India Stainless Steel Market Size, Share, Trends and Forecast by Product, Grade, Application, and Region, 2026-2034

India Stainless Steel Market Summary:

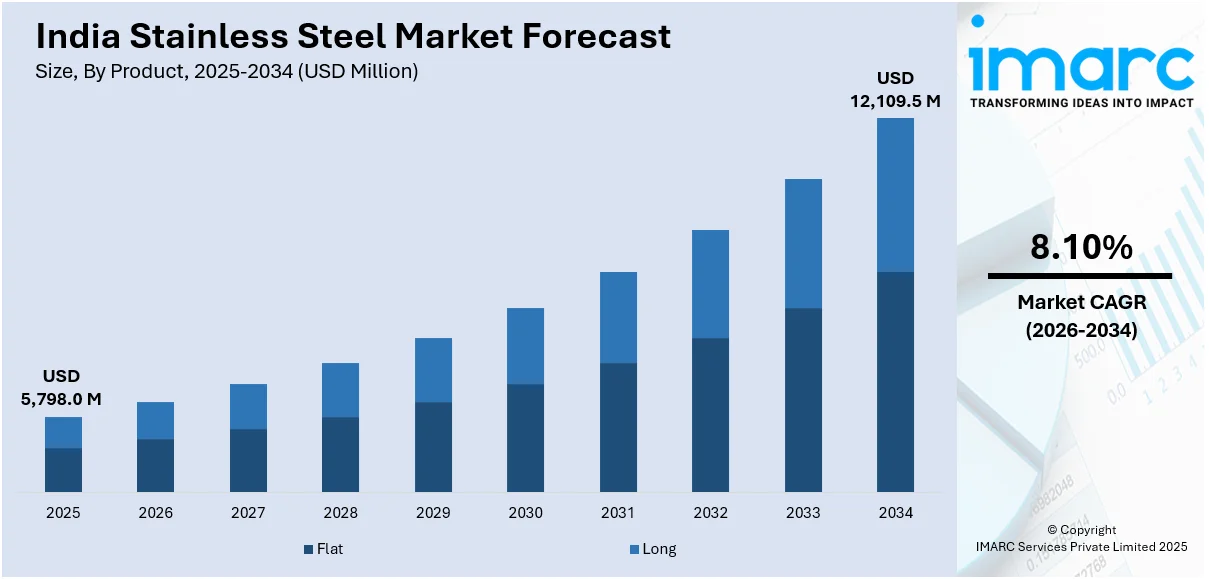

The India stainless steel market size was valued at USD 5,798.0 Million in 2025 and is projected to reach USD 12,109.5 Million by 2034, growing at a compound annual growth rate of 8.10% from 2026-2034.

The market is driven by rapid urbanization, large-scale infrastructure development, and expanding industrial manufacturing activities across the country. Growing adoption in automotive, consumer goods, and heavy engineering sectors, along with favorable government initiatives promoting domestic production and self-reliance, is further accelerating demand. Rising preference for corrosion-resistant and durable materials across diverse end-use industries is contributing to the expanding India stainless steel market share.

Key Takeaways and Insights:

- By Product: Flat dominates the market with a share of 56% in 2025, driven by its extensive application across construction, automotive panels, kitchen appliances, and industrial equipment manufacturing.

- By Grade: 300 Series leads the market with a share of 50% in 2025, owing to its superior corrosion resistance, excellent weldability, high formability, and versatility across demanding industrial applications.

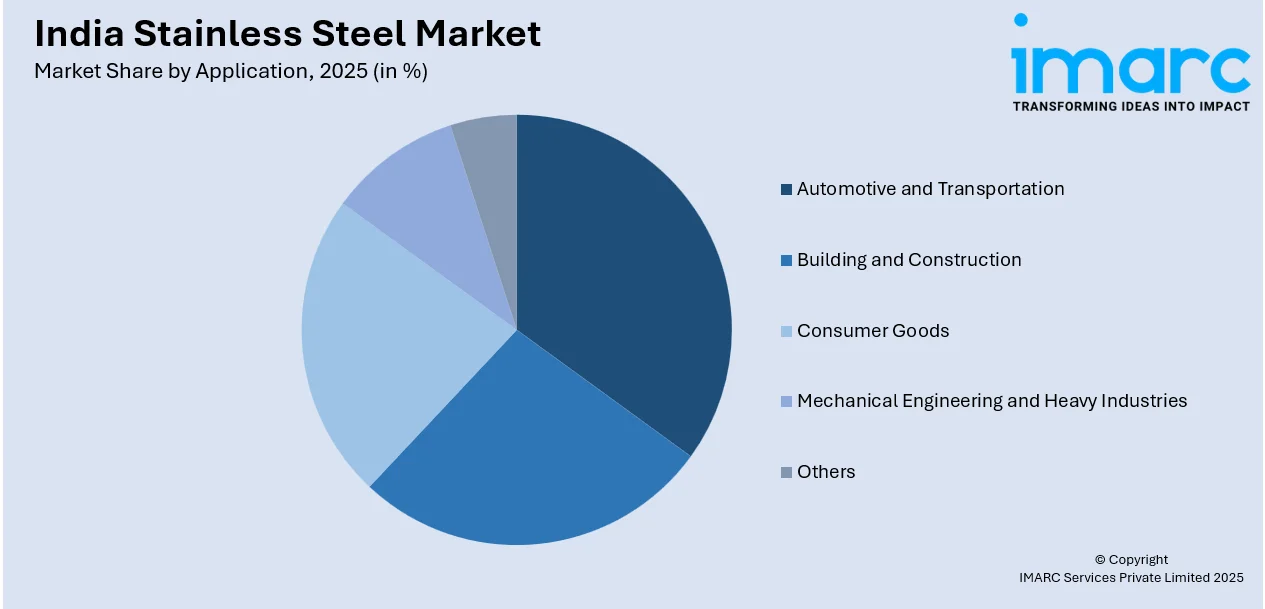

- By Application: Building and construction represents the largest segment with a market share of 33% in 2025, driven by massive government-backed infrastructure programs, rapid urbanization, and growing preference for maintenance-free structural materials.

- By Region: North India leads the market with a share of 35% in 2025, driven by the concentration of major manufacturing hubs, proximity to key industrial corridors, and robust transportation infrastructure.

- Key Players: The India stainless steel market exhibits a moderately consolidated competitive landscape, with large-scale integrated producers competing alongside regional manufacturers and specialty processors across product grades and application segments.

To get more information on this market Request Sample

The India stainless steel market is experiencing robust growth propelled by a convergence of structural and policy-driven factors. Accelerating urbanization and the expansion of residential and commercial infrastructure across the country are generating sustained demand for high-performance materials. In March 2025, Jindal Stainless announced a ₹40,000 crore investment to set up a new stainless steel plant in Maharashtra, aimed at significantly boosting domestic production capacity. Government initiatives aimed at strengthening domestic manufacturing capacity and reducing import dependency are creating a favorable ecosystem for producers. The automotive sector's transition toward lightweight and corrosion-resistant components is further elevating consumption. Additionally, rising disposable incomes and evolving consumer preferences for durable household products are broadening the application base. Ongoing investments in railways, ports, highways, and smart city projects continue to underpin long-term demand growth across multiple end-use verticals.

India Stainless Steel Market Trends:

Growing Adoption of Stainless Steel in Green and Sustainable Construction

The Indian construction industry is increasingly embracing stainless steel as a preferred material for sustainable building practices. Architects and developers are leveraging the material's inherent recyclability, longevity, and minimal maintenance requirements to meet evolving green building standards. According to reports, in August 2025, Jindal Stainless partnered with Whiteland Corporation to supply 410L‑grade stainless steel rebars for the Westin Residences Gurugram project, marking one of the first uses of stainless steel rebars in branded residential construction in India.

Rising Preference for Higher-Grade Alloys in Industrial Applications

Indian manufacturers and end-users are progressively shifting toward higher-grade stainless steel alloys to meet stringent performance requirements of advanced industrial applications. Sectors such as pharmaceuticals, chemical processing, and food and beverage are demanding materials with superior resistance to extreme temperatures, aggressive chemicals, and microbial contamination. In June 2024, India’s Jindal Stainless made its maiden supply of 21LN high‑grade stainless steel for the fabrication of high‑speed train coaches, showcasing adoption of premium alloys in critical transport infrastructure. Moreover, this trend is encouraging domestic producers to expand their product portfolios and invest in advanced melting and finishing technologies.

Expansion of Stainless Steel Applications in Railway and Metro Infrastructure

India's ambitious railway modernization and metro expansion programs are creating significant new avenues for stainless steel consumption. The material's combination of high strength-to-weight ratio, superior corrosion resistance, and aesthetic versatility makes it ideally suited for manufacturing train coaches, station infrastructure, escalators, and platform furnishings. In September 2025, Jindal Stainless supplied over 1,031 metric tonnes of premium 301N austenitic stainless steel for the Bengaluru Metro Phase‑2 expansion, reinforcing stainless steel’s role in urban transport infrastructure. Urban transit authorities are increasingly specifying stainless steel for its low maintenance characteristics and extended operational life, helping reduce total cost of ownership for public transportation systems.

Market Outlook 2026-2034:

The India stainless steel market is poised for sustained revenue growth over the forecast period, underpinned by accelerating infrastructure investments, expanding industrial manufacturing capacity, and rising per capita consumption. Government-led initiatives focused on domestic production and self-reliance are expected to bolster revenue generation across the value chain. Growing adoption in emerging application areas such as green construction, railway modernization, and renewable energy infrastructure is anticipated to create incremental revenue streams, while the premiumization trend toward higher-grade alloys is projected to enhance revenue realization for producers and processors. The market generated a revenue of USD 5,798.0 Million in 2025 and is projected to reach a revenue of USD 12,109.5 Million by 2034, growing at a compound annual growth rate of 8.10% from 2026-2034.

India Stainless Steel Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Flat |

56% |

|

Grade |

300 Series |

50% |

|

Application |

Building and Construction |

33% |

|

Region |

North India |

35% |

Product Insights:

- Flat

- Long

Flat dominates with a market share of 56% of the total India stainless steel market in 2025.

The flat segment commands the leading position in the India stainless steel market, driven by its widespread utilization across construction, automotive, consumer appliances, and industrial manufacturing sectors. Flat products, including sheets, plates, and coils, offer superior versatility in terms of processing and fabrication, enabling manufacturers to achieve precise specifications for diverse end-use applications. The growing emphasis on infrastructure modernization, urbanization, and expanding industrial activities continues to bolster demand for flat stainless steel products.

Flat are increasingly preferred in architectural cladding, roofing solutions, and modular kitchen installations, where surface finish quality and dimensional precision are critical requirements. The expanding food processing and pharmaceutical industries are further strengthening demand for flat stainless steel products due to their hygienic properties and ease of cleaning. Domestic producers are investing in advanced cold rolling and surface treatment technologies to enhance product quality, enabling them to cater to evolving specifications across premium application segments nationwide.

Grade Insights:

- 200 Series

- 300 Series

- 400 Series

- Duplex Series

- Others

300 series lead with a share of 50% of the total India stainless steel market in 2025.

The 300 series holds the dominant position in the India stainless steel market, attributed to the austenitic grade's exceptional combination of corrosion resistance, formability, weldability, and mechanical strength. This grade family is extensively utilized across food processing, chemical handling, pharmaceutical manufacturing, architectural applications, and high-performance industrial equipment. In October 2025, India’s Directorate General of Trade Remedies launched an anti‑dumping investigation on cold‑rolled stainless steel 300 and 400 series imports from China, Indonesia, and Vietnam after complaints from domestic producers, underscoring the strategic importance of protecting high‑grade austenitic supply.

The versatility of the 300 series makes it possible for its use in both industrial and consumer applications. The rising awareness among consumers of the long-term cost-effectiveness of austenitic stainless steel grades over cheaper alternatives is also contributing to the dominance of the market. Local companies are increasing their production capacity for 300 Series products to cater to the rising demand from infrastructure development projects, healthcare facility construction projects, and water treatment projects.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive and Transportation

- Building and Construction

- Consumer Goods

- Mechanical Engineering and Heavy Industries

- Others

Building and construction exhibits a clear dominance with a 33% share of the total India stainless steel market in 2025.

The building and construction dominate the India stainless steel market, fueled by the country's massive infrastructure development programs and rapid urbanization trajectory. Stainless steel is increasingly preferred in structural facades, roofing systems, handrails, elevator components, and interior design elements for its durability, low maintenance requirements, and aesthetic appeal. Government-led initiatives promoting affordable housing, smart city development, and urban transportation infrastructure are generating sustained demand for stainless steel across residential, commercial, and public infrastructure projects nationwide.

The segment is further supported by the increasing use of stainless steel in water management systems, sewage treatment plants, and bridge construction, where the ability to resist corrosion and last for a long time is of utmost importance. Architects and urban planners are increasingly using stainless steel in landmark buildings and public spaces because of its ability to withstand harsh environmental conditions while also being aesthetically pleasing. The development of tier two and tier three cities is also opening up new demand channels.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

North India dominates with a market share of 35% of the total India stainless steel market in 2025.

North India commands the leading position in the regional market landscape, driven by the concentration of major manufacturing facilities, proximity to key industrial corridors, and robust demand from the automotive and consumer goods sectors. The region benefits from well-established distribution networks, access to skilled labor pools, and strong government investment in urban infrastructure development. Major metropolitan centers and industrial clusters in the region generate consistent demand across diverse stainless steel product categories and application segments throughout the year.

The dominance of the region is further aided by its favorable geographical location, which makes it easier to source raw materials and distribute products to the northern and central regions. The region is also witnessing an increase in the development of industrial parks, special economic zones, and freight corridors, which is attracting new investments in manufacturing, thus fueling the growth of stainless steel consumption. The rise in residential and commercial construction in the growing cities is also generating new demand, while the region’s presence in kitchenware and consumer goods manufacturing is generating steady demand.

Market Dynamics:

Growth Drivers:

Why is the India Stainless Steel Market Growing?

Accelerating Infrastructure Development and Urbanization

India's unprecedented infrastructure expansion is serving as a primary catalyst for stainless steel demand growth. The government's sustained commitment to developing highways, railways, airports, ports, and urban transit systems is generating massive consumption of corrosion-resistant and durable construction materials. In June 2025, domestic stainless steel consumption registered an 84 % increase over five years to reach 4.80 million tonnes in FY 2024‑25, driven largely by robust demand from infrastructure, railways, airports, and metros across the country. Rapid urbanization, particularly the emergence and expansion of tier-two and tier-three cities, is driving demand for modern building materials in residential complexes, commercial establishments, and public facilities.

Expanding Automotive and Transportation Manufacturing

The robust growth of India's automotive and transportation manufacturing sector is creating significant incremental demand for stainless steel across multiple product categories. Vehicle manufacturers are increasingly adopting stainless steel components for exhaust systems, fuel tanks, structural reinforcements, and decorative trim elements, driven by the material's superior corrosion resistance and weight optimization potential. The government's emphasis on promoting electric vehicle adoption and modernizing public transportation infrastructure is generating additional demand for specialized stainless steel grades in battery enclosures, charging equipment, and rail coach manufacturing.

Rising Consumer Demand and Lifestyle Transformation

India's growing middle-class population and rising disposable incomes are driving a fundamental shift in consumer preferences toward premium, durable, and hygienic materials for household and lifestyle applications. Stainless steel is witnessing expanding adoption in kitchenware, home appliances, water storage systems, and modular kitchen installations, supported by increasing awareness of its health benefits, longevity, and recyclability. In November 2025, a rising number of Gen Z consumers in India started preferring stainless steel cookware over aluminium and non‑stick alternatives due to health, sustainability, and durability concerns, helping fuel demand in urban markets.

Market Restraints:

What Challenges the India Stainless Steel Market is Facing?

Volatility in Raw Material Prices

The India stainless steel market faces persistent pressure from fluctuations in prices of critical raw materials, particularly nickel and chromium, which are predominantly imported. These price swings directly impact production costs and profit margins for domestic manufacturers, creating uncertainty in pricing strategies and exposing the industry to geopolitical supply disruption risks.

Competition from Alternative Materials

Stainless steel faces increasing competition from alternative materials such as aluminum alloys, carbon fiber composites, engineered plastics, and coated carbon steel across several application segments. These substitutes often offer cost advantages or specific performance characteristics appealing to price-sensitive segments, potentially limiting stainless steel penetration into certain emerging application areas.

High Energy Consumption and Environmental Compliance Costs

Stainless steel production is an energy-intensive process involving significant electricity and fuel consumption during melting, refining, and finishing operations. Rising energy costs and increasingly stringent environmental regulations are elevating overall production costs. Compliance with emission norms and sustainability requirements necessitates substantial capital investment in pollution control equipment and process optimization.

Competitive Landscape:

The India stainless steel market features a moderately consolidated competitive structure characterized by the presence of large-scale integrated producers operating alongside mid-sized regional manufacturers and specialty processors. Leading market participants leverage vertically integrated operations spanning raw material sourcing, melting, hot and cold rolling, and finishing to maintain cost competitiveness and quality consistency. Strategic investments in capacity expansion, product diversification, and downstream value addition are key competitive strategies adopted by major players. The market also witnesses active participation from importers and trading entities that contribute to competitive pricing dynamics.

Recent Developments:

- In May 2025, Jindal Stainless launched Project Pragati, India’s first supply chain digitalisation initiative in the steel sector at its Hisar unit. The project automates production planning from casting to finishing, improving delivery performance, reducing lead times by 10–15%, optimising inventory, and enhancing capacity utilisation.

India Stainless Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Flat, Long |

| Grades Covered | 200 Series, 300 Series, 400 Series, Duplex Series, Others |

| Applications Covered | Automotive and Transportation, Building and Construction, Consumer Goods, Mechanical Engineering and Heavy Industries, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India stainless steel market size was valued at USD 5,798.0 Million in 2025.

The India stainless steel market is expected to grow at a compound annual growth rate of 8.10% from 2026-2034 to reach USD 12,109.5 Million by 2034.

Flat held the largest market share, driven by its extensive utilization across construction, automotive panels, kitchen appliances, and industrial equipment manufacturing, offering superior structural stability, design flexibility, and ease of processing.

Key factors driving the India stainless steel market include include accelerating infrastructure development and urbanization, expanding automotive manufacturing, rising consumer demand for durable materials, and government initiatives promoting domestic production.

Major challenges include volatility in raw material prices particularly nickel and chromium, competition from alternative materials such as aluminum and engineered plastics, high energy consumption costs, stringent environmental compliance requirements, and dependence on imported alloying elements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)