India Sunflower Oil Market Size, Share, Trends and Forecast by Type, Packaging Type, Pack Size, Domestic Manufacturing/Imports, Application, Distribution Channel, and Region, 2026-2034

India Sunflower Oil Market Summary:

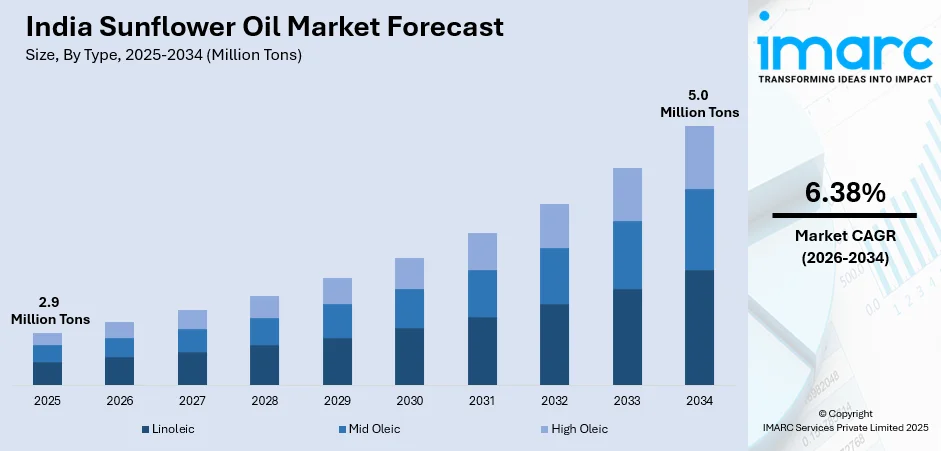

The India sunflower oil market size reached 2.9 Million Tons in 2025 and is projected to reach 5.0 Million Tons by 2034, growing at a compound annual growth rate of 6.38% from 2026-2034.

The India sunflower oil market is witnessing expansion owing to the increasing health consciousness among consumers and the growing preference for heart-healthy cooking oils. Rising urbanization, evolving dietary patterns, and the shift toward premium fortified edible oils are accelerating market penetration across urban and rural households. The expanding food processing sector, coupled with government initiatives to boost domestic oilseed production, is creating favorable conditions for market participants. Growing awareness about the nutritional benefits of sunflower oil, including its high vitamin E content and low saturated fat levels, continues to strengthen India sunflower oil market share.

Key Takeaways and Insights:

-

By Type: Linoleic dominates the market with a share of 48% in 2025, owing to its widespread availability, cost-effectiveness, and versatile applications in household cooking and food processing industries across India.

-

By Packaging Type: Pouches lead the market with a share of 45% in 2025. This dominance is driven by affordability, lightweight design, convenience for single-use consumption, and strong penetration in both urban and rural retail channels.

-

By Pack Size: 1 Litres - 5 litres represent the biggest segment with a market share of 24% in 2025, reflecting consumer preference for mid-sized packaging that balances value-for-money purchasing with practical household storage requirements.

-

By Domestic Manufacturing/Imports: Domestic manufacturing exhibits a clear dominance in the market with 82% share in 2025, supported by established processing infrastructure, government incentives for local production, and strategic investments by leading edible oil manufacturers.

-

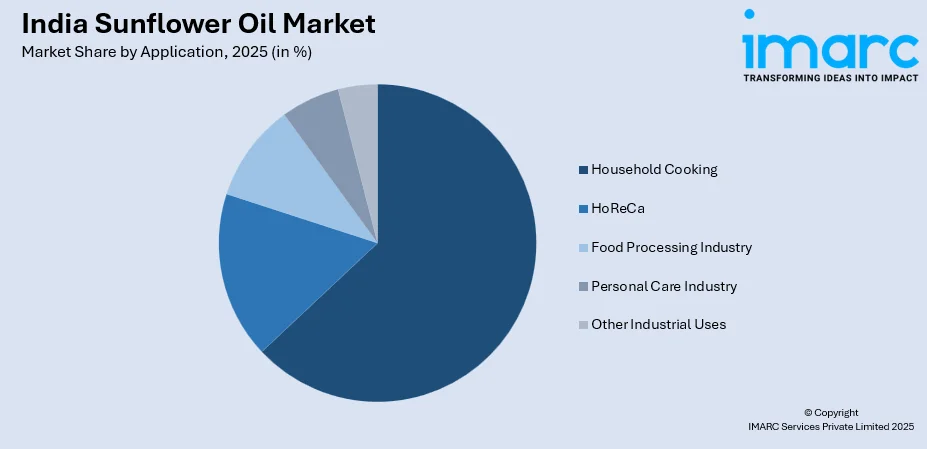

By Application: Household cooking dominates the market with a share of 63% in 2025, owing to the deep-rooted cooking traditions in Indian cuisine and increasing adoption of sunflower oil as a healthier alternative to traditional cooking mediums.

-

By Distribution Channel: Supermarkets and hypermarkets lead the market with 28% share in 2025, driven by organized retail expansion, consumer preference for branded products, and the convenience of one-stop shopping experiences.

-

By Region: West and Central India is the largest region with 34% share in 2025, driven by high population density in Maharashtra and Gujarat, established food processing clusters, and strong consumer awareness about health-conscious cooking oil choices.

-

Key Players: Key players drive the India sunflower oil market by expanding manufacturing capacities, introducing fortified and premium product variants, strengthening distribution networks, and investing in consumer awareness campaigns to build brand loyalty and capture greater market share across diverse consumer segments.

To get more information on this market Request Sample

The India sunflower oil market continues to evolve as health-conscious consumers increasingly prioritize cooking oils that offer nutritional benefits without compromising on taste and versatility. Sunflower oil has emerged as the third most consumed edible oil in India after palm and soybean oil, with demand particularly concentrated in southern and western states. The market is benefiting from the Government's National Mission on Edible Oils – Oilseeds launched in 2024 with a budgetary allocation of INR 10,103 Crore, aimed at boosting domestic oilseed production and achieving self-reliance in edible oils. The rising penetration of e-commerce and quick commerce platforms has transformed distribution dynamics, with major brands expanding their digital presence to cater to convenience-seeking urban consumers. The food processing industry's growing demand for stable, high-quality cooking oils is further propelling India sunflower oil market growth.

India Sunflower Oil Market Trends:

Rising Demand for Heart-Healthy Cooking Oils

The increasing prevalence of cardiovascular diseases and lifestyle-related health conditions is driving consumers toward healthier cooking oil alternatives. Sunflower oil's favorable fatty acid profile, rich vitamin E content, and low saturated fat levels position it as a preferred choice among health-conscious households. The oil's nutritional composition supports cardiovascular wellness while meeting everyday cooking requirements. This growing health awareness is prompting manufacturers to emphasize nutritional benefits in marketing campaigns and product labeling strategies.

Expansion of Organized Retail and E-Commerce Channels

The rapid growth of supermarkets, hypermarkets, and digital retail platforms is reshaping sunflower oil distribution patterns across India. Urban consumers increasingly favor branded products available through organized retail channels that offer quality assurance and competitive pricing. The Indian online grocery market was valued at USD 14.33 Billion in 2025, with staples and cooking essentials driving significant transaction volumes. Quick commerce platforms like Zepto, Blinkit, and Swiggy Instamart are accelerating market accessibility, enabling same-day delivery services that cater to convenience-oriented consumers.

Premium and Fortified Product Innovation

Manufacturers are responding to evolving consumer preferences by introducing premium, fortified, and functional sunflower oil variants. Product innovations include vitamin-enriched formulations, blended oils combining multiple health benefits, and organic cold-pressed variants targeting health-conscious consumers. In November 2025, Gemini Edibles launched a consumer awareness campaign for Freedom Sunflower Oil emphasizing quality standards and accurate quantity labeling. This trend toward product differentiation is enabling brands to command premium pricing while strengthening consumer loyalty in competitive market segments.

Market Outlook 2026-2034:

The India sunflower oil market demonstrates promising growth prospects as consumer preferences continue shifting toward healthier cooking oil alternatives. The market size was estimated at 2.9 Million Tons in 2025 and is expected to reach 5.0 Million Tons by 2034, reflecting a compound annual growth rate of 6.38% over the forecast period 2026-2034. Government initiatives supporting domestic oilseed cultivation and processing infrastructure development are expected to reduce import dependency while strengthening local supply chains. Rising disposable incomes, expanding food service sectors, and increasing penetration of branded products in rural markets will drive sustained demand growth throughout the forecast period.

India Sunflower Oil Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Linoleic |

48% |

|

Packaging Type |

Pouches |

45% |

|

Pack Size |

1 Litres - 5 litres |

24% |

|

Domestic Manufacturing/Imports |

Domestic Manufacturing |

82% |

|

Application |

Household Cooking |

63% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

28% |

|

Region |

West and Central India |

34% |

Type Insights:

- Linoleic

- Mid Oleic

- High Oleic

Linoleic dominates with a market share of 48% of the total India sunflower oil market in 2025.

Linoleic sunflower oil maintains its dominant position due to its widespread availability, affordable pricing, and versatile culinary applications. This oil type offers excellent performance in high-temperature cooking methods preferred in Indian cuisine, including deep frying and sautéing. The balanced fatty acid composition makes it suitable for diverse food preparation techniques while maintaining favorable organoleptic properties. The oil's stability under heat ensures consistent cooking results across various preparation methods commonly employed in Indian households and commercial kitchens. Its light texture and clean finish make it adaptable to both traditional recipes and contemporary culinary innovations gaining popularity among urban consumers.

The consumer preference for linoleic sunflower oil extends across household cooking and commercial food service applications. Its neutral flavor profile ensures compatibility with regional culinary traditions without altering dish characteristics. Major manufacturers have established extensive distribution networks ensuring consistent supply across urban and rural markets. The segment continues benefiting from established consumer familiarity and competitive pricing strategies that position linoleic variants as value-for-money options within the broader edible oil category. Brand loyalty and repeat purchase patterns reinforce market dominance.

Packaging Type Insights:

- Pouches

- Jars

- Cans

- Bottles

Pouches lead with a share of 45% of the total India sunflower oil market in 2025.

Pouches have emerged as the preferred packaging format due to their cost-effectiveness, lightweight construction, and convenience for single-use consumption patterns. The flexible packaging design reduces material costs and transportation expenses, enabling manufacturers to offer competitive retail pricing. Pouch packaging particularly resonates with rural consumers seeking affordable quantities and urban households preferring convenient storage solutions. The format accommodates various volume requirements, allowing consumers to purchase quantities aligned with their consumption frequency and budget constraints. Manufacturers leverage pouch packaging to introduce trial-sized options that encourage product sampling and brand switching among price-sensitive consumer segments seeking quality alternatives.

The growing adoption of stand-up pouches and multi-layer barrier films has enhanced product protection against light, oxygen, and moisture exposure. Manufacturers are increasingly incorporating spill-proof features and improved opening mechanisms to enhance user experience. The segment benefits from strong penetration across traditional retail channels including local grocery stores and general trade outlets that dominate India's retail landscape. Environmental considerations are driving innovation toward biodegradable and recyclable pouch materials aligning with sustainability trends. These advancements address growing consumer environmental consciousness while maintaining packaging functionality.

Pack Size Insights:

- Less than 1 Litres

- 1 Litres

- 1 Litres - 5 litres

- 5 Litres - 10 Litres

- 10 Litres and Above

1 Litres - 5 litres exhibit a clear dominance with a 24% share of the total India sunflower oil market in 2025.

1 Litres - 5 litres category balances value-for-money purchasing with practical household storage requirements. This pack size range appeals to nuclear families and urban households seeking optimal quantity without excessive inventory accumulation. The format enables efficient storage in modern kitchen spaces while providing cost savings compared to smaller single-use packages. Consumer purchasing patterns indicate preference for monthly replenishment cycles supported by this pack size category. The packaging dimensions accommodate standard kitchen cabinet configurations prevalent in contemporary residential designs, enhancing convenience for consumers managing limited storage spaces. Additionally, the pack size aligns with typical household consumption rates, minimizing product wastage while ensuring freshness throughout the usage period.

The segment demonstrates strong performance across organized retail channels where family-sized packs command prominent shelf positioning. Manufacturers offer attractive promotional pricing and bundled deals for mid-sized packs to encourage bulk purchasing behavior. The format supports brand-building efforts through enhanced label visibility and premium packaging designs that communicate product quality attributes. Growing consumer sophistication regarding price-per-unit calculations favors larger pack sizes offering better value propositions. Marketing strategies emphasizing economic benefits continue strengthening segment performance across diverse consumer demographics.

Domestic Manufacturing/Imports Insights:

- Domestic Manufacturing

- Imports

Domestic manufacturing dominates with a market share of 82% of the total India sunflower oil market in 2025.

India's domestic sunflower oil manufacturing infrastructure has expanded significantly through strategic investments by leading edible oil companies. The processing capacity development enables efficient conversion of imported crude oil and domestically produced oilseeds into refined products meeting consumer quality expectations. Major manufacturing facilities are concentrated in Maharashtra, Gujarat, Karnataka, and Andhra Pradesh, positioning production near both raw material sources and consumption centers. The domestic manufacturing advantage includes supply chain control, quality assurance capabilities, and responsive capacity to meet seasonal demand fluctuations. Local processing operations enable rapid response to changing market conditions while reducing dependency on finished product imports subject to international price volatility and logistics uncertainties.

Government policies supporting domestic processing through tariff structures and production incentives have strengthened the manufacturing sector's competitive position. The National Mission on Edible Oils – Oilseeds aims to increase oilseed production from 39 Million Tons to 69.7 Million Tons by 2030-31, potentially expanding domestic raw material availability for sunflower oil production. Manufacturers continue investing in advanced refining technologies, quality control systems, and packaging automation to enhance operational efficiency and product consistency.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Household Cooking

- HoReCa

- Food Processing Industry

- Personal Care Industry

- Other Industrial Uses

Household cooking represents the leading segment with a 63% share of the total India sunflower oil market in 2025.

Household cooking remains the primary consumption driver as sunflower oil integrates seamlessly into diverse Indian culinary traditions. The oil's high smoke point makes it ideal for deep-frying applications common in Indian cuisine, while its neutral flavor profile suits various regional cooking styles. Rising health awareness has prompted households to transition from traditional cooking mediums toward sunflower oil for its perceived cardiovascular benefits. The versatility of sunflower oil accommodates multiple cooking techniques including sautéing, tempering, shallow frying, and salad preparation prevalent across different regional cuisines. Its ability to enhance food texture without overpowering natural flavors makes it particularly suitable for dishes requiring subtle oil presence.

The segment benefits from strong brand awareness campaigns emphasizing health benefits and cooking versatility. Manufacturers have developed region-specific marketing strategies addressing local taste preferences and cooking practices. The expanding middle-class population with increasing disposable incomes continues driving premiumization trends within household consumption patterns. Consumer education initiatives highlighting proper storage practices and cooking techniques support sustained demand growth. Intergenerational knowledge transfer regarding cooking oil selection reinforces brand preferences and consumption habits established within family networks across successive generations.

Distribution Channel Insights:

- Direct/Institutional Sales

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Supermarkets and hypermarkets exhibit a clear dominance with a 28% share of the total India sunflower oil market in 2025.

Supermarkets and hypermarkets have established market leadership in India's sunflower oil distribution through extensive product assortments, competitive pricing strategies, and enhanced shopping experiences. These organized retail formats provide consumers with opportunities to compare multiple brands and variants within controlled environments, facilitating informed purchasing decisions. The expansion of modern retail chains beyond metropolitan centers into tier-2 and tier-3 cities has significantly increased accessibility for suburban and semi-urban consumers. Strategic store placements in high-traffic commercial areas and residential neighborhoods ensure convenient access while promotional offers and loyalty programs strengthen consumer engagement and repeat purchasing behavior.

The channel benefits from sophisticated inventory management systems, improved supply chain logistics, and dedicated shelf space allocations that enhance product visibility and availability. Private label offerings introduced by major retail chains have expanded consumer choice while intensifying competitive dynamics within the segment. Promotional partnerships between sunflower oil manufacturers and retailers drive trial purchases and brand switching among value-seeking consumers. The integration of omnichannel strategies connecting in-store experiences with digital platforms continues strengthening market positioning. Modern retail formats increasingly incorporate technology-enabled solutions including self-checkout systems and mobile payments that streamline transactions and enhance overall consumer convenience.

Regional Insights:

- North India

- West and Central India

- East India

- South India

West and Central India comprises the largest region with 34% share of the total India sunflower oil market in 2025.

West and Central India demonstrates market leadership through a combination of high population density, established food processing infrastructure, and strong consumer awareness regarding health-conscious cooking oil choices. Maharashtra and Gujarat serve as major consumption and processing hubs with extensive manufacturing facilities and distribution networks. The region's diverse culinary traditions accommodate sunflower oil across various cooking applications from household consumption to commercial food service operations. The presence of major port facilities enables efficient import logistics for crude oil supplies supporting regional processing operations. Additionally, the established industrial ecosystem facilitates backward and forward integration opportunities for manufacturers seeking operational efficiencies and supply chain optimization.

The concentration of quick service restaurants, organized retail chains, and food processing units in metropolitan areas drives substantial commercial demand. Regional manufacturers have established strong distribution networks penetrating both urban centers and rural markets. The progressive urbanization patterns and rising middle-class populations in these states continue supporting market expansion. Consumer preference for branded products and quality-certified edible oils creates favorable conditions for premium product positioning. Cultural openness toward adopting healthier cooking alternatives accelerates sunflower oil acceptance across traditional and modern household segments throughout the region.

Market Dynamics:

Growth Drivers:

Why is the India Sunflower Oil Market Growing?

Government Initiatives Supporting Domestic Oilseed Production

The Indian Government has implemented comprehensive policy frameworks to reduce import dependency and strengthen domestic edible oil production capabilities. The import duty structure has been calibrated to protect domestic producers while managing consumer price impacts. In September 2024, import duties on crude edible oils including sunflower were raised from nil to 20%, making the effective duty 27.5%. These protective measures encourage local cultivation and processing investment while the government simultaneously supports farmers through Minimum Support Price mechanisms under the Pradhan Mantri Annadata Aay Sanrakshan Abhiyan. The comprehensive approach addresses supply chain vulnerabilities while building long-term domestic production capacity.

Rising Health Consciousness and Lifestyle Changes

Growing awareness about cardiovascular health, obesity prevention, and lifestyle disease management is fundamentally reshaping consumer preferences toward healthier cooking oil alternatives. Sunflower oil's nutritional profile, featuring high vitamin E content and favorable polyunsaturated fatty acid composition, positions it as a preferred choice among health-conscious households. Indian consumers increasingly prioritize oils with lower saturated fat content, creating sustained demand for sunflower oil across demographic segments. Urbanization and exposure to health information through digital media have accelerated awareness about cooking oil quality and nutritional impacts. Manufacturers have responded by introducing fortified variants enriched with omega-3, vitamins, and natural antioxidants to meet evolving consumer expectations. The premium segment targeting health-conscious consumers continues expanding as rising disposable incomes enable trade-up purchasing behavior. Consumer education initiatives by industry associations and health organizations support informed decision-making regarding cooking oil selection.

Expansion of Food Processing and Foodservice Industries

The rapid growth of India's food processing sector and expanding foodservice industry are creating substantial commercial demand for high-quality sunflower oil. Quick service restaurants, cloud kitchens, and packaged food manufacturers require cooking oils offering consistent quality, stability at high temperatures, and neutral flavor profiles. The expansion of organized foodservice beyond metropolitan areas into tier-2 and tier-3 cities broadens the commercial consumption base. The food processing industry's growth trajectory, supported by government initiatives including production-linked incentives and infrastructure development schemes, drives institutional demand. Sunflower oil's versatility in various food preparation applications from frying to baking makes it a preferred choice for commercial operations. The segment benefits from bulk purchasing arrangements, dedicated supply contracts, and technical support services from manufacturers. Industry consolidation and quality standardization efforts continue strengthening commercial channel development.

Market Restraints:

What Challenges the India Sunflower Oil Market is Facing?

High Import Dependency and Supply Chain Vulnerabilities

Despite domestic manufacturing capabilities, India remains heavily dependent on imports for sunflower oil supplies. The country relies primarily on Russia, Ukraine, and Argentina for crude sunflower oil supplies, creating exposure to geopolitical disruptions and international price volatility. Supply chain uncertainties arising from Black Sea region conflicts and global logistics challenges have impacted price stability and supply consistency in recent years.

Price Volatility and Consumer Sensitivity

Sunflower oil prices in India have experienced significant fluctuations driven by elevated import costs, currency depreciation, and global supply constraints. The persistent price volatility reflects dependency on international markets and vulnerability to geopolitical developments affecting major exporting regions. Price-sensitive consumer segments may shift toward more affordable alternatives including palm oil and mustard oil during periods of elevated sunflower oil pricing. The competitive dynamics within the edible oil category intensify pricing pressures on manufacturers, compelling them to balance margin preservation with market share retention across diverse consumer segments.

Competition from Alternative Cooking Oils

The Indian edible oil market features intense competition among multiple oil types including palm, soybean, mustard, groundnut, and rice bran oils. Regional preferences strongly influence consumption patterns, with mustard oil dominating in northern states and coconut oil preferred in southern regions. Palm oil's significant price advantage attracts cost-conscious consumers despite health perception challenges. The competitive landscape requires continuous investment in marketing, distribution, and product differentiation to maintain market positioning.

Competitive Landscape:

The India sunflower oil market features a competitive environment characterized by established domestic manufacturers and multinational players leveraging diverse product portfolios and extensive distribution networks. Key market participants focus on brand differentiation through quality positioning, health-benefit communication, and innovative packaging solutions. Strategic investments in manufacturing capacity expansion, supply chain optimization, and marketing campaigns support market share development. Competition intensifies around price points, promotional activities, and shelf space optimization across retail channels. Industry consolidation through mergers, acquisitions, and strategic partnerships continues reshaping competitive dynamics as players seek scale advantages and portfolio diversification.

India Sunflower Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD, Million Tons |

| Segment Coverage |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type Covered | Linoleic, Mid Oleic, High Oleic |

| Packaging Type Covered | Pouches, Jars,Cans, Bottles |

| Pack Size Covered | Less than 1 Litres, 1 Litres, 1 Litres - 5 litres, 5 Litres - 10 Litres, 10 Litres and Above |

| Domestic Manufacturing/Imports Covered | Domestic Manufacturing, Imports |

| Application Covered | Household Cooking, HoReCa, Food Processing Industry, Personal Care Industry, Other Industrial Uses |

| Distribution Channel Covered | Direct/Institutional Sales, Supermarkets and Hypermarkets, Convenience Stores, Online, Others |

| Region Covered | North India, West and Central India, East India, South India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India sunflower oil market reached a volume of 2.9 Million Tons in 2025.

The India sunflower oil market is expected to grow at a compound annual growth rate of 6.38% from 2026-2034 to reach 5.0 Million Tons by 2034.

Linoleic, holding the largest market share of 48%, remains the dominant type due to its widespread availability, cost-effectiveness, versatile culinary applications, and established consumer preference across Indian households and commercial segments.

Key factors driving the India sunflower oil market include government support for domestic oilseed production, rising health consciousness among consumers, expanding food processing and foodservice sectors, increasing urbanization, and growing penetration of organized retail channels.

Major challenges include high import dependency creating supply vulnerabilities, price volatility due to global market fluctuations, intense competition from alternative cooking oils, currency depreciation impacting import costs, and infrastructure constraints in domestic oilseed cultivation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)