India Sports Betting Market Size, Share, Trends and Forecast by Platform, Betting Type, Sports Type, and Region, 2025-2033

India Sports Betting Market Size and Share:

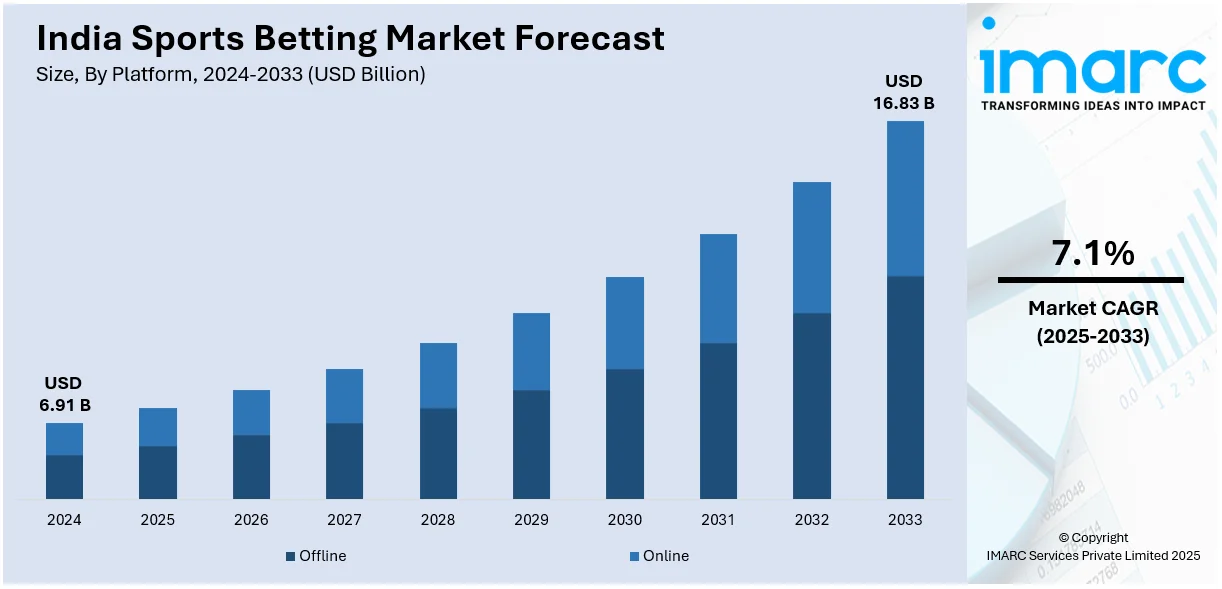

The India sports betting market size was valued at USD 6.91 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 16.83 Billion by 2033, exhibiting a CAGR of 7.1% from 2025-2033. The market is rapidly expanding fueled by increased smartphone and internet penetration. Growth is mainly propelled by tech-savvy, young demographic and innovative technologies positioning India as a significant player in the global sports betting industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.91 Billion |

| Market Forecast in 2033 | USD 16.83 Billion |

| Market Growth Rate (2025-2033) | 7.1% |

The market is primarily driven by the growing popularity of online sports betting due to growing accessibility of digital platforms and evolving consumer preferences The rapid growth of internet penetration and smartphone adoption in India has significantly driven the sports betting market. According to an article published by the Press Information Bureau, as of April 2024, 95.15% of India's 644,131 villages have access to 3G or 4G connectivity. In March 2024, the internet subscribers count elevated to 954.40 million, up from 251.59 million in March 2014.. The government's initiatives such as TIDE 2.0 and GENESIS aim to cover 213,000 Gram Panchayats with a total funding of around Rs 800 crore. These advancements have made online platforms more accessible enabling users to place bets appropriately . The rising popularity of major sports leagues such as the Indian Premier League (IPL) and international cricket tournaments has heightened engagement. The availability of real-time data, live streaming, and analytics further enhances user experiences attracting a broader audience to online betting platforms.

To get more information on this market, Request Sample

Transforming regulations and a heightening acceptance of sports betting have also played an integralrole. States including Nagaland and Sikkim have legalized particular forms of online gambling signaling potential regulatory shifts. The demographic advantage with a large youth population interested in sports combined with increasing disposable incomes contributes to market expansion. According to industry reports, India's per capita disposable income is projected at ₹2.14 lakh for 2023-24, showing an 8% growth for FY24. Innovative marketing strategies, partnerships with sports teams and user-friendly apps are fostering consumer interest making sports betting a thriving sector in India.

India Sports Betting Market Trends:

Shift to Online Platforms

The sports betting landscape in India is experiencing a noticeable transition from traditional physical outlets to online platforms. This shift is driven by widespread smartphone adoption and affordable internet access, particularly in semi-urban and rural areas. This digital transformation in the sports betting industry aligns with broader advancements in India's digital infrastructure underscored by significant developments such as Nokia's multi-billion-dollar partnership with Bharti Airtel in November 2024 to enhance 4G and 5G networks across the country. Online betting platforms offer convenience, privacy, and a range of options including multiple sports, live updates, and seamless payment gateways. Enhanced accessibility through mobile apps has made it easier for users to engage in betting anytime and anywhere. The growth of secure digital payment methods and multilingual interfaces has further broadened the reach enabling more individuals to participate in online sports betting.

Global Operators Entering the Market

The Indian sports betting market is attracting global operators due to its immense potential and expanding user base. International brands are entering the market by forming strategic partnerships with local companies leveraging their understanding of regional preferences and regulatory landscapes. These collaborations enable global operators to offer customized services including localized betting options and multilingual platforms enhancing their appeal. Some brands are setting up operations such as technology hubs and customer support centers to strengthen their foothold. For instance, in August 2024, Flutter Entertainment a Dublin-based online sports betting and iGaming firm launched a Global Capability Centre in Hyderabad with a $3.5 million investment aiming to employ 700 staff focused on data engineering and game integrity. The expansion is part of its strategy to enhance global operations while committing to local initiatives and increasing female leadership by 2026. This influx of international players intensifies competition driving innovation, improved user experiences and better promotions further fueling the growth of the Indian market.

Rise of Fantasy Sports

The rise of fantasy sports platforms such as Dream11 and My11Circle has transformed how users engage with sports. These platforms allow participants to create virtual teams based on real players and earn points based on actual game performance. While they are technically classified as skill-based games their competitive nature and the possibility of earning money closely mimic traditional gambling. The IPL and cricket leagues have been key drivers with users drawn to the interactive and analytical aspects of team selection. For instance, In March 2024, My11Circle secured a five-year partnership with the IPL outbidding Dream11 to become its official fantasy sports partner. Strategic advertising, celebrity endorsements, and user-friendly interfaces have broadened their appeal, particularly among younger audiences. This blend of gaming and wagering is reshaping the sports entertainment landscape.

India Sports Betting Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India sports betting market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on platform, betting type, and sports type.

Analysis by Platform:

- Offline

- Online

Offline sports betting in India primarily involves traditional bookmakers and physical betting shops predominantly operating in regions where local regulations permit. Cricket remains the highly popular sport for offline wagers followed by football and kabaddi. Despite its longstanding presence, the offline market faces challenges such as stringent legal restrictions and the rise of digital alternatives. Illegal betting remains widespread, posing regulatory and enforcement issues. In areas with legalized frameworks, offline betting continues to attract enthusiasts who prefer face-to-face interactions and tangible betting experiences maintaining a steady albeit limited market presence.

The online sports betting industry in India is experiencing rapid growth driven by widespread internet and smartphone adoption. Legalization efforts in several states have created a more regulated environment fostering trust and expanding the user base. Cricket dominates online betting complemented by football, eSports, and emerging sports like kabaddi. Innovative technologies, including mobile apps secure payment gateways, and live streaming improve customer experience. Mobile apps have played a pivotal role in boosting the India sports betting market share for various sports. A tech-savvy, young population and magnifying disposable incomes further propel the sector. Continuous regulatory advancements and strategic partnerships position online sports betting as a dynamic and significant segment in India’s gambling industry.

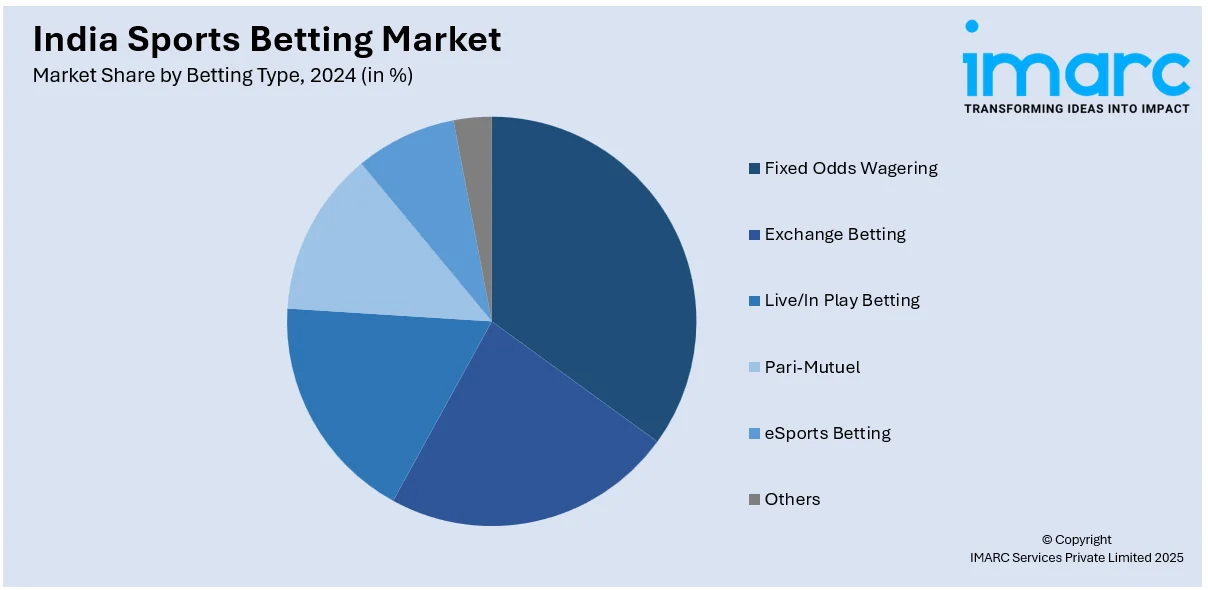

Analysis by Betting Type:

- Fixed Odds Wagering

- Exchange Betting

- Live/In Play Betting

- Pari-Mutuel

- eSports Betting

- Others

Fixed odds wagering remains the most prevalent betting type in India particularly popular for cricket and football. Bettors place bets at predetermined odds offered by bookmakers ensuring fixed returns if their predictions are correct. This traditional model is favored for its simplicity and transparency. The growth of online platforms has significantly boosted fixed odds betting providing users with a wide range of options and competitive odds thereby driving substantial revenue in the Indian market.

Exchange betting is gaining traction in India as it allows bettors to wager against each other in place of a against a bookmaker. Platforms facilitate this peer-to-peer betting offering more competitive odds and the capability to make bets (betting on an outcome not to occur). Although still emerging exchange betting appeals to experienced bettors seeking greater flexibility and potentially higher returns. Regulatory developments and increased awareness are expected to further propel this segment in the Indian sports betting landscape.

Live or in-play betting has soared in popularity enabled by real-time data and high-speed internet connections. This type enables bettors to place wagers on events as they unfold providing dynamic odds that alter with the game’sadvancement. Sports like cricket, football, and eSports are particularly suited for in-play betting. The interactive nature and the thrill of making split-second decisions attract a younger and tech-savvy audience making live betting a significant growth driver in India's online sports betting market.

Analysis by Sports Type:

- Football

- Basketball

- Baseball

- Horse Racing

- Cricket

- Hockey

- Others

Cricket holds significant attention in betting market mainly due to iconic tournaments like the Indian Premier League (IPL), ICC World Cup, and bilateral series attracting millions of bettors. The popularity of cricket is driven by its cultural significance and the availability of multiple betting formats including match outcomes, player performance, and live betting options. The growth of online platforms and increased accessibility to international cricket events have further solidified cricket’s position as the cornerstone of India’s sports betting market.

Football is the second most popular sport for betting in India spurred by global tournaments such as the UEFA Champions League, FIFA World Cup, and domestic leagues such as the English Premier League. Bettors are drawn to a wide variety of options including pre-match fixed odds, live betting, and player-specific bets. The younger demographic influenced by international exposure and the growing popularity of the Indian Super League (ISL) significantly contributes to the expansion of football betting in the country.

Horse racing has a time-honored history in India and is one of the few sports with legalized betting in many states. The sport is regulated through racecourses in cities like Bengaluru, Kolkata, and Mumbai. Bettors primarily engage in pari-mutuel betting wagering on outcomes like winners, exactas, and trifectas. Despite facing competition from other sports horse racing maintains a loyal following due to its established regulatory framework and traditional appeal.

Regional Analysis:

- South India

- North India

- West and Central India

- East India

South India represents a significant portion of the sports betting market driven by the region's passion for cricket and increasing interest in football. States like Tamil Nadu, Karnataka, and Andhra Pradesh have a tech-savvy population contributing to the rise of online platforms. Fantasy sports and live betting are particularly popular here supported by higher internet penetration and smartphone usage. Regulatory variations across states affect market dynamics but the region maintains a strong foothold for both traditional and online sports betting activities.

North India is a vibrant market for sports betting with cricket leading the way, particularly during IPL and major international events. States like Delhi, Uttar Pradesh, and Haryana see high engagement in online betting while traditional betting remains prevalent in rural areas. Football betting is also gaining traction driven by a younger demographic. Regulatory challenges and cultural factors shape the market's growth and increasing digital adoption and awareness are expanding opportunities in this region.

West and Central India including Maharashtra, Gujarat, and Madhya Pradesh are key regions for sports betting fueled by urban hubs like Mumbai and Pune. Cricket and horse racing dominate the betting landscape with Mumbai hosting some of the country's prominent racecourses. Online sports betting platforms have seen substantial adoption catering to a diverse audience. The region's economic strength and affinity for both traditional and digital betting formats make it a dynamic contributor to the market.

East India has a growing sports betting market with states like West Bengal and Odisha leading in activity. Horse racing particularly in Kolkata has historical significance while cricket sustains its position as the most popular sport for betting. Online platforms are gradually penetrating the market appealing to urban and semi-urban populations. Regulatory challenges and lower internet penetration in certain areas pose hurdles but the rising popularity of football and kabaddi betting is creating growth opportunities in the region.

Competitive Landscape:

The competitive landscape of India’s sports betting market is shaped by a mix of traditional operators and emerging digital platforms. Online platforms dominate the market leveraging mobile apps, live streaming, and secure payment gateways to attract tech-savvy users. Companies compete on user experience offering features like real-time odds, diverse betting options, and localized content tailored to regional preferences. Offline operators maintain a presence in states with a legal framework focusing on in-person interactions and community trust. Market participants face regulatory complexities encouraging innovation in compliance and security. The rise of fantasy sports and eSports betting has intensified competition with platforms diversifying offerings to capture niche audiences. The market's growth is impacted by tactical partnerships, advertising campaigns, and technological advancements.

The report provides a comprehensive analysis of the competitive landscape in the India sports betting market with detailed profiles of all major companies.

Latest News and Developments:

- In February 2024, Dream11 renewed its partnership with the NBA and WNBA continuing as the official fantasy gaming partner in India. This multiyear extension allows fans to engage in daily NBA and WNBA-themed fantasy games enhancing their experience and connection to the leagues.

- September 2024: The Competition Commission of India (CCI) approved Singapore-based TIGA Investments' acquisition of a stake in Dream Sports Inc., the parent company of Dream11. The deal involves Tiga Acquisition Corp III purchasing preferred stock from an undisclosed existing shareholder, cleared under the green channel route, which signifies no significant competition concerns.

India Sports Betting Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platforms Covered | Offline, Online |

| Betting Types Covered | Fixed Odds Wagering, Exchange Betting, Live/In Play Betting, Pari-Mutuel, eSports Betting, Others |

| Sports Types Covered | Football, Basketball, Baseball, Horse Racing, Cricket, Hockey, Others |

| Regions Covered | South India, North India, West and Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India sports betting market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India sports betting market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India sports betting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Sports betting encompasses predicting the culmination of sports events and placing wagers on the results. It encompasses various forms like fixed odds wagering, live betting, and pari-mutuel betting. Popular applications include betting on cricket, football, horse racing, and eSports through online and offline platforms.

The India sports betting market was valued at USD 6.91 Billion in 2024.

IMARC estimates the India sports betting market to exhibit a CAGR of 7.1% during 2025-2033.

Growth is driven by increased smartphone and internet penetration, a young and tech-savvy population, rising popularity of major sports leagues, and advancements in online platforms offering secure payment options and real-time data. Changing regulations and higher disposable incomes also contribute significantly.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)