India Sports and Energy Drinks Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033

Market Overview 2025-2033:

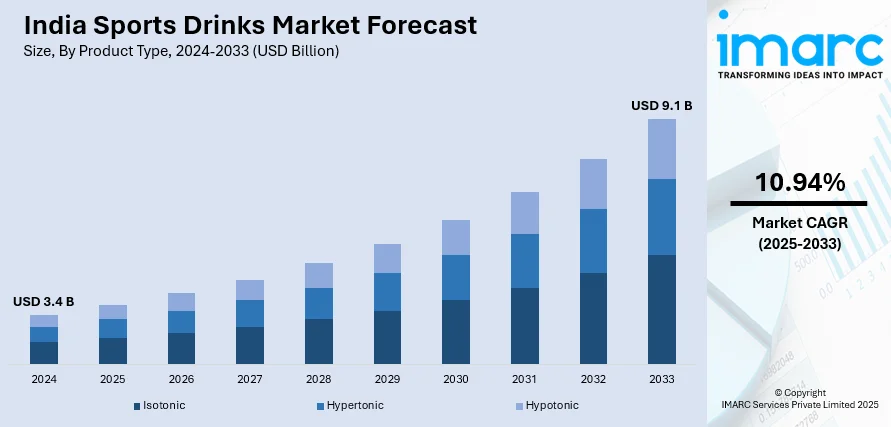

The India sports and energy drinks market size reached USD 3.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.1 Billion by 2033, exhibiting a growth rate (CAGR) of 10.94% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.4 Billion |

| Market Forecast in 2033 | USD 9.1 Billion |

| Market Growth Rate (2025-2033) | 10.94% |

Sports and energy drinks are beverages consumed for physical and mental stimulation while performing sports- and fitness-related activities. These beverages are rich in essential nutrients, such as carbohydrates, vitamins, minerals and caffeine, which provide an instant energy boost to the body. They also replenish the electrolytes lost during physical activities and hydrate the body. Sports and energy drinks are commonly available in carbonated and non-carbonated variants, along with a wide variety of flavors, including strawberry, cranberry, lime, apple and pineapple.

To get more information on this market, Request Sample

The increasing prevalence of lifestyle diseases among the masses, along with the increasing engagement in sports-related activities to maintain a healthy lifestyle, is one of the key factors driving the market in India. Furthermore, the increasing consumer expenditure on lifestyle and well-being activities has enhanced the overall demand for sports and energy drinks. In line with this, aggressive promotions by leading brands through various social media platforms, is also contributing to the market growth. Product manufacturers are developing sugar-free variants with natural ingredients and are collaborating with sports personalities and celebrities to endorse their products. Other factors, including the increasing preference for ready-to-drink (RTD) beverages and the emerging gym culture across the country, are anticipated to drive the market further.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India sports and energy drinks market report, along with forecasts at the country and regional levels from 2025-2033. Our report has categorized the market based on product type, packaging type, distribution channel, type and target consumer.

India Sports Drinks Market

Breakup by Product Type:

- Isotonic

- Hypertonic

- Hypotonic

Breakup by Packaging Type:

- Bottle (Pet/Glass)

- Can

- Others

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East India

India Energy Drinks Market

Breakup by Product:

- Alcoholic

- Non-Alcoholic

Breakup by Type:

- Non-Organic

- Organic

Breakup by Packaging Type:

- Bottle (Pet/Glass)

- Can

- Others

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Breakup by Target Consumer:

- Teenagers

- Adults

- Geriatric Population

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Product Type, Packaging Type, Distribution Channel, Type, Target Consumer, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India sports and energy drinks market was valued at USD 3.4 Billion in 2024.

We expect the India sports and energy drinks market to exhibit a CAGR of 10.94% during 2025-2033.

The rising demand for sports and energy drinks, as they aid in improving hydration levels, reducing fatigue, boosting energy, etc., is primarily driving the India sports and energy drinks market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of sports and energy drinks across the nation.

Based on the product type, the India sports drinks market has been bifurcated into isotonic, hypertonic, and hypotonic. Among these, isotonic currently accounts for the majority of the total market share.

Based on the product, the India energy drinks market can be categorized into alcoholic and non-alcoholic. Currently, non-alcoholic exhibits a clear dominance in the market.

Based on the type, the India energy drinks market has been segregated into non-organic and organic, where non-organic currently holds the largest market share.

Based on the packaging type, the India sports and energy drinks market can be segmented into bottle (pet/glass), can, and others. Currently, bottle (pet/glass) accounts for the majority of the total market share.

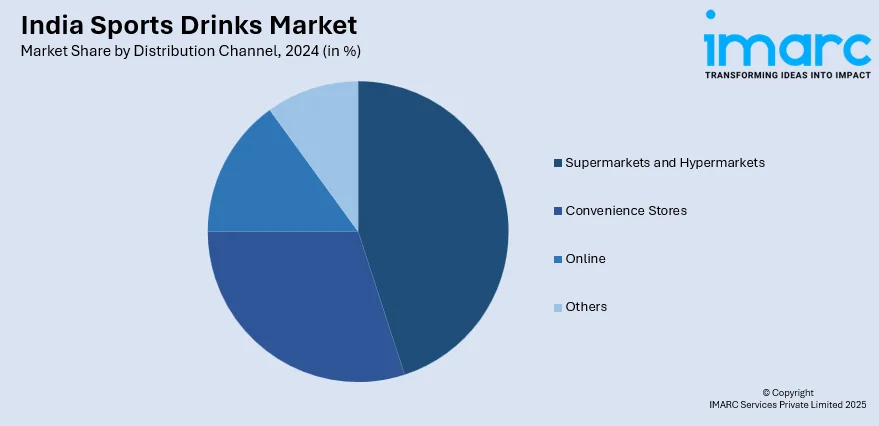

Based on the distribution channel, the India sports and energy drinks market has been divided into supermarkets and hypermarkets, convenience stores, online, and others. Among these, supermarkets and hypermarkets currently exhibit a clear dominance in the market.

Based on the target consumer, the India energy drinks market can be bifurcated into teenagers, adults, and geriatric population. Currently, adults hold the largest market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)