India Superfoods Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2026-2034

India Superfoods Market Size and Share:

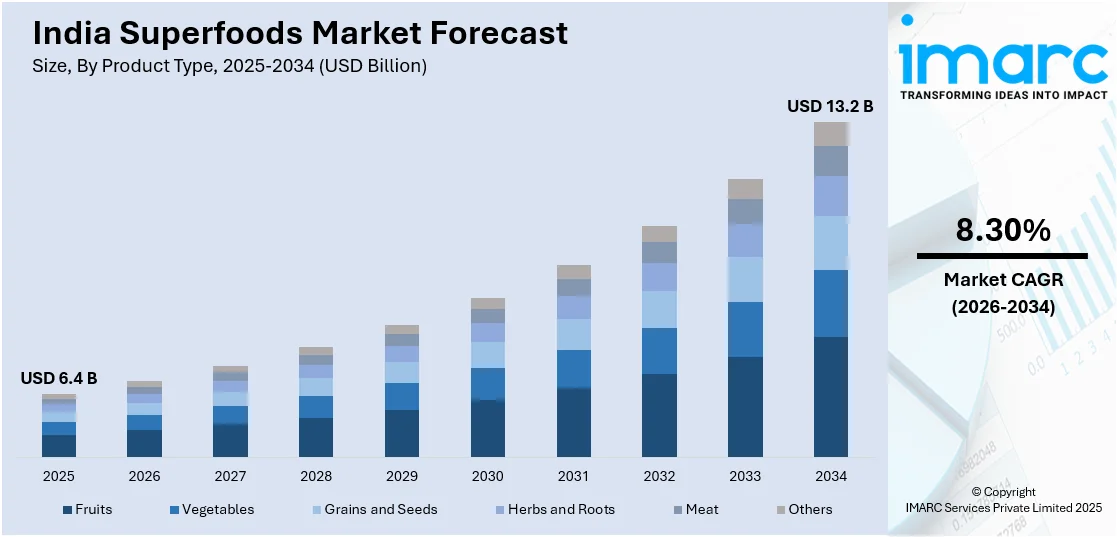

The India superfoods market size was valued at USD 6.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 13.2 Billion by 2034, exhibiting a CAGR of 8.30% from 2026-2034. The India superfoods market share is growing due to the rising health consciousness among the masses, inflating consumer disposable incomes, and increased digital influence pushing the benefits of superfoods across a broad and connected audience all over the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 6.4 Billion |

|

Market Forecast in 2034

|

USD 13.2 Billion |

| Market Growth Rate (2026-2034) | 8.30% |

The India superfoods market growth is attributed to the growing health consciousness among consumers. Increasing knowledge about the nutritional importance of superfoods such as quinoa, chia seeds, and moringa has motivated them to include superfoods in their diet. Additionally, the emphasis on preventive care, due to increasing lifestyle disorders such as diabetes and hypertension, has further spurred demand. Besides that, urbanization and increased disposable incomes have even opened premium, health-driven products to a more substantial part of the population. The World Bank Group states that India is urbanizing very fast and that, by 2036, towns and cities will accommodate 600 Million people, or 40%, of its total population. This urban growth is encouraging a trend toward more modern diets, with superfoods being one of the preferred options for health-conscious urban dwellers.

To get more information on this market Request Sample

The role of social media and influencers in marketing superfoods as trendy, healthy options have also played a critical role in shaping the India superfoods market trend. The government's efforts toward healthier living through initiatives such as "Eat Right India" have also provided a conducive environment for the adoption of superfoods. Innovation and diversification of the superfood industry are the primary drivers. The domestic brands have been launching many different types of superfoods available in ready-to-eat formats, powders, and beverage forms. Consumers' increasing propensity to consume a convenient lifestyle amidst urban life has contributed to the growth. The integration of old Indian superfoods, turmeric, amla, and millet into a modern diet has further contributed toward market growth. Increased export opportunities and strategic partnerships have also made India a hub for the production and consumption of superfoods.

India Superfoods Market Trends:

Popularity of plant-based and vegan superfoods

The plant-based diet and veganism trends have greatly influenced the Indian superfoods market, pushing demand for plant-based alternatives for protein and nutrition. Health, environmental, and ethical considerations are making consumers seek out superfoods such as quinoa, chia seeds, and flaxseeds, which are excellent sources of plant-based protein and omega-3 fatty acids. Brands are responding to this trend by launching innovative products, such as dairy-free almond milk fortified with moringa and vegan protein powders, to cater to this growing market segment. This shift is particularly prominent among the younger demographic, which is more conscious of its environmental footprint and actively seeks sustainable dietary choices. This momentum is reflected in India's vegan food market, which reached US$ 1,468.3 Million in 2024. The IMARC Group estimates that this market will grow at a tremendous rate, reaching US$ 3,474.8 Million by 2033. Manufacturers have been compelled to innovate products and expand offerings to make them accessible and affordable to a wider audience due to the growing plant-based movement. This dual focus on sustainability and inclusivity has positioned the plant-based and vegan segment as a critical driver for boosting the Indian superfoods demand.

Blending traditional ingredients with modern formats

The most significant trend in the Indian superfoods market is the blending of traditional ingredients with modern formats. Traditional Indian superfoods such as turmeric, amla, moringa, and millet are now reimagined in the form of powders, capsules, energy bars, and infused beverages. This combination is attractive to consumers who seek the health benefits of heritage ingredients and prefer the convenience of modern packaging. Brands are innovating to create hybrid products, such as turmeric lattes and millet-based pasta, catering to urban lifestyles. Moreover, the trend benefits from increasing interest in Ayurvedic and traditional treatments aside from acceptance of Indian superfoods. This aspect of regional and green products provided by indigenous superfoods complements Indian superfood demands.

E-commerce and social media impact

With premium superfoods being made accessible by e-commerce platforms and D2C brands, the convenience, variety, and information on products increase the trust for purchasing through an online platform. Social media and influencers have amplified the importance of superfoods for fitness, weight management, and general wellness, driving demand. Moreover, the growth of e-commerce in India is playing a key role in this shift. According to the India Brand Equity Foundation, Indian e-commerce is expected to grow at a CAGR of 27% up to US$ 163 Billion by 2026. This growth has expanded digital marketplaces, allowing superfoods to penetrate smaller cities and towns broadly. Innovative offerings such as superfood subscription boxes and curated health bundles further engage consumers, keeping in line with modern preferences for personalization and convenience. The superfoods industry has capitalized on digital platforms to bridge geographical gaps and make itself widely accessible to diverse demographics, in addition to enhancing its position in the health and wellness movement.

India Superfoods Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India superfoods market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type, application, and distribution channel.

Analysis by Product Type:

- Fruits

- Vegetables

- Grains and Seeds

- Herbs and Roots

- Meat

- Others

There has been an increasing fruit demand for berry, amla, avocado, and pomegranate due to their richness in antioxidants, vitamins, and minerals, all becoming staples for smoothies, desserts, and functional beverages. Moreover, nutrient-dense vegetables like kale, broccoli, and spinach are sought after for their variety and richness and often find themselves in soups, salads, and juices. Grains and seeds such as quinoa, chia, flaxseeds, and millets are being used increasingly due to their high fiber, protein, and essential fatty acid content and have become staples in breakfast cereals, health bars, and bakery products. Ministry of Agriculture & Farmers Welfare states that the total Kharif food grain production for 2024-25 has been estimated at 1647.05 Lakh Metric Tonnes (LMT), up by 89.37 LMT from last year's statistic, showing healthy agricultural production to service growing demand. Herbs and roots such as turmeric, ginger, ashwagandha, and moringa continue to be in high demand, given the medicinal importance these hold in immunity-boosting supplements or drinks. Meanwhile, meat-based superfoods include lean meats, eggs, and fish such as salmon that address consumer demand for high-protein diets and muscle-building goals, as widely sought after by athletes and fitness enthusiasts.

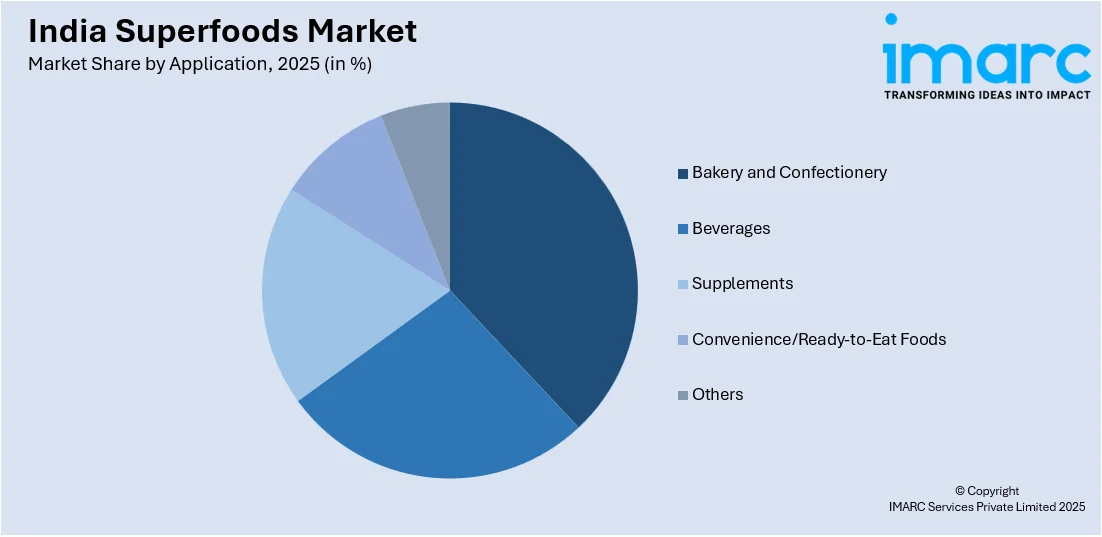

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Bakery and Confectionery

- Beverages

- Supplements

- Convenience/Ready-to-Eat Foods

- Others

Bakery and confectionery products with superfoods like cookies, muffins, bread, and granola bars will address the growing demand for functional food. Be it superfood-infused tea, green juice, plant-based milk, or a smoothie, the consumer demands convenience and refreshment, along with meeting their health objectives, with these functional drinks. Supplements are available in form of capsule, powder, gummies, and effervescent tablet formats, which has given consumers a quick way to bring in nutrients and adaptogens. Convenience/ready-to-eat foods, such as superfood-packed salads, soups, and meal kits, address the busy lifestyle of urban consumers who seek ready nutrition very quickly. According to the India Brand Equity Foundation, the ready-to-eat market in India is expected to increase by about 45% over the next five years from 2024 and will continue to drive the segment's growth. This expansion is through innovation in packaging and flavor profiles, making these products more appealing to a broad spectrum of age groups and dietary needs.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Independent Small Grocery Stores

- Online Sales

- Others

Supermarkets and hypermarkets are among the key distribution hubs, offering a wide array of superfoods alongside promotional discounts, attracting urban and suburban shoppers. Convenience stores serve the growing demand for quick, on-the-go purchases, especially for superfood snacks, juices, and single-serve items. Specialty retail offers choices to health-conscious and superfood enthusiasts who expect high-quality products to be available in specialty settings with expert help and curation. Independent, smaller grocery stores remain an important store channel in more rural and semi-urban environments, selling products such as locally sourced millets, turmeric, and amla for the regional marketplace. Online is also growing exponentially as customers get a smoother experience on various e-commerce and D2C websites with exhaustive information about their products and the convenience of doorstep delivery. The digital channel also supports wider reach, from urban cities to the far-flung, through discounts and subscription-based models for continuous consumer engagements.

Regional Analysis:

- South India

- North India

- West and Central India

- East India

South India has a substantial market, as the region highly depends on traditional superfoods such as millet, coconut, and moringa, besides a strong preference for Ayurveda-based products. According to the India Brand Equity Foundation, NirogStreet's survey suggests that the Ayurveda products market in India will reach US$ 16.27 Billion by FY28, which is an indication of the growing dominance of Ayurveda-based superfoods in the country. Production and consumption are significantly dominated by states like Tamil Nadu and Karnataka. North India has strong growth that is driven by the urban centers, particularly Delhi and Chandigarh, where health awareness and lifestyle shifts are strong. The region also reflects growing interest in immunity-boosting and weight-management superfoods. West and Central India, including Maharashtra, Gujarat, and Madhya Pradesh, contributes highly due to a large urban population, higher disposable incomes, and a trend toward fitness-oriented lifestyles. The availability of diverse superfood products in cities like Mumbai and Pune drives regional demand. East India is an emerging market with increasing interest in indigenous superfoods like black rice, jackfruit, and locally sourced herbs. Increasing the penetration of online platforms and the promotion of government initiatives toward agricultural development continue to foster growth in this region.

Competitive Landscape:

Indian superfoods market players are increasingly innovating, diversifying products, and entering strategic partnerships to corner a greater share of the expanding market. Most brands are now introducing new formats in ready-to-eat meals, snacks, beverages, and supplements as consumers are evolving in terms of convenience and health. The most significant trend is the integration of Indian traditional superfoods such as moringa, turmeric, and amla into modern products, where local knowledge blends with contemporary trends. All these product contributions exemplify the dynamic nature of growth in this sector. Players are also forming collaborations with e-commerce platforms and expanding their online presence to tap into the growing digital consumer base. Sustainability practices, such as eco-friendly packaging and organic sourcing, are becoming key differentiators, aligned with consumer expectations for health-focused and environmentally conscious products. These efforts are providing a positive India superfood market outlook.

The report provides a comprehensive analysis of the competitive landscape in the India superfoods market with detailed profiles of all major companies.

Latest News and Developments:

- On November 2024, Ramoji Group launched Sabala Millets-Bharat Ka Super Food on the 88th birth anniversary of Ramoji Rao at Ramoji Film City, Hyderabad. The brand launched 45 millet-based superfood products, including cookies, health bars, and noodles, promoting wholesome and innovative nutrition.

- In August 2024, Tropicool, a superfood brand hailing from Brazil, expanded further in India with Tropicool Açai and Café-a focus on Gen Z and millennials. Already at 11 outlets and proposing franchises in Pune and Bangalore, the brand created its menu especially to suit the Indian palate for ₹15 crores in fiscal year-end sales.

- On September 2024, Tata Soulfull has launched Masala Muesli, a savory version of traditional muesli, in two flavors: Mast Masala and Teekha Twist. With 16% millet, the baked, preservative-free cereal is ready to hit Indian taste buds, and it can be consumed with curd. This innovative product has redefined breakfast cereals as a wholesome, spiced option.

- On October 2024, Danta Herbs launched Japanese matcha blended with superfoods like turmeric, tulsi, ashwagandha, and mint moringa to enhance health benefits. Sourced from Shizuoka, Japan, the blends combine authentic matcha with Indian ingredients. Founded by Vishal and Tripti Parik, the brand emphasized artisanal, high-quality teas shipped directly from the source.

India Superfoods Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fruits, Vegetables, Grains and Seeds, Herbs and Roots, Meat, Others |

| Applications Covered | Bakery and Confectionery, Beverages, Supplements, Convenience/Ready-to-Eat Foods, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Independent Small Grocery Stores, Online Sales, Others |

| Regions Covered | South India, North India, West and Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India superfoods market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India superfoods market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India superfoods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India superfoods market was valued at USD 6.4 Billion in 2025.

The India superfoods market share is growing due to the rising health consciousness among the masses, inflating consumer disposable incomes, and increased digital influence pushing the benefits of superfoods across a broad and connected audience all over the country.

IMARC estimates the India superfoods market to exhibit a CAGR of 8.30% during 2026-2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)