and Logistics, Chemicals, Food and Beverage, Government, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India sustainable finance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India sustainable finance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India sustainable finance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India sustainable finance market size reached USD 653.76 Billion in 2025.

The India sustainable finance market is expected to reach USD 2,420.7 Billion by 2034, exhibiting a CAGR of 14.44% during 2026-2034.

Growth is driven by increasing investor focus on environmental, social, and governance (ESG) criteria, rising government support for green finance initiatives, and growing awareness about climate change impacts. The adoption of sustainable investment practices by financial institutions, along with regulatory frameworks promoting responsible financing, also contribute significantly. Additionally, rising demand for renewable energy projects and sustainable infrastructure development fuel market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)