India Surge Protection Devices Market Size, Share, Trends and Forecast by Product, Type, Power Rating, End Use, and Region, 2025-2033

India Surge Protection Devices Market Overview:

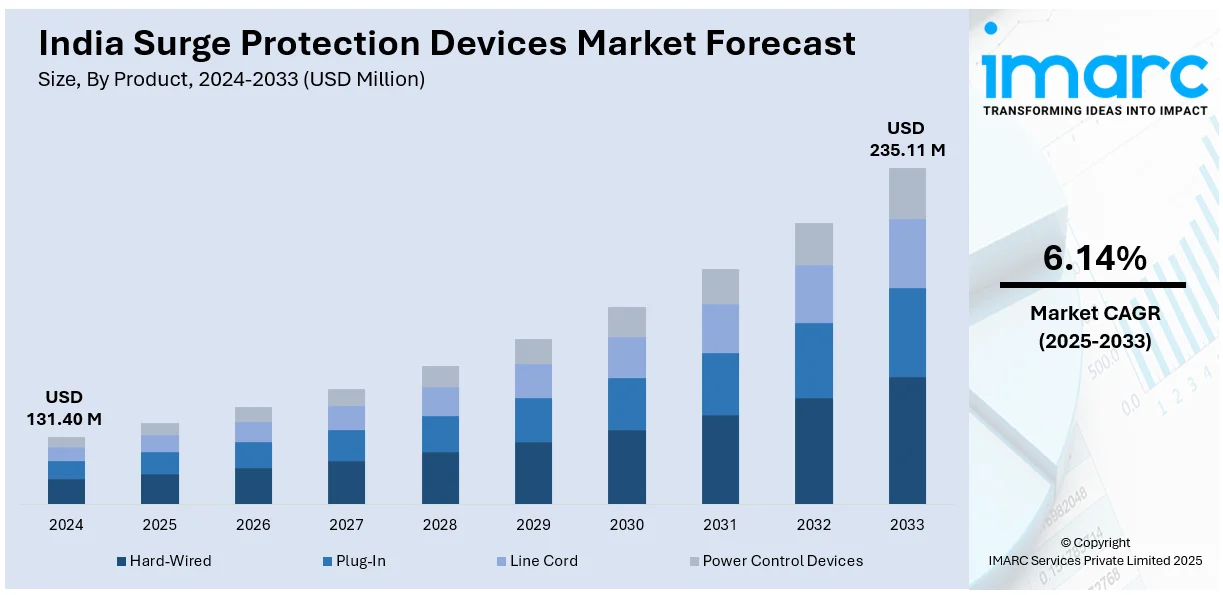

The India surge protection devices market size reached USD 131.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 235.11 Million by 2033, exhibiting a growth rate (CAGR) of 6.14% during 2025-2033. The rising power quality issues, increasing infrastructure development, growing industrial automation, expanding data centers, higher adoption of renewable energy, stricter electrical safety regulations, and rising demand for consumer electronics, ensuring protection against voltage fluctuations and transient surges are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 131.40 Million |

| Market Forecast in 2033 | USD 235.11 Million |

| Market Growth Rate (2025-2033) | 6.14% |

India Surge Protection Devices Market Trends:

Growing Demand for Advanced Surge Protection Solutions

The increasing reliance on electronic devices is driving demand for high-quality surge protection solutions in India. Consumers are seeking options that offer multiple sockets, USB-A, and Type-C PD ports to accommodate diverse charging needs. Safety features, including overload protection and fire-resistant materials, are becoming standard expectations. With warranties extending up to three years, buyers prioritize long-term reliability alongside protection. As pricing becomes more competitive, surge protectors with enhanced safety measures and versatile connectivity are gaining traction, appealing to both residential and commercial users. The growing adoption of smart gadgets and home office setups further fuels the need for robust power management solutions, reinforcing the shift toward safer and more efficient electrical accessories. For example, in April 2024, Secure Connection introduced a new range of Honeywell surge protectors in India, starting at INR 899. The lineup includes models with 1 to 8 universal sockets, USB-A ports, and Type-C PD ports, catering to various device protection needs. Each surge protector features eight safety measures, such as overload protection and fire-resistant materials, and comes with a three-year warranty.

To get more information on this market, Request Sample

Rising Focus on Electrical Safety in Energy Infrastructure

The increasing complexity of power management systems is driving the need for advanced surge protection solutions in India. As renewable energy adoption accelerates and industrial automation expands, robust circuit protection is becoming essential for ensuring electrical safety and efficiency. Innovations in surge protection technology are addressing voltage fluctuations, reducing equipment failures, and enhancing system reliability. With stricter safety regulations and rising investments in energy infrastructure, the focus on high-performance protection devices is intensifying. The push for battery management systems in electric vehicles and renewable power storage further amplifies demand. As industries integrate smarter and more efficient power solutions, the role of advanced surge protection continues to grow, ensuring operational stability across diverse applications. For instance, in August 2023, Bourns, Inc. showcased its surge protection solutions at electronica India 2023, highlighting advanced circuit protection for battery management systems. The company’s innovations addressed voltage surge challenges, enhancing safety and efficiency in power electronics. These solutions cater to India's expanding renewable energy and industrial sectors, ensuring robust electrical protection in critical applications while meeting evolving safety standards. The event reinforced Bourns’ role in advancing surge protection technology in India.

India Surge Protection Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, type, power rating, and end use.

Product Insights:

- Hard-Wired

- Plug-In

- Line Cord

- Power Control Devices

The report has provided a detailed breakup and analysis of the market based on the product. This includes hard-wired, plug-in, line cord, and power control devices.

Type Insights:

- Type 1

- Type 2

- Type 3

- Type 4

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes type 1, type 2, type 3, and type 4.

Power Rating Insights:

- 0-50 kA

- 50.1-100 kA

- 100.1-200 kA

- 200.1 kA and Above

The report has provided a detailed breakup and analysis of the market based on the power rating. This includes 0-50 kA, 50.1-100 kA, 100.1-200 kA, and 200.1 kA and above.

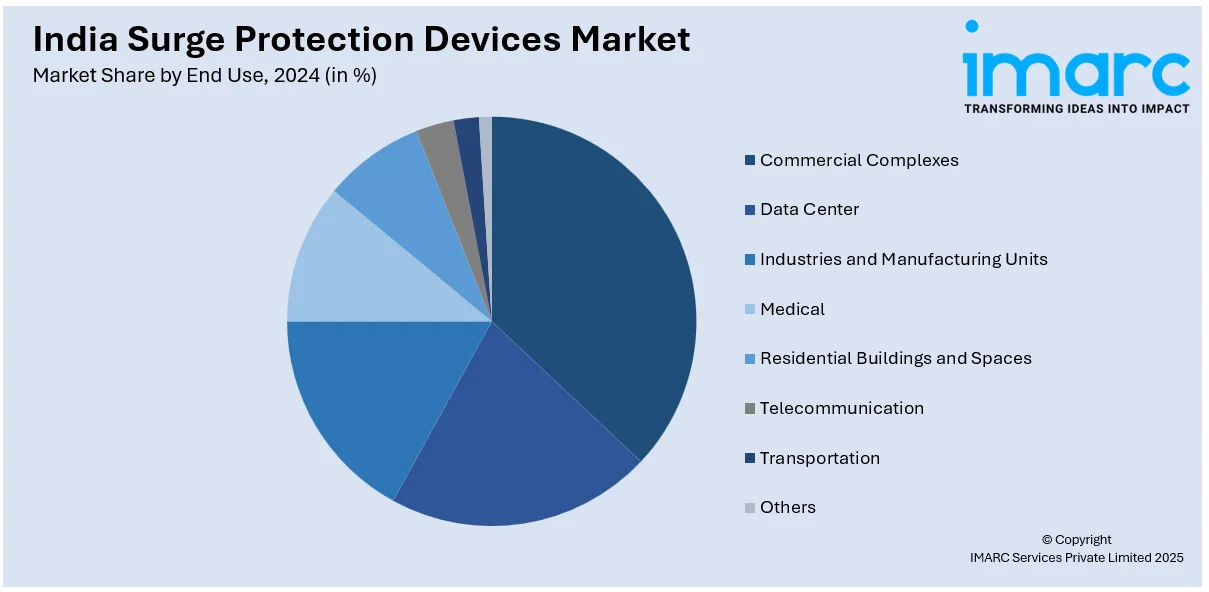

End Use Insights:

- Commercial Complexes

- Data Center

- Industries and Manufacturing Units

- Medical

- Residential Buildings and Spaces

- Telecommunication

- Transportation

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes commercial complexes, data center, industries and manufacturing units, medical, residential buildings and spaces, telecommunication, transportation, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Surge Protection Devices Market News:

- In October 2024, Schneider Electric launched the Miluz ZeTa series in India, featuring advanced switches and sockets with built-in voltage surge protectors. These devices safeguard household appliances from unexpected power surges, enhancing electrical safety. The range also includes air quality indicators for real-time monitoring and USB A+C fast-charging ports for modern convenience. Compatible with Schneider's Wiser system, Miluz ZeTa integrates seamlessly into smart home ecosystems, offering both safety and connectivity.

India Surge Protection Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Hard-Wired, Plug-In, Line Cord, Power Control Devices |

| Types Covered | Type 1, Type 2, Type 3, Type 4 |

| Power Ratings Covered | 0-50 kA, 50.1-100 kA, 100.1-200 kA, 200.1 kA and Above |

| End Uses Covered | Commercial Complexes, Data Center, Industries and Manufacturing Units, Medical, Residential Buildings and Spaces, Telecommunication, Transportation, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India surge protection devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India surge protection devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India surge protection devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The surge protection devices market in India was valued at USD 131.40 Million in 2024.

The India surge protection devices market is projected to exhibit a CAGR of 6.14% during 2025-2033, reaching a value of USD 235.11 Million by 2033.

The rapid electrification of rural and semi-urban areas has increased the need for safeguarding electrical equipment, driving the demand for surge protectors. In urban settings, rising use of sensitive electronics in homes, offices, and data centers is further promoting the adoption of protective devices. Industrial automation and the growing reliance on uninterrupted power for digital operations are encouraging industries to invest in reliable surge protection.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)