India Surgical Instruments Market Size, Share, Trends and Forecast by Product Type, Application, End-User, and Region, 2025-2033

India Surgical Instruments Market Overview:

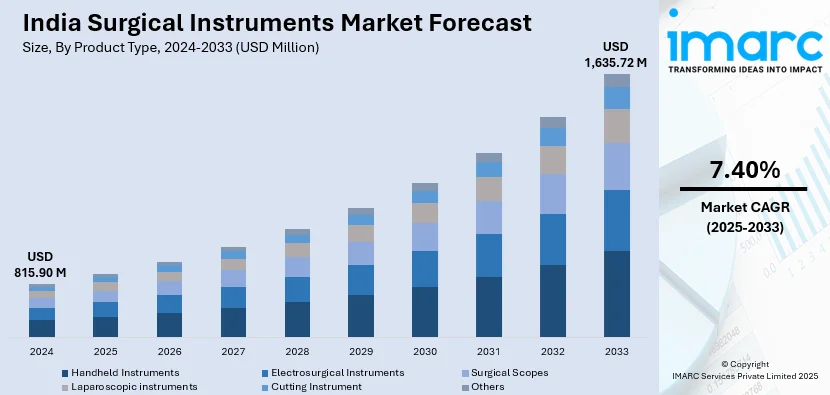

The India surgical instruments market size reached USD 815.90 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,635.72 Million by 2033, exhibiting a growth rate (CAGR) of 7.40% during 2025-2033. The market is growing as a result of expanding healthcare infrastructure investment, growing surgical interventions, and developments in minimally invasive technologies. Furthermore, the increase in the prevalence of chronic conditions, government initiatives towards affordable care, and demand for precision tools are fueling market growth. Medical tourism and technological advances are also propelling market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 815.90 Million |

| Market Forecast in 2033 | USD 1,635.72 Million |

| Market Growth Rate (2025-2033) | 7.40% |

India Surgical Instruments Market Trends:

Adoption of Minimally Invasive and Robotic-Assisted Surgeries

There is a growing demand for minimally invasive surgery (MIS) in India because of its advantages in minimizing hospitalization, recovery period, and complications post procedure. Robotic-assisted surgical procedures are being adopted on an increasing scale across specialties such as orthopedic, cardiology, and oncology owing to greater precision and efficiency. Robotic surgery centers and hospitals are making a high-end investment in surgical robots for better patient care with improved outcome, attributed to growing awareness and access to robot-assisted treatment. For instance, in January 2025, Prashanth Hospitals in Chennai launched the Institute of Robotic Surgery along with an indigenously developed surgical robotic system for minimally invasive procedures. The hospital aims to enhance patient recovery, reduce pain, and minimize blood loss through advanced robotic-assisted surgeries. This initiative highlights India's growing adoption of robotic surgery, improving accessibility to advanced healthcare technologies while strengthening the country’s medical infrastructure and innovation capabilities. The integration of AI and real-time imaging technologies is further advancing this segment. As surgical techniques continue evolving, the demand for specialized instruments designed for minimally invasive and robotic-assisted procedures is expected to increase, influencing the future of surgical instrument manufacturing and procurement in India.

To get more information on this market, Request Sample

Increasing Localization of Surgical Instrument Manufacturing

India has traditionally relied on imported surgical instruments, but recent trends indicate a shift toward domestic manufacturing. Government initiatives such as Make in India and the Production Linked Incentive (PLI) scheme are encouraging local production, reducing dependence on imports while ensuring cost-effective, high-quality instruments. For instance, in November 2024, the Indian government launched a ₹500 crore scheme to boost the medical device industry, focusing on manufacturing, skill development, clinical studies, infrastructure, and industry promotion. The scheme, running until 2026-27, includes funding for medical device clusters, testing facilities, and incentives for domestic production. India's USD 14 Billion medical device market is projected to reach USD 30 Billion by 2030, supported by exports and reduced import dependence. Several Indian manufacturers are focusing on precision engineering and regulatory compliance, aligning with global standards such as ISO 13485 and CE certifications. Additionally, collaborations between public and private sectors are fostering innovation in customized surgical tools for local healthcare needs. The shift towards local manufacturing is expected to strengthen the supply chain, enhance affordability, and improve accessibility to advanced surgical instruments across India’s growing healthcare network.

India Surgical Instruments Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, application, and end-user.

Product Type Insights:

- Handheld Instruments

- Electrosurgical Instruments

- Surgical Scopes

- Laparoscopic instruments

- Cutting Instrument

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes handheld instruments, electrosurgical instruments, surgical scopes, laparoscopic instruments, cutting instrument, and others.

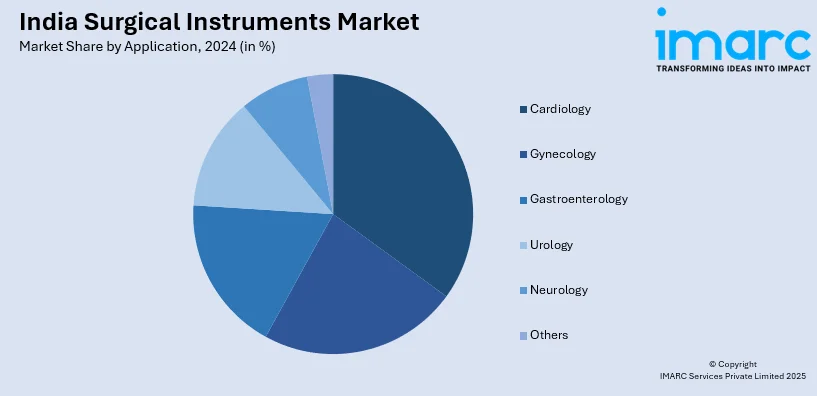

Application Insights:

- Cardiology

- Gynecology

- Gastroenterology

- Urology

- Neurology

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cardiology, gynecology, gastroenterology, urology, neurology, and others.

End-User Insights:

- Hospitals and Clinics

- Ambulatory Surgery Centers

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes hospitals and clinics and ambulatory surgery centers.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Surgical Instruments Market News:

- In January 2024, Surgical Instruments Group Holdings (SIGH), a UK-based medical devices manufacturer, announced plans to invest ₹231.5 crore to establish a healthcare device manufacturing facility in Hyderabad, India. This initiative, part of SIGH's global expansion into the Indian market, will unfold over the next two to three years. In the initial phase, the facility will produce general surgical instruments, precision tools for micro-surgeries, orthopedic power tools, dermatomes for maxillofacial surgery, ophthalmic instruments, and devices for minimally invasive surgeries. The subsequent phase aims to expand into robotic medical devices. SIGH's entry is expected to enhance local manufacturing capabilities and contribute to more affordable healthcare solutions in India.

- In March 2025, SS Innovations unveiled India’s first Mobile Tele-Surgical Unit, "SSI MantraM”. This innovation enhances remote surgical access using high-speed telecommunication and robotic-assisted surgery, bridging healthcare gaps in underserved regions. The unit enables real-time collaboration between remote and on-site surgical teams, offering tele-surgical procedures, mentoring, and patient data analytics. Approved by India’s CDSCO, it marks a significant leap in robotic surgery and telemedicine, positioning India as a leader in global med-tech advancements.

India Surgical Instruments Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Handheld Instruments, Electrosurgical Instruments, Surgical Scopes, Laparoscopic Instruments, Cutting Instrument, Others |

| Applications Covered | Cardiology, Gynecology, Gastroenterology, Urology, Neurology, Others |

| End-Users Covered | Hospitals and Clinics, Ambulatory Surgery Centers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India surgical instruments market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India surgical instruments market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India surgical instruments industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The surgical instruments market in India was valued at USD 815.90 Million in 2024.

The India surgical instruments market is projected to exhibit a (CAGR) of 7.40% during 2025-2033, reaching a value of USD 1,635.72 Million by 2033.

Increased demand for minimally invasive procedures, expansion in hospital and healthcare facilities, and higher medical tourism are major drivers. Efforts by the government to strengthen public health infrastructure, as well as technical improvements in surgical equipment and higher incidences of chronic diseases, also drive the market forward. The trend toward precision surgeries and robotic surgery also improves the demand for surgical instruments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)