India Software Defined Radio Market Size, Share, Trends and Forecast by Type, Application, Component, Platform, Frequency Band, and Region, 2025-2033

Market Overview:

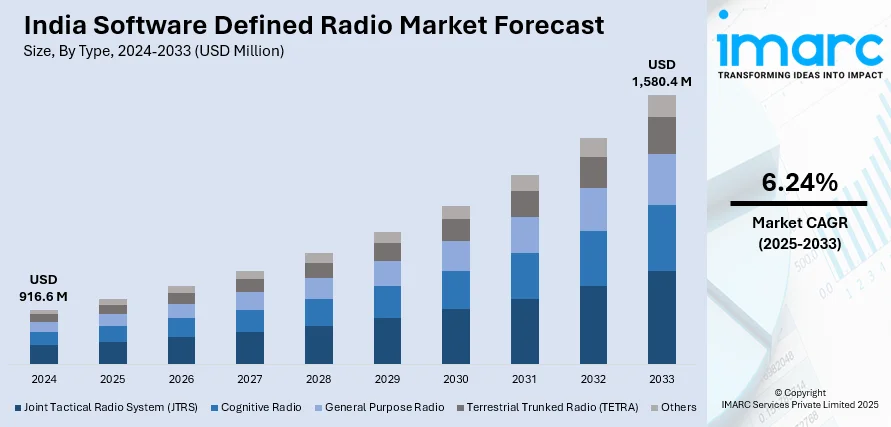

India software defined radio market size reached USD 916.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,580.4 Million by 2033, exhibiting a growth rate (CAGR) of 6.24% during 2025-2033. The continuous evolution of wireless communication standards and technologies, such as 5G, which boosts the adoption of software defined radio platforms that can adapt to new standards through software updates, thereby providing a cost-effective way to stay current with the latest technological advancements, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 916.6 Million |

|

Market Forecast in 2033

|

USD 1,580.4 Million |

| Market Growth Rate 2025-2033 | 6.24% |

Software defined radio (SDR) is a revolutionary technology that replaces traditional hardware components in radio communication systems with software algorithms. Unlike conventional radios with fixed functionalities, SDR allows users to reconfigure and adapt radio parameters dynamically through software applications. It relies on a flexible architecture that separates signal-processing tasks from hardware components, enabling users to modify radio functions, waveforms, and protocols without altering the underlying hardware. SDR enhances flexibility, interoperability, and efficiency in wireless communication systems, making it a versatile solution for applications ranging from amateur radio and military communication to public safety and telecommunications. With SDR, radio devices become more adaptable, cost-effective, and capable of keeping pace with evolving communication standards and technologies.

To get more information on this market, Request Sample

India Software Defined Radio Market Trends:

The software defined radio market in India is experiencing unprecedented growth, propelled by a confluence of factors. Firstly, the increasing demand for seamless and efficient communication systems across diverse industries acts as a primary driver. As organizations strive for enhanced connectivity, SDR emerges as a versatile solution that adapts to evolving communication standards. Moreover, the rising prevalence of wireless communication in military and defense applications further accelerates the market's momentum. SDR's ability to facilitate spectrum flexibility and interoperability aligns perfectly with the dynamic requirements of defense operations. Furthermore, the proliferation of IoT devices contributes significantly to the expansion of the SDR market. With the Internet of Things becoming ubiquitous, the need for agile and adaptable communication platforms intensifies, driving the adoption of SDR technologies. Additionally, the relentless evolution of 5G networks amplifies the demand for SDR, as it offers the flexibility to seamlessly transition between different frequencies and protocols. In conclusion, the SDR market in India is thriving due to the interplay of factors such as the quest for enhanced connectivity, expanding defense applications, the surge in IoT devices, and the relentless march towards advanced 5G networks. These interconnected drivers position SDR as a pivotal player in the ever-evolving landscape of wireless communication technologies.

India Software Defined Radio Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, application, component, platform, and frequency band.

Type Insights:

- Joint Tactical Radio System (JTRS)

- Cognitive Radio

- General Purpose Radio

- Terrestrial Trunked Radio (TETRA)

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes joint tactical radio system (JTRS), cognitive radio, general purpose radio, terrestrial trunked radio (TETRA), and others.

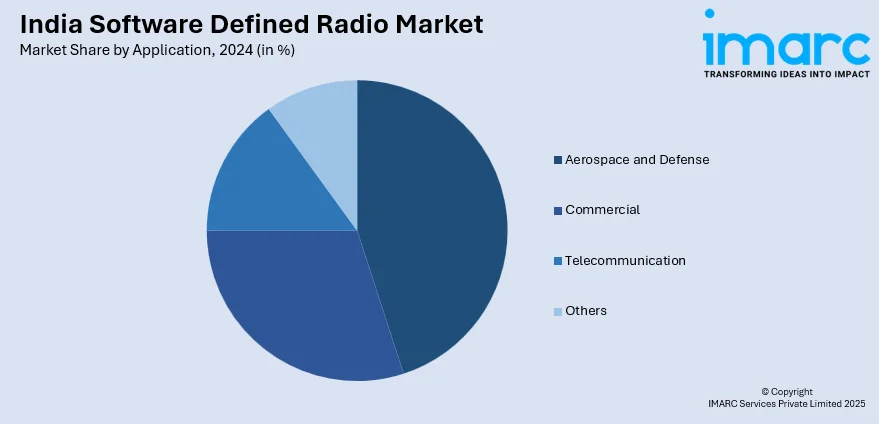

Application Insights:

- Aerospace and Defense

- Commercial

- Telecommunication

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes aerospace and defense, commercial, telecommunication, and others.

Component Insights:

- Transmitter

- Receiver

- Auxiliary System

- Software

The report has provided a detailed breakup and analysis of the market based on the component. This includes transmitter, receiver, auxiliary system, and software.

Platform Insights:

- Land

- Airborne

- Naval

- Space

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes land, airborne, naval, and space.

Frequency Band Insights:

- High Frequency

- Very High Frequency

- Ultra-High Frequency

- Others

The report has provided a detailed breakup and analysis of the market based on the frequency band. This includes high frequency, very high frequency, ultra-high frequency, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Software Defined Radio Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Joint Tactical Radio System (JTRS), Cognitive Radio, General Purpose Radio, Terrestrial Trunked Radio (TETRA), Others |

| Applications Covered | Aerospace and Defense, Commercial, Telecommunication, Others |

| Components Covered | Transmitter, Receiver, Auxiliary System, Software |

| Platforms Covered | Land, Airborne, Naval, Space |

| Frequency Bands Covered | High Frequency, Very High Frequency, Ultra-High Frequency, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India software defined radio market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India software defined radio market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India software defined radio industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The software defined radio market in India was valued at USD 916.6 Million in 2024.

The India software defined radio market is projected to exhibit a CAGR of 6.24% during 2025-2033, reaching a value of USD 1,580.4 Million by 2033.

The India software defined radio market is driven by growing defense modernization, growing demand for secure and flexible communication systems, and rising adoption in public safety and disaster management. Technological advancements and the need for interoperable, multi-band communication platforms also contribute to market expansion across military and civilian sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)