India Steel Market Size, Share, Trends and Forecast by Type, Product, Application, and Region, 2025-2033

India Steel Market Size and Trends:

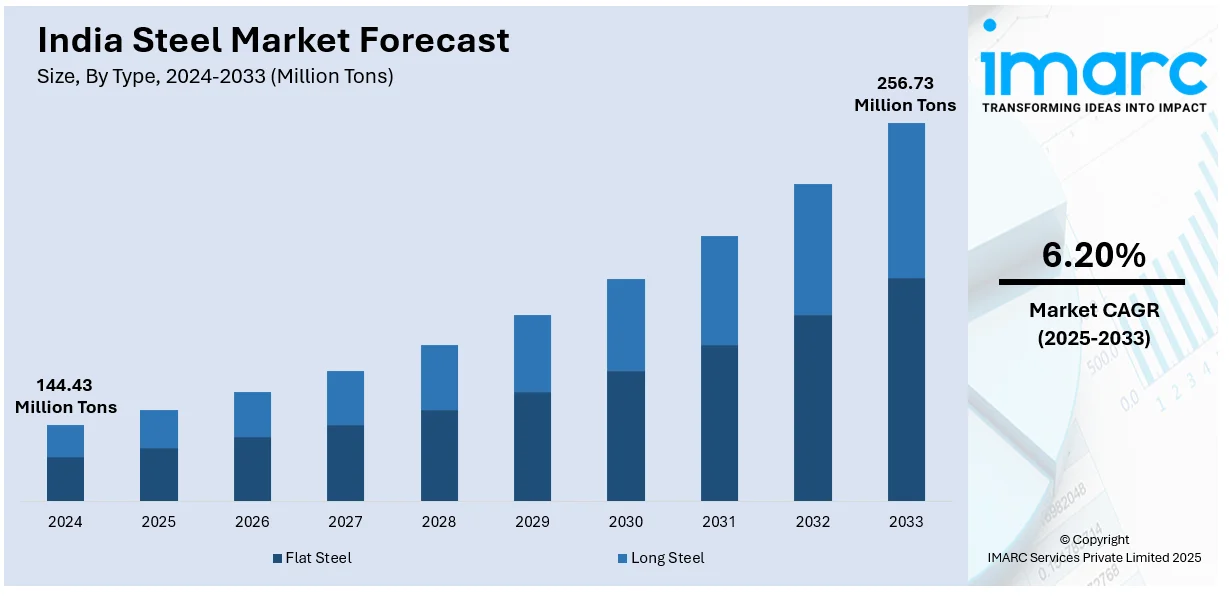

The India steel market size was valued at 144.43 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 256.73 Million Tons by 2033, exhibiting a CAGR of 6.20% from 2025-2033. The heightened investments in roads, bridges, airports, and urban infrastructure, rising construction activities, increase in automotive production owing to high need for efficient cars, growing demand for residential and commercial buildings, and supportive government policies are responsible for expanding the India steel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 144.43 Million Tons |

| Market Forecast in 2033 | 256.73 Million Tons |

| Market Growth Rate (2025-2033) | 6.20% |

The steel sector in India plays a key part in the country's industrial and economic development. One of the primary drivers of the market is the robust demand from infrastructure and construction sectors. Infrastructure development is an area on which the government is putting a great deal of importance, including the development of roads, railways, airports, and housing. Increased urban populations mean that there will be a requirement for more residential and commercial constructions. This trend is associated with the rise in innovations within the real estate sector, being one of the major users of structural steel, reinforcing bars, and other products made of steel, thereby driving the India steel market demand.

To get more information on this market, Request Sample

The automotive sector is a significant user of steel, thus requiring efficient steel products in India. The country emerging as a manufacturing hub for automobiles presents an increasing production of passenger vehicles, commercial vehicles, and two-wheelers. Vehicles are being lightened to enhance fuel efficiency and safety; high-strength steels are increasingly being used as well. Innovations in the steel sector are opened with the above-mentioned avenues. Consumption of steel is increasing except for this as the production of EVs is bound to increase with increased demand for special steel used in battery packs and other componentry. Other than this, the adoption of new-age technologies is revolutionizing the Indian steel industry. More and more integrations of automation, artificial intelligence (AI), and the Internet of Things (IoT) go into steel making, improving efficiency, reducing cost, and developing quality products.

India Steel Market Trends:

Surge in infrastructure development

Infrastructure development has emerged as a pivotal driver for the steel market in India. The Indian government has emphasized infrastructure development as an engine for growth, which is increasingly leading to more investments in a variety of large-scale projects. Developments , such as the Bharatmala Pariyojana, pointed at advancing connectivity of roads, and the Smart Cities Mission, concentrated on urban renewal and retrofitting, are creating significant demand for steel products. Additionally, the nation is aiming to reach 200,000 km of National Highways by 2025 with more private involvement. Construction of bridges, highways, airports, and ports through such projects increases a massive quantity of steel and supports market growth. The focus of the country is on increasing the development of industrial corridors and freight corridors for supporting industrial growth that is widening the India steel market share.

Rise in construction activities

The rise in construction activities across residential, commercial, and industrial sectors is another significant trend driving the steel market in India. In addition, the demand for steel is escalating, especially due to the building of high-rise buildings, shopping malls, and residential complexes that are responsible for market expansion. The strength, durability, and versatility of steel have made it the first choice of the construction sector, thereby increasing the consumption of steel products. The development of smart cities and affordable housing projects under government schemes like Pradhan Mantri Awas Yojana is also increasing the demand for steel in the construction sector. The Finance Minister of India announced Pradhan Mantri Awas Yojana-urban 2.0 with a fund allocation of INR 10 lakh crore in her Union budget 2024-25. This is to support the 1 crore urban poor for affordable housing.

Increase in innovation in the automotive sector

The high innovation in the automotive sector is another key growth-enabling factor that is proving to have a positive India steel industry outlook. India is among the largest automotive manufacturers, and the automotive industry uses significant quantities of steel in the manufacture of different parts of the vehicle, such as body structures, engine parts, and transmission systems. The annual requirement of India for flat steel is 7.8 million tons, according to an article published by Autocar Professional in 2025. With passenger vehicle and commercial vehicle demand growing steadily, and a rising requirement for electric vehicles in India, high-quality steel requirements have increased further. Incentives and policy support from the government for electric mobility have also led to increased steel consumption in the automobile sector. Moreover, the growing adoption of advanced high-strength steels (AHSS) in vehicle manufacturing as it is believed to enhance fuel efficiency and safety, is a positive factor for the India steel market outlook.

India Steel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India steel market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, product, and application.

Analysis by Type:

- Flat Steel

- Long Steel

Flat steel represents the largest segment. Flat steel refers to products such as sheets, plates, and strips that are extensively used in manufacturing, automotive, and construction industries. Its versatility, high tensile strength, and corrosion resistance make it suitable for applications in the production of appliances, machinery, and infrastructure components like pipelines and roofs. Flat steel presents exceptional mechanical properties like high tensile strength and durability. These characteristics make it an ideal material for load-bearing structures and products subjected to significant stress, such as bridges, high-rise buildings, and machinery parts, thereby propelling the India steel market growth. It is easy to process and fabricate, allowing for cutting, welding, bending, and molding into desired shapes. Its workability reduces construction and manufacturing time, making it a preferred material for industries requiring customization and speed.

Analysis by Product:

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes

- Braids

Structural steel is the dominant segment because of its strength, durability, and ability to bear loads. Structural steel provides an excellent strength-to-weight ratio, ensuring considerable load-bearing capacity while remaining quite light. This feature is especially beneficial in substantial constructions such as skyscrapers and bridges, where minimizing weight while maintaining strength is essential. It can be effortlessly shaped into various forms, such as beams, columns, and trusses. Its flexibility permits architects and engineers to create intricate structures with distinct shapes, facilitating groundbreaking construction endeavors. The fabrication of structural steel parts in factories enables faster assembly at the construction site. This shortens construction duration, lowers labor expenses, and minimizes possible project setbacks, rendering it a time-effective option for builders.

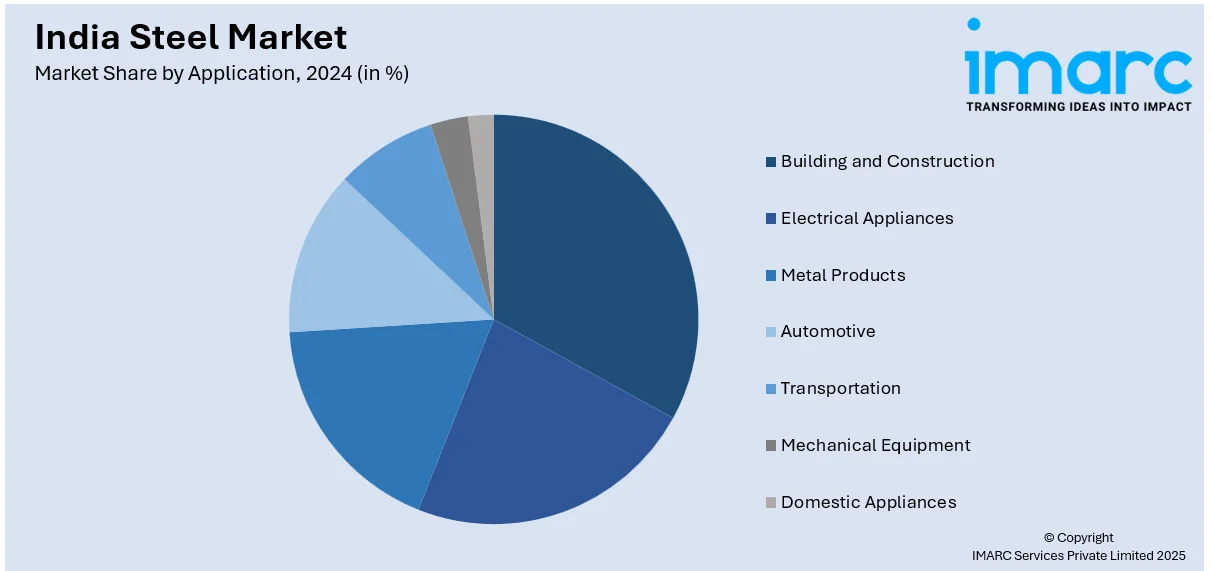

Analysis by Application:

- Building and Construction

- Electrical Appliances

- Metal Products

- Automotive

- Transportation

- Mechanical Equipment

- Domestic Appliances

Building and construction account for the majority of the marker share according to the India steel industry report. Steel is the backbone of modern construction, forming the primary structural framework for all kinds of buildings, such as residential, commercial, and industrial ones. Its weight-to-strength ratio enables the building of skyscrapers, bridges, and large industrial structures. Steel beams and columns are widely utilized in framing, offering essential support to endure both vertical and horizontal forces. Trusses, made up of linked steel components, are utilized in roofs and bridges to effectively distribute load and improve structural integrity. In skyscrapers, steel frameworks allow for the building of tall structures that can withstand dynamic forces like wind, seismic events, and vibrations.

Regional Analysis:

- South India

- North India

- West and Central India

- East India

South India has experienced booming growth in the steel market because of the trend toward industrialization, urbanization, and infrastructure development in this region. The IT sector, automobile manufacturing, and real estate sectors are very prominent in cities like Bengaluru, Chennai, and Hyderabad, contributing to the high demand for steel products in construction and automotive applications. Additionally, major ports of Chennai and Visakhapatnam also assist the region with exports and imports, further helping its market dynamics.

North India leads the steel industry because of its large-scale construction and infrastructure projects, fueled by the area's swift urban growth and industrial advancement. Regions such as Uttar Pradesh, Haryana, and Punjab, together with the National Capital Region (NCR), are experiencing significant investments in real estate and infrastructure endeavors like highways, metro networks, and smart city projects. The area's closeness to suppliers of raw materials, especially iron ore and coal from Central India, promotes a consistent supply chain for steel production.

West and Central India hold a considerable portion of the steel market owing to their industrial and economic importance. Maharashtra and Gujarat serve as major industrial centers, featuring a significant presence in the automotive, manufacturing, and construction industries.

East India plays a significant role in the Indian steel industry because of its rich deposits of raw materials, especially iron ore and coal, located in states such as Odisha, Jharkhand, and West Bengal. Government investments in mining and infrastructure projects, including the enlargement of railway and port systems, have greatly increased steel demand in this area.

Competitive Landscape:

To cater to the rising domestic and international demand, steel manufacturers in India are aggressively expanding their production capacities. For instance, in 2025, ArcelorMittal Nippon Steel India (AM/NS India) commissioned two new automotive steel production lines at the Hazira plant in Gujarat. Key market players have integrated advanced automation and digitalization across its manufacturing units. Technologies like artificial intelligence (AI), internet of things (IoT), and machine learning (ML) are being deployed to monitor processes, reduce downtime, and enhance productivity. They are also investing in enhanced manufacturing technologies to create high-strength steel for specialized applications, catering to automotive, infrastructure, and defense sectors. Sustainability has become a core focus area for Indian steel manufacturers, driven by stringent environmental regulations and increasing global emphasis on green practices. Companies are pioneering initiatives to reduce its carbon footprint, such as developing high-strength, low-weight steel and increasing the use of scrap-based production.

The report provides a comprehensive analysis of the competitive landscape in the India steel market with detailed profiles of all major companies, including:

- SAIL

- JSW

- Tata Steel

- AM/NS INDIA

- Jindal Steel & Power Limited

- NMDC Steel Limited

- Rashtriya Ispat Nigam Limited

- Vedanta Limited

- Visa Steel

- Hira Power & Steels Ltd.

Latest News and Developments:

- September 2024: ArcelorMittal Nippon Steel India (AM/NS India) introduced its brand of alloy coated steel known as Magnelis. The company asserted that it would serve as an import substitute and is best suited for steel products in solar projects. The joint venture (JV) between ArcelorMittal and Nippon Steel India announced that the brand is currently being manufactured and delivered in India. Before, it was primarily imported from Korea, Japan, and China.

- October 2024: Gensol Engineering (Gensol) has teamed up with Matrix Gas & Renewables Consortium (Matrix) to support the creation of India’s inaugural steel production facility powered by green hydrogen.

- January 2025: India's steel ministry announced the second iteration of its productivity-linked incentive (PLI) scheme for the industry. Applications from steel brands viewing for incentives under the new PLI scheme initiated on Monday, January 6, and will be available until January 31.

- December 2024: Tata Steel transformed India’s mining industry by introducing an all-female workforce at its Noamundi Iron Mine located in Jharkhand. From December 26, 2024, female employees are allowed to independently manage all mining work throughout their shift.

- March 2024: JSW Steel is adding its product mix that reduces the coated steel import for India through the native Made In India, JSW Magsure. JSW Steel has thereby become the only steel company manufacturing & marketing Zinc-Magnesium-Aluminium alloy coated steel products in the Indian domestic market. JSW Steel has patented its exceptional chemical structure of JSW Magsure.

India Steel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flat Steel, Long Steel |

| Products Covered | Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids |

| Applications Covered | Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances |

| Regions Covered | South India, North India, West and Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India steel market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India steel market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India steel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India steel market in the region was valued at 144.43 Million Tons in 2024.

The growth of the India steel market is driven by rapid urbanization, infrastructure development, rising demand from construction and automotive sectors, government initiatives like "Make in India," increasing foreign direct investments, and advancements in manufacturing technologies. Additionally, growing exports and sustainable steel production practices contribute to market expansion.

The India steel market is projected to exhibit a CAGR of 6.20% during 2025-2033, reaching a value of 256.73 Million Tons by 2033.

Flat steel leads the market by type, driven by its versatility, high tensile strength, corrosion resistance, and widespread use in automotive, manufacturing, and construction industries.

Structural steel leads the market by product, driven by its exceptional strength-to-weight ratio, durability, adaptability in complex structures, and efficiency in construction, particularly for bridges and high-rise buildings.

Building and construction lead the market by application, driven by the increasing demand for residential, commercial, and industrial structures, coupled with government initiatives like smart cities and affordable housing projects.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)