India Solar Panel Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

India Solar Panel Market Size:

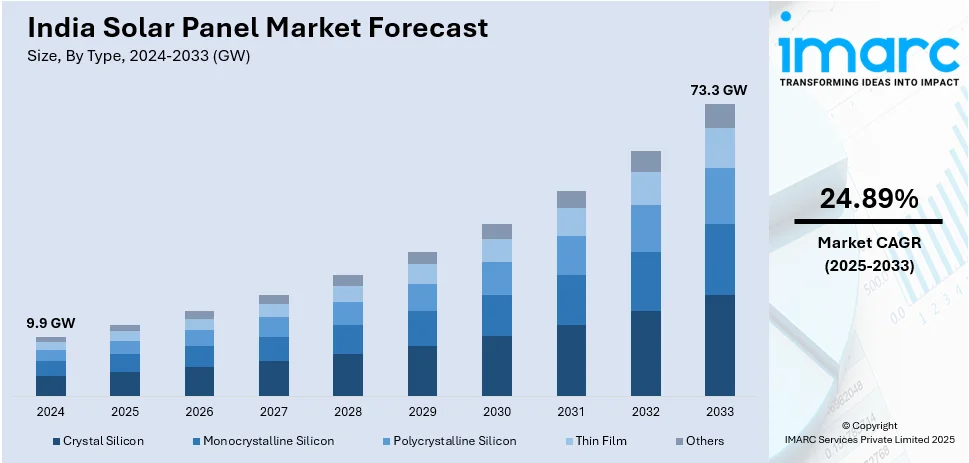

India solar panel market size reached 9.9 GW in 2024. Looking forward, IMARC Group expects the market to reach 73.3 GW by 2033, exhibiting a growth rate (CAGR) of 24.89% during 2025-2033. The market is experiencing significant growth mainly driven by increasing government initiatives, favorable policies, and the rising demand for clean energy. With advancements in solar technology and declining costs, the market is poised for further expansion, thus contributing significantly to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

9.9 GW |

|

Market Forecast in 2033

|

73.3 GW |

| Market Growth Rate 2025-2033 | 24.89% |

India Solar Panel Market Analysis:

- Major Market Drivers: Key market drivers include government initiatives such as the National Solar Mission and various subsidies, which aim to increase solar capacity and reduce dependency on fossil fuels. Falling prices of solar panels, driven by technological advancements and economies of scale, make solar energy more affordable. The rising electricity demand, coupled with growing environmental concerns and global commitments to reduce carbon emissions, further fuel market growth. Additionally, corporate investments in renewable energy and the increasing adoption of solar power in residential, commercial, and industrial sectors are contributing positively to the India solar panel market growth.

- Key Market Trends: Key trends in the market include a growing shift toward high-efficiency technologies such as bifacial and monocrystalline solar panels, which offer better energy output. The adoption of solar-plus-storage solutions is rising, allowing for energy storage and round-the-clock power supply. Rooftop solar installations are also gaining traction, particularly in urban areas and industrial sectors. Government-backed solar parks and large-scale utility projects are further expanding the market. Additionally, corporate sustainability initiatives are driving the adoption of solar power in commercial buildings, while digital technologies like IoT are enhancing the efficiency and management of solar energy systems.

- Competitive Landscape: Key players in the India solar panel market are actively expanding their production capacities and adopting advanced technologies to improve panel efficiency and reduce costs. They are focusing on large-scale solar projects, including utility-scale and rooftop installations, to meet growing energy demands. Many companies are forming strategic partnerships and joint ventures to strengthen their market position and enhance distribution networks. Additionally, players are increasingly involved in government-backed solar initiatives, participating in tenders and contracts to secure large projects. Companies are also emphasizing on research and development (R&D) to innovate in areas like energy storage and smart solar solutions, which, in turn, is driving the India solar panel demand.

The report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. - Challenges and Opportunities: The market faces various challenges such as high initial installation costs, land acquisition issues for large-scale projects, and the intermittent nature of solar energy. Additionally, the reliance on imported components like solar cells and modules can create supply chain vulnerabilities. However, there are significant opportunities, including growing government support through incentives and subsidies, rapidly declining solar panel costs, and the rising demand for clean energy due to environmental concerns. Advancements in energy storage solutions and corporate investments in renewable energy provide further growth potential in both urban and rural areas.

To get more information on this market, Request Sample

India Solar Panel Market Trends:

Rooftop Solar Adoption

Rooftop solar adoption in India is gaining traction as both residential and commercial sectors increasingly seek sustainable energy solutions. Government incentives, such as subsidies, tax benefits, and net metering policies, are making rooftop solar installations more financially attractive. Rising electricity costs and frequent power outages are further encouraging consumers to switch to solar, offering significant long-term savings and energy independence. Additionally, falling costs of solar panels and improved financing options have made installations more accessible. Commercial enterprises are adopting rooftop solar to reduce operational costs and meet sustainability targets, while residential users are drawn to its cost-effectiveness and environmental benefits. According to the India solar panel market analysis report, rooftop solar installations are poised for rapid growth, driven by a combination of supportive government policies, increased affordability, and growing consumer interest in renewable energy solutions. According to an article published by The Hindu, India made significant progress in rooftop solar capacity, with 11.87 GW installed as of March 2024. To meet its goal of 500 GW renewable energy capacity by 2030, rooftop solar needs to contribute 100 GW. Gujarat leads with 3,456 MW, followed by Maharashtra (2,072 MW) and Rajasthan (1,154 MW). The 'Pradhan Mantri Surya Ghar Yojana' aims to provide 1 crore households with rooftop solar systems, adding 20 GW capacity. These developments, coupled with increasing government initiatives and private sector participation, are creating a positive India solar panel market outlook, positioning rooftop solar as a key contributor to India's renewable energy transition.

Solar-Plus-Storage Solutions

Solar-plus-storage solutions are becoming increasingly popular in India as they offer the ability to store excess solar energy generated during daylight hours for use during non-sunlight periods, such as evenings or cloudy days. This integration addresses the intermittent nature of solar power and enhances grid reliability, making it particularly valuable for areas with frequent power outages. Advances in battery technologies, including lithium-ion and other energy storage systems, have driven down costs, making these solutions more accessible. These systems also allow for energy independence, reduced reliance on fossil fuels, and improved management of energy loads, making solar-plus-storage a critical trend in India's renewable energy landscape. According to the India solar panel market forecast, the demand for solar-plus-storage systems is expected to grow rapidly as India seeks to enhance energy security, cut emissions, and meet its renewable energy targets. For instance, in June 2024, Larsen & Toubro (L&T) successfully secured a contract to construct a 185 MW grid-connected solar project and a 254 MWh battery energy storage system (BESS) in Bihar, India. The project, located in Kajra, Lakshisarai district, will aid in storing solar energy during low-demand periods and provide support during peak demand, while also managing fluctuations in generation.

Expansion of Utility-Scale Solar Projects

The expansion of utility-scale solar projects in India is accelerating, driven by government initiatives such as solar parks and ultra-mega solar power projects. These large-scale solar farms are designed to significantly increase the country’s renewable energy capacity and help meet its ambitious targets. Private investments are playing a crucial role in financing and implementing these projects, while government incentives, such as land provision and tax benefits, are encouraging further development. These utility-scale installations are critical for supplying large amounts of clean energy to the grid, reducing reliance on fossil fuels, and addressing the country’s growing power demand. According to the India solar panel market research report, utility-scale solar projects are expected to dominate solar capacity additions, positioning them as key drivers in achieving India’s renewable energy targets and contributing to sustainable energy security. According to an article published by India Brand and Equity Foundation (IBEF), in the first half of 2024, India's solar industry saw impressive growth, adding a record 15 GW of solar capacity, marking a 282% increase from the same period in 2023. The total installed solar capacity reached 87.2 GW by June 2024, with utility-scale projects accounting for nearly 87% and rooftop solar for over 13%. The average cost of large-scale solar projects decreased by nearly 26% year-on-year and 2% quarter-on-quarter. Additionally, 41.4 GW of tenders were announced, reflecting a 51% increase from the previous year, and 31.8 GW of projects were auctioned, a significant rise from the previous year. These factors are driving India solar panel market growth and supporting the country’s transition toward renewable energy leadership.

India Solar Panel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end use.

Breakup by Type:

- Crystal Silicon

- Monocrystalline Silicon

- Polycrystalline Silicon

- Thin Film

- Others

The report has provided a detailed breakup and analysis of the market based on type. This includes crystal silicon, monocrystalline silicon, polycrystalline silicon, thin film, and others.

Crystalline silicon is the most widely used material in solar panels, known for its high efficiency and durability. It consists of two main types: monocrystalline and polycrystalline. Crystalline silicon panels are popular in both residential and commercial installations due to their long lifespan and high-power output. The technology is mature, with extensive research improving its efficiency over time. While the initial cost can be higher as compared to other materials, the long-term energy savings and reliability make crystalline silicon a preferred choice in India's rapidly growing solar market.

Monocrystalline silicon solar panels are made from single-crystal silicon, offering the highest efficiency rates among all types of solar panels, typically between 15% and 22%. These panels are characterized by their uniform, black appearance and are more space-efficient, making them ideal for rooftop installations where space is limited. Although they are more expensive than polycrystalline panels, their higher efficiency and longer lifespan can offset the initial investment. Monocrystalline panels are gaining popularity, holding a significant India solar panel market share, especially in urban areas where space and performance are crucial factors.

Polycrystalline silicon panels are made from multiple silicon crystals, which makes them less efficient than monocrystalline panels, with efficiency rates ranging from 13% to 17%. They have a bluish hue and are typically more affordable, making them a popular choice for large-scale installations where space is not a primary concern. Polycrystalline panels are widely used in utility-scale projects in India due to their lower cost and adequate performance in areas with ample sunlight. As the Indian solar market grows, polycrystalline silicon continues to be a cost-effective solution for various applications.

Thin-film solar panels are made by depositing photovoltaic material onto a substrate, resulting in a lighter, more flexible product compared to crystalline silicon panels. Although they have lower efficiency, typically around 10% to 12%, they perform better in low-light and high-temperature conditions, making them suitable for specific climates. Thin-film panels are also less expensive to manufacture, though they require more space to produce the same amount of energy as crystalline panels. In India, thin-film technology is used in specialized applications, such as large-scale projects in regions with high temperatures.

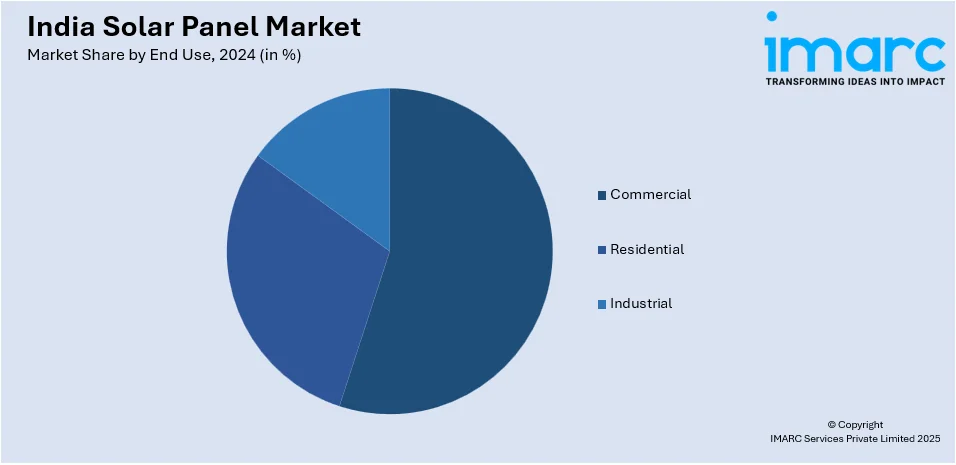

Breakup by End Use:

- Commercial

- Residential

- Industrial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes commercial, residential, and industrial.

In India's commercial sector, solar panels are increasingly being adopted to reduce electricity costs and enhance sustainability efforts. Commercial buildings, offices, shopping complexes, and educational institutions install solar systems to offset grid dependence and reduce operational expenses. Rooftop solar solutions are particularly popular due to available government incentives like subsidies and tax benefits. Solar power enables businesses to meet renewable energy goals and improve their green credentials. As energy costs continue to rise, commercial solar installations are expected to grow rapidly, providing long-term financial benefits and contributing to India's clean energy targets.

Solar panel adoption in India’s residential sector is gaining traction due to rising electricity prices, government subsidies, and an increased focus on sustainable living. Homeowners are installing rooftop solar systems to reduce their reliance on grid electricity and save on monthly utility bills. The availability of net metering policies, which allow excess energy to be sold back to the grid, has made residential solar more financially attractive. As installation costs continue to decrease and awareness grows, more households are expected to switch to solar, contributing to energy independence and lower carbon footprints.

The industrial sector in India is a key driver of solar panel adoption, as companies seek to reduce operational costs and enhance energy security. Solar installations in industries such as manufacturing, textiles, and food processing help offset high electricity consumption and support environmental goals. Large-scale solar projects, both rooftop and ground-mounted, provide stable power supplies while reducing reliance on expensive, non-renewable energy sources. Government incentives, along with growing corporate social responsibility (CSR) commitments, are encouraging more industrial players to invest in solar, supporting India’s ambitious renewable energy targets and reducing overall emissions.

Breakup by Region:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major markets in the region, which include North India, West and Central India, South India, and East and Northeast India.

North India is a key region for solar panel installations due to its high solar radiation levels and large land availability. States like Rajasthan, Haryana, and Punjab are actively investing in utility-scale solar projects and rooftop installations. Rajasthan, in particular, hosts large solar parks, benefiting from government support and private investments. With increasing energy demand in cities like Delhi, rooftop solar systems are becoming popular. The region's vast desert areas and long sunlight hours make it ideal for expanding solar capacity, contributing significantly to India's renewable energy targets.

West and Central India, including states like Gujarat, Maharashtra, and Madhya Pradesh, are major hubs for solar energy development. Gujarat is a leader in both utility-scale and rooftop solar installations, with vast solar parks and supportive government policies. Maharashtra, being an industrial powerhouse, has seen significant solar adoption in the commercial and industrial sectors. Madhya Pradesh is also contributing with large-scale solar projects, including floating solar farms. These regions benefit from high solar irradiance and have become key players in India’s renewable energy landscape, driving market growth.

South India is witnessing rapid growth in solar panel adoption, particularly in states like Tamil Nadu, Karnataka, and Andhra Pradesh. These states have abundant sunlight and strong government policies that promote solar energy use in both residential and industrial sectors. Tamil Nadu leads in wind-solar hybrid projects, while Karnataka and Andhra Pradesh are focusing on large solar parks. Rooftop solar adoption is also increasing in urban areas, driven by the rising energy demand and favorable regulations. South India plays a critical role in helping India achieve its renewable energy targets.

Solar energy adoption in East and Northeast India is growing, though at a slower pace as compared to other regions. States like West Bengal, Odisha, and Assam are focusing on smaller-scale solar projects and rooftop installations. The hilly terrain and remote areas of the Northeast pose challenges for large-scale projects, but solar solutions are being deployed for rural electrification. Government initiatives are promoting solar energy to provide reliable power in underserved areas. With growing interest and improved infrastructure, the region holds potential for future solar energy development, particularly in off-grid and hybrid systems.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided.

- The India solar panel market is highly competitive, driven by increasing demand for renewable energy and strong government support. Domestic and international players are competing in segments like residential, commercial, and industrial solar installations. Price competitiveness, technological advancements, and efficiency are key factors that differentiate companies. Players are focusing on scaling production, developing high-efficiency panels, and investing in research and development to capture market share. The market's growth is fueled by declining solar panel costs and increased adoption of rooftop and utility-scale projects, creating opportunities for innovation and expansion in a rapidly evolving industry. According to the India solar panel market report, the market is expected to witness strong growth driven by favorable government policies, falling solar panel prices, and increased demand for clean energy.

India Solar Panel Market News:

- In July 2024, Tata Power Solar Systems announced their partnership with Bank of India to provide easy financing for rooftop solar installations and electric vehicle (EV) charging stations. The collaboration aims to support the government's green energy initiatives by offering loans with attractive interest rates and collateral-free options. The partnership targets residential users, housing societies, and MSMEs, providing financing options for a wide range of customers looking to invest in solar and EV charging infrastructure.

- In July 2024, Tata Power Renewable Energy Limited (TPREL) and NHPC Renewable Energy Limited (NHPC-REL) signed an MoU to solarize government buildings under the PM Surya Ghar Yojna Scheme by 2025. The initiative aims to achieve 100% solarization of government-owned facilities and will be led by NHPC-REL as the Scheme Implementing Partner. TPREL will provide expertise in executing Rooftop Solar Projects to meet the ambitious solarization target.

India Solar Panel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | GW |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Crystal Silicon, Monocrystalline Silicon, Polycrystalline Silicon, Thin Film, Others |

| End Uses Covered | Commercial, Residential, Industrial |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India solar panel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India solar panel market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India solar panel industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India solar panel market size reached 9.9 GW in 2024.

The India solar panel market is projected to exhibit a CAGR of 24.89% during 2025-2033, reaching a volume of 73.3 GW by 2033.

India’s solar panel market is driven by strong government support, increasing environmental awareness, rising energy demand, and the shift towards renewable energy. Advancements in solar technology, improved affordability, and growing adoption in residential, commercial, and industrial sectors further boost market growth, making solar energy a preferred power source.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)