India Solar Power Equipment Market Size, Share, Trends and Forecast by Equipment, Application, and Region, 2025-2033

Market Overview:

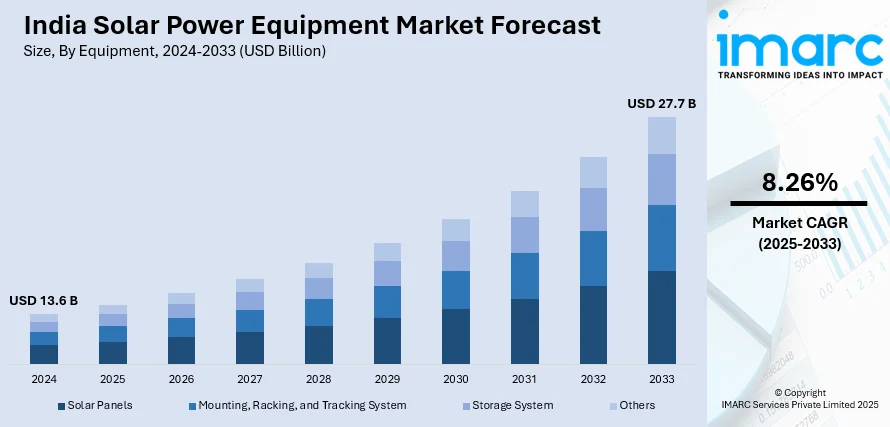

India solar power equipment market size reached USD 13.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 27.7 Billion by 2033, exhibiting a growth rate (CAGR) of 8.26% during 2025-2033. The growing inclination among individuals towards sustainable and renewable energy solutions and favorable policies by government bodies are primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.6 Billion |

| Market Forecast in 2033 | USD 27.7 Billion |

| Market Growth Rate (2025-2033) | 8.26% |

Solar power equipment encompass a range of devices designed to harness and convert sunlight into usable electricity. This technology generally relies on solar panels, which consist of photovoltaic cells that generate direct current (DC) electricity when exposed to sunlight. Solar power equipment include inverters, which convert DC electricity into alternating current (AC) suitable for household or industrial use. Batteries play a crucial role in storing excess energy for use during periods of low sunlight. Charge controllers regulate the charging process to protect batteries from damage. Mounting structures, tracking systems, and wiring complete the solar power setup, optimizing the efficiency of energy capture. This eco-friendly and sustainable approach to electricity generation has gained widespread popularity for residential, commercial, and industrial applications, contributing to the shift towards clean and renewable energy sources.

To get more information on this market, Request Sample

India Solar Power Equipment Market Trends:

The India solar power equipment market is experiencing a transformative phase driven by key drivers and emerging trends that underscore the nation's commitment to renewable energy. A primary driver is the increasing demand for clean and sustainable power sources. Besides this, the government's initiatives, such as the National Solar Mission, are fostering investments and innovations in solar power equipment, thereby bolstering the market growth. Technological advancements play a pivotal role, with a focus on improving the efficiency and affordability of solar power equipment. Moreover, innovations in photovoltaic cell technology, energy storage solutions, and smart inverters contribute to the market's growth. Apart from this, the elevating integration of artificial intelligence and IoT technologies is enhancing the monitoring and management of solar power systems, ensuring optimal performance. Furthermore, there is a noticeable trend towards decentralized solar power systems, with a focus on rooftop solar installations for residential and commercial buildings. This encourages consumers to generate their own clean energy, contributing to grid resilience and reducing dependency on traditional power sources. In conclusion, the elevating focus of industry players on innovations, government support, and decentralized energy generation are projected to bolster the India solar power equipment market in the coming years.

India Solar Power Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on equipment and application.

Equipment Insights:

- Solar Panels

- Mounting, Racking, and Tracking System

- Storage System

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment. This includes solar panels, mounting, racking, and tracking system, storage system, and others.

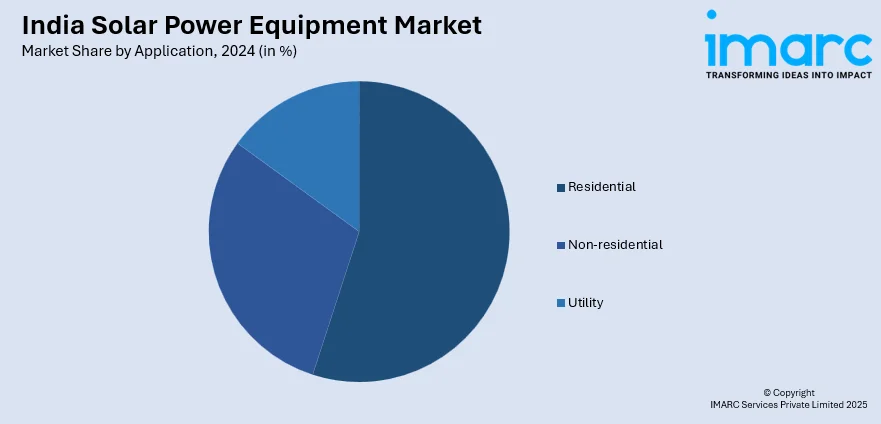

Application Insights:

- Residential

- Non-residential

- Utility

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, non-residential, and utility.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Solar Power Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipments Covered | Solar Panels, Mounting, Racking, and Tracking System, Storage System, Others |

| Applications Covered | Residential, Non-residential, Utility |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India solar power equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India solar power equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India solar power equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The solar power equipment market in India was valued at USD 13.6 Billion in 2024.

The India solar power equipment market is projected to exhibit a CAGR of 8.26% during 2025-2033, reaching a value of USD 27.7 Billion by 2033.

The India solar power equipment market is driven by rising energy demand, government support through subsidies and policies, and growing focus on renewable energy adoption. Declining equipment costs, expanding rural electrification efforts, and increasing awareness about environmental sustainability further contribute to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)