India Sportswear Market Size, Share, Trends and Forecast by Product, Distribution Channel, End User, and Region, 2026-2034

India Sportswear Market Summary:

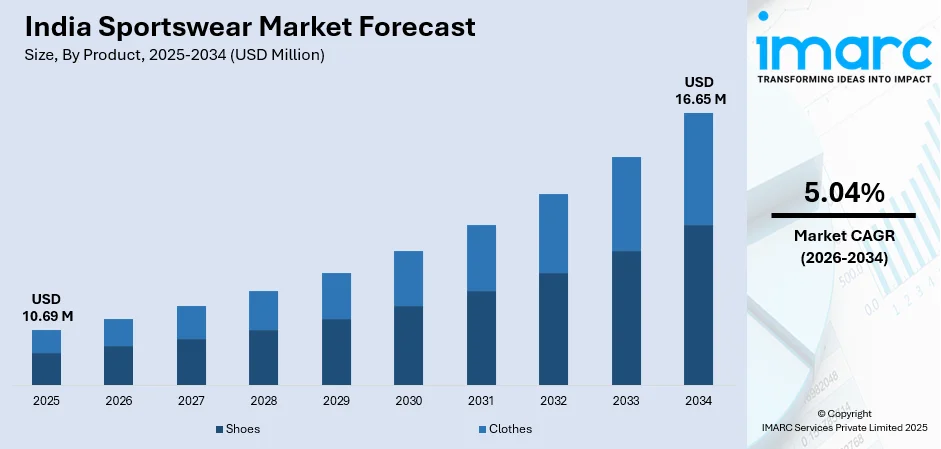

The India sportswear market size was valued at USD 10.69 Million in 2025 and is projected to reach USD 16.65 Million by 2034, growing at a compound annual growth rate of 5.04% from 2026-2034.

The market growth is primarily propelled by heightened health and fitness consciousness among the masses, widespread adoption of athleisure as everyday wear, rising disposable incomes enabling premium product purchases, and government-led sports development initiatives including infrastructure expansion. Apart from this, rising occurrence of youth participation programs and the rapid proliferation of e-commerce platforms providing seamless access across tier-two and tier-three cities is expanding the India sportswear market share.

Key Takeaways and Insights:

-

By Product: Shoes dominate the market with a share of 55.74% in 2025, driven by increasing running culture, specialized footwear requirements for diverse sports activities, and expansion of both global brands and domestic manufacturers focusing on affordability combined with performance attributes across metropolitan and emerging urban markets.

-

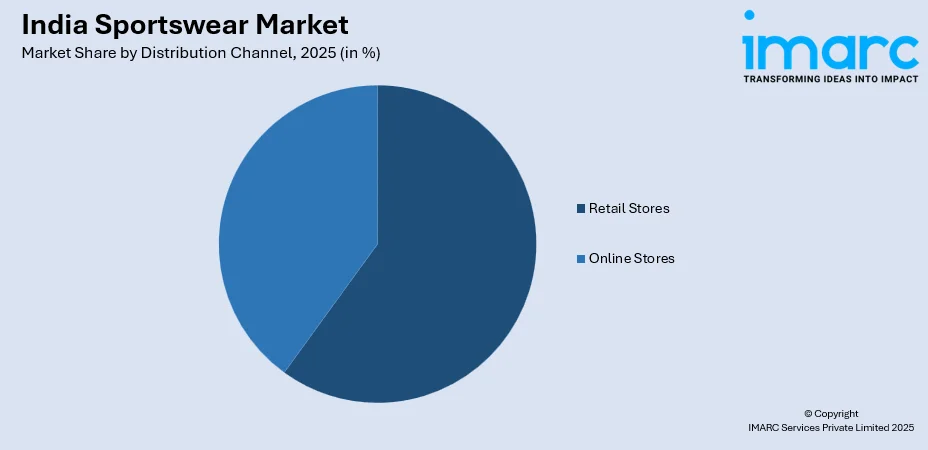

By Distribution Channel: Retail stores lead the market with a share of 35.28% in 2025, benefiting from preference for touch-and-feel experiences particularly in smaller towns, immediate product availability eliminating delivery waiting periods, expert assistance for proper sizing and product selection, and strategic retail expansion by major brands into tier-two and tier-three cities through franchise and multi-brand outlet models.

-

By End User: Men represent the largest segment with a market share of 59.84% in 2025, reflecting higher participation in organized sports and gym memberships, stronger brand loyalty patterns, higher average transaction values for performance-oriented products, and sustained marketing investments by sportswear companies targeting male consumers through cricket sponsorships and celebrity endorsements.

-

By Region: North India leads the market with a share of 32% in 2025, supported by concentrated population centers, higher per capita disposable incomes, robust sports infrastructure development, and strong retail presence of both international and domestic sportswear brands.

-

Key Players: The India sportswear market exhibits intense competitive dynamics, with multinational corporations competing alongside emerging domestic brands across multiple price segments, each leveraging distinct strategies from premium positioning to value-conscious affordability.

To get more information on this market Request Sample

The India sportswear market is experiencing transformative growth fueled by a fundamental shift toward health-conscious lifestyles and active living. The convergence of rising fitness culture, government-backed sports infrastructure development, and digital commerce expansion has created unprecedented market opportunities. In 2025, ASICS announced plans to increase local production in India from 30% to 40% to comply with government quality certification regulations, while targeting expansion to 200 stores by 2026 in a domestic market. This expansion reflects broader industry confidence in India's sportswear potential, driven by a young demographic profile where a major part of the population is under age 25, increasing gym memberships, and the proliferation of athleisure as mainstream fashion transcending traditional workout contexts to encompass daily wear, travel attire, and even workplace casual settings.

India Sportswear Market Trends:

Explosive Growth of Athleisure Blending Performance with Fashion

The Indian sportswear landscape has witnessed a dramatic transformation as athleisure emerges as a dominant fashion category, fundamentally redefining consumer wardrobe choices by seamlessly merging athletic functionality with everyday style. This trend has gained remarkable traction among urban millennials and Gen Z consumers who prioritize versatility, comfort, and contemporary aesthetics in their clothing selections. The India athleisure market, valued at USD 13,156.1 Million in 2024, is projected to reach USD 21,250.2 Million by 2033, according to IMARC Group. Social media influencers and celebrity endorsements have accelerated adoption, normalizing sportswear for contexts far beyond gyms and running tracks, including casual office environments, social gatherings, and travel scenarios, thereby expanding the addressable market significantly.

Government-Led Sports Infrastructure and Youth Development Initiatives

India's sports ecosystem has undergone substantial enhancement through comprehensive government programs aimed at fostering grassroots participation and elite athlete development nationwide. The Ministry of Youth Affairs and Sports received a record allocation of INR 3,794 crores for FY 2025-26, with INR 1,000 crores designated specifically for the Khelo India Programme, which has established 1,045 Khelo India Centres for grassroots training and approved 326 new sports infrastructure projects worth INR 3,124.12 crores. These initiatives have catalyzed increased participation in organized sports, with fitness facility memberships projected to rise, directly translating into heightened demand for specialized sportswear and athletic footwear across diverse sporting disciplines.

Rapid Expansion into Tier-Two and Tier-Three Cities

The geographic distribution of sportswear consumption has shifted dramatically as tier-two and tier-three cities emerge as critical growth engines, driven by rising aspirational consumption, improved digital connectivity, and retail infrastructure development. Tier-three cities alone posted 21% year-on-year growth in e-commerce orders during 2025 summer sales, substantially outpacing the overall 8% growth rate, indicating strong purchasing power and brand awareness in these markets. Major retailers including Decathlon have accelerated store expansion in cities like Indore, Jaipur, Surat, Kochi, and Raipur, bringing affordable activity-specific apparel and footwear closer to previously underserved audiences. This geographic diversification has enabled sportswear brands to tap into a vast consumer base beyond metropolitan saturation, supported by lower operational costs, higher customer loyalty, and growing middle-class populations with discretionary spending capacity.

Market Outlook 2026-2034:

The India sportswear market is positioned for robust expansion throughout the forecast period, propelled by structural shifts in consumer behavior, technological innovations in fabric manufacturing, and accelerating digital commerce penetration. The market generated a revenue of USD 10.69 Million in 2025 and is projected to reach a revenue of USD 16.65 Million by 2034, growing at a compound annual growth rate of 5.04% from 2026-2034. Women's sportswear segment growth, fueled by increasing participation in yoga, fitness activities, and casualwear adoption, alongside technological fabric innovations incorporating moisture-wicking and climate-responsive properties, will further support the market growth.

India Sportswear Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Shoes | 55.74% |

| Distribution Channel | Retail Stores | 35.28% |

| End User | Men | 59.84% |

| Region | North India | 32% |

Product Insights:

- Shoes

- Clothes

Shoes dominate with a market share of 55.74% of the total India sportswear market in 2025.

The shoes segment maintains market leadership through its essential role in athletic performance and the growing popularity of running and walking as primary fitness activities among Indian consumers. Specialized footwear categories including running shoes, training shoes, and sports-specific variants have gained traction as consumers increasingly recognize the importance of proper footwear in injury prevention and performance enhancement. Moreover, innumerable people are engaging in marathons and daily running, which is further driving the need for properly cushioned and efficient running shoes.

In 2025, Lehar Footwear Limited, a prominent entity in India's footwear sector, has unveiled its new sports and athleisure brand, RANNR. This marks the company's entry into the performance footwear market, expanding its main offerings of sandals and slippers. The brand aims to satisfy the heightened demand for fashionable and resilient sports shoes, especially among young professionals, students, fitness lovers, and lifestyle-oriented users. RANNR is marketed as a cost-effective choice that merges style, functionality, and comfort, aimed at consumers who value both budget-friendly prices and long-lasting durability in their shoe selections. The segment benefits from technological innovations such as advanced cushioning systems, breathable mesh constructions, and biomechanically engineered designs that deliver superior comfort and functionality across diverse sporting applications.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online Stores

- Retail Stores

Retail stores lead with a share of 35.28% of the total India sportswear market in 2025.

The retail stores segment maintains its dominant position through the irreplaceable value of physical product examination, expert sizing assistance, and instant gratification of immediate purchase fulfillment. Traditional retail formats including exclusive brand outlets, multi-brand outlets, and department stores continue to resonate strongly in tier-two and tier-three cities where consumers prefer touch-and-feel experiences before committing to sportswear purchases. Major brands have strategically expanded their retail footprints, with Puma operating over 577 stores nationwide backed by aggressive celebrity endorsements and marketing campaigns, while Adidas signed a major franchise agreement to open 100 new stores targeting India's tier-two and tier-three markets with concept retail outlets designed for enhanced brand engagement.

The retail channel benefits from lower return rates compared to e-commerce, stronger emotional connections through experiential retail environments, and the ability to provide comprehensive product demonstrations particularly for technical footwear and specialized athletic apparel categories. In 2025, Nike has enhanced its retail footprint in Mumbai by opening its newest store at Oberoi Sky City Mall, Borivali East. Having been accessible to the public since 15 June, the new site represents a significant advancement in Nike's expanding presence in the city's western suburbs. Located in Oberoi Sky City Mall, a top lifestyle and shopping hub featuring global brands, the new Nike store emerges as a leading destination for sports and fashion fans. The launch highlights Nike's dedication to providing straightforward access to sport-inspired innovations and an enhanced in-store experience for urban shoppers in Mumbai.

End User Insights:

- Men

- Women

- Kids

Men exhibit a clear dominance with a 59.84% share of the total India sportswear market in 2025.

The men's segment maintains its market leadership position through higher participation rates in organized sports, gym memberships, and outdoor athletic activities, translating into stronger and more frequent sportswear purchasing patterns. Male users demonstrate greater brand loyalty and willingness to invest in premium performance-oriented products, particularly in categories such as running shoes, training apparel, and sports-specific equipment. The segment benefits from extensive marketing campaigns leveraging cricket sponsorships, football associations, and celebrity brand ambassadors, with major brands like Adidas pushing cricket engagement after signing with the Indian national team, while Nike maintains strong brand equity despite scaling back physical store presence.

Men's sportswear purchasing decisions are increasingly influenced by social media fitness influencers and peer recommendations, creating organic demand amplification through digital channels. In 2025, CAVA Athleisure, a newly established athleisure clothing brand, is collaborating with Zepto, India’s leading quick commerce platform, to make athleisure as essential as everyday items. Alongside introducing a new collection of men's sportswear, CAVA intends to unveil proprietary textiles that have undergone several years of extensive research and development.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

North India leads with a share of 32% of the total India sportswear market in 2025.

The North India sportswear market is experiencing robust growth, driven by the growing health consciousness, rising disposable incomes, and developing fitness culture across major urban centers including Delhi NCR, Punjab, Haryana, and Uttar Pradesh. The region's young demographic profile, combined with growing awareness about active lifestyles, has created substantial demand for performance-oriented athletic apparel and footwear. Key growth drivers include the proliferation of gymnasiums, yoga studios, and sports facilities, alongside government initiatives promoting sports participation.

The market benefits from strong retail infrastructure, with both international brands and domestic players establishing significant presence through exclusive stores and multi-brand outlets. E-commerce penetration has further accelerated market expansion, enabling consumers in tier-2 and tier-3 cities to access premium sportswear brands. The athleisure trend, where sportswear doubles as casual wear, has broadened the consumer base beyond traditional athletes. Rising participation in marathons, cycling events, and adventure sports continues fueling demand, positioning North India as a critical growth corridor for sportswear manufacturers targeting India's evolving fitness and wellness landscape.

Market Dynamics:

Growth Drivers:

Why is the India Sportswear Market Growing?

Surging Fitness Culture and Health Consciousness Across Demographics

India is experiencing a fundamental societal transformation as fitness and wellness transition from niche pursuits to mainstream lifestyle priorities across age groups and socioeconomic segments. This cultural shift has been catalyzed by increasing awareness of lifestyle diseases including diabetes, obesity, and cardiovascular conditions, prompting preventive health measures through regular physical activity and structured exercise regimens. The number of fitness centers in India increased, reflecting widespread adoption of gym memberships, yoga practices, and organized sports participation. In May 2025, the NESCO Center in Mumbai saw the inaugural HYROX race in India, signifying the introduction of this internationally acclaimed fitness event. Featuring 1,650 participants from 24 nations, the event demonstrated that fitness in India is prepared for a fresh challenge. This expanding fitness ecosystem directly translates into heightened demand for specialized sportswear that enhances performance, prevents injuries, and provides comfort during diverse athletic activities, creating sustained market growth momentum across product categories.

Production-Linked Incentive Scheme Driving Domestic Manufacturing Expansion

The Indian government's Production-Linked Incentive scheme for the textile sector has catalyzed substantial domestic manufacturing capacity expansion in sportswear and technical textiles, reducing import dependency while improving product availability and affordability for consumers. The scheme's budget allocation for textiles surged from INR 45 crores in the 2024-25 revised estimates to INR 1,148 crores in 2025-26, reflecting government commitment to strengthening the synthetic fiber and sportswear manufacturing ecosystem. Major sportswear manufacturers have announced substantial expansion plans. This manufacturing localization trend improves supply chain efficiency, enables competitive pricing for domestic consumers, and allows brands to respond more rapidly to emerging fashion trends and consumer preferences in the Indian market.

Women's Sports Participation and Female Fitness Movement Acceleration

The dramatic increase in women's participation in sports and fitness activities represents a transformative growth driver, expanding the addressable market significantly beyond the traditionally male-dominated sportswear segment. The women's sportswear segment is projected to grow driven by increasing participation in yoga, gym workouts, running, and general fitness activities alongside athleisure adoption for casual everyday wear. Female consumers increasingly seek sportswear that combines functionality with aesthetic sophistication, demanding supportive construction without movement restriction, proportionate sizing accommodating diverse body types, and versatile designs that seamlessly transition between workout environments and social contexts. Government initiatives have accelerated this trend, with programs like "10 Ka Dum" organizing competitions across 10 disciplines in 10 cities specifically aimed at encouraging mass participation of women in sports and developing a sporting culture. Several homegrown brands including BlissClub have successfully carved powerful niches by creating high-quality activewear specifically designed for Indian women's body proportions, while international premium brand Lululemon announced plans in May 2024 to enter the Indian market to capitalize on growing demand for fitness and athleisure apparel among women.

Market Restraints:

What Challenges the India Sportswear Market is Facing?

Intense Competition from International Brands Limiting Domestic Player Growth

The India sportswear market faces substantial competitive pressure from well-established international brands including Nike, Adidas, Puma, and Reebok, which dominate premium market segments through strong brand equity, extensive marketing budgets, and celebrity endorsements that create significant entry barriers for domestic manufacturers. These multinational corporations leverage global design capabilities, advanced fabric technologies, and established distribution networks that domestic brands struggle to replicate, creating pricing power and consumer preference advantages particularly in metropolitan markets where international brand affinity remains strong among affluent customers.

High Product Costs and Price Sensitivity in Mass Market Segments

Despite rising disposable incomes, the Indian consumer base remains predominantly price-sensitive, creating challenges for sportswear brands attempting to maintain healthy margins while offering competitive pricing accessible to middle-income segments. The cost structures for high-performance sportswear incorporating advanced moisture-wicking fabrics, compression technologies, and specialized construction techniques result in retail prices substantially higher than basic casual wear alternatives, limiting adoption among budget-conscious individuals particularly in tier-three cities and rural markets where affordability considerations outweigh brand preferences and technical performance attributes.

Limited Consumer Awareness of Technical Sportswear Benefits

A significant portion of the Indian consumer population remains unaware of the performance advantages and injury prevention benefits offered by specialized athletic footwear and technical sportswear, often perceiving these products as overpriced alternatives to conventional casual wear. This knowledge gap particularly affects semi-urban and rural markets where traditional clothing habits persist and the value proposition of moisture-wicking fabrics, biomechanically designed footwear, and compression garments remain inadequately communicated, restricting market expansion beyond fitness-conscious urban demographics who actively seek performance-enhancing athletic apparel.

Competitive Landscape:

Key market players in the India sportswear market are implementing multifaceted strategies to strengthen their competitive position and capture growing demand. Companies are aggressively expanding their digital presence through e-commerce platforms and mobile applications, recognizing the shift in consumer purchasing behavior. Product innovation remains central, with emphasis on developing performance-enhancing fabrics, moisture-wicking technologies, and athleisure collections that blend functionality with everyday wear. Market participants are localizing their offerings by introducing region-specific designs and price points that cater to India's diverse consumer base. Omnichannel retail expansion continues, combining flagship stores in tier-1 cities with penetration into tier-2 and tier-3 markets. Sustainability initiatives are gaining prominence, with companies incorporating recycled materials and eco-friendly manufacturing processes to appeal to environmentally conscious consumers.

Recent Developments:

-

In December 2025, Fashion and lifestyle brand Superdry has launched its new performance-wear line, Superdry Sport, in India, aiming to capitalize on the increasing demand for technical activewear in the country, it announced in a media statement. The introduction signifies the brand's growth in performance-oriented clothing, featuring items tailored for running, functional training, and various recreational fitness pursuits that are becoming popular with city dwellers.

-

In October 2025, Cricket legend and Bharat Ratna Sachin Tendulkar unveiled TEN x YOU, a sportswear and athleisure brand, on Friday (October 10, 2025), created from his insights and firsthand experiences as an elite athlete.

-

In June 2025, Aeractive has debuted as a premium performance wear label, launching into India’s expanding activewear sector with a top-tier collection of men's and women's clothing. From intense exercise to recuperation and everyday activities, the brand launches its first collection showcasing leggings, tanks, sports bras, T-shirts, sweatshirts, shorts, and track pants.

India Sportswear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Shoes, Clothes |

| Distribution Channels Covered | Online Stores, Retail Stores |

| End Users Covered | Men, Women, Kids |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India sportswear market size was valued at USD 10.69 Million in 2025.

The India sportswear market is expected to grow at a compound annual growth rate of 5.04% from 2026-2034 to reach USD 16.65 Million by 2034.

Shoes held the largest share with 55.74% in 2025, driven by increasing running culture, specialized footwear requirements for diverse sports activities, and expansion of both global brands and domestic manufacturers focusing on affordability combined with performance attributes across metropolitan and emerging urban markets.

Key factors driving the India sportswear market include surging fitness culture and health consciousness with fitness facility memberships projected to grow, government-backed sports development programs receiving record budget allocation, and Production-Linked Incentive scheme allocations for textiles surging to INR 1,148 crores catalyzing domestic manufacturing expansion and reducing import dependency.

Major challenges include intense competition from well-established international brands dominating premium segments through strong brand equity and extensive marketing budgets, high product costs and price sensitivity limiting adoption among budget-conscious middle-income customers, limited consumer awareness of technical sportswear benefits particularly in semi-urban and rural markets, and supply chain complexities affecting consistent product availability across diverse geographic markets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)