India Stacker Market Size, Share, Trends and Forecast by Type, End User, and Region, 2026-2034

Market Overview:

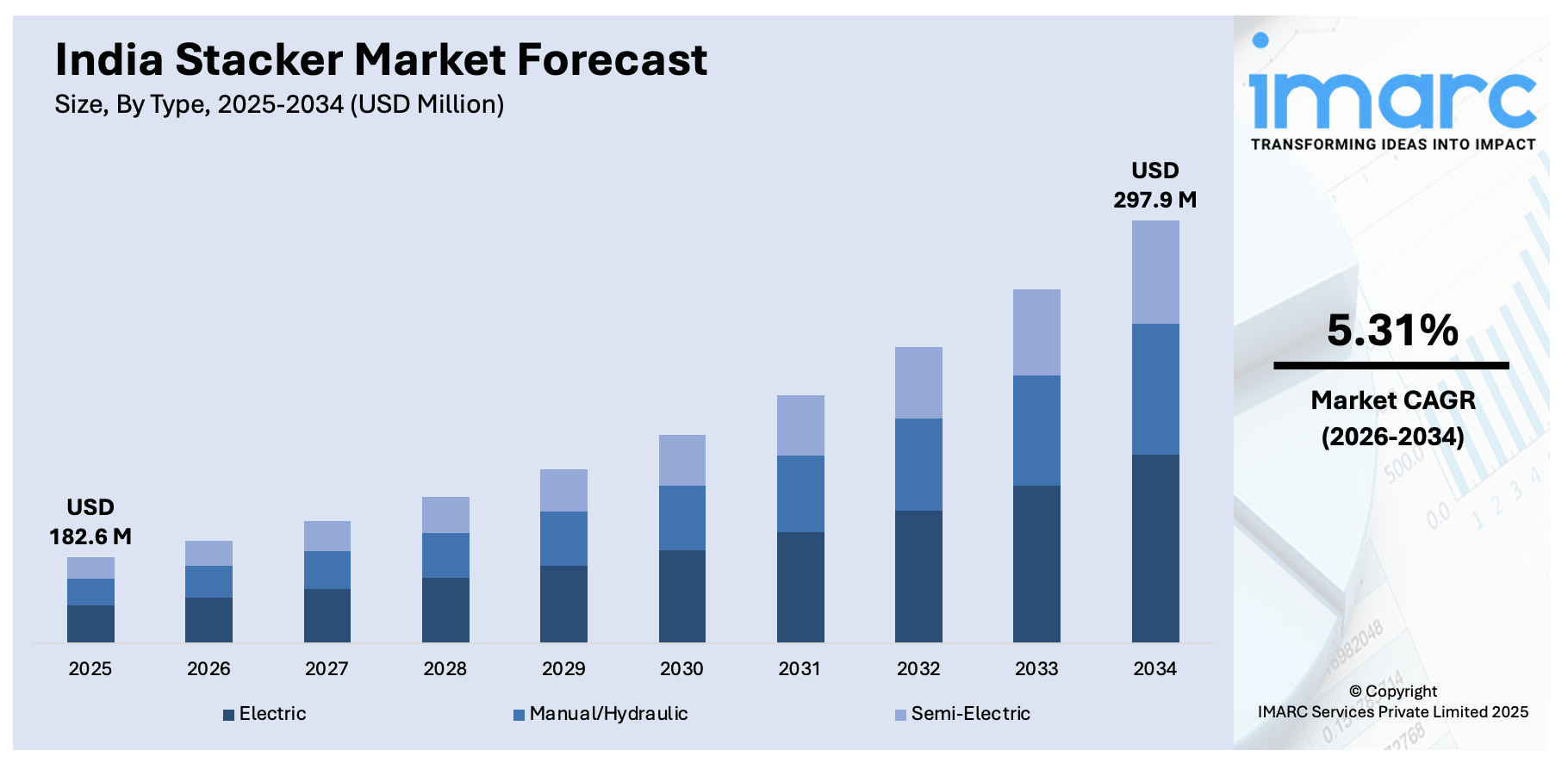

The India stacker market size reached USD 182.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 297.9 Million by 2034, exhibiting a growth rate (CAGR) of 5.31% during 2026-2034. The integration of automation and robotics, the widespread adoption of stacker to minimize carbon footprints and reduce long-term operational costs, and the implementation of safety regulations and labor laws across the country represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 182.6 Million |

| Market Forecast in 2034 | USD 297.9 Million |

| Market Growth Rate (2026-2034) | 5.31% |

A stacker is a type of industrial machinery primarily devised for handling, stacking, and storing various materials, such as pallets and boxes, in industrial and warehousing contexts. It is equipped with a lifting system governed by hydraulic or electric means. It can hoist materials to diverse heights, facilitating storage on shelves or in racking structures. Depending on its design, the stacker can either be manual, requiring physical effort for their operation, or powered, utilizing an onboard motor for drive and lift functions. It is an integral part of locations where the transportation of heavy loads over shorter distances is a necessity, including warehouses, distribution centers, and manufacturing plants. Through the use of stackers, manual labor is significantly mitigated, storage capacity is enhanced, and space utilization is optimized, thus making them an indispensable tool in contemporary industrial operations.

To get more information on this market Request Sample

India Stacker Market Trends:

The stacker market in India is currently witnessing remarkable growth, propelled by the rapid expansion of e-commerce and the subsequent growth of warehouses and distribution centers across the country. In addition to this, technological advancements in stacker machinery, particularly the integration of automation and robotics, are providing a robust stimulus to the market. These automated stackers improve operational efficiency, mitigate human error, and enhance productivity, significantly supporting the market in India. Further, numerous industries are showing an increased preference for electric stackers due to an enhanced focus on sustainability. These environmentally friendly options minimize carbon footprints and reduce long-term operational costs, making them appealing to businesses. Customized stacker solutions tailored to meet specific industrial needs are another trend propelling the market. As industries demand stackers with varied heights, load capacities, and maneuverability features, manufacturers are innovating their offerings, leading to market expansion. Apart from this, the tightening of safety regulations and labor laws in India has prompted businesses to replace manual labor with industrial equipment, including stackers, for heavy lifting tasks. Furthermore, the increasing awareness of these benefits amongst businesses is creating a positive market outlook. Also, various government initiatives aimed at promoting the manufacturing sector and enhancing industrial infrastructure are positively impacting the demand for stackers across the countey. Incentives and subsidies provided to industries for adopting modern material handling equipment like stackers further stimulate the overall market growth. Some of the other factors driving the market include rapid urbanization, ongoing infrastructure development projects across various industries, such as construction, manufacturing, and automotive, and the integration of Industry 4.0 technologies.

India Stacker Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India stacker market report, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and end user.

Type Insights:

- Electric

- Manual/Hydraulic

- Semi-Electric

The report has provided a detailed breakup and analysis of the market based on the type. This includes electric, manual/hydraulic, and semi-electric.

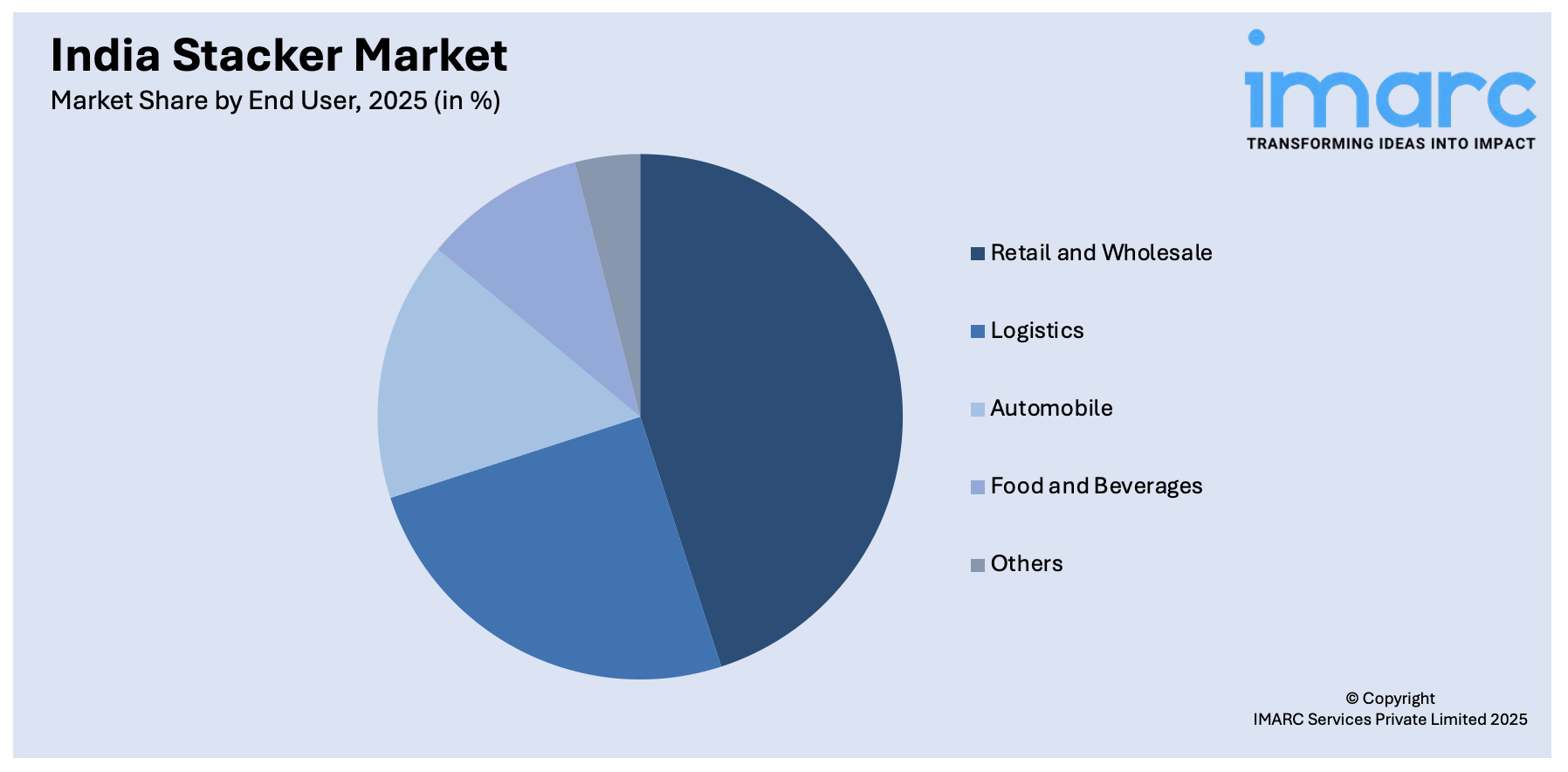

End User Insights:

Access the comprehensive market breakdown Request Sample

- Retail and Wholesale

- Logistics

- Automobile

- Food and Beverages

- Others

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes retail and wholesale, logistics, automobile, food and beverages, and others.

Regional Insights:

- South India

- North India

- West & Central India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include South India, North India, West & Central India, and East India.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Stacker Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Electric, Manual/Hydraulic, Semi-Electric |

| End Users Covered | Retail and Wholesale, Logistics, Automobile, Food and Beverages, Others |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India stacker market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India stacker market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India stacker industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The stacker market in India was valued at USD 182.6 Million in 2025.

The India stacker market is projected to exhibit a CAGR of 5.31% during 2026-2034, reaching a value of USD 297.9 Million by 2034.

The market is driven by the increasing need for efficient material handling across logistics, warehousing, retail, and construction. Rapid urbanization and industrial growth are encouraging investments in automated storage solutions. Adoption of electric stackers is gaining traction due to sustainability goals, cost efficiency, and reduced emissions, further strengthening demand from modern warehouses and manufacturing facilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)