India Soil Testing Equipment Market Size, Share, Trends and Forecast by Type of Test, End User, and Region, 2025-2033

India Soil Testing Equipment Market Size and Share:

The India soil testing equipment market size reached USD 200 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 470 Million by 2033, exhibiting a growth rate (CAGR) of 10.08% during 2025-2033. The market is on the rise due to increasing demand for precision farming, government policy encouraging soil health, and developments in testing devices, which are improving the efficacy and availability of soil analysis to farmers throughout India.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 200 Million |

| Market Forecast in 2033 | USD 470 Million |

| Market Growth Rate (2025-2033) | 10.08% |

India Soil Testing Equipment Market Trends:

Growing Demand for Precision Agriculture in India

As precision farming methods gradually become adopted by Indian agriculture, the demand for sophisticated soil-testing equipment has exploded. Precision farming emphasizes relying on data to maximally improve the yields of crops and cut expenditures by monitoring crop nutrition levels as well as health of soil. Soil testing devices are a key component of this method by offering precise information regarding soil content, water content, and potential hydrogen (pH), which allows farmers to make informed decisions for optimal crop care. For example, in December 2023, ICRISAT introduced 'Technology on Wheels', a mobile lab with cutting-edge soil and water testing tools. It offers farmers in Telangana on-site services, supporting sustainable agriculture and enhancing soil health management. Furthermore, the incorporation of technology, such as sensors, Internet of Things (IoT) devices, and automated systems has enhanced soil testing by becoming more efficient in collecting and analyzing data in real-time. This increasing demand is due to the demand for sustainable agriculture and the government's initiative for organic farming, which demands frequent and intensive soil analysis. Therefore, the Indian market for soil testing equipment is anticipated to grow at a fast pace, with small-scale as well as large-scale farmers seeking dependable solutions to enhance productivity and maintain soil health.

.webp)

To get more information on this market, Request Sample

Government Initiatives Supporting Soil Health

The government of India has put forward several schemes aimed at sustainable agriculture and soil health. Schemes such as the National Mission for Sustainable Agriculture (NMSA) and the Soil Health Management (SHM) Scheme highlight the need to conduct soil tests on a regular basis in order to improve productivity. These initiatives by the government have not only increased awareness in farmers regarding soil testing but also created greater access to soil testing instruments and services. Subsidy and financial aid programs have resulted in soil testing services becoming more economically viable, particularly for marginal and small farmers. Additionally, government-sponsored soil health cards enable farmers to track and ensure soil health, and investments in soil testing instruments. As these projects take off, the need for accurate and affordable soil testing instruments is likely to increase, helping contribute to the overall growth of India's agriculture industry and encouraging sustainable cultivation practices throughout the nation.

Technological Advancements in Soil Testing Equipment

Technological developments are contributing a major role towards the development of soil testing equipment in India. The conventional soil testing techniques are being substituted with more efficient, accurate, and friendly technologies that offer faster results. Developments, such as portable soil testers, smartphone-based devices, and automated systems are increasing the availability of soil testing for farmers, especially those in rural areas. According to the sources, in November 2024, IIT Kanpur introduced the Soil Nutrient Sensing Device, a small, smartphone-compatible device that offers real-time soil analysis. The device employs Near-Infrared (NIR) Spectroscopy for effective and precise evaluations, with the data being stored on the cloud. Moreover, these tools tend to have provisions of real-time transmission of data, cloud storage, and instant outcome, which facilitate farmers in decision-making related to fertilization and irrigation. With the increasing application of IoT-based soil sensors, soil testing has changed even more profoundly, facilitating regular monitoring of the health of soils. These can identify imbalances in nutrients, moisture, and pH, guiding farmers to apply best practices of soil management. The convergence of artificial intelligence (AI) and machine learning (ML) is predicted to continue improving the precision of soil testing equipment, fueling future development in the Indian market.

India Soil Testing Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type of test and end user.

Type of Test Insights:

- Physical Test

- Chemical Test

- Residual Test

The report has provided a detailed breakup and analysis of the market based on the type of test. This includes physical test, chemical test, and residual test.

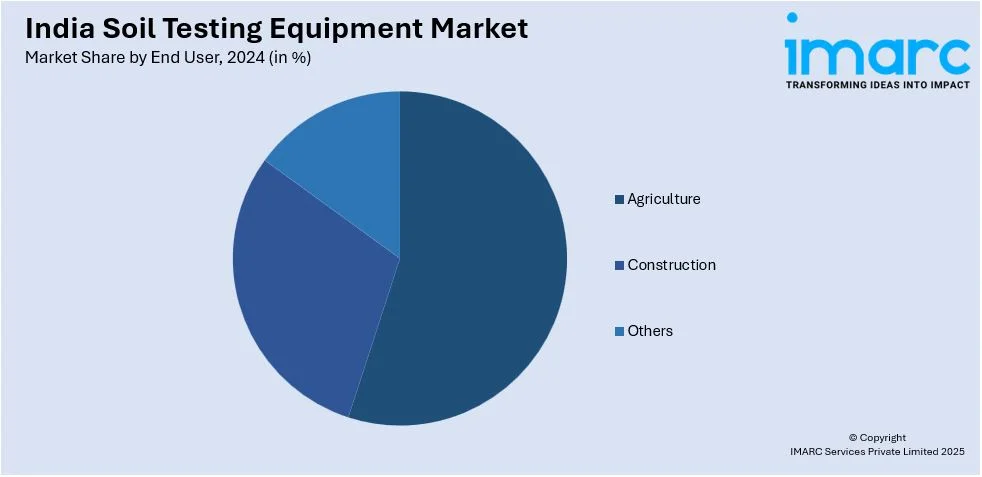

End User Insights:

- Agriculture

- Construction

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes agriculture, construction, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Soil Testing Equipment Market News:

- In February 2025, CropCopter Innovations Pvt. Ltd. introduced a real-time soil testing prototype drone. The drone, which is fitted with sophisticated sensors, assists in the determination of exact fertilizer requirements, saving labor costs and enhancing productivity. The technology seeks to meet mounting agricultural challenges and boost efficiency in agriculture.

India Soil Testing Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Tests Covered | Physical Test, Chemical Test, Residual Test |

| End Users Covered | Agriculture, Construction, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India soil testing equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the India soil testing equipment market on the basis of type of test?

- What is the breakup of the India soil testing equipment market on the basis of end user?

- What is the breakup of the India soil testing equipment market on the basis of region?

- What are the various stages in the value chain of the India soil testing equipment market?

- What are the key driving factors and challenges in the India soil testing equipment?

- What is the structure of the India soil testing equipment market and who are the key players?

- What is the degree of competition in the India soil testing equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India soil testing equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India soil testing equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India soil testing equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)