India Sparkling Wine Market Size, Share, Trends and Forecast by Type, Product, Price Point, Sales Channel, and Region, 2025-2033

India Sparkling Wine Market Overview:

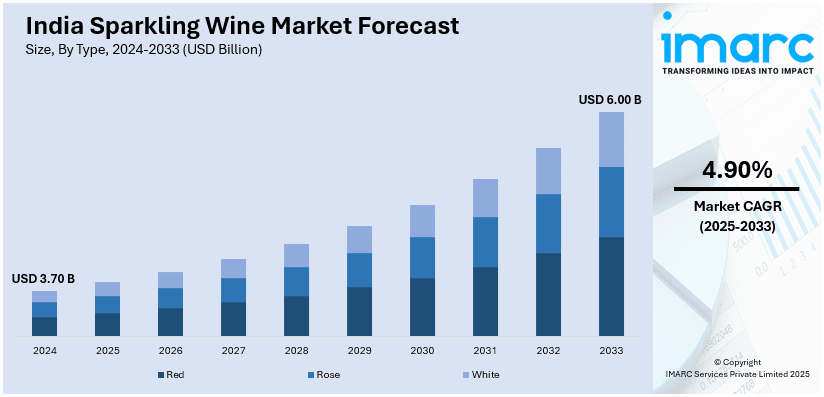

The India sparkling wine market size reached USD 3.70 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.00 Billion by 2033, exhibiting a growth rate (CAGR) of 4.90% during 2025-2033. The India sparkling wine market is driven by rising disposable incomes, evolving consumer preferences, growing wine tourism, premiumization of beverages, global recognition of Indian wines, expanding retail and e-commerce accessibility, regulatory support, and heightened demand for celebratory and luxury drinks in urban centers, strengthening both domestic consumption and export potential.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.70 Billion |

| Market Forecast in 2033 | USD 6.00 Billion |

| Market Growth Rate 2025-2033 | 4.90% |

India Sparkling Wine Market Trends:

Surge in Domestic Tourism

India's internal tourism industry has been a key driver of consumer demand in several different industries, including the beverage industry. As mobility has picked up, there have been shifts in lifestyle patterns and a greater focus on experiential tourism, there has been heightened demand for premium alcohol like sparkling wine. Domestic tourist visits (DTVs) reached 677.63 million in 2021, a significant bounce-back in local travel, as per the Ministry of Tourism's India Tourism Statistics 2022 report. It has impacted the hospitality industry, with hotels, resorts, and eateries constantly upsizing their beverages to provide for discerning consumers. Sparkling wine has become a sought-after option, particularly in high-end hotels and upscale restaurants, where customers demand refined drink options to pair with their meals. In addition, celebratory events like weddings, corporate events, and festivals have further contributed to demand. With the strongly entrenched culture of lavish celebrations in India, sparkling wine has effortlessly become a part of celebrations as a symbol of celebration and luxury. Regions like Maharashtra, Rajasthan, and Goa—tourism hotspots—have experienced greater consumption of sparkling wines, with tourists actively looking for high-end beverage experiences.

To get more information on this market, Request Sample

Rising Disposable Income and Premiumization of Alcoholic Beverages

India's rising middle-class population and growing disposable income are key drivers of sparkling wine demand. Urban consumers, with increased purchasing power, are gravitating toward premium alcoholic drinks, such as sparkling wines, which were previously a luxury item. The aspirational quality of Indian customers, especially millennials and young professionals, has resulted in a greater demand for high-end wines. Consumers are increasingly ready to try out global wine brands, and sparkling wine, with its festive edge and celebratory image, is seeing robust momentum. Premiumization trends in the alcohol beverage market have also motivated local and foreign wineries to launch improved-quality sparkling wines at affordable prices. The strengthening wine culture in India, driven by a significant number of wine tastings, vineyard tourism, and social media, has also pushed demand. Cities like Mumbai, Delhi, and Bangalore have experienced a rise in fine dining restaurants, luxury hotels, and bars selling sparkling wine as an elegant option over conventional spirits.

India Sparkling Wine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, product, price point, and sales channel.

Type Insights:

- Red

- Rose

- White

The report has provided a detailed breakup and analysis of the market based on the type. This includes red, rose, and white.

Product Insights:

- Cava

- Champagne

- Cremant

- Prosecco

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes cava, champagne, cremant, prosecco, and others.

Price Point Insights:

- Economy

- Mid-Range

- Luxury

A detailed breakup and analysis of the market based on the price point have also been provided in the report. This includes economy, mid-range, and luxury.

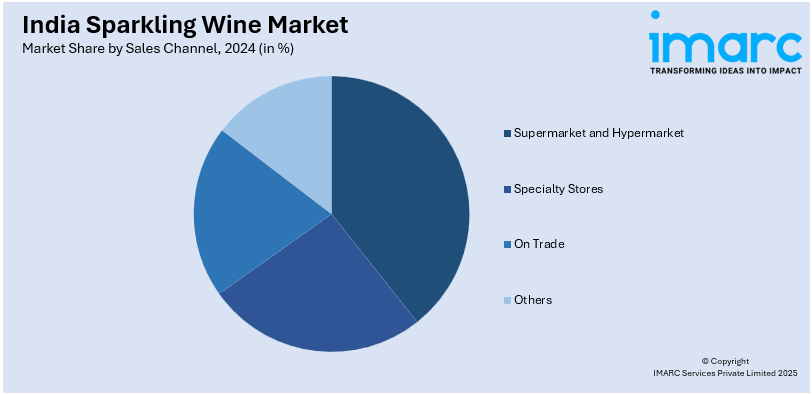

Sales Channel Insights:

- Supermarket and Hypermarket

- Specialty Stores

- On Trade

- Others

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes supermarket and hypermarket, specialty stores, on trade, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Sparkling Wine Market News:

- November 2024: A seafood and wine tasting event to promote India's high-end wines, including sparkling wine, was organized by the Indian Embassy in Brussels. The event promoted India's expanding wine industry, which has become recognized internationally through enhancements in quality and international collaborations. The campaign fuels the Indian sparkling wine market by enhancing worldwide exposure, consolidating trade relations, and fostering wine tourism, further boosting domestic demand.

- September 2024: Chandon India launched Delice, a sweet sparkling wine, that received a silver medal at the Champagne and Sparkling Wine World Championship. This is a boost to the premium status of Indian sparkling wines, making more consumers loyal to the category. The emphasis on new flavors and branding has made the market more robust, with the locally made sparkling wines garnering more attention.

India Sparkling Wine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Red, Rose, White |

| Products Covered | Cava, Champagne, Cremant, Prosecco, Others |

| Price Points Covered | Economy, Mid-Range, Luxury |

| Sales Channels Covered | Supermarket and Hypermarket, Specialty Stores, On Trade, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India sparkling wine market performed so far and how will it perform in the coming years?

- What is the breakup of the India sparkling wine market on the basis of type?

- What is the breakup of the India sparkling wine market on the basis of product?

- What is the breakup of the India sparkling wine market on the basis of price point?

- What is the breakup of the India sparkling wine market on the basis of sales channel?

- What are the various stages in the value chain of the India sparkling wine market?

- What are the key driving factors and challenges in the India sparkling wine market?

- What is the structure of the India sparkling wine market and who are the key players?

- What is the degree of competition in the India sparkling wine market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India sparkling wine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India sparkling wine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India sparkling wine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)