India Structured Cabling Market Size, Share, Trends and Forecast by Product Type, Wire Category, Application, Vertical, and Region 2026-2034

India Structured Cabling Market Summary:

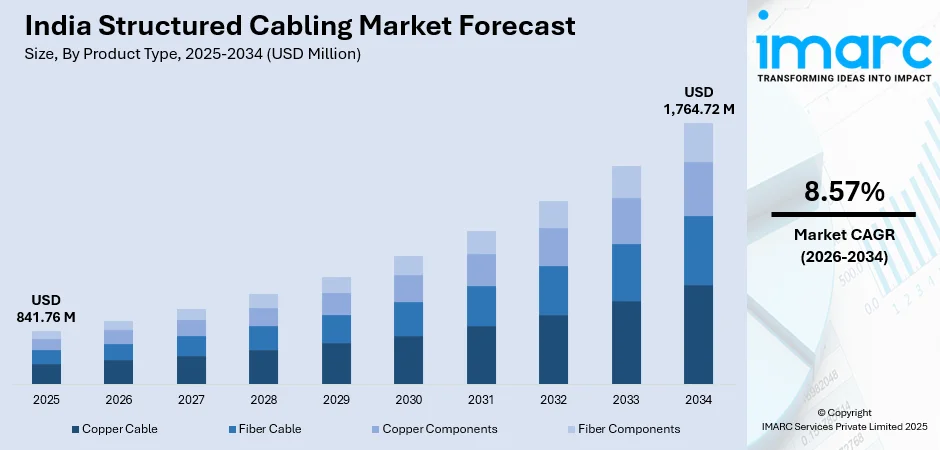

The India structured cabling market size was valued at USD 841.76 Million in 2025 and is projected to reach USD 1,764.72 Million by 2034, growing at a compound annual growth rate of 8.57% from 2026-2034.

The India structured cabling market is witnessing growth driven by rapid digital transformation across enterprise and government sectors. Accelerating investments in data center infrastructure, widespread deployment of fifth-generation network technologies, and the growing adoption of intelligent building management (IBM) systems are reshaping connectivity requirements. The proliferation of cloud computing services, increasing internet penetration across urban and rural regions, and favorable government initiatives promoting digital infrastructure development are strengthening the market growth. Enhanced focus on modernizing legacy network systems, rising demand for high-bandwidth applications, and the emergence of smart city projects are creating substantial opportunities for structured cabling solutions across diverse verticals, contributing to the market growth.

Key Takeaways and Insights:

- By Product Type: Copper cable dominates the market with a share of 38% in 2025, driven by cost-effectiveness for short-distance data transmission, widespread compatibility with existing network infrastructure, and established installation expertise across commercial and industrial facilities supporting diverse enterprise connectivity requirements.

- By Wire Category: Category 6 leads the market with a share of 35% in 2025, owing to its optimal balance between performance capabilities and cost considerations, supporting gigabit ethernet applications and providing adequate bandwidth for most commercial networking requirements.

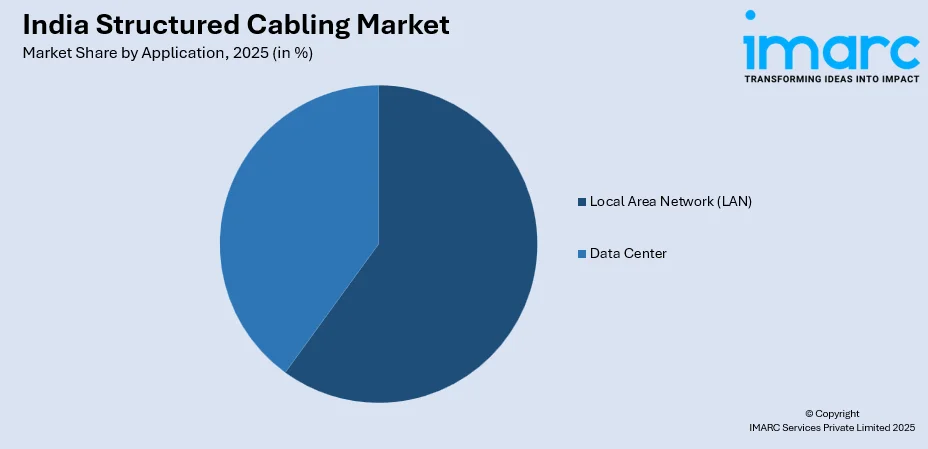

- By Application: Local area network (LAN) represents the largest segment with a market share of 60% in 2025. This dominance reflects the fundamental role of LAN infrastructure in connecting enterprise devices, enabling seamless internal communications, and supporting mission-critical business operations across organizations.

- By Vertical: IT and telecommunications dominate the market with a share of 34% in 2025, due to continuous expansion of network infrastructure, rising demand for high-speed connectivity solutions, and increasing investments in communication technology upgrades.

- Region: South India leads the market with a share of 26% in 2025, influenced by a strong concentration of IT parks, data centers, and technology driven enterprises.

- Key Players: The India structured cabling market exhibits moderate competitive intensity, with multinational technology corporations competing alongside regional manufacturers across product categories and distribution channels.

To get more information on this market Request Sample

The Indian structured cabling market represents a critical enabler of the nation’s digital transformation, providing the underlying infrastructure for enterprise connectivity, telecommunications networks, and emerging technology deployments. Market growth is closely aligned with India’s accelerating digitization, reflected in rising data usage, wider cloud adoption, and increasing employment of connected devices across commercial, industrial, and residential sectors. This momentum is reinforced by rapid telecom infrastructure expansion. According to the Telecom Regulatory Authority of India Annual Report 2024–25, as of 28 February 2025, telecom service providers had installed 4.69 lakh 5G base transceiver stations nationwide, with nearly 25 crore mobile subscribers already using 5G services, marking one of the fastest 5G rollouts globally. Such scale and speed of network deployment are intensifying requirements for reliable, high-capacity internal connectivity within data centers, offices, and access networks. As digital services expand and performance expectations rise, structured cabling remains essential for ensuring network stability, scalability, and long-term operational efficiency across India’s evolving digital ecosystem.

India Structured Cabling Market Trends:

Accelerated 5G Network Deployment

The rapid rollout of 5G wireless networks across India is catalyzing the demand for advanced structured cabling solutions to support expanding network backhaul infrastructure. Telecommunications operators require high-capacity fiber connectivity between base stations and core networks to deliver low latency and high bandwidth services. According to the Economic Survey 2025, 5G services were launched across all states and union territories by October 2024, with coverage in 779 of 783 districts supported by more than 460,000 deployed 5G base transceiver stations. Government efforts to extend 5G into rural and semi urban regions are further increasing requirements for robust cabling systems capable of handling higher data throughput while maintaining signal integrity over long distances.

Smart City Development

Accelerating smart city initiatives across India are driving the demand for structured cabling infrastructure to support integrated urban communication networks. For example, in 2025, Vingroup signed a USD 3 Billion MoU with the Telangana government to develop a comprehensive smart city and electric vehicle ecosystem, including a 1,080-hectare Vinhomes Smart City project. Such large-scale developments highlight the need for scalable and reliable connectivity. As urban infrastructure projects expand, municipalities and developers increasingly invest in standardized structured cabling solutions that support long term connectivity across residential, commercial, and public environments.

Expansion of Digital Infrastructure and Data Centers

Rapid expansion of digital infrastructure across India is a key factor influencing the structured cabling market, supported by the growing demand for data centers, cloud services, and enterprise networks. These environments require reliable, high-performance cabling to manage large data volumes and ensure uninterrupted connectivity. In 2025, Equinix launched its first data center in Chennai with an initial investment of USD 69 Million, offering 800 cabinets in the first phase and plans to scale to 4,250 cabinets, interconnected with its Mumbai campus. Such developments highlight the rising demand for standardized, scalable, and high bandwidth structured cabling solutions across commercial and industrial facilities.

Market Outlook 2026-2034:

The India structured cabling market demonstrates strong growth potential during the forecast period, supported by sustained investment in digital infrastructure and rising connectivity needs across commercial, industrial, and residential sectors. The market generated a revenue of USD 841.76 Million in 2025 and is projected to reach a revenue of USD 1,764.72 Million by 2034, growing at a compound annual growth rate of 8.57% from 2026-2034. Expanding data centers, smart buildings, and enterprise networks, along with increasing adoption of high-speed communication systems, are expected to drive the market demand.

India Structured Cabling Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Copper Cable |

38% |

|

Wire Category |

Category 6 |

35% |

|

Application |

Local Area Network (LAN) |

60% |

|

Vertical |

IT and Telecommunications |

34% |

|

Region |

South India |

26% |

Product Type Insights:

- Copper Cable

- Fiber Cable

- Copper Components

- Fiber Components

Copper cable dominates with a market share of 38% of the total India structured cabling market in 2025.

Copper cable holds the biggest market share due to its cost effectiveness, ease of installation, and wide compatibility with existing network infrastructure. It is commonly used for voice, data, and power transmission across commercial and residential buildings.

Its dominance is further supported by strong availability, established standards, and lower maintenance requirements compared to alternative solutions. Copper cabling offers reliable performance for short to medium distance connectivity, making it a preferred choice for enterprises and data networks.

Wire Category Insights:

- Category 5e

- Category 6

- Category 6A

- Category 7

Category 6 leads with a market share of 35% of the total India structured cabling market in 2025.

Category 6 dominates the market owing to its ability to support higher data transfer speeds and improved bandwidth performance. It meets the growing demand for reliable connectivity across offices, data centers, and commercial buildings adopting high speed networks.

Its dominance is also driven by compatibility with existing Ethernet standards and cost efficiency compared to higher categories. Category 6 cabling offers reduced crosstalk and better signal quality, making it suitable for modern enterprise networking requirements.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Data Center

- Local Area Network (LAN)

Local area network (LAN) exhibits a clear dominance with a 60% share of the total India structured cabling market in 2025.

Local area network (LAN) represents the largest segment, driven by its widespread deployment across offices, educational institutions, healthcare facilities, and commercial buildings. For example, in 2025, CommScope partnered with Nokia to integrate next generation optical LAN into Ruckus platforms, enhancing enterprise networking efficiency in sectors like hospitality, education, and campus networks. LAN infrastructure supports internal data communication, internet access, and networked devices, making it essential for daily business operations.

The dominance is further reinforced by rapid digitalization and the growing adoption of cloud-based services within organizations. Increasing use of connected devices and enterprise software systems continues to drive the demand for reliable LAN cabling solutions.

Vertical Insights:

- Government

- Industrial

- IT and Telecommunications

- Residential and Commercial

- Others

IT and telecommunications dominate with a market share of 34% of the total India structured cabling market in 2025.

IT and telecommunications accounts for the majority of the market share, attributed to continuous expansion of data centers, network infrastructure, and broadband connectivity projects. These sectors require high capacity, reliable cabling systems to support data transmission, cloud computing, and communication services.

Their dominance is further supported by rising mobile data consumption, rollout of advanced network technologies, and increasing enterprise digitization. For instance, India's 5G subscriber count is anticipated to rise to 980 million by 2030, up from 290 million in 2024, with average monthly mobile data usage expected to hit 62 GB per smartphone.

Regional Insights:

- North India

- West and Central India

- South India

- East India

South India leads with a market share of 26% of the total India structured cabling market in 2025.

South India dominates the market due to a strong concentration of IT parks, data centers, and technology driven enterprises. Cities, including Bengaluru, Hyderabad, and Chennai host extensive digital infrastructure, creating sustained demand for advanced cabling systems to support high-capacity data transmission and network reliability.

In 2025, Google announced a USD 6 Billion investment in a data center in Visakhapatnam, Andhra Pradesh, featuring one gigawatt of power capacity and significant renewable energy integration. Such investments highlight the region’s infrastructure growth, supported by skilled technical talent, industrial development, and continuous expansion of smart buildings and telecom networks.

Market Dynamics:

Growth Drivers:

Why is the India Structured Cabling Market Growing?

Growth of IT and Telecommunications Sector

India’s robust IT and telecommunications sector, supported by rising mobile data usage, broadband penetration, and enterprise connectivity needs, is propelling the market growth. Telecom operators and IT service providers depend on robust cabling infrastructure to ensure network reliability, speed, and scalability. India’s telecom sector recorded strong growth, with gross revenue increasing from USD 39.22 Billion in FY24 to USD 43.42 Billion in FY25, while total tele density reached 86.09% by June 2025. These indicators reflect widespread connectivity expansion. Ongoing deployment of advanced communication technologies and network upgrades across urban and semi urban regions continues to increase cabling requirements, sustaining long term demand for copper and fiber based structured cabling systems nationwide.

Rise of Retail and E-Commerce Infrastructure

The expansion of organized retail, warehouses, and e-commerce fulfillment centers is catalyzing the demand for structured cabling infrastructure across India. These facilities depend on reliable networks to support inventory management, payment processing, surveillance, and automated operations. In 2025, Amazon India expanded its logistics network by adding 12 fulfillment centers and six sort centers, increasing storage capacity by 8.6 million cubic feet to enhance delivery speed and reliability. Such large-scale expansions highlight the growing need for high performance cabling systems. As e-commerce volumes continue to rise and supply chains become more digitized, investment in structured cabling is increasing to support real time data processing, system integration, and operational efficiency across logistics and retail environments.

Rising Adoption of Internet of Things (IoT) Technologies

The increasing deployment of IoT devices across multiple industries is driving the need for structured cabling infrastructure in India. Connected sensors, security systems, building automation, and industrial monitoring applications require stable and scalable network connectivity to function efficiently. According to IMARC Group estimates, the India IoT market is projected to reach USD 3.6 Billion by 2033, growing at a compound annual growth rate of 10.2% from 2025 to 2033. This rapid expansion underscores the rising volume of connected devices. As IoT adoption grows across manufacturing, utilities, buildings, and transportation sectors, investment in high quality structured cabling systems is increasing to ensure reliable performance, simplified management, and long-term network scalability.

Market Restraints:

What Challenges the India Structured Cabling Market is Facing?

Fluctuating Raw Material Prices Affecting Cost Structures

Volatility in copper and other essential raw material prices creates uncertainty for structured cabling manufacturers and system integrators. Frequent price fluctuations affect cost planning, contract pricing, and profit margins. These variations complicate long term procurement strategies and may cause delays in infrastructure projects as buyers wait for stable pricing conditions.

High Initial Investment Requirements for Infrastructure Deployment

Structured cabling deployment consists of significant upfront investment in cabling materials, network components, skilled installation labor, and supporting infrastructure. These high capital requirements can discourage adoption among small and medium-sized enterprises (SMEs) in India. Budget constraints often lead organizations to delay network upgrades or implement phased deployments rather than comprehensive modernization initiatives.

Skilled Labor Shortage for Installation and Maintenance

A limited availability of trained and certified technicians continues to challenge structured cabling deployment and maintenance across India. Proper installation requires specialized expertise in cable routing, termination, grounding, and compliance with testing standards. Gaps in training programs and certification pathways restrict workforce expansion, leading to longer project timelines, inconsistent installation quality, and potential performance issues that affect long term network reliability and operational efficiency.

Competitive Landscape:

The India structured cabling market exhibits moderate competitive intensity characterized by the presence of multinational technology corporations alongside regional manufacturers competing across product categories and distribution channels. Market dynamics reflect strategic positioning, ranging from premium innovation-driven offerings emphasizing advanced performance specifications to value-oriented products targeting cost-conscious commercial segments. The competitive landscape is increasingly shaped by data center infrastructure capabilities, fiber optic technology expertise, and integrated solutions addressing converging network requirements. Companies are investing in research and development (R&D) to introduce higher category cables and enhanced fiber components while expanding distribution networks and technical support capabilities to strengthen market presence.

Recent Developments:

- November 2025: Zyxel launched its new Structured Cabling Solutions, proudly manufactured in India. The range included high-performance copper and fiber optic cables, designed to meet the growing demand for scalable, future-ready networks. These products ensured faster data transmission and reliable performance, ideal for various industries like enterprise, education, and healthcare.

- July 2025: Avirata Defence Systems (ADS) and AFL launched a joint venture, Avirata AFL Connectivity Systems Limited (A2CS), in India to transform data center connectivity. The JV focused on providing high-performance structured cabling and fiber optic infrastructure, addressing the growing needs of hyperscalers and enterprise customers.

India Structured Cabling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Copper Cable, Fiber Cable, Copper Components, Fiber Components |

| Wire Categories Covered | Category 5e, Category 6, Category 6A, Category 7 |

| Applications Covered | Data Center, Local Area Network (LAN) |

| Verticals Covered | Government, Industrial, IT and Telecommunications, Residential and Commercial, Others |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India structured cabling market size was valued at USD 841.76 Million in 2025.

The India structured cabling market is expected to grow at a compound annual growth rate of 8.57% from 2026-2034 to reach USD 1,764.72 Million by 2034.

Copper cable, holding the largest revenue share of 38%, remains pivotal for India's structured cabling market, owing to cost-effectiveness, widespread compatibility with existing infrastructure, and established installation expertise across commercial and industrial facilities.

Key factors driving the India structured cabling market include rapid expansion of digital infrastructure. In 2025, Equinix launched its first Chennai data center with a USD 69 million investment, highlighting the growing requirements for high bandwidth, scalable cabling to support cloud services, enterprise networks, and uninterrupted data connectivity.

Major challenges include fluctuating raw material prices affecting cost structures, high initial investment requirements for comprehensive infrastructure deployment, skilled labor shortages for installation and maintenance, and competition from wireless alternatives in specific application scenarios.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)