India Spray Adhesive Market Size, Share, Trends and Forecast by Chemistry, Type, End User, and Region, 2025-2033

India Spray Adhesive Market Overview:

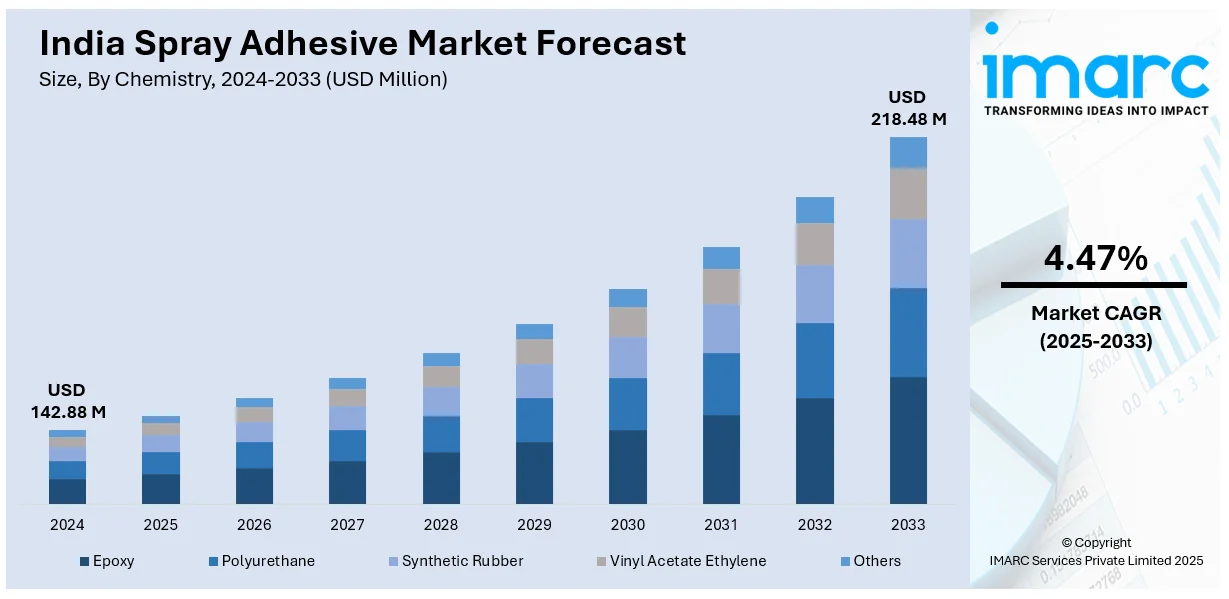

The India spray adhesive market size reached USD 142.88 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 218.48 Million by 2033, exhibiting a growth rate (CAGR) of 4.47% during 2025-2033. The market is driven by rising demand from the automotive and construction sectors, government infrastructure initiatives, and increasing adoption of eco-friendly adhesives. Growth in packaging, furniture, and DIY applications, along with advancements in adhesive technology, further fuels expansion. Stringent environmental regulations and consumer preference for sustainable products are also expanding the India spray adhesive market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 142.88 Million |

| Market Forecast in 2033 | USD 218.48 Million |

| Market Growth Rate 2025-2033 | 4.47% |

India Spray Adhesive Market Trends:

Rising Demand for Eco-Friendly Spray Adhesives in India

The growing demand for eco-friendly and low-VOC (volatile organic compound) products, driven by increasing environmental awareness and stringent government regulations is favoring the India spray adhesive market growth. Industries such as packaging, automotive, and construction are shifting toward water-based and solvent-free adhesives to comply with sustainability norms and reduce harmful emissions. Consumers and manufacturers are prioritizing green alternatives due to their non-toxic nature and lower environmental impact. Additionally, the rise of eco-conscious brands and corporate sustainability goals is accelerating the adoption of bio-based adhesives. A study published in August 2024 examined the new bio-based adhesive synthesized from soybean meal and wood-derived bio-oil. It shows a breakthrough of 487.5% improvement in wet bonding strength (0.94 MPa) with excellent anti-mold ability. This bio-based adhesive, which has a low ecological footprint and is cost-effective, serves as a surrogate for a traditional petrochemical adhesive. Since this innovation comes in response to the growing demand for eco-friendly options in India, painters and industry experts believe that there are considerable opportunities for the spray adhesive market, particularly in the wood composites and packaging sectors. In addition, companies are investing in research and development (R&D) activities to develop high-performance, eco-friendly adhesives that maintain strong bonding properties while being safer for users and the environment. This trend is expected to expand further as India strengthens its focus on sustainable industrial practices, creating new growth opportunities for manufacturers in the spray adhesive sector.

To get more information on this market, Request Sample

Growth in Automotive and Construction Sectors

The increasing applications in the automotive and construction industries are creating a positive India spray adhesive market outlook. In the automotive sector, spray adhesives are widely used for interior trim bonding, upholstery, and soundproofing, driven by rising vehicle production and demand for lightweight materials. The automotive industry in India produced 30.6 Million vehicles in 2024, of which 4.27 Million passenger vehicles, 0.95 million commercial vehicles, and 19.5 Million two-wheelers were sold domestically. In December, it recorded production of 1.92 Million units, reflecting strong market demand. The trend of expanding the automotive sector is seen as having a positive effect on the spray adhesive market, driven by increasing automotive production. Similarly, the construction industry utilizes these adhesives for installing insulation panels, flooring, and decorative elements, supported by India's booming infrastructure development. The government's initiatives, such as the "Smart Cities Mission" and "Housing for All," are further propelling demand for high-performance adhesives in construction projects. Additionally, the ease of application and quick bonding properties of spray adhesives make them a preferred choice over traditional methods. As these industries continue to expand, the spray adhesive market is expected to grow steadily, with manufacturers focusing on innovative formulations to meet diverse industrial requirements.

India Spray Adhesive Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on chemistry, type, and end user.

Chemistry Insights:

- Epoxy

- Polyurethane

- Synthetic Rubber

- Vinyl Acetate Ethylene

- Others

The report has provided a detailed breakup and analysis of the market based on the chemistry. This includes epoxy, polyurethane, synthetic rubber, vinyl acetate ethylene, and others.

Type Insights:

- Solvent-Based

- Water-Based

- Hot Melt

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes solvent-based, water-based, and hot melt.

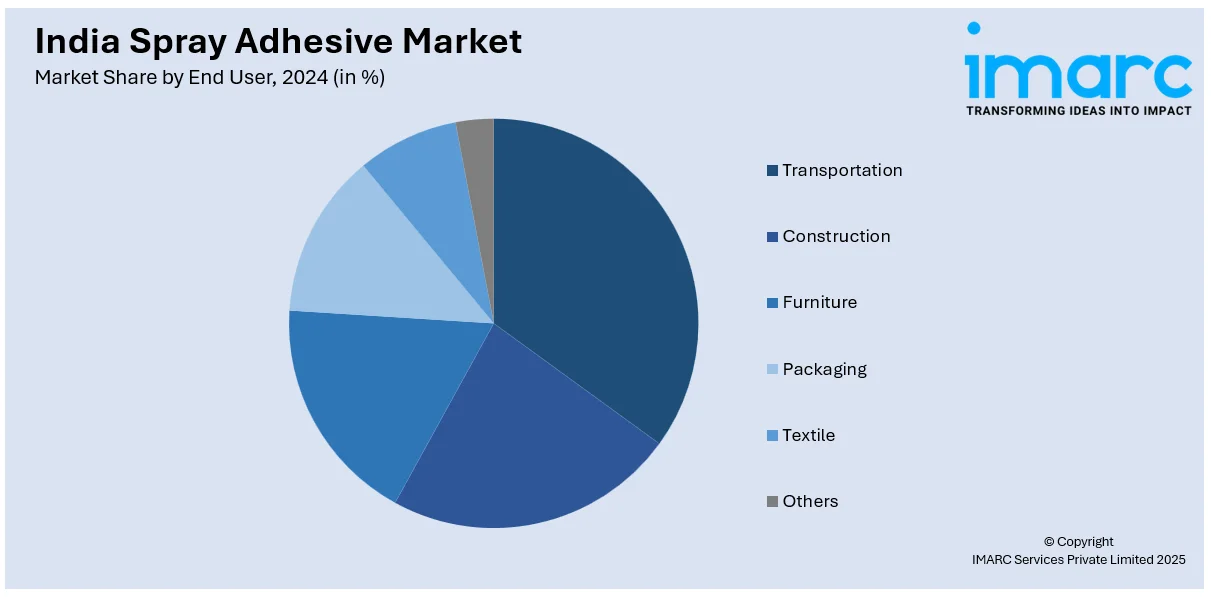

End User Insights:

- Transportation

- Construction

- Furniture

- Packaging

- Textile

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes transportation, construction, furniture, packaging, textile, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Spray Adhesive Market News:

- August 2024: Henkel Adhesives Technologies India Private Limited (Henkel India) completed Phase III of its LEED Gold-certified manufacturing facility in Kurkumbh, near Pune, Maharashtra. This facility plans to address the growing demand for high-performance adhesives, sealants, and surface treatment products in India. The Kurkumbh facility aims to satisfy the rising need in sectors such as automotive components, maintenance, and manufacturing and maintenance.

India Spray Adhesive Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Chemistries Covered | Epoxy, Polyurethane, Synthetic Rubber, Vinyl Acetate Ethylene, Others |

| Types Covered | Solvent-Based, Water-Based, Hot Melt |

| End Users Covered | Transportation, Construction, Furniture, Packaging, Textile, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India spray adhesive market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India spray adhesive market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India spray adhesive industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The spray adhesive market in India was valued at USD 142.88 Million in 2024.

The India spray adhesive market is projected to exhibit a CAGR of 4.47% during 2025-2033, reaching a value of USD 218.48 Million by 2033.

The growth of the India spray adhesive market is driven by rapid urbanization, expanding automotive production, furniture and woodworking demand, and the shift toward convenient bonding solutions. Growth in construction and packaging industries, rising disposable incomes, and increasing DIY activities also fuel demand. Eco-friendly, low-VOC formulations and advancements in application technology attract manufacturers and consumers, pushing market expansion further.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)