India Steel Pipes Market Size, Share, Trends and Forecast by Material Type, Application, and Region, 2026-2034

India Steel Pipes Market Overview:

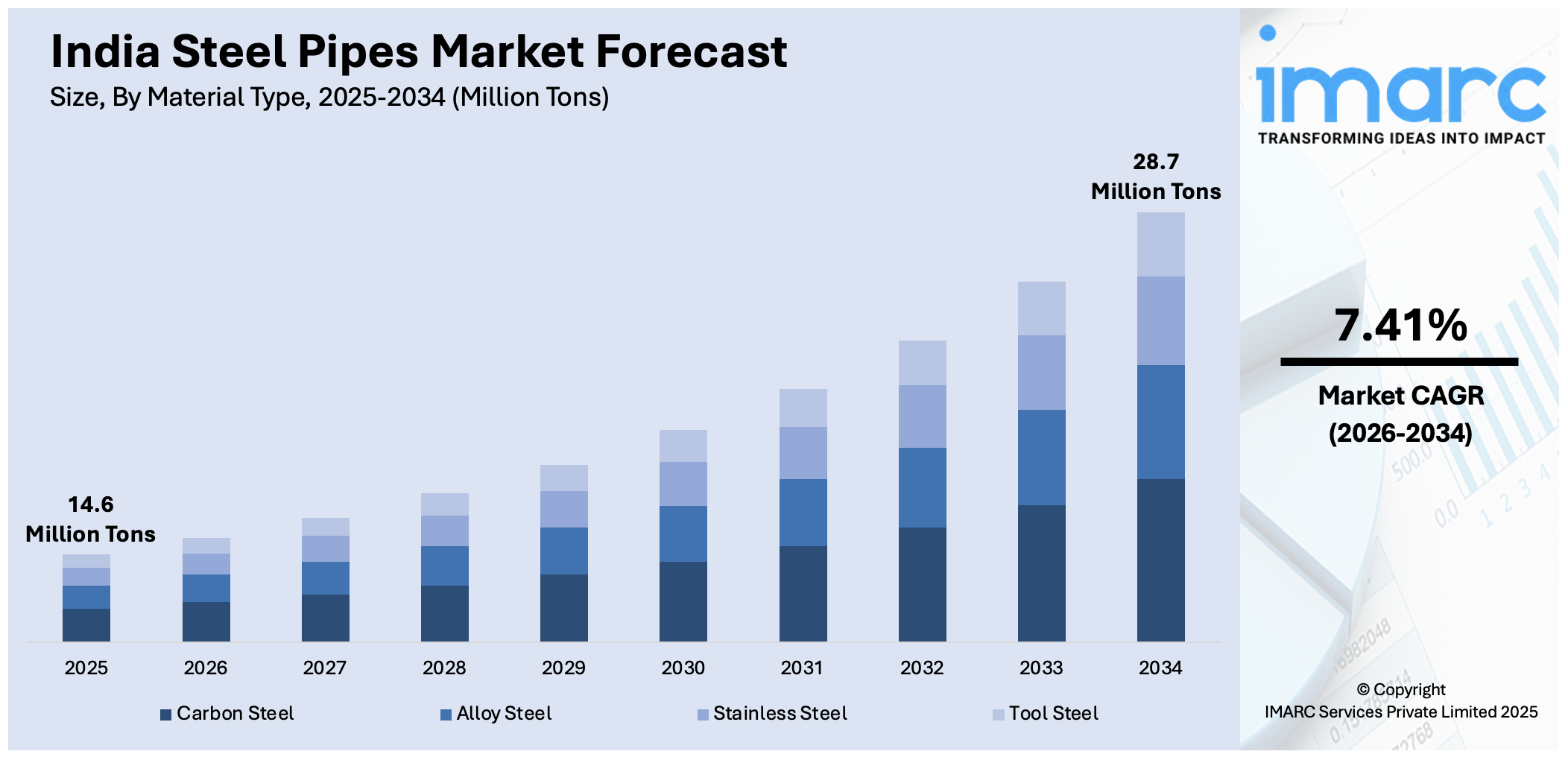

The India steel pipes market size reached 14.6 Million Tons in 2025. Looking forward, IMARC Group expects the market to reach 28.7 Million Tons by 2034, exhibiting a growth rate (CAGR) of 7.41% during 2026-2034. The market is growing steadily, driven by infrastructure development, expanding oil & gas projects, rising exports, expanding government initiatives, increasing demand for seamless and welded pipes, and ongoing advancements in manufacturing and sustainability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 14.6 Million Tons |

| Market Forecast in 2034 | 28.7 Million Tons |

| Market Growth Rate (2026-2034) | 7.41% |

India Steel Pipes Market Trends:

Rising Demand for Seamless Steel Pipes in Oil & Gas and Infrastructure

The India steel pipes market growth is experiencing a rising demand for seamless steel pipes due to its widespread use in oil & gas and infrastructure applications. For instance, in March 2025, Cairn India announced its intention to boost oil production from 100,000 barrels per day (bpd) to 500,000 bpd within the next six to seven years by seeking a joint venture partner. This expansion is expected to increase the demand for seamless steel pipes in oil extraction and transportation. The market also shows a growing preference for seamless pipes because they provide outstanding strength with durability alongside high-pressure resistance. In line with this, the government’s energy production expansion through initiatives like the Pradhan Mantri Urja Ganga project has generated substantial market demand. Moreover, the quick pace of urban development along with industrial development creates a strong market demand for superior pipes utilized in construction works and water delivery systems. Besides this, the steel manufacturing industry in India increases its production capacity to fulfill rising demand by investing in state-of-the-art technologies for seamless pipe production. Furthermore, the automotive sector and power sector are adopting seamless pipes which creates stronger market growth conditions. Additionally, the expanding industrial landscape of India heavily depends on seamless steel pipes because industries maintain their focus on efficiency and durability requirements, thus boosting the India steel pipes market share.

To get more information on this market Request Sample

Growth of Environmentally Sustainable and High-Performance Steel Pipes

The India steel pipe industry places sustainability at the forefront of its market strategy while prioritizing eco-friendly production alongside product performance excellence. In addition to this, the adoption of electric arc furnaces and hydrogen-based steelmaking technologies has become necessary for Indian steel pipe manufacturers due to the rising global and national carbon emission regulations. Concurrently, the market demands companies to use recyclable and corrosion-resistant steel pipes because such materials improve durability and minimize environmental impact. In confluence with this, the market demand for galvanized and epoxy-coated steel pipes continues to grow because these coated variants help protect steel infrastructure by resisting corrosion thus ensuring long service lives for water supply and construction projects. Furthermore, manufacturers receive government backing for green steel and circular economy practices which drives them toward implementing energy-efficient production processes. For example, in January 2025, India's steel ministry sought ₹150 billion ($1.74 billion) from the 2025-26 budget to incentivize low-carbon steel production, focusing on emission reduction, R&D enhancement, raw material efficiency, and renewable energy financing. Apart from this, India is emerging as a leading player in global environmentally responsible infrastructure and industrial development because of rising sustainable steel pipe demand supported by governmental regulatory measures, which is significantly enhancing the India steel pipes market outlook.

India Steel Pipes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on material type and application.

Material Type Insights:

- Carbon Steel

- Alloy Steel

- Stainless Steel

- Tool Steel

The report has provided a detailed breakup and analysis of the market based on the material type. This includes carbon, alloy, stainless and tool steel.

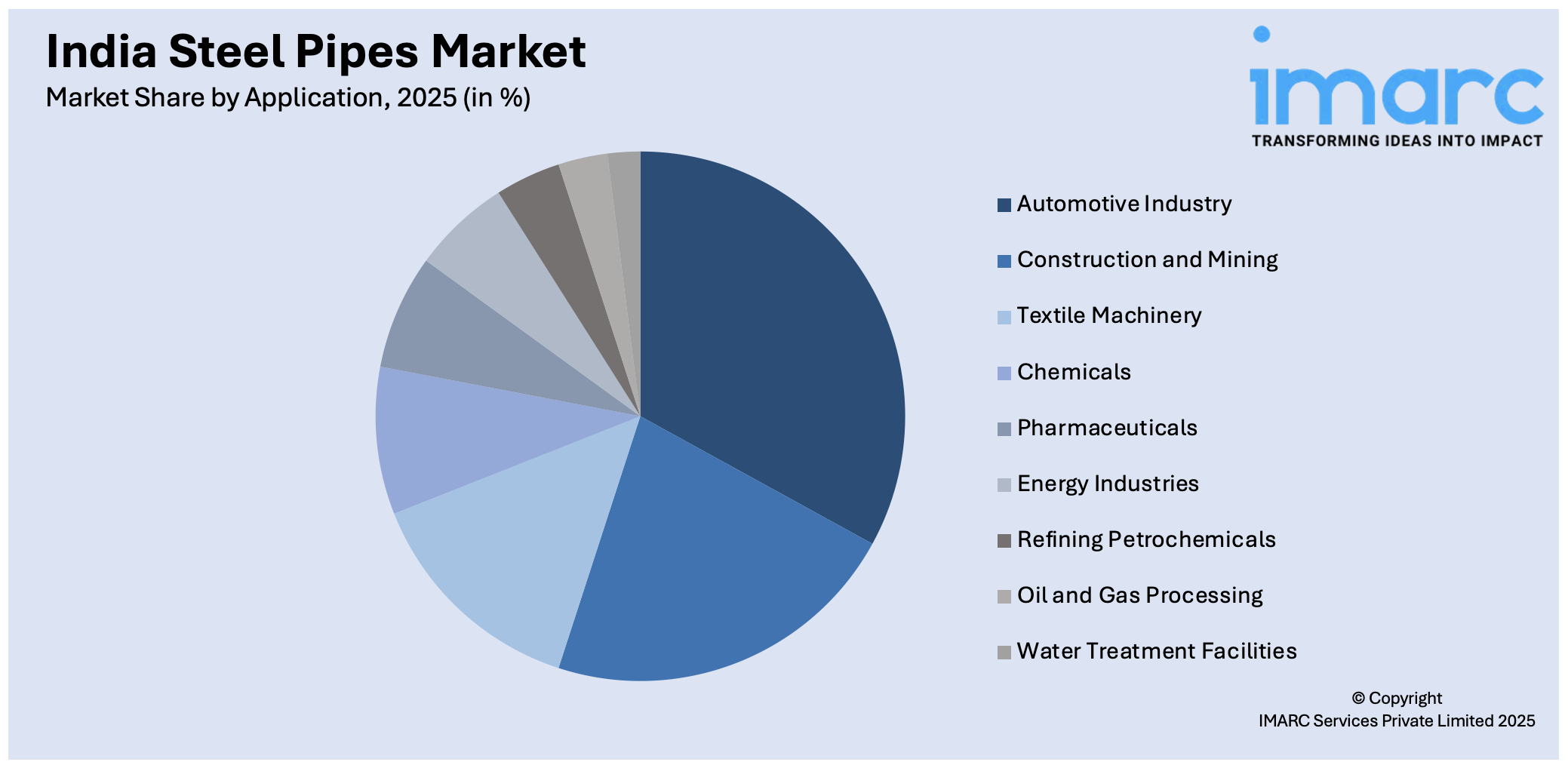

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive Industry

- Construction and Mining

- Textile Machinery

- Chemicals

- Pharmaceuticals

- Energy Industries

- Refining Petrochemicals

- Oil and Gas Processing

- Water Treatment Facilities

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive industry, construction and mining, textile machinery, chemicals, pharmaceuticals, energy industries, refining petrochemicals, oil and gas processing, and water treatment facilities.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Steel Pipes Market News:

- In August 2024, Tata Steel and Welspun Corp announced the successful development of Electric Resistance Welded (ERW) pipes designed for transporting 100% pure gaseous hydrogen under high pressure. This collaboration positions them as the first Indian companies to produce such specialized pipes, aligning with the government's green hydrogen initiatives and paving the way for sustainable energy infrastructure.

- In June 2024, Maruti Ispat & Pipes Pvt. Ltd. announced a $24 million investment to expand its Andhra Pradesh facility, adding a production capacity of 600,000 metric tons per year for ERW steel pipes. This expansion aims to meet the growing demand for steel pipes in infrastructure and construction, enhancing the company's market presence and contributing to industry growth.

India Steel Pipes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Carbon Steel, Alloy Steel, Stainless Steel, Tool Steel |

| Applications Covered | Automotive Industry, Construction and Mining, Textile Machinery, Chemicals, Pharmaceuticals, Energy Industries, Refining Petrochemicals, Oil and Gas Processing, Water Treatment Facilities |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India steel pipes market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India steel pipes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India steel pipes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The steel pipes market in India reached 14.6 Million Tons in 2025.

The India steel pipes market is projected to exhibit a CAGR of 7.41% during 2026-2034, reaching 28.7 Million Tons by 2034.

The India steel pipes market is primarily driven by rapid infrastructure development, urbanization, and increased investment in oil, gas, and water transportation projects. Rising demand across the construction, automotive, and manufacturing sectors, combined with supportive government policies aimed at boosting industrial development, is propelling the growth of the steel pipes market across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)