India Specialty Chemicals Market Size, Share, Trends and Forecast by Type, and Region, 2025-2033

India Specialty Chemicals Market Size:

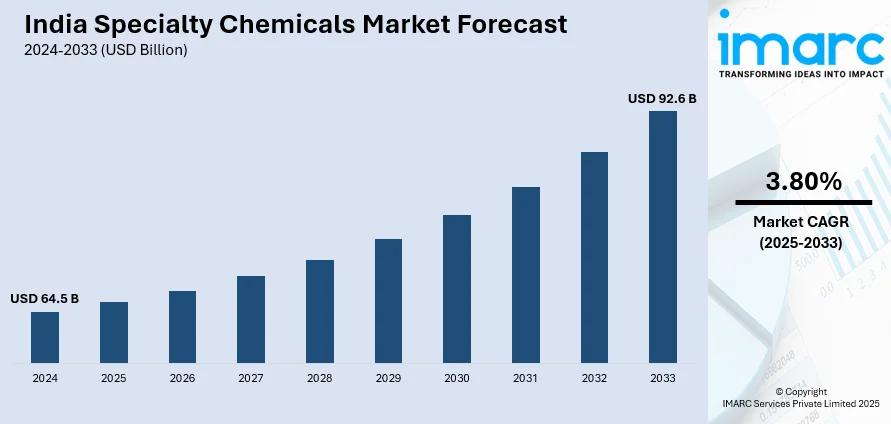

India specialty chemicals market size reached USD 64.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 92.6 Billion by 2033, exhibiting a growth rate (CAGR) of 3.80% during 2025-2033. The market is experiencing robust growth chiefly due to soaring demand in sectors including agriculture, construction, and automotive. Moreover, escalating industrialization as well as urbanization, coupled with innovation in product formulations, are further fueling the market, establishing it as a pivotal segment for economic development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 64.5 Billion |

|

Market Forecast in 2033

|

USD 92.6 Billion |

| Market Growth Rate 2025-2033 | 3.80% |

India Specialty Chemicals Market Analysis:

- Major Market Drivers: The market is chiefly driven by increasing product demand in industries such as electronics, automotive, and construction and accelerating industrialization. The government’s beneficial policies and heightened overseas investment are boosting domestic production capacities. In addition, an inclination towards eco-friendly and sustainable chemicals in paving new opportunities for market expansion. Moreover, technological advancements and an emphasis on research and development are further improving product innovation, addressing the diverse industry demands and driving market growth.

- Key Market Trends: Some of the key trends that are steering the market include a robust focus on sustainability and innovation, with major companies rapidly investing in green chemicals solutions. Additionally, there is a growing demand for superior-performance chemicals in agriculture and pharmaceuticals industries, which is supporting the market growth. Furthermore, strategic collaborations and mergers are emerging as a prevalent tactic, targeting the improvement of production capacities and increasing India specialty chemicals market share. Consequently, such trends are set to impact the market dynamics substantially in the coming years.

- Competitive Landscape: Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

- Challenges and Opportunities: The market experiences challenges including stringent environmental adherence and regulatory protocols. Nonetheless, such challenges provide ample opportunities for various enterprises to adopt sustainable methodologies and innovate. The rising focus on domestic manufacturing and government funds promoting industry development offer substantial growth opportunities. In addition, companies that can efficiently tackle these challenges by utilizing technology and emphasizing on sustainable methods are anticipated to attain a competitive advantage in the market dynamics.

To get more information on this market, Request Sample

India Specialty Chemicals Market Trends:

Increasing Shift Towards Sustainable and Green Chemistry

India specialty chemicals market is rapidly emphasizing on green and sustainable chemicals solutions. Major companies are heavily investing in eco-friendly techniques to develop chemicals with low toxicity and high biodegradability that align with global environmental policies and customer preferences. This trend is primarily being driven by regulatory protocols and an increasing awareness of adverse environmental impact among end-users as well as manufacturers. Moreover, the adoption of green chemistry not only lowers the environmental footprint but also aid in establishing new markets, especially in industries like pharmaceuticals, personal care, and agriculture, where need for sustainable products is currently soaring. For instance, in April 2023, Clariant IGL Specialty Chemicals Private Limited, an India-based chemical manufacturer, launched its Vita range, which includes 100% bio-based ethylene oxide derivatives and surfactants that can effectively support reduction of carbon footprints in various sectors.

Rising Demand in End-Use Sectors

According to the India specialty chemicals market analysis report, a significant surge in product demand is being witnessed across various end-use sectors, such as construction, pharmaceuticals, and automotive. Industries, especially the pharmaceutical sector, is playing a major role in boosting the demand for optimal-performance specialty chemicals principally because of an upsurge in drug formulation and research and development projects. Moreover, the automotive industry’s expansion, facilitated by increasing customer demand and economic demand, propelling the need for advanced lubricants as well as coatings. For instance, in August 2024, Vipul Organics Limited, one of the leading specialty chemicals companies in India, launched an innovative refined-grade, organic specialty chemical particularly for automotive sector that is to be leveraged for components such as bumper extension and absorbers. In addition, the construction sector’s robust growth is also promoting the demand for specialty sealants, coatings, and adhesives, fostering overall market expansion.

Increasing Emphasis on Research and Development

As per the India specialty chemicals market report, an escalated emphasis on research and development (R&D) is a major trend that is significantly steering the market growth. Major companies are apportioning substantial resources to develop and innovate new products that cater to the exclusive demands of consumers and comply to strict quality standards. Such initiatives not only improve product portfolio but also aid in distinguishing the companies in a competitive environment. In addition, partnerships between key industry players and academic or research institutions are reinforcing innovation, resulting in the development of state-of-the-art chemical solutions that cater to the evolving market demands and regulatory needs. For instance, in July 2024, UPL University of Sustainable Technology, an initiative of Indian agrochemical company UPL Group, signed a MoU with the Indian Space Research Organization (ISRO) to revolutionize and enhance innovation and research in chemical sciences.

India Specialty Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type.

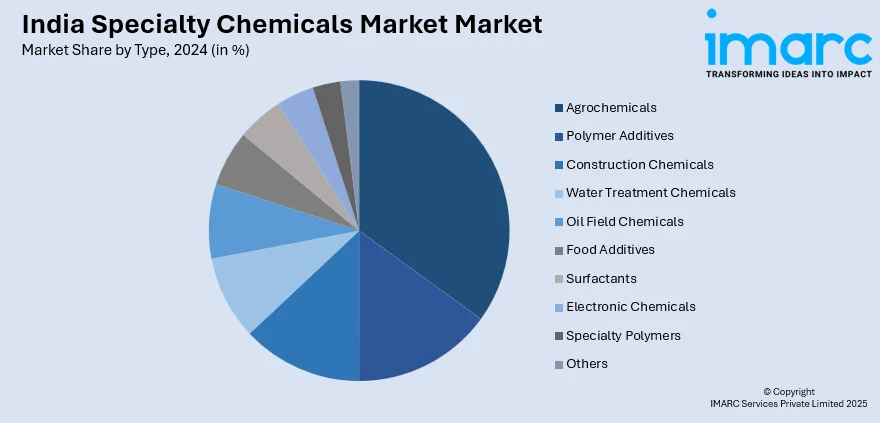

Breakup by Type:

- Agrochemicals

- Polymer Additives

- Construction Chemicals

- Water Treatment Chemicals

- Oil Field Chemicals

- Food Additives

- Surfactants

- Electronic Chemicals

- Specialty Polymers

- Others

The report has provided a detailed breakup and analysis of the market by type. This includes agrochemicals, polymer additives, construction chemicals, water treatment chemicals, oil field chemicals, food additives, surfactants, electronic chemicals, specialty polymers, and others.

According to the India specialty chemicals market research report, agrochemicals are one of the most crucial forms of specialty chemical, which majorly include herbicides, fertilizers, and pesticides, that are processed to improve the quality as well as yield of plantation. The demand for agrochemicals is primarily fueled by the necessity to enhance agricultural productivity to address the amplifying food demand in the country. Moreover, with a proliferating population and limited farmable land, the utilization of agrochemicals has become requisite for practicing sustainable agricultural methods. Additionally, numerous manufacturers are currently emphasizing on formulating eco-friendly and effective chemicals to cater to this evolving sector. For instance, in December 2023, Sumitomo Chemical, a leading specialty chemical producer, announced the development of a new agrochemical plant in India, with an initial investment of around USD 35 million.

Polymer additives are essential in the India specialty chemicals market, improving the attributes of polymers and plastics. These additives, such as flame retardants, stabilizers, and plasticizers, enhance the safety, durability, and versatility of polymer products. Moreover, the increasing demand for lightweight materials in various industries like electronics, automotive, and packaging, is boosting the need of polymer additives. In addition, innovations and advancements in additive technology are supporting the manufacturers to adhere to stringent regulatory protocols and manufacture high-functionality materials.

According to the India specialty market forecast, construction chemicals are anticipated to retain their position as one of the most essential forms in the market. Such chemicals encompass products like sealants, concrete admixtures, and waterproofing agents. These chemicals are requisite for enhancing the sustainability, durability, and quality of construction ventures. Moreover, increase in infrastructure development and urbanization in India are significantly driving the demand for construction chemicals. According to the World Bank, it is projected that by 2036, 600 million people will be dwelling in urban areas in India. Additionally, companies are currently focusing on innovative formulations that improve efficiency of construction, lower environmental impact, and adhere to strict regulatory framework, resultantly fostering the sector's growth.

Water treatment chemicals are a vital part of the market, that are commonly deployed for the water purification applications in numerous segments like residential, industrial, or municipal. These chemicals, which encompass biocides, coagulants, and flocculants, play a critical role in affirming hygienic and safe water supply. Moreover, magnifying concerns about water pollution and shortage are propelling the India specialty chemicals demand for efficient water treatment solutions. As per industry reports, 70% of surface water in India is unsafe for human consumption. Moreover, approximately 40 million liters of wastewater is released in water bodies, like river, on daily basis. Additionally, major companies are heavily investing in advanced technologies to manufacture cost-effective and eco-friendly chemicals that address both regulatory protocols and environmental concerns.

Oil field chemicals are a major segment of the India specialty chemicals market, typically leveraged in oil production, drilling, and exploration processes. Such chemicals, encompassing friction reducers, corrosion inhibitors, and demulsifiers are requisite for improving oil recovery and operational efficacy. Moreover, with the intensifying emphasis on domestic oil exploration and production activities, the need for oil field chemicals is on the rise. Furthermore, numerous companies are actively developing innovative formulations to upgrade performance under harsh environments and lower environmental impact. For instance, in May 2024, Dorf Ketal Chemicals India, a specialty chemicals producer, announced the acquisition of Impact Fluid Solutions, to expand its chemical solutions portfolio for gas and oil production.

Food additives are a crucial form of specialty chemicals, which include stabilizers, preservatives, and flavor enhancers. These additives are generally utilized to enhance the shelf life, taste, and appearance of food products. Moreover, the escalating customer demand for convenient and processed foods is bolstering the need for safe and innovative food additives. Additionally, regulatory adherence and an intense emphasis on health-conscious formulations are spurring the development of additives that cater to the customer preferences and industry standards, thereby contributing to a favorable India specialty chemicals market outlook.

Surfactants are an essential type in the India specialty chemicals market, extensively leveraged in personal care products, detergents, and industrial applications. These compounds can effectively decrease surface tension, enhancing the wetting and spreading attributes of liquids. Moreover, the demand for surfactants is principally driven by their multifaceted applications across numerous sectors. Furthermore, with an increased focus on sustainable practices, manufacturers are currently developing biodegradable and bio-based surfactants to adhere to environmental policies and address the heightening preference for eco-friendly chemicals. For instance, in August 2024, researchers of Indian Institute of Science developed an eco-friendly, sustainable surfactant by leveraging agricultural byproduct waste, i.e., nut shell liquid.

Electronic chemicals are a specialized form of specialty chemicals market, critical for the manufacturing of certain electronic components, including printed circuit boards and semiconductors. Such chemicals, including solvents, photoresists, and etchants, are essential for attaining excellent accuracy and quality in electronic production. Moreover, the accelerating growth of the electronics sector in India, majorly driven by amplifying customer demand and technological advancements, is propelling the requirement for excellent-purity electronic chemicals customized to specific manufacturing demands. According to industry reports, it is anticipated that electronic manufacturing in India will double in the coming five years, reaching nearly USD 250 billion.

Specialty polymers are a fundamental form of specialty chemicals in Indian market, widely known for their unique attributes and premium-grade capabilities. Such polymers, including temperature-resistant materials and engineering plastics, are leveraged in numerous applications across certain industries including electronics, automotive, and aerospace. Furthermore, the demand for specialty polymers is primarily proliferating due to the elevated requirement for durable and lightweight materials that improve product performance. Additionally, continuous advancements in polymer technology are facilitating the manufacturers to address the demands of this evolving sector and comply with stringent quality standards.

Breakup by Region:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of the India specialty chemicals market by region, including North India, West and Central India, South India, and East and Northeast India.

North India plays a critical role in the specialty chemicals market primarily because of its firmly rooted industrial base in states such as Uttar Pradesh, Haryana, and Punjab. This region majorly profits from the easy accessibility of raw material sources and a resilient infrastructure, boosting India specialty chemicals market growth as well as demand in industries including pharmaceuticals, agriculture, and textiles. Moreover, major cities like Noida and Delhi serve as key hubs for chemical distribution and production, facilitating the region’s growth through tactical investment and innovative manufacturing capabilities.

West and Central India are major contributors to the specialty chemicals market, led by Maharashtra and Gujarat, which host numerous chemical manufacturing units and industrial clusters. These states are renowned for their advanced manufacturing infrastructure and strong export capabilities. Additionally, Gujarat, in particular, has a significant presence in petrochemicals and dyes, while Maharashtra is a key player in pharmaceuticals and agrochemicals, fostering market growth through innovation, strategic partnerships, and government incentives aimed at bolstering local industries.

South India’s specialty chemicals market is driven by a diverse industrial base, particularly in Tamil Nadu, Karnataka, and Andhra Pradesh. These states have seen rapid growth in sectors like automotive, electronics, and textiles, which demand specialized chemical solutions. Moreover, the presence of technology parks and innovation hubs in cities like Bangalore and Chennai facilitates research and development in advanced chemicals. Additionally, South India’s strategic coastal location also supports efficient export activities, making it a significant contributor to the national market.

East and Northeast India are emerging markets for specialty chemicals, driven by economic development and growing industrial activities in states like West Bengal, Assam, and Odisha. The region is gradually becoming a hub for chemicals used in mining, tea processing, and agro-based industries. Furthermore, government initiatives to improve infrastructure and industrial connectivity are enhancing market prospects. Additionally, the abundance of natural resources provides a foundation for the development of niche chemical segments, fostering regional growth and investment opportunities.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

- The competitive landscape is represented by intense competition among both domestic and international players. Leading companies are currently focusing on innovation, sustainable practices, and expanding their product portfolios to maintain a competitive edge. Moreover, strategic partnerships and mergers are common as firms seek to enhance their market presence and technological capabilities. For instance, in May 2024, UPL, an India-based agrochemical company, announced a joint venture partnership with Aarti Industries, an Indian chemical manufacturing company, for producing as well as marketing of specialty chemicals that will be leveraged in various end-use sectors. Additionally, the market is influenced by price sensitivity, regulatory changes, and the growing need for high-performance and environmentally friendly chemicals to meet evolving industry demands.

India Specialty Chemicals Market News:

- In July 2024, Lubrizol, an international specialty chemicals producer, announced a significant investment of USD 150 million to set up a greenfield manufacturing facility in India, which will focus on producing lubricants for automotives, pertaining to increasing new vehicles demand in the country.

- In April 2024, Himadri Specialty Chemicals, one of the major specialty chemicals manufacturers in India, announced the brownfield expansion of its new specialty line of carbon black. The company will increase the capacity to 130,000 tpa, costing around ₹ 220 crore.

India Specialty Chemicals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Agrochemicals, Polymer Additives, Construction Chemicals, Water Treatment Chemicals, Oil Field Chemicals, Food Additives, Surfactants, Electronic Chemicals, Specialty Polymers, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India specialty chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India specialty chemicals market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India specialty chemicals industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The specialty chemicals market in India was valued at USD 64.5 Billion in 2024.

The specialty chemicals market in India is projected to exhibit a CAGR of 3.80% during 2025-2033, reaching a value of USD 92.6 Billion by 2033.

Growth in key industries like automotive, agriculture, and construction, along with rising urbanization and favorable government policies, are supporting market expansion. Increasing demand for eco-friendly solutions, research and development investments, and rising overseas investments are also accelerating the India specialty chemicals market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)