India Solar Battery Market Size, Share, Trends and Forecast by Type, Capacity, End User, and Region, 2025-2033

India Solar Battery Market Overview:

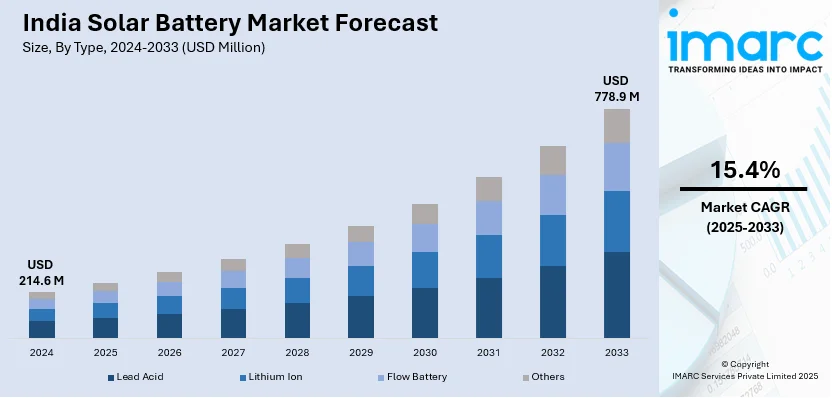

The India solar battery market size reached USD 214.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 778.9 Million by 2033, exhibiting a growth rate (CAGR) of 15.4% during 2025-2033. The rising solar energy adoption, government incentives, increasing energy storage demand, declining battery costs, and grid reliability concerns are the factors propelling the growth of the market. Growth in residential, commercial, and industrial solar installations further boosts market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 214.6 Million |

| Market Forecast in 2033 | USD 778.9 Million |

| Market Growth Rate 2025-2033 | 15.4% |

India Solar Battery Market Trends:

Rising Focus on High-Efficiency Solar Energy Solutions

The push for more efficient solar energy systems is gaining momentum with advancements in solar tracking technology designed to maximize photovoltaic output. These innovations significantly enhance energy generation, optimizing land use and improving returns on solar investments. Alongside this, substantial financial commitments are accelerating the expansion of bioenergy infrastructure, reinforcing the shift toward cleaner energy sources. This dual approach, enhancing solar efficiency while scaling up complementary renewable solutions, indicates a deeper commitment to energy sustainability. The integration of improved tracking systems with battery storage solutions is expected to further strengthen grid reliability, reducing dependence on conventional power sources. As investment flows into scalable solutions, the renewable sector is evolving with a focus on both performance improvements and long-term energy security. For example, the 17th Renewable Energy India (REI) Expo, held from October 3 to 5, 2024, at the India Expo Centre in Greater Noida, showcased significant advancements in India's solar battery market. Key highlights included the introduction of innovative solar tracking technology by SolarfiX India and Kanemasa Japan, aiming to boost photovoltaic plant generation by up to 150%. Additionally, the Indian Biogas Association announced investments totaling INR 1,600 Crores in the biogas sector, reflecting the nation's commitment to renewable energy expansion.

To get more information on this market, Request Sample

Expanding Adoption of Solar-Integrated Energy Storage

The combination of solar power and battery storage is becoming a key solution for ensuring reliable electricity supply, especially in remote and island regions. Advanced storage systems are enabling greater energy independence by reducing reliance on conventional grids and fossil fuels. With a stronger focus on sustainability, projects integrating battery storage with solar installations are gaining momentum, supporting long-term energy security. These developments align with broader efforts to enhance grid stability while maximizing renewable energy utilization. The deployment of such systems not only helps in managing intermittent solar power but also strengthens resilience against power disruptions. As more regions explore similar solutions, the shift toward decentralized, storage-equipped solar energy systems is shaping the future of clean power infrastructure. For instance, in September 2024, Honeywell launched India’s first on-grid solar microgrid with battery storage in Lakshadweep. The system integrates solar power with advanced battery storage, ensuring reliable energy supply for the island region. This project, developed for the Solar Energy Corporation of India (SECI), highlights the growing adoption of solar battery solutions in India, enhancing energy security and reducing dependence on conventional power sources.

India Solar Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, capacity, and end user.

Type Insights:

- Lead Acid

- Lithium Ion

- Flow Battery

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes lead acid, lithium ion, flow battery, and others.

Capacity Insights:

- Below 75 AH

- 75 To 150 AH

- Above 150 AH

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes below 75 AH, 75 to 150 AH, and above 150 AH.

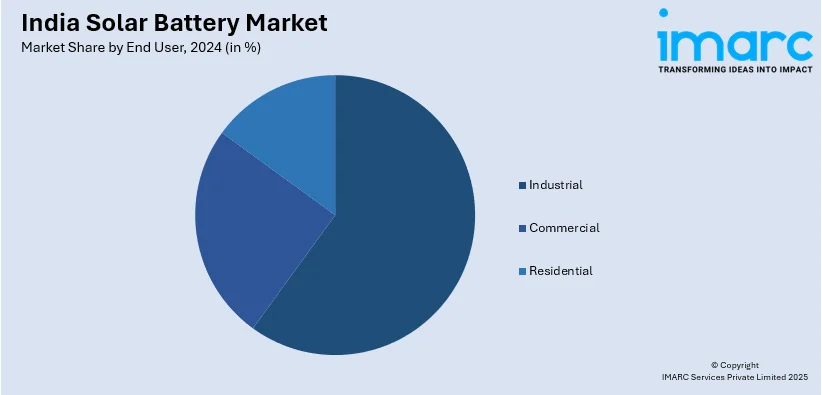

End User Insights:

- Industrial

- Commercial

- Residential

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes industrial, commercial, and residential.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Solar Battery Market News:

- In January 2025, Vayve Mobility launched Eva, India's first solar-assisted electric vehicle, starting at INR 3.25 Lakh. The compact car offers three battery options, i.e., 9 kWh, 12.6 kWh, and 18 kWh, providing ranges of 125 km, 175 km, and 250 km, respectively. An optional solar roof panel, priced between INR 20,000 and INR 25,000 depending on the variant, adds up to 10 km of daily range. This integration of solar technology into electric vehicles signifies a notable advancement in India's solar battery market.

- In September 2024, Enphase Energy introduced Enphase Energy System in India, featuring the IQ Battery 5P, IQ8 microinverters, and the IQ System Controller. The IQ Battery 5P offers a modular 5 kWh capacity, expandable up to 40 kWh, utilizing lithium iron phosphate chemistry for enhanced safety and reduced maintenance. The system ensures seamless backup power during outages with smooth transitions.

India Solar Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Lead Acid, Lithium Ion, Flow Battery, Others |

| Capacities Covered | Below 75 AH, 75 To 150 AH, Above 150 AH |

| End Users Covered | Industrial, Commercial, Residential |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India solar battery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India solar battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India solar battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The solar battery market in India was valued at USD 214.6 Million in 2024.

The India solar battery market is projected to exhibit a CAGR of 15.4% during 2025-2033, reaching a value of USD 778.9 Million by 2033.

Government incentives, subsidies, and initiatives are encouraging the installation of solar systems, driving the demand for efficient battery storage. The growing need for reliable backup power in rural and off-grid areas is further supporting the market expansion. Technological advancements are making solar batteries more affordable and compact, attracting both urban and rural users.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)