India Solar Street Lighting Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Solar Street Lighting Market Overview:

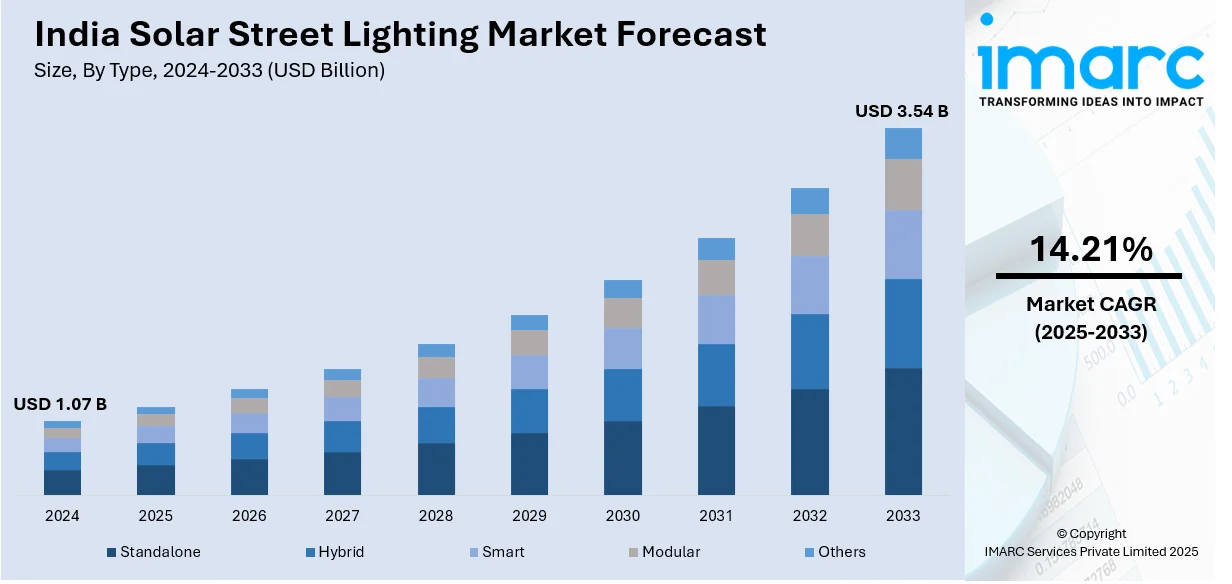

The India solar street lighting market size reached USD 1.07 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.54 Billion by 2033, exhibiting a growth rate (CAGR) of 14.21% during 2025-2033. The market is driven by several government initiatives, rural electrification, smart city projects, and declining solar panel costs. Moreover, the growing environmental concerns, energy efficiency policies, advancements in battery storage, and increasing adoption in highways, urban areas, and remote locations further propel the India solar street lighting market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.07 Billion |

| Market Forecast in 2033 | USD 3.54 Billion |

| Market Growth Rate (2025-2033) | 14.21% |

India Solar Street Lighting Market Trends:

Government Initiatives and Policies

The Indian government is promoting solar street lighting through schemes like the Atal Jyoti Yojana (AJAY) and the Smart Cities Mission. For instance, in December 2023, R.K. Singh, the Union Minister for New and Renewable Energy, stated in a written response to the Rajya Sabha during the winter parliamentary session that approximately 2.72 lakh solar street lights were installed in two phases of the Atal Jyoti Yojana. The written reply stated that 1.35 solar street lights were installed during the first phase, whereas 1.37 lakh street lights were put up in the second phase. These programs aim to enhance urban and rural lighting infrastructure using renewable energy. Subsidies, tax benefits, and incentives under the Faster Adoption and Manufacturing of Electric Vehicles (FAME) and Renewable Energy Service Company (RESCO) models further support adoption. State governments are also mandating solar street lights in public spaces, highways, and municipal projects. These policies accelerate deployment by reducing initial costs and encouraging local manufacturing, strengthening the overall India solar street lighting market growth.

To get more information on this market, Request Sample

Rural Electrification and Smart City Development

Expanding rural electrification is driving demand for solar street lighting, especially in remote areas where grid access is limited or unreliable. The Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY) supports decentralized renewable energy solutions, making solar lighting a practical alternative. Simultaneously, smart city initiatives are integrating solar-powered infrastructure to enhance energy efficiency in urban development. The adoption of smart solar street lights with motion sensors, IoT connectivity, and remote monitoring capabilities is increasing, making cities more sustainable. These trends ensure wider deployment of solar street lighting across both rural and urban landscapes. For instance, in July 2023, WindStream Energy Technologies, located in India, developed a hybrid LED street light system powered by wind and solar energy, generating more power per square foot than a solar street light. An off-grid lighting system was set up at the National Institute of Rural Development and Panchayat Raj's campus located in Hyderabad. The off-grid LED street lighting setup includes a wind turbine, solar panels, a controller, backup batteries, and an LED light.

Declining Costs of Solar Panels and Battery Storage

The falling prices of photovoltaic (PV) panels, lithium-ion batteries, and energy storage solutions are making solar street lighting more cost-effective which is further creating a positive India solar street lighting market outlook. Advances in battery technology, including longer lifespan and improved efficiency, are enhancing the reliability of solar lighting systems. The reduction in the levelized cost of electricity (LCOE) for solar energy further makes it a competitive alternative to conventional street lighting. Manufacturing innovations, economies of scale, and domestic production under India’s Make in India initiative are also driving affordability, encouraging municipalities, private developers, and industrial zones to invest in solar street lighting solutions. For instance, in May 2023, Signify, the world leader in lighting, declared the launch of its inaugural 'Philips Solar Light Hub' in India, a unique retail space intended to encourage the adoption of solar lighting solutions. The shop will serve a diverse array of customer segments, spanning home and garden to industrial and street lighting needs, offering clients an interactive space to explore solar lighting uses and showcase its comprehensive product range.

India Solar Street Lighting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Standalone

- Hybrid

- Smart

- Modular

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes standalone, hybrid, smart, modular, and others.

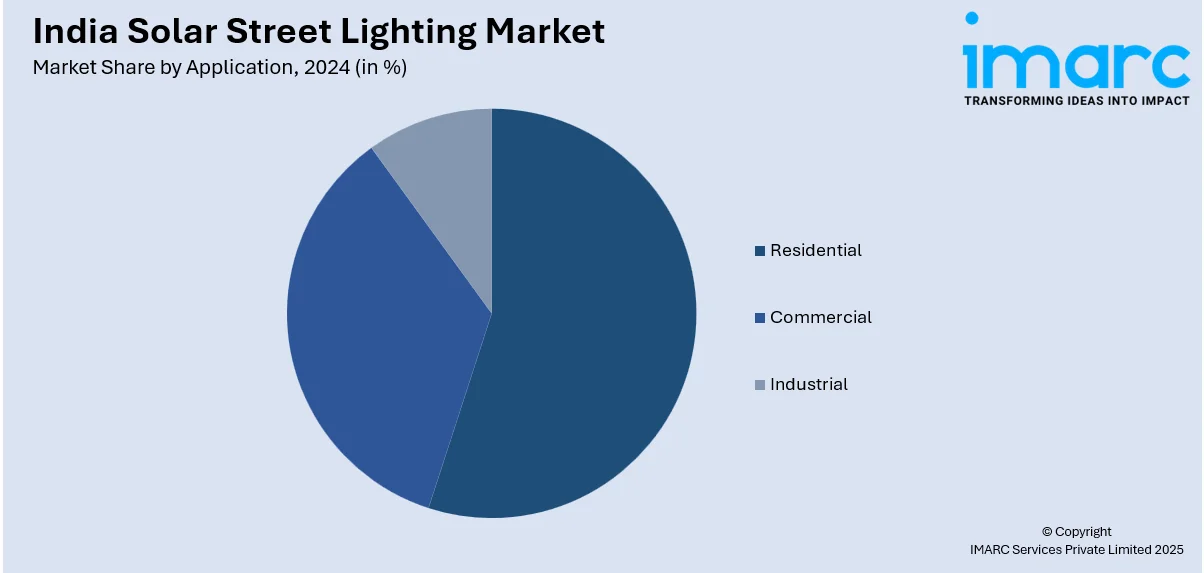

Application Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Solar Street Lighting Market News:

- In September 2024, ITI Limited, the first public sector unit (PSU) in India post-independence and a notable telecom manufacturing company, has secured an order approximately valued at Rs 300 crore from the Bihar Renewable Energy Development Authority (BREDA). The directive requires the provision and installation of 1,000,000 solar street lighting systems for the Bihar State Government.

- In August 2024, Desiccant Rotors International Pvt. Ltd., the leading firm of the Pahwa Group, set up solar street lights on the edges of Dadhikar hamlet in Alwar as a component of their CSR effort. The objective of the project is to upgrade the electrical system in the village by improving the area's lighting.

India Solar Street Lighting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Standalone, Hybrid, Smart, Modular, Others |

| Applications Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India solar street lighting market performed so far and how will it perform in the coming years?

- What is the breakup of the India solar street lighting market on the basis of type?

- What is the breakup of the India solar street lighting market on the basis of application?

- What is the breakup of the India solar street lighting market on the basis of region?

- What are the various stages in the value chain of the India solar street lighting market?

- What are the key driving factors and challenges in the India solar street lighting market?

- What is the structure of the India solar street lighting market and who are the key players?

- What is the degree of competition in the India solar street lighting market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India solar street lighting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India solar street lighting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India solar street lighting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)