India Surface Treatment Chemicals Market Size, Share, Trends and Forecast by Chemicals Type, Base Material, End-User Industry, and Region, 2026-2034

India Surface Treatment Chemicals Market Overview:

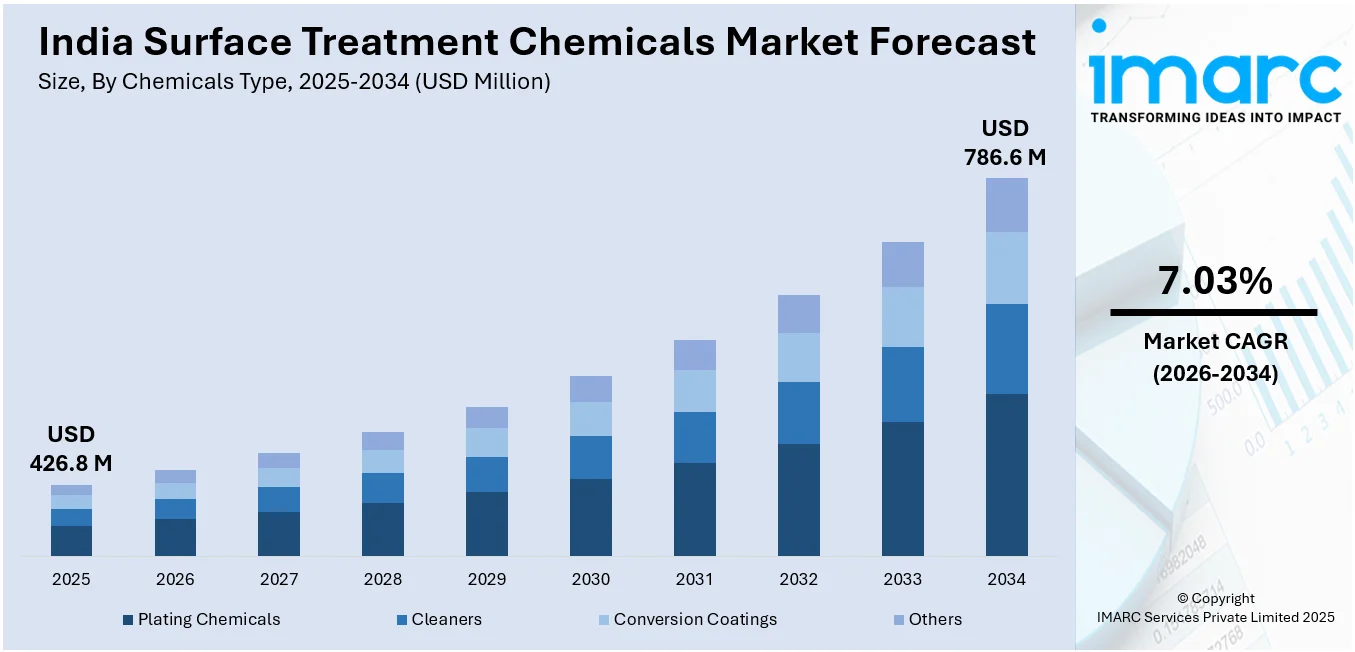

The India surface treatment chemicals market size reached USD 426.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 786.6 Million by 2034, exhibiting a growth rate (CAGR) of 7.03% during 2026-2034. The India surface treatment chemicals market is growing with increasing demand for corrosion protection, environmental-friendly coatings, and high-tech finishing solutions. Similarly, industrialization, regulatory requirements, and sustainability efforts are driving growth, compelling manufacturers to use low-VOC, high-performance coatings in automotive, construction, and electronics applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 426.8 Million |

| Market Forecast in 2034 | USD 786.6 Million |

| Market Growth Rate 2026-2034 | 7.03% |

India Surface Treatment Chemicals Market Trends:

Rising Demand for Corrosion Protection

The Indian market is seeing significant growth driven by the growing demand for corrosion-resistant coatings in industries like automotive, aerospace, and construction. Moreover, industries are investing in long-lasting protective solutions to prolong the lifespan of metals and alloys with speedy industrialization and infrastructure growth. Heavy machinery, transport equipment, and construction materials need advanced chemical treatment to resist rough environmental conditions, moisture, and chemical exposure. Manufacturers are moving towards high-performance coatings that offer long-term durability and lower maintenance expenses. The increasing focus on product reliability and operating efficiency is also driving demand. New market trends reflect the introduction of high-performance anti-corrosion coatings with improved adhesion, wear resistance, and eco-friendly formulations. Demand for chromate-free and low-VOC surface treatment chemicals is increasing as companies focus on meeting strict environmental regulations. Government initiatives promoting sustainable production and industrial development are also motivating investment in R&D for future corrosion protection technology. As companies look for durable and economical solutions, the use of advanced protective coatings keeps on rising.

To get more information on this market, Request Sample

Growing Adoption of Eco-Friendly Coatings

Sustainability concerns are reshaping the Indian market towards green coatings. Water-based alternatives, bio-based coatings, and heavy metal-free coatings are increasingly being used in place of toxic chemicals to adhere to changing environmental norms. Low-VOC emissions and industrial waste reduction efforts are compelling companies to innovate high-performance, sustainable surface treatments for automotive, electronic, and industrial equipment applications. Firms are incorporating high-performance formulations for better adhesion, durability, and corrosion resistance while meeting stringent environmental regulations at lower costs. New developments in nanotechnology-based surface treatments are picking up, providing self-cleaning, anti-fouling, and wear-resistant characteristics. Furthermore, the increasing emphasis on energy-efficient coatings is creating the demand for heat-reflective and UV-resistant formulations that improve durability and environmental performance. Firms are putting money into research and development to create future-generation protective coatings with more performance and adherence to stringent sustainability standards. The incorporation of recyclable materials and sustainable raw materials is leading the market's future.

India Surface Treatment Chemicals Market Segmentation

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on chemicals type, base material, and end-user industry.

Chemicals Type Insights:

- Plating Chemicals

- Cleaners

- Conversion Coatings

- Others

The report has provided a detailed breakup and analysis of the market based on the chemicals type. This includes plating chemicals, cleaners, conversion coatings, and others.

Base Material Insights:

- Metals

- Plastic

- Others

The report has provided a detailed breakup and analysis of the market based on the base material. This includes metals, plastic, and others.

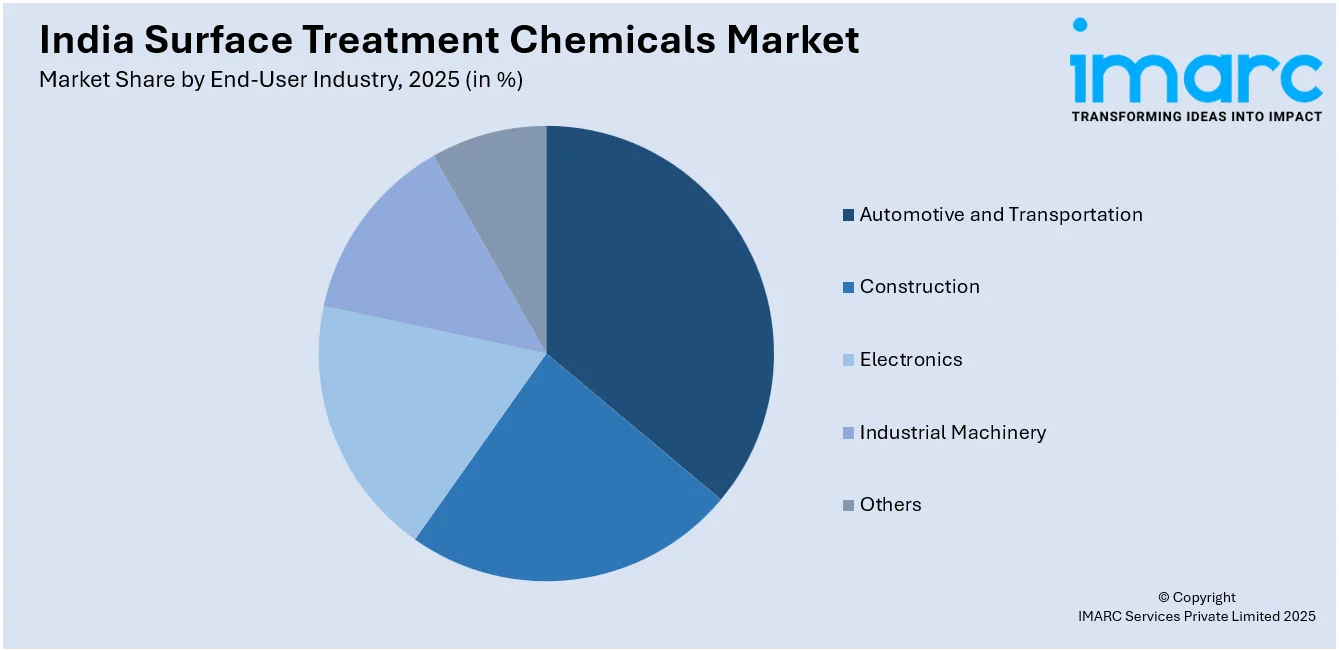

End-User Industry Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Automotive and Transportation

- Construction

- Electronics

- Industrial Machinery

- Others

A detailed breakup and analysis of the market based on the end-user industry have also been provided in the report. This includes automotive and transportation, construction, electronics, industrial machinery, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Surface Treatment Chemicals Market News

- July 2024: Henkel expanded its surface treatment chemicals footprint in India by investing in its Kurkumbh manufacturing facility. The new Loctite plant enhances local production, reduces import dependency, and supports automotive, MRO, and industrial applications. This strengthens supply chains, accelerates Industry 4.0 adoption, and boosts market growth.

- November 2024: The India surface treatment & finishing expo is set to showcase advancements in surface treatment chemicals, including anti-corrosion solutions, protective coatings, and chemical finishing technologies. This event is expected to drive innovation, industry collaboration, and market expansion, enhancing product durability, manufacturing efficiency, and compliance with evolving environmental regulations.

India Surface Treatment Chemicals Market Report Coverage

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Chemicals Types Covered | Plating Chemicals, Cleaners, Conversion Coatings, Others |

| Base Materials Covered | Metals, Plastic, Others |

| End-User Industries Covered | Automotive and Transportation, Construction, Electronics, Industrial Machinery, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India surface treatment chemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the India surface treatment chemicals market on the basis of chemicals type?

- What is the breakup of the India surface treatment chemicals market on the basis of base material?

- What is the breakup of the India surface treatment chemicals market on the basis of end-user industry?

- What are the various stages in the value chain of the India surface treatment chemicals market?

- What are the key driving factors and challenges in the India surface treatment chemicals market?

- What is the structure of the India surface treatment chemicals market and who are the key players?

- What is the degree of competition in the India surface treatment chemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India surface treatment chemicals market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India surface treatment chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India surface treatment chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)